UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 11, 2016

DAVITA HEALTHCARE PARTNERS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-14106 |

|

No. 51-0354549 |

| (State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

2000 16th Street

Denver, CO 80202

(Address

of principal executive offices including Zip Code)

(303) 405-2100

(Registrant’s telephone number, including area code)

Not applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 240.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On February 11, 2016, DaVita HealthCare Partners Inc. issued a press release announcing its financial results for the quarter and year

ended December 31, 2015. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information contained in

this Form 8-K (including Exhibit 99.1 attached hereto) is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section and shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as shall be

expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release dated February 11, 2016 announcing the registrant’s financial results for the quarter and year ended December 31, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

DAVITA HEALTHCARE PARTNERS INC. |

|

|

|

| Date: February 11, 2016 |

|

By: |

|

/s/ James K. Hilger |

|

|

|

|

James K. Hilger |

|

|

|

|

Chief Accounting Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release dated February 11, 2016, announcing the registrant’s financial results for the quarter and year ended December 31, 2015. |

Exhibit 99.1

Contact: Jim Gustafson

Investor Relations

DaVita HealthCare Partners Inc.

(310) 536-2585

DaVita HealthCare Partners

Inc. 4th Quarter 2015 Results

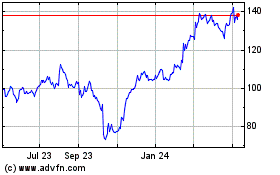

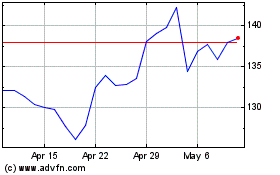

Denver, Colorado, February 11, 2016 – DaVita HealthCare Partners Inc. (NYSE: DVA) today announced

results for the quarter and year ended December 31, 2015. Adjusted net income attributable to DaVita HealthCare Partners Inc. for the quarter ended December 31, 2015 was $214 million, or $1.01 per share, excluding estimated non-cash

goodwill and other intangible asset impairment charges, as discussed below, and an estimated accrual for damages and liabilities associated with our pharmacy business, all after-tax. Net loss attributable to DaVita HealthCare Partners Inc. for the

quarter ended December 31, 2015 including these items was $(6) million, or $(0.03) per share.

Adjusted net income attributable to DaVita

HealthCare Partners Inc. for the year ended December 31, 2015 was $828 million, or $3.83 per share, excluding estimated non-cash goodwill and other intangible asset impairment charges, an estimated accrual for damages and liabilities

associated with our pharmacy business, debt redemption charges and a settlement charge related to the Vainer private civil suit, all after-tax. Net income attributable to DaVita HealthCare Partners Inc. for the year ended December 31, 2015

including these items was $270 million, or $1.25 per share.

Net income attributable to DaVita HealthCare Partners Inc. for the quarter ended

December 31, 2014 was $208 million, or $0.96 per share. Adjusted net income attributable to DaVita HealthCare Partners Inc. for the year ended December 31, 2014 was $792 million, or $3.64 per share, excluding debt redemption and

refinancing charges, and a loss contingency accrual related to the 2010 and 2011 U.S. Attorney physician relationship investigations, all after-tax. Net income attributable to DaVita HealthCare Partners Inc. for the year ended December 31, 2014

including these items was $723 million, or $3.33 per share.

See schedules of reconciliations of non-GAAP measures.

Financial and operating highlights include:

| |

• |

|

Cash Flow: For the quarter and year ended December 31, 2015, operating cash flow was $437 million and $1.6 billion, respectively, and free cash flow was $256 million and $1.1 billion,

respectively. Operating cash flow and free cash flow for the year ended December 31, 2015 were negatively impacted by approximately $304 million of after-tax payments made during the second quarter of 2015 in connection with the settlement

of the Vainer suit. Excluding this item, adjusted operating cash flow for the year ended December 31, 2015 would have been $1.9 billion. |

| |

• |

|

Operating Income and Adjusted Operating Income: Adjusted operating income for the quarter ended December 31, 2015 was $474 million, excluding estimated non-cash goodwill and other intangible asset

impairment charges and an estimated accrual for damages and liabilities associated with our pharmacy business. Operating income for the quarter ended December 31, 2015 including these items was $245 million. Adjusted operating income for

the year ended December 31, 2015 was $1.9 billion, excluding estimated non-cash goodwill and other intangible asset impairment charges, an estimated accrual for damages and liabilities associated with our pharmacy business, and a

settlement charge related to the Vainer suit. Operating income for the year ended December 31, 2015 including these items was $1.2 billion. |

Operating income for the quarter and year ended December 31, 2014 was $452 million and $1.8 billion, respectively. Adjusted

operating income for the year ended December 31, 2014, excluding a loss contingency accrual related to the 2010 and 2011 U.S. Attorney physician relationship investigations was $1.8 billion.

1

| |

• |

|

Goodwill and Other Intangible Asset Impairment Charges: During the quarter ended December 31, 2015, we determined that circumstances indicated it had become more likely than not that the non-cash goodwill

and an indefinite-lived intangible asset of certain HealthCare Partners reporting units had become impaired. These circumstances included underperformance of the business in recent quarters, as well as changes in other market conditions, including

government reimbursement cuts and our expected ability to mitigate them. We are performing the required valuation of certain HCP reporting units and have estimated the fair value of their net assets and implied goodwill with the assistance of a

third-party valuation firm. Based on the current assessments, we recorded an estimated $206 million in non-cash goodwill and other intangible asset impairment charges of certain HCP reporting units. The final amount of these impairment charges

will depend upon the final outcome of this valuation work, which we expect will be completed in the first quarter of 2016. |

| |

• |

|

Adjusted Diluted Net Income Per Share: Adjusted net income attributable to DaVita HealthCare Partners Inc. for the quarter ended December 31, 2015, excluding the amortization of intangible assets associated

with acquisitions, net of tax, and certain other additional non-GAAP measures, was $239 million and adjusted diluted net income per share was $1.12. Adjusted net income attributable to DaVita HealthCare Partners Inc. for the year ended

December 31, 2015, excluding the amortization of intangible assets and certain other additional non-GAAP measures was $930 million, and adjusted diluted net income per share was $4.30. |

Adjusted net income attributable to DaVita HealthCare Partners Inc. for the quarter ended December 31, 2014, excluding the amortization of

intangible assets associated with acquisitions, net of tax, was $236 million, and adjusted diluted net income per share was $1.09. Adjusted net income attributable to DaVita HealthCare Partners Inc. for the year ended December 31, 2014,

excluding the amortization of intangible assets and additional certain other non-GAAP measures was $896 million, and adjusted diluted net income per share was $4.13.

See schedules of reconciliations of non-GAAP measures.

| |

• |

|

Volume: Total U.S. dialysis treatments for the fourth quarter of 2015 were 6,649,227, or 84,061 treatments per day, representing a per day increase of 3.2% over the fourth quarter of 2014. Normalized

non-acquired treatment growth in the fourth quarter of 2015 as compared to the fourth quarter of 2014 was 3.7%. |

The number

of member months for which HCP provided care during the fourth quarter of 2015 was approximately 2.4 million, of which 0.9 million, 1.1 million and 0.4 million related to Medicare, commercial and Medicaid members, respectively.

| |

• |

|

Effective Tax Rate: Our effective tax rate was 76.4% and 40.9% for the quarter and year ended December 31, 2015, respectively. The effective tax rate attributable to DaVita HealthCare Partners Inc. was

105.7% and 52.2% for the quarter and year ended December 31, 2015, respectively. This effective tax rate is impacted by non-deductible non-cash goodwill impairment charges, the non-deductible portion of the estimated pharmacy accrual, as well

as the amount of third-party owners’ income attributable to non-tax paying entities. |

The adjusted effective tax rate

attributable to DaVita HealthCare Partners Inc. for the quarter ended December 31, 2015, excluding estimated non-cash goodwill and other intangible asset impairment charges and an estimated accrual for damages and liabilities associated with

our pharmacy business, was 36.0%. In addition, the adjusted effective tax rate attributable to DaVita HealthCare Partners Inc. for the year ended December 31, 2015, further excluding a settlement charge related to the Vainer private civil suit,

was 38.2%.

We currently expect our 2016 effective tax rate attributable to DaVita HealthCare Partners Inc. to be approximately 40.0% to

41.0%.

| |

• |

|

Center Activity: As of December 31, 2015, we provided dialysis services to a total of approximately 190,000 patients at 2,369 outpatient dialysis centers, of which 2,251 centers are located in the

United States and 118 centers are located in ten countries outside of the United States. During the fourth quarter of 2015, we opened a total of 26 new dialysis centers and sold one dialysis center in the United States. We also acquired 14

dialysis centers and opened one new dialysis center outside of the United States. |

| |

• |

|

Share Repurchases: During the quarter ended December 31, 2015, we repurchased a total of 2,156,951 shares of our common stock for $151 million, or an average price of $69.86 per share. During the

year ended December 31, 2015, we repurchased 7,779,958 shares of our common stock for $575 million, at an average price of $73.96 per share. |

In addition, we also repurchased 3,689,738 shares of our common stock for $249 million, at an average price of $67.61 per share,

during January 2016. As a result of these transactions we now have approximately $259 million remaining under our current board authorization for share repurchases.

2

Outlook

| |

• |

|

We expect our consolidated operating income for 2016 to be in the range of $1.800 billion to $1.950 billion. |

| |

• |

|

We expect our operating income for Kidney Care for 2016 to be in the range of $1.625 billion to $1.725 billion. |

| |

• |

|

We expect our operating income for HCP for 2016 to be in the range of $175 million to $225 million. |

| |

• |

|

We expect our consolidated operating cash flows for 2016 to be in the range of $1.550 billion to $1.750 billion. |

These projections and the underlying assumptions involve significant risks and uncertainties, including those described below, and do not give effect to

potential non-recurring items, and actual results may vary significantly from these current projections.

We will be holding a conference call to discuss

our results for the fourth quarter ended December 31, 2015 on February 11, 2016 at 5:00 p.m. Eastern Time. To join the conference call, please dial (877) 918-6630 from the U.S. or (212) 547-0235 from outside the U.S. A replay of the conference call will be available on our website at investors.davitahealthcarepartners.com, for the following 30 days.

3

This release contains forward-looking statements within the meaning of the federal securities laws, including

statements related to our guidance and expectations for our 2016 consolidated operating income, our 2016 Kidney Care operating income, HCP’s 2016 operating income, our 2016 consolidated operating cash flows, our 2016 effective tax rate

attributable to DaVita HealthCare Partners Inc. and our estimated charges and accruals and anticipated timing of the completion of the valuation of certain HCP reporting units. Factors that could impact future results include the uncertainties

associated with the risk factors set forth in our SEC filings, including our annual report on Form 10-K for the year ended December 31, 2014, our subsequent quarterly and annual reports, and our

current reports on Form 8-K. The forward-looking statements should be considered in light of these risks and uncertainties.

These risks and uncertainties include, but are not limited to, and are qualified in their entirety by reference to the full text of those risk factors in

our SEC filings relating to:

| |

• |

|

the concentration of profits generated by higher-paying commercial payor plans for which there is continued downward pressure on average realized payment rates, and a reduction in the number of patients under such

plans, which may result in the loss of revenues or patients, |

| |

• |

|

a reduction in government payment rates under the Medicare End Stage Renal Disease program or other government-based programs, |

| |

• |

|

the impact of the Center for Medicare and Medicaid Services (CMS) 2015 Medicare Advantage benchmark structure, |

| |

• |

|

risks arising from potential federal and/or state legislation that could have an adverse effect on our operations and profitability, |

| |

• |

|

changes in pharmaceutical or anemia management practice patterns, payment policies, or pharmaceutical pricing, |

| |

• |

|

legal compliance risks, including our continued compliance with complex government regulations and including compliance with the provisions of our current corporate integrity agreement and current or potential

investigations by various government entities and related government or private-party proceedings, and restrictions on our business and operations required by our corporate integrity agreement and other settlement terms, and the financial impact

thereof, |

| |

• |

|

continued increased competition from large- and medium-sized dialysis providers that compete directly with us, |

| |

• |

|

our ability to maintain contracts with physician medical directors, changing affiliation models for physicians, and the emergence of new models of care introduced by the government or private sector, that may erode

our patient base and reimbursement rates, such as accountable care organizations, independent practice associations and integrated delivery systems, or to businesses outside of dialysis and HCP business, |

| |

• |

|

our ability to complete acquisitions, mergers or dispositions that we might be considering or announce, or to integrate and successfully operate any business we may acquire or have acquired, including HCP, or to

expand our operations and services to markets outside the United States, |

| |

• |

|

the variability of our cash flows, |

| |

• |

|

the risk that we might invest material amounts of capital and incur significant costs in connection with the growth and development of our international operations, yet we might not be able to operate them profitably

anytime soon, if at all, |

| |

• |

|

risks arising from the use of accounting estimates, judgments and interpretations in our financial statements, |

| |

• |

|

risks of losing key HCP employees, potential disruption from the HCP transaction making it more difficult to maintain business and operational relationships with customers, partners, associated physicians and

physician groups, hospitals and others, |

| |

• |

|

the risk that laws regulating the corporate practice of medicine could restrict the manner in which HCP conducts its business, |

| |

• |

|

the risk that the cost of providing services under HCP’s agreements may exceed our compensation, |

| |

• |

|

the risk that reductions in reimbursement rates, including Medicare Advantage rates, and future regulations may negatively impact HCP’s business, revenue and profitability, |

| |

• |

|

the risk that HCP may not be able to successfully establish a presence in new geographic regions or successfully address competitive threats that could reduce its profitability, |

| |

• |

|

the risk that a disruption in HCP’s healthcare provider networks could have an adverse effect on HCP’s business operations and profitability, |

4

| |

• |

|

the risk that reductions in the quality ratings of health maintenance organization plan customers of HCP could have an adverse effect on HCP’s business, or |

| |

• |

|

the risk that health plans that acquire health maintenance organizations may not be willing to contract with HCP or may be willing to contract only on less favorable terms. |

We base our forward-looking statements on information currently available to us at the time of this release, and except as required by law we undertake no

obligation to update or revise any forward-looking statements, whether as a result of changes in underlying factors, new information, future events or otherwise.

This release contains non-GAAP financial measures. For reconciliations of these non-GAAP financial measures to their most comparable measure calculated and

presented in accordance with GAAP, see the attached reconciliation schedules. For the reasons stated in the reconciliation schedules, we believe our presentation of non-GAAP financial measures provides useful supplemental information for investors.

5

DAVITA HEALTHCARE PARTNERS INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(dollars in

thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

December 31, |

|

|

Year ended

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Patient service revenues |

|

$ |

2,430,851 |

|

|

$ |

2,324,458 |

|

|

$ |

9,480,279 |

|

|

$ |

8,868,338 |

|

| Less: Provision for uncollectible accounts |

|

|

(113,279 |

) |

|

|

(96,664 |

) |

|

|

(427,860 |

) |

|

|

(366,884 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net patient service revenues |

|

|

2,317,572 |

|

|

|

2,227,794 |

|

|

|

9,052,419 |

|

|

|

8,501,454 |

|

| Capitated revenues |

|

|

865,543 |

|

|

|

825,808 |

|

|

|

3,509,095 |

|

|

|

3,261,288 |

|

| Other revenues |

|

|

350,474 |

|

|

|

274,415 |

|

|

|

1,220,323 |

|

|

|

1,032,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net revenues |

|

|

3,533,589 |

|

|

|

3,328,017 |

|

|

|

13,781,837 |

|

|

|

12,795,106 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses and charges: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Patient care costs and other costs |

|

|

2,515,131 |

|

|

|

2,366,461 |

|

|

|

9,824,834 |

|

|

|

9,119,305 |

|

| General and administrative |

|

|

408,882 |

|

|

|

355,987 |

|

|

|

1,452,135 |

|

|

|

1,261,506 |

|

| Depreciation and amortization |

|

|

163,330 |

|

|

|

153,253 |

|

|

|

638,024 |

|

|

|

590,935 |

|

| Provision for uncollectible accounts |

|

|

2,743 |

|

|

|

4,773 |

|

|

|

9,240 |

|

|

|

14,453 |

|

| Equity investment income |

|

|

(7,601 |

) |

|

|

(4,542 |

) |

|

|

(18,325 |

) |

|

|

(23,234 |

) |

| Goodwill and other intangible asset impairment charges |

|

|

206,169 |

|

|

|

— |

|

|

|

210,234 |

|

|

|

— |

|

| Settlement charge and loss contingency accrual |

|

|

— |

|

|

|

— |

|

|

|

495,000 |

|

|

|

17,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses and charges |

|

|

3,288,654 |

|

|

|

2,875,932 |

|

|

|

12,611,142 |

|

|

|

10,979,965 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

244,935 |

|

|

|

452,085 |

|

|

|

1,170,695 |

|

|

|

1,815,141 |

|

| Debt expense |

|

|

(103,259 |

) |

|

|

(97,949 |

) |

|

|

(408,380 |

) |

|

|

(410,294 |

) |

| Debt redemption and refinancing charges |

|

|

— |

|

|

|

— |

|

|

|

(48,072 |

) |

|

|

(97,548 |

) |

| Other income, net |

|

|

4,631 |

|

|

|

229 |

|

|

|

8,893 |

|

|

|

2,374 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

146,307 |

|

|

|

354,365 |

|

|

|

723,136 |

|

|

|

1,309,673 |

|

| Income tax expense |

|

|

111,833 |

|

|

|

103,977 |

|

|

|

295,726 |

|

|

|

446,343 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

34,474 |

|

|

|

250,388 |

|

|

|

427,410 |

|

|

|

863,330 |

|

| Less: Net income attributable to noncontrolling interests |

|

|

(40,474 |

) |

|

|

(42,368 |

) |

|

|

(157,678 |

) |

|

|

(140,216 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income attributable to DaVita HealthCare Partners Inc. |

|

$ |

(6,000 |

) |

|

$ |

208,020 |

|

|

$ |

269,732 |

|

|

$ |

723,114 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net (loss) income per share attributable to DaVita HealthCare Partners Inc. |

|

$ |

(0.03 |

) |

|

$ |

0.98 |

|

|

$ |

1.27 |

|

|

$ |

3.41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net (loss) income per share attributable to DaVita HealthCare Partners Inc. |

|

$ |

(0.03 |

) |

|

$ |

0.96 |

|

|

$ |

1.25 |

|

|

$ |

3.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares for earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

208,762,717 |

|

|

|

212,941,850 |

|

|

|

211,867,714 |

|

|

|

212,301,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

208,762,717 |

|

|

|

217,620,369 |

|

|

|

216,251,807 |

|

|

|

216,927,681 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

DAVITA HEALTHCARE PARTNERS INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited)

(dollars in

thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

December 31, |

|

|

Year ended

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Net income |

|

$ |

34,474 |

|

|

$ |

250,388 |

|

|

$ |

427,410 |

|

|

$ |

863,330 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive (loss) income, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized losses on interest rate swap and cap agreements: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized losses on interest rate swap and cap agreements |

|

|

(2,177 |

) |

|

|

(2,882 |

) |

|

|

(12,241 |

) |

|

|

(10,059 |

) |

| Reclassifications of net swap and cap agreements realized losses into net income |

|

|

739 |

|

|

|

849 |

|

|

|

3,111 |

|

|

|

10,608 |

|

| Unrealized (losses) gains on investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized (losses) gains on investments |

|

|

(45 |

) |

|

|

(279 |

) |

|

|

(1,413 |

) |

|

|

238 |

|

| Reclassification of net investment realized losses into net income |

|

|

(1 |

) |

|

|

— |

|

|

|

(377 |

) |

|

|

(207 |

) |

| Foreign currency translation adjustments |

|

|

(4,007 |

) |

|

|

(11,081 |

) |

|

|

(23,889 |

) |

|

|

(22,952 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive loss |

|

|

(5,491 |

) |

|

|

(13,393 |

) |

|

|

(34,809 |

) |

|

|

(22,372 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income |

|

|

28,983 |

|

|

|

236,995 |

|

|

|

392,601 |

|

|

|

840,958 |

|

| Less: Comprehensive income attributable to noncontrolling interests |

|

|

(40,474 |

) |

|

|

(42,368 |

) |

|

|

(157,678 |

) |

|

|

(140,216 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive (loss) income attributable to DaVita HealthCare Partners Inc. |

|

$ |

(11,491 |

) |

|

$ |

194,627 |

|

|

$ |

234,923 |

|

|

$ |

700,742 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

DAVITA HEALTHCARE PARTNERS INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

(dollars in

thousands)

|

|

|

|

|

|

|

|

|

| |

|

Year ended

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

427,410 |

|

|

$ |

863,330 |

|

| Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Settlement charge and loss contingency accrual |

|

|

495,000 |

|

|

|

17,000 |

|

| Depreciation and amortization |

|

|

638,024 |

|

|

|

590,935 |

|

| Goodwill and other intangible asset impairment charges |

|

|

210,234 |

|

|

|

— |

|

| Debt redemption and refinancing charges |

|

|

48,072 |

|

|

|

97,548 |

|

| Stock-based compensation expense |

|

|

56,664 |

|

|

|

56,743 |

|

| Tax benefits from stock award exercises |

|

|

45,749 |

|

|

|

59,119 |

|

| Excess tax benefits from stock award exercises |

|

|

(28,157 |

) |

|

|

(45,271 |

) |

| Deferred income taxes |

|

|

61,744 |

|

|

|

210,955 |

|

| Equity investment income, net |

|

|

9,293 |

|

|

|

10,125 |

|

| Other non-cash charges |

|

|

44,691 |

|

|

|

39,274 |

|

| Changes in operating assets and liabilities, other than from acquisitions and divestitures: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(202,867 |

) |

|

|

(40,676 |

) |

| Inventories |

|

|

(48,313 |

) |

|

|

(46,398 |

) |

| Other receivables and other current assets |

|

|

32,761 |

|

|

|

(61,674 |

) |

| Other long-term assets |

|

|

3,723 |

|

|

|

2,916 |

|

| Accounts payable |

|

|

30,998 |

|

|

|

(2,956 |

) |

| Accrued compensation and benefits |

|

|

54,950 |

|

|

|

97,261 |

|

| Other current liabilities |

|

|

113,470 |

|

|

|

83,590 |

|

| Settlement payments |

|

|

(493,775 |

) |

|

|

(410,356 |

) |

| Income taxes |

|

|

24,175 |

|

|

|

(60,475 |

) |

| Other long-term liabilities |

|

|

33,354 |

|

|

|

(1,583 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

1,557,200 |

|

|

|

1,459,407 |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Additions of property and equipment |

|

|

(707,998 |

) |

|

|

(641,330 |

) |

| Acquisitions |

|

|

(96,469 |

) |

|

|

(272,094 |

) |

| Proceeds from asset and business sales |

|

|

19,715 |

|

|

|

8,791 |

|

| Purchase of investments available for sale |

|

|

(8,783 |

) |

|

|

(8,440 |

) |

| Purchase of investments held-to-maturity |

|

|

(1,709,883 |

) |

|

|

(472,628 |

) |

| Proceeds from sale of investments available for sale |

|

|

2,058 |

|

|

|

2,475 |

|

| Proceeds from investments held-to-maturity |

|

|

1,637,358 |

|

|

|

141,072 |

|

| Purchase of intangible assets |

|

|

— |

|

|

|

(1,018 |

) |

| Purchase of equity investments |

|

|

(17,911 |

) |

|

|

(35,382 |

) |

| Distributions received on equity investments |

|

|

129 |

|

|

|

825 |

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(881,784 |

) |

|

|

(1,277,729 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Borrowings |

|

|

54,541,988 |

|

|

|

60,038,508 |

|

| Payments on long-term debt and other financing costs |

|

|

(53,922,290 |

) |

|

|

(60,046,487 |

) |

| Deferred financing costs and debt redemption and refinancing costs |

|

|

(76,672 |

) |

|

|

(122,988 |

) |

| Purchase of treasury stock |

|

|

(549,935 |

) |

|

|

— |

|

| Distributions to noncontrolling interests |

|

|

(174,635 |

) |

|

|

(149,339 |

) |

| Stock award exercises and other share issuances, net |

|

|

26,155 |

|

|

|

19,500 |

|

| Excess tax benefits from stock award exercises |

|

|

28,157 |

|

|

|

45,271 |

|

| Contributions from noncontrolling interests |

|

|

54,644 |

|

|

|

64,655 |

|

| Proceeds from sales of additional noncontrolling interests |

|

|

— |

|

|

|

3,777 |

|

| Purchase of noncontrolling interests |

|

|

(66,382 |

) |

|

|

(17,876 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

|

(138,970 |

) |

|

|

(164,979 |

) |

| Effect of exchange rate changes on cash and cash equivalents |

|

|

(2,571 |

) |

|

|

2,293 |

|

|

|

|

|

|

|

|

|

|

| Net increase in cash and cash equivalents |

|

|

533,875 |

|

|

|

18,992 |

|

| Cash and cash equivalents at beginning of the year |

|

|

965,241 |

|

|

|

946,249 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of the period |

|

$ |

1,499,116 |

|

|

$ |

965,241 |

|

|

|

|

|

|

|

|

|

|

8

DAVITA HEALTHCARE PARTNERS INC.

CONSOLIDATED BALANCE SHEETS

(unaudited)

(dollars in

thousands, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

December 31,

2015 |

|

|

December 31,

2014 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,499,116 |

|

|

$ |

965,241 |

|

| Short-term investments |

|

|

408,084 |

|

|

|

337,399 |

|

| Accounts receivable, less allowance of $264,144 and $242,674 |

|

|

1,724,228 |

|

|

|

1,525,849 |

|

| Inventories |

|

|

185,575 |

|

|

|

136,084 |

|

| Other receivables |

|

|

412,285 |

|

|

|

400,916 |

|

| Other current assets |

|

|

190,322 |

|

|

|

186,842 |

|

| Income tax receivable |

|

|

60,070 |

|

|

|

83,839 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

4,479,680 |

|

|

|

3,636,170 |

|

| Property and equipment, net |

|

|

2,779,778 |

|

|

|

2,469,099 |

|

| Intangibles, net |

|

|

1,687,326 |

|

|

|

1,864,842 |

|

| Equity investments |

|

|

73,368 |

|

|

|

65,637 |

|

| Long-term investments |

|

|

94,122 |

|

|

|

89,389 |

|

| Other long-term assets |

|

|

73,560 |

|

|

|

77,000 |

|

| Goodwill |

|

|

9,294,479 |

|

|

|

9,415,295 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

18,482,313 |

|

|

$ |

17,617,432 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

504,988 |

|

|

$ |

445,453 |

|

| Other liabilities |

|

|

658,523 |

|

|

|

510,223 |

|

| Accrued compensation and benefits |

|

|

741,926 |

|

|

|

698,475 |

|

| Medical payables |

|

|

332,102 |

|

|

|

314,346 |

|

| Current portion of long-term debt |

|

|

129,037 |

|

|

|

120,154 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

2,366,576 |

|

|

|

2,088,651 |

|

| Long-term debt |

|

|

9,001,308 |

|

|

|

8,298,624 |

|

| Other long-term liabilities |

|

|

439,229 |

|

|

|

389,806 |

|

| Deferred income taxes |

|

|

726,962 |

|

|

|

650,075 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

12,534,075 |

|

|

|

11,427,156 |

|

| Commitments and contingencies: |

|

|

|

|

|

|

|

|

| Noncontrolling interests subject to put provisions |

|

|

864,066 |

|

|

|

829,965 |

|

| Equity: |

|

|

|

|

|

|

|

|

| Preferred stock ($0.001 par value, 5,000,000 shares authorized; none issued) |

|

|

|

|

|

|

|

|

| Common stock ($0.001 par value, 450,000,000 shares authorized; 217,120,346 and 215,640,968 shares issued and 209,754,247 and

215,640,968 shares outstanding, respectively) |

|

|

217 |

|

|

|

216 |

|

| Additional paid-in capital |

|

|

1,118,326 |

|

|

|

1,108,211 |

|

| Retained earnings |

|

|

4,356,835 |

|

|

|

4,087,103 |

|

| Treasury stock (7,366,099 shares) |

|

|

(544,772 |

) |

|

|

— |

|

| Accumulated other comprehensive loss |

|

|

(59,826 |

) |

|

|

(25,017 |

) |

|

|

|

|

|

|

|

|

|

| Total DaVita HealthCare Partners Inc. shareholders’ equity |

|

|

4,870,780 |

|

|

|

5,170,513 |

|

| Noncontrolling interests not subject to put provisions |

|

|

213,392 |

|

|

|

189,798 |

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

5,084,172 |

|

|

|

5,360,311 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

18,482,313 |

|

|

$ |

17,617,432 |

|

|

|

|

|

|

|

|

|

|

9

DAVITA HEALTHCARE PARTNERS INC.

SUPPLEMENTAL FINANCIAL DATA

(unaudited)

(dollars in

millions, except for per share and per treatment data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Year ended

December 31,

2015 |

|

| |

|

December 31,

2015 |

|

|

September 30,

2015 |

|

|

December 31,

2014 |

|

|

| 1. Consolidated Financial Results: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net revenues |

|

$ |

3,534 |

|

|

$ |

3,526 |

|

|

$ |

3,328 |

|

|

$ |

13,782 |

|

| Operating income |

|

$ |

245 |

|

|

$ |

509 |

|

|

$ |

452 |

|

|

$ |

1,171 |

|

| Adjusted operating income excluding certain items(1) |

|

$ |

474 |

|

|

$ |

509 |

|

|

$ |

452 |

|

|

$ |

1,898 |

|

| Operating income margin |

|

|

6.9 |

% |

|

|

14.4 |

% |

|

|

13.6 |

% |

|

|

8.5 |

% |

| Adjusted operating income margin excluding certain items(1) |

|

|

13.4 |

% |

|

|

14.4 |

% |

|

|

13.6 |

% |

|

|

13.8 |

% |

| Net (loss) income attributable to DaVita HealthCare Partners Inc. |

|

$ |

(6 |

) |

|

$ |

216 |

|

|

$ |

208 |

|

|

$ |

270 |

|

| Adjusted net income attributable to DaVita HealthCare Partners Inc. excluding certain

items(1) |

|

$ |

214 |

|

|

$ |

216 |

|

|

$ |

208 |

|

|

$ |

828 |

|

| Diluted net (loss) income per share attributable to DaVita HealthCare Partners Inc. |

|

$ |

(0.03 |

) |

|

$ |

1.00 |

|

|

$ |

0.96 |

|

|

$ |

1.25 |

|

| Adjusted diluted net income per share attributable to DaVita HealthCare Partners Inc. excluding certain items(1) |

|

$ |

1.01 |

|

|

$ |

1.00 |

|

|

$ |

0.96 |

|

|

$ |

3.83 |

|

| 2. Consolidated Business Metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and administrative expenses as a percent of consolidated net revenues (including the $23 million pharmacy accrual)(2) |

|

|

11.6 |

% |

|

|

10.0 |

% |

|

|

10.7 |

% |

|

|

10.5 |

% |

| Consolidated effective tax rate |

|

|

76.4 |

% |

|

|

36.0 |

% |

|

|

29.3 |

% |

|

|

40.9 |

% |

| Consolidated effective tax rate attributable to DaVita HealthCare Partners

Inc.(1) |

|

|

105.7 |

% |

|

|

40.5 |

% |

|

|

33.3 |

% |

|

|

52.2 |

% |

| Adjusted consolidated effective tax rate

attributable to DaVita HealthCare Partners Inc.(1) |

|

|

36.0 |

% |

|

|

40.5 |

% |

|

|

33.3 |

% |

|

|

38.2 |

% |

| 3. Summary of Division Financial Results: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Kidney Care: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net dialysis and related lab services revenues |

|

$ |

2,216 |

|

|

$ |

2,201 |

|

|

$ |

2,151 |

|

|

$ |

8,642 |

|

| Net ancillary services and strategic initiatives revenues, including international dialysis operations |

|

|

398 |

|

|

|

345 |

|

|

|

309 |

|

|

|

1,382 |

|

| Elimination of intersegment revenues |

|

|

(22 |

) |

|

|

(21 |

) |

|

|

(14 |

) |

|

|

(79 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Kidney Care net revenues |

|

|

2,592 |

|

|

|

2,525 |

|

|

|

2,446 |

|

|

|

9,945 |

|

| Net HCP revenues |

|

|

942 |

|

|

|

1,001 |

|

|

|

882 |

|

|

|

3,837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net consolidated revenues |

|

$ |

3,534 |

|

|

$ |

3,526 |

|

|

$ |

3,328 |

|

|

$ |

13,782 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Kidney Care: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dialysis and related lab services operating income |

|

$ |

464 |

|

|

$ |

462 |

|

|

$ |

443 |

|

|

$ |

1,260 |

|

| Other – Ancillary services and strategic initiatives, including international dialysis operations operating loss |

|

|

(34 |

) |

|

|

(30 |

) |

|

|

(19 |

) |

|

|

(104 |

) |

| Corporate support and related long-term incentive compensation |

|

|

(4 |

) |

|

|

(6 |

) |

|

|

(5 |

) |

|

|

(19 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Kidney Care operating income |

|

|

426 |

|

|

|

426 |

|

|

|

419 |

|

|

|

1,137 |

|

| HCP operating (loss) income |

|

|

(181 |

) |

|

|

83 |

|

|

|

33 |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total consolidated operating income |

|

$ |

245 |

|

|

$ |

509 |

|

|

$ |

452 |

|

|

$ |

1,171 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10

DAVITA HEALTHCARE PARTNERS INC.

SUPPLEMENTAL FINANCIAL DATA—continued

(unaudited)

(dollars in

millions, except for per share and per treatment data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Year ended

December 31,

2015 |

|

| |

|

December 31,

2015 |

|

|

September 30,

2015 |

|

|

December 31,

2014 |

|

|

| 4. Summary of Reportable Segment Financial Results: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dialysis and Related Lab Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Patient services revenues |

|

$ |

2,316 |

|

|

$ |

2,301 |

|

|

$ |

2,243 |

|

|

$ |

9,034 |

|

| Provision for uncollectible accounts |

|

|

(104 |

) |

|

|

(103 |

) |

|

|

(95 |

) |

|

|

(406 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net patient service operating revenues |

|

|

2,212 |

|

|

|

2,198 |

|

|

|

2,148 |

|

|

|

8,628 |

|

| Other revenues |

|

|

4 |

|

|

|

3 |

|

|

|

3 |

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net operating revenues |

|

$ |

2,216 |

|

|

$ |

2,201 |

|

|

$ |

2,151 |

|

|

$ |

8,642 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Patient care costs |

|

$ |

1,462 |

|

|

$ |

1,461 |

|

|

$ |

1,415 |

|

|

$ |

5,755 |

|

| General and administrative |

|

|

181 |

|

|

|

170 |

|

|

|

192 |

|

|

|

709 |

|

| Depreciation and amortization |

|

|

112 |

|

|

|

112 |

|

|

|

105 |

|

|

|

438 |

|

| Equity investment income |

|

|

(3 |

) |

|

|

(4 |

) |

|

|

(4 |

) |

|

|

(15 |

) |

| Settlement charge |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

495 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

1,752 |

|

|

|

1,739 |

|

|

|

1,708 |

|

|

|

7,382 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment operating income |

|

|

464 |

|

|

|

462 |

|

|

|

443 |

|

|

|

1, 260 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation for non-GAAP measure: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Settlement charge |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

495 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted segment operating income(1) |

|

$ |

464 |

|

|

$ |

462 |

|

|

$ |

443 |

|

|

$ |

1,755 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| HCP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| HCP capitated revenues |

|

$ |

850 |

|

|

$ |

907 |

|

|

$ |

808 |

|

|

$ |

3,437 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Patient services revenues |

|

|

80 |

|

|

|

84 |

|

|

|

56 |

|

|

|

333 |

|

| Provision for uncollectible accounts |

|

|

(4 |

) |

|

|

(5 |

) |

|

|

(1 |

) |

|

|

(15 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net patient service operating revenues |

|

|

76 |

|

|

|

79 |

|

|

|

55 |

|

|

|

318 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other revenues |

|

|

16 |

|

|

|

15 |

|

|

|

19 |

|

|

|

82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net operating revenues |

|

$ |

942 |

|

|

$ |

1,001 |

|

|

$ |

882 |

|

|

$ |

3,837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Patient care costs |

|

$ |

757 |

|

|

$ |

768 |

|

|

$ |

717 |

|

|

$ |

3,006 |

|

| General and administrative |

|

|

121 |

|

|

|

106 |

|

|

|

90 |

|

|

|

421 |

|

| Depreciation and amortization |

|

|

44 |

|

|

|

43 |

|

|

|

43 |

|

|

|

174 |

|

| Goodwill and other intangible asset impairment charges |

|

|

206 |

|

|

|

— |

|

|

|

— |

|

|

|

206 |

|

| Equity investment (income) loss |

|

|

(5 |

) |

|

|

1 |

|

|

|

(1 |

) |

|

|

(4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

1,123 |

|

|

|

918 |

|

|

|

849 |

|

|

|

3,803 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment operating (loss) income |

|

|

(181 |

) |

|

|

83 |

|

|

|

33 |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation for non-GAAP measure: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Goodwill and other intangible asset impairment charges |

|

|

206 |

|

|

|

— |

|

|

|

— |

|

|

|

206 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted segment operating income(1) |

|

$ |

25 |

|

|

$ |

83 |

|

|

$ |

33 |

|

|

$ |

240 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

DAVITA HEALTHCARE PARTNERS INC.

SUPPLEMENTAL FINANCIAL DATA—continued

(unaudited)

(dollars in

millions, except for per share and per treatment data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Year ended

December 31,

2015 |

|

| |

|

December 31,

2015 |

|

|

September 30,

2015 |

|

|

December 31,

2014 |

|

|

| 5. Dialysis and Related Lab Services Business Metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Volume |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Treatments |

|

|

6,649,227 |

|

|

|

6,611,799 |

|

|

|

6,465,826 |

|

|

|

25,986,719 |

|

| Number of treatment days |

|

|

79.1 |

|

|

|

79.0 |

|

|

|

79.4 |

|

|

|

312.7 |

|

| Treatments per day |

|

|

84,061 |

|

|

|

83,694 |

|

|

|

81,434 |

|

|

|

83,104 |

|

| Per day year over year increase |

|

|

3.2 |

% |

|

|

4.2 |

% |

|

|

6.2 |

% |

|

|

4.1 |

% |

| Normalized non-acquired growth year over year |

|

|

3.7 |

% |

|

|

3.5 |

% |

|

|

4.6 |

% |

|

|

3.9 |

% |

| Operating revenues before provision for uncollectible accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dialysis and related lab services revenue per treatment |

|

$ |

348.26 |

|

|

$ |

348.01 |

|

|

$ |

346.95 |

|

|

$ |

347.64 |

|

| Per treatment increase (decrease) from previous quarter |

|

|

0.1 |

% |

|

|

(0.1 |

%) |

|

|

1.7 |

% |

|

|

|

|

| Per treatment increase from previous year |

|

|

0.4 |

% |

|

|

2.0 |

% |

|

|

2.0 |

% |

|

|

1.6 |

% |

| Percent of net consolidated revenues |

|

|

62.3 |

% |

|

|

62.0 |

% |

|

|

64.4 |

% |

|

|

62.3 |

% |

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Patient care costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Percent of total segment operating net revenues |

|

|

66.0 |

% |

|

|

66.4 |

% |

|

|

65.8 |

% |

|

|

66.6 |

% |

| Per treatment |

|

$ |

219.86 |

|

|

$ |

220.92 |

|

|

$ |

218.81 |

|

|

$ |

221.46 |

|

| Per treatment decrease from previous quarter |

|

|

(0.5 |

%) |

|

|

(0.6 |

%) |

|

|

(0.1 |

%) |

|

|

|

|

| Per treatment increase from previous year |

|

|

0.5 |

% |

|

|

0.8 |

% |

|

|

0.9 |

% |

|

|

0.9 |

% |

| General and administrative expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Percent of total segment operating net revenues |

|

|

8.2 |

% |

|

|

7.7 |

% |

|

|

8.9 |

% |

|

|

8.2 |

% |

| Per treatment |

|

$ |

27.21 |

|

|

$ |

25.78 |

|

|

$ |

29.75 |

|

|

$ |

27.28 |

|

| Per treatment increase (decrease) from previous quarter |

|

|

5.5 |

% |

|

|

(4.5 |

%) |

|

|

10.8 |

% |

|

|

|

|

| Per treatment decrease from previous year |

|

|

(8.5 |

%) |

|

|

(4.0 |

%) |

|

|

(1.5 |

%) |

|

|

(0.1 |

%) |

| Accounts receivable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net receivables |

|

$ |

1,255 |

|

|

$ |

1,243 |

|

|

$ |

1,157 |

|

|

|

|

|

| DSO |

|

|

53 |

|

|

|

51 |

|

|

|

50 |

|

|

|

|

|

| Provision for uncollectible accounts as a percentage of revenues |

|

|

4.5 |

% |

|

|

4.5 |

% |

|

|

4.25 |

% |

|

|

4.5 |

% |

| 6. HCP Business Metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capitated membership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total members |

|

|

807,400 |

|

|

|

808,300 |

|

|

|

837,000 |

|

|

|

|

|

| Total member months |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Medicare |

|

|

951,500 |

|

|

|

950,100 |

|

|

|

928,400 |

|

|

|

3,774,300 |

|

| Commercial |

|

|

1,109,900 |

|

|

|

1,120,600 |

|

|

|

1,165,700 |

|

|

|

4,497,900 |

|

| Medicaid |

|

|

367,100 |

|

|

|

374,600 |

|

|

|

408,700 |

|

|

|

1,556,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total member months |

|

|

2,428,500 |

|

|

|

2,445,300 |

|

|

|

2,502,800 |

|

|

|

9,828,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capitated revenues by sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial revenues |

|

$ |

184 |

|

|

$ |

181 |

|

|

$ |

174 |

|

|

$ |

727 |

|

| Senior revenues |

|

|

607 |

|

|

|

641 |

|

|

|

573 |

|

|

|

2,473 |

|

| Medicaid revenues |

|

|

59 |

|

|

|

85 |

|

|

|

61 |

|

|

|

237 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total capitated revenues |

|

$ |

850 |

|

|

$ |

907 |

|

|

$ |

808 |

|

|

$ |

3,437 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total care dollars under management(1) |

|

$ |

1,213 |

|

|

$ |

1,260 |

|

|

$ |

1,165 |

|

|

$ |

4,952 |

|

| Ratio of operating (loss) income to total care dollars under

management(1) |

|

|

(14.9 |

%) |

|

|

6.6 |

% |

|

|

2.8 |

% |

|

|

0.7 |

% |

| Full time clinicians |

|

|

1,315 |

|

|

|

1,311 |

|

|

|

1,156 |

|

|

|

|

|

| IPA primary care physicians |

|

|

2,937 |

|

|

|

2,935 |

|

|

|

3,331 |

|

|

|

|

|

12

DAVITA HEALTHCARE PARTNERS INC.

SUPPLEMENTAL FINANCIAL DATA—continued

(unaudited)

(dollars in

millions, except for per share and per treatment data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Year ended

December 31,

2015 |

|

| |

|

December 31,

2015 |

|

|

September 30,

2015 |

|

|

December 31,

2014 |

|

|

| 7. Cash Flow: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating cash flow |

|

$ |

436.7 |

|

|

$ |

679.0 |

|

|

$ |

(70.0 |

) |

|

$ |

1,557.2 |

|

| Operating cash flow, last twelve months |

|

$ |

1,557.2 |

|

|

$ |

1,050.5 |

|

|

$ |

1,459.4 |

|

|

|

|

|

| Free cash flow(1) |

|

$ |

256.2 |

|

|

$ |

556.6 |

|

|

$ |

(197.0 |

) |

|

$ |

1,055.5 |

|

| Free cash flow, last twelve months(1) |

|

$ |

1,055.5 |