Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

April 14 2015 - 5:06PM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Registration Statement 333-203394

Final Term Sheet

April 14, 2015

$1,500,000,000

DaVita

HealthCare Partners Inc.

5.000% Senior Notes due 2025

April 14, 2015

This final term sheet

supplements, and should be read in conjunction with, DaVita HealthCare Partners Inc.’s preliminary prospectus supplement dated April 14, 2015 (the “Preliminary Prospectus Supplement”) and accompanying prospectus dated

April 14, 2015 and the documents incorporated by reference therein. The information in this final term sheet supplements the Preliminary Prospectus Supplement and supersedes the information in the Preliminary Prospectus Supplement to the extent

it is inconsistent with the information in the Preliminary Prospectus Supplement. Terms used herein but not defined herein shall have the respective meanings as set forth in the Preliminary Prospectus Supplement.

|

|

|

|

|

| Issuer: |

|

DaVita HealthCare Partners Inc. (the “Issuer”) |

|

|

| Title of Securities: |

|

5.000% Senior Notes due 2025 (the “Notes”) |

|

|

| Aggregate Offering Size: |

|

$1,500,000,000, which represents an increase of $250,000,000 from the amount offered under the Preliminary Prospectus Supplement dated April 14, 2015 |

|

|

| Maturity Date: |

|

May 1, 2025 |

|

|

| Coupon: |

|

5.000% per annum, accruing from April 17, 2015 |

|

|

| Offering Price: |

|

100.000%, plus accrued interest from April 17, 2015, if any |

|

|

| Interest Payment Dates: |

|

May 1 and November 1 |

|

|

| First Interest Payment Date: |

|

November 1, 2015 |

|

|

| Optional Redemption: |

|

At any time prior to May 1, 2020, the Issuer may redeem the Notes at its option, in whole or from time to time in part, at a

“make whole” redemption price, plus accrued and unpaid interest, if any, to the date of redemption, as set forth in the Preliminary Prospectus Supplement.

At any time on and after May 1, 2020, the Issuer may redeem the Notes at its option, in whole or from time to time in part, at the following redemption prices

(expressed as a percentage of principal amount), plus accrued and unpaid interest, if any, to the redemption date, if redeemed during the 12-month period beginning on May 1 of the years set forth

below: |

|

|

|

|

|

| Year |

|

|

|

Price |

|

|

|

| 2020 |

|

|

|

102.500% |

|

|

|

| 2021 |

|

|

|

101.667% |

|

|

|

| 2022 |

|

|

|

100.833% |

|

|

|

| 2023 and thereafter |

|

|

|

100.000% |

1

|

|

|

|

|

| Optional Redemption with Net Cash Proceeds of Equity Offerings: |

|

At any time prior to May 1, 2018, the Issuer may redeem at its option, on any one or more occasions, up to 35% of the original aggregate principal amount of the Notes (including the original aggregate principal amount

of any Additional Notes) with the Net Cash Proceeds of one or more Equity Offerings at a redemption price of 105.000%, plus accrued and unpaid interest, if any, to the redemption date; provided that at least 65% of the original aggregate principal

amount of the Notes (including the original aggregate principal amount of any Additional Notes) remains outstanding after each such redemption. |

|

|

| Change of Control: |

|

101%, plus accrued and unpaid interest, if any, to the Change of Control Payment Date |

|

|

| Joint Book-Running Managers: |

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Barclays Capital Inc. Credit Suisse Securities (USA) LLC

Goldman, Sachs & Co. J.P. Morgan Securities LLC

Morgan Stanley & Co. LLC SunTrust Robinson Humphrey, Inc.

Wells Fargo Securities, LLC |

|

|

| Co-managers: |

|

Credit Agricole Securities (USA) Inc.

Mitsubishi UFJ Securities (USA), Inc. Scotia Capital (USA)

Inc. SMBC Nikko Securities America, Inc. |

|

|

| CUSIP/ISIN Numbers: |

|

CUSIP: 23918K AR9 ISIN:

US23918KAR95 |

|

|

| Trade Date: |

|

April 14, 2015 |

|

|

| Settlement Date: |

|

April 17, 2015 (T+3) |

|

|

| Use of Proceeds: |

|

We estimate the net proceeds from this offering, after deducting the underwriting discount and other estimated expenses payable by us, will be approximately $1.481 billion. We intend to use the net proceeds from this

offering to repurchase any 2020 Notes tendered in the Offer and to redeem any 2020 Notes not tendered in the Offer, pay fees and expenses related to this offering and the Offer, and for general corporate purposes, which may include future

acquisitions and share repurchases. Pending application of the net proceeds from the offering of the notes for the purposes described above, we may temporarily invest the net proceeds in short-term investments. |

2

Revisions to the Preliminary Prospectus Supplement:

Under the heading “Summary–Summary Financial and Operating Data” of the Preliminary Prospectus Supplement, the “As Adjusted

data” appearing in the table on page S-11 is hereby revised as follows:

Interest expense shall be increased from $396 to $407.

Ratio of Adjusted EBITDA to interest expense shall be decreased from 6.3x to 6.1x.

Ratio of earnings to fixed charges shall be decreased from 3.0x to 2.9x.

Please refer to pages S-12 and S-13 of the Preliminary Prospectus Supplement for the notes applicable to the “As Adjusted data” appearing above.

The issuer has filed a registration statement (including a prospectus) and a prospectus supplement with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that registration statement and the prospectus supplement and other documents the issuer has filed with the SEC for more complete information about the issuer and this

offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and the prospectus

supplement, when available, if you request it by contacting (i) BofA Merrill Lynch at (800) 294-1322 or email: dg.prospectus_requests@baml.com, (ii) Barclays Capital Inc. at (888) 603-5847 or Barclaysprospectus@ broadridge.com,

(iii) Credit Suisse Securities (USA) LLC at (800) 221-1037 or Newyork.prospectus@credit-suisse.com, (iv) Goldman, Sachs & Co. at (866) 471-2526 or prospectus-ny@ny.email.gs.com, (v) J.P. Morgan Securities LLC at

(800) 245-8812, (vi) Morgan Stanley & Co. LLC at (866) 718-1649, (vii) SunTrust Robinson Humphrey, Inc. at (404) 926-5052 and (viii) Wells Fargo Securities, LLC at (800) 326-5897 or

cmclientsupport@wellsfargo.com.

Any disclaimer or other notice that may appear below the text of this legend is not applicable to this

communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by, or posted on, Bloomberg or another electronic mail system.

3

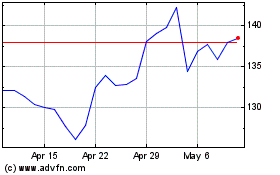

DaVita (NYSE:DVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

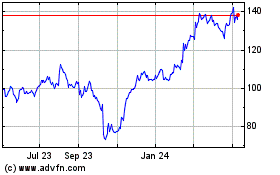

DaVita (NYSE:DVA)

Historical Stock Chart

From Apr 2023 to Apr 2024