Farmers in the U.S. are pouring out tens of millions of gallons

of excess milk, amid a massive glut that has slashed prices and has

filled warehouses with cheese.

More than 43 million gallons' worth of milk have ended up in

fields, manure lagoons or animal feed, or have been lost on truck

routes or discarded at plants, according to data from the U.S.

Department of Agriculture. That is enough milk to fill 66 Olympic

swimming pools, and the most wasted in at least 16 years' worth of

data requested by The Wall Street Journal.

Desperate producers are working to find new uses for the excess,

like getting more milk into school lunches, and in revamped tacos

and Egg McMuffins. But many can't even afford to transport raw milk

to market at current prices, which have plunged 36% on average

since prices hit records in 2014.

"Everyone has dumped milk, from Minnesota to New England," said

Ken Nobis, head of the Michigan Milk Producers Association.

Dairy and meat producers in the U.S. and abroad expanded their

operations two years ago in response to a shortage, setting the

stage for the current global glut.

American farmers are in the process of harvesting record-large

corn and soybean crops, and meatpackers are now producing the most

ever meat and poultry. As a result, food prices in the U.S. have

plummeted and farm incomes this year are headed for their third

consecutive drop.

On Tuesday, the USDA pledged to buy about $20 million of cheddar

cheese to help struggling dairy farmers, the second time it has

intervened in the market in less than three months.

The Michigan Milk Producers Association, a farmer-run

cooperative, has added shifts at its dairy plants in Ovid and

Constantine and bought equipment to handle an additional million

pounds of raw milk each day. As the market has softened, the group

has donated 83,000 gallons of milk to a food bank.

Even so, over the summer, the co-op had to dump a batch of

excess skim milk into lagoons of manure because it couldn't find a

trucker to haul it to a plant with spare capacity in Wisconsin.

"Any milk disposal is a very difficult decision," said Mr. Nobis.

"No one gets any value whatsoever out of it."

Meanwhile, Dairy Management Inc., a de facto marketing firm that

is paid for by America's 43,000 dairy farmers, has invested tens of

millions of dollars in the past year to develop new milk-heavy menu

items with McDonald's Corp., Yum! Brands Inc.'s Taco Bell, Domino's

Pizza Inc. and about 10 other companies it calls "dairy

partners."

Food scientists and dietitians funded by DMI worked with

McDonald's, for instance, to replace liquid margarine with butter

in its breakfast egg sandwiches, muffins, buns and other menu

items. The new recipe was introduced at 15,000 restaurants in

September 2015. McDonald's spokeswoman Becca Hary said switching to

butter was part of the chain's "customer-led" shift to source

simpler ingredients, and contributed to "a double-digit percentage

increase in Egg McMuffin sales."

With Taco Bell, the dairy group created the "Quesalupa," a

cheese-laden cross between a flat quesadilla and a firm-shelled

chalupa that made its debut in February.

DMI ramped up spending on strategic partnerships last year to

over $30 million, more than double the investment six years ago,

when the group first began researching and developing new products

with companies.

Thanks in part to cheesier pizzas and more buttery buns,

commercial use of those two dairy products was up 4% in the year

through July. On average, each American last year ate an extra

pound of cheese and butter combined, according to the latest USDA

data. That has helped the industry combat a decadeslong decline in

American's consumption of fluid milk.

McDonald's switch to butter alone is projected to use up to 600

million pounds of milk annually.

"If you create the innovative products that people want, in the

ways they want them, you can be successful," said DMI Chief

Executive Tom Gallagher.

Even organic dairy farmers, whose costs can be as much as double

those for conventional producers thanks to their smaller scale and

pricey feed, have resorted to selling milk to faraway or

conventional plants to get rid of it, sacrificing their price

advantage.

"There are California producers so desperate to move organic

milk they're coming after our market in Atlanta," said Eric Newman,

vice president of sales at Organic Valley in La Farge, Wis The

dairy cooperative this year shipped organic milk powder to a

customer in Europe at a steep discount. "It's a mess," Mr. Newman

said.

(END) Dow Jones Newswires

October 12, 2016 11:25 ET (15:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

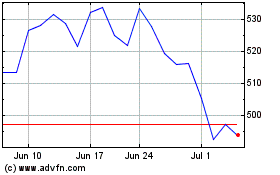

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

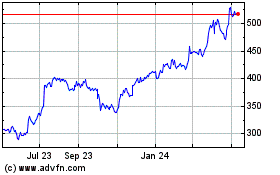

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Apr 2023 to Apr 2024