Current Report Filing (8-k)

April 30 2015 - 4:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): April 30, 2015

DRIL-QUIP, INC.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-13439 |

|

74-2162088 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 6401 N. Eldridge Parkway

Houston, Texas |

|

77041 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (713) 939-7711

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition. |

On April 30, 2015, Dril-Quip, Inc.

(“Dril-Quip”) reported first quarter 2015 earnings. For additional information regarding Dril-Quip’s first quarter 2015 earnings, please refer to Dril-Quip’s press release attached to this report as Exhibit 99.1 (the “Press

Release”), which Press Release is incorporated by reference herein.

The information in the Press Release is being furnished, not filed, pursuant to

Item 2.02. Accordingly, the information in the Press Release will not be incorporated by reference into any registration statement filed by Dril-Quip under the Securities Act of 1933, as amended, unless specifically identified therein as being

incorporated therein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

The exhibit listed below is being furnished pursuant to Item 2.02 of this Form

8-K:

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release issued April 30, 2015. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| DRIL-QUIP, INC. |

|

|

| By: |

|

/s/ Jerry M. Brooks |

|

|

Jerry M. Brooks |

|

|

Vice President—Finance and Chief Financial Officer |

Date: April 30, 2015

3

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release issued April 30, 2015. |

4

Exhibit 99.1

Contact: Jerry M. Brooks, Chief Financial Officer, (713) 939-7711

DRIL-QUIP, INC. ANNOUNCES RESULTS FOR FIRST QUARTER 2015

HOUSTON, April 30, 2015 — Dril-Quip, Inc. (NYSE: DRQ) today announced net income of $53.7 million, or $1.38 per diluted share, for the three months

ended March 31, 2015, versus net income of $42.6 million, or $1.04 per diluted share, for the first quarter of 2014. Total revenues were $226.0 million during the quarter ended March 31, 2015 compared to $204.1 million for the same period

in 2014. In addition, the first quarter 2015 results were favorably impacted by an after-tax foreign exchange gain of $4.8 million, or $0.12 per diluted share, as compared to an after-tax foreign exchange loss of $660,000, or $0.02 per diluted

share, during the first quarter of 2014. The Company’s backlog at March 31, 2015 was approximately $1.1 billion, compared to its March 31, 2014 backlog of approximately $1.3 billion and its December 31, 2014 backlog of

approximately $1.2 billion.

Blake DeBerry, Dril-Quip’s President and CEO, stated, “We are pleased with our first quarter 2015 results as both

revenue and gross margins exceeded our expectations in the face of difficult industry conditions. As anticipated, new product orders were soft during the quarter but we expect bookings to strengthen as the year progresses.

Additionally, we believe that our strong balance sheet and free cash flow during 2015 will allow us to enhance shareholder value through both stock

repurchases and potential M&A activity, should attractive opportunities arise.”

Based upon current market conditions, the Company expects its

earnings per diluted share for the second quarter of 2015 to approximate $1.15 to $1.25 and its earnings per diluted share for the full year to approximate $4.60 to $4.80, excluding any unusual items and foreign currency gains and losses.

Dril-Quip is a leading manufacturer of highly engineered offshore drilling and production equipment, which is well suited for use in deepwater, harsh

environment and severe service applications.

Statements contained herein relating to future operations and financial results that are forward looking

statements are based upon certain assumptions and analyses made by the management of the Company in light of its experience and perception of historical trends, current conditions, expected future developments and other factors. These statements are

subject to risks beyond the Company’s control, including, but not limited to, the volatility of oil and natural gas prices and cyclicality of the oil and gas industry, uncertainties regarding the effects of new governmental regulations, the

Company’s international operations, operating risks, and other factors detailed in the Company’s public filings with the Securities and Exchange Commission. Investors are cautioned that any such statements are not guarantees of future

performance and actual outcomes may vary materially from those indicated.

Dril-Quip, Inc.

Comparative Condensed Consolidated Statements of Income

(in thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Revenues |

|

$ |

226,002 |

|

|

$ |

204,073 |

|

| Cost and expenses: |

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

125,138 |

|

|

|

110,787 |

|

| Selling, general and administrative |

|

|

16,958 |

|

|

|

23,935 |

|

| Engineering and product development |

|

|

12,213 |

|

|

|

10,784 |

|

|

|

|

|

|

|

|

|

|

|

|

|

154,309 |

|

|

|

145,506 |

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

71,693 |

|

|

|

58,567 |

|

| Interest income |

|

|

49 |

|

|

|

83 |

|

| Interest expense |

|

|

(3 |

) |

|

|

(7 |

) |

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

71,739 |

|

|

|

58,643 |

|

| Income tax provision |

|

|

18,075 |

|

|

|

16,025 |

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

53,664 |

|

|

$ |

42,618 |

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per share |

|

$ |

1.38 |

|

|

$ |

1.04 |

|

|

|

|

|

|

|

|

|

|

| Weighted average shares–diluted |

|

|

38,940 |

|

|

|

40,887 |

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

$ |

7,455 |

|

|

$ |

7,680 |

|

|

|

|

|

|

|

|

|

|

| Capital expenditures |

|

$ |

6,156 |

|

|

$ |

13,220 |

|

|

|

|

|

|

|

|

|

|

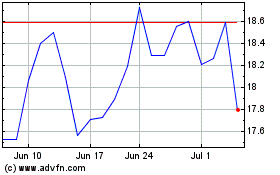

Dril Quip (NYSE:DRQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

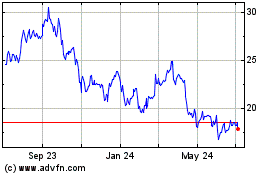

Dril Quip (NYSE:DRQ)

Historical Stock Chart

From Apr 2023 to Apr 2024