More than a decade after Toys "R" Us Inc. was acquired in a

leveraged buyout, the retailer is still struggling with a chronic

problem: running out of goods during the important holiday

season.

To tackle the issue, Chief Executive David Brandon, who took the

helm in July, asked engineers to design an algorithm to better

predict when goods will run low. He also is filling shelves with

more products—a move that is counter to the get-lean mind-set of

Wal-Mart Stores Inc. and other retailers.

Making sure Toys "R" Us has enough items to sell is a lesson he

learned early in his career as a manager for Procter & Gamble

Co., overseeing brands such as Crisco oil and Jif peanut butter. It

is also part of a larger strategy that he hopes will help get the

company back on track as he prepares to take it public next year

and provide its private-equity owners with a long-awaited exit.

"If a customer can't find what they're looking for at your store

60% of the time, they will shop somewhere else and never come

back," the 63-year-old Mr. Brandon said in a recent interview. "We

want our stores to be bulkier," he said of the effort to stuff

shelves with more goods. "We call it full and chunky."

Retailers walk a fine line between having enough merchandise,

but not too much. The latter requires markdowns to clear unsold

goods, which hurts profits. The former results in missed sales.

According to a report from DynamicAction, a software analytics

company, and research firm IHL Group, stock-outs cost retailers

about $634 billion annually in lost sales.

Mr. Brandon is taking charge of Toys "R" Us during what appears

to be a banner year for the toy industry. Sales through September

were up 8% compared with the same period last year, according to

retailers that participate in NPD Group's tracking service, which

represents about 80% of the U.S. retail toy market.

But the former Domino's Pizza Inc. CEO has his work cut out for

him. A string of executives have tried and failed to turn around

the toy chain, which was acquired in 2005 for $6.6 billion by Bain

Capital Partners LLC, KKR & Co. and Vornado Realty Trust. The

company lost $292 million last year, which followed a $1.04 billion

loss the prior year.

Paul Berberian, the chief executive of Sphero Inc., maker of the

"Star Wars" BB-8 Droid, one of the season's hot toys, said he

prefers to sell his products in Apple Inc., Brookstone and other

specialty stores. "Consumers want higher quality, deeper

experiences," he said. "Toys "R" Us is plastic by the pound."

Mr. Brandon said Toys "R" Us has carved out a different position

from rivals by having the broadest selection of toys. It is selling

hundreds of "Star Wars" products this holiday season, including

some exclusives such as an interactive Chewbacca action figure. The

company is trying to enrich the store experience with events like

one in October that invited children to build and take home a Lego

structure.

But Toys "R" Us, which has about 1,800 stores world-wide, needs

to make sure shoppers don't go away empty-handed. Before Mr.

Brandon arrived, stores were considered to be in stock if they had

three of a particular item. "If someone came in and bought those

three items, we'd be out of stock, which meant we were out of stock

a lot," Mr. Brandon said. Fuller shelves are more appealing to

shoppers than half empty racks that look picked over, he said.

Citigroup analyst Jenna Giannelli said the company's in-stock

rates are running about 95%, better than in past years. A Toys "R"

Us spokeswoman declined to verify the in-stock figures.

Online, Toys "R" Us seems to be fairing less well. On Black

Friday, the retailer's website was in stock 62% of the time on 100

top selling toys, according to an analysis by price-tracking firm

360pi. That was roughly on par with Wal-Mart Stores Inc., which had

a 63% in-stock rate, and better than Target Corp.'s 51% rate. But

it was worse than Toys "R" Us's 76% in-stock rate last year.

"If Wal-Mart is out of stock, they can sell something else,"

said Sean McGowan, an analyst with Oppenheimer & Co. "If Toys

"R" Us is out of stock, it ruins their whole image as the place to

go for toys."

The Toys "R" Us spokeswoman declined to comment on the 360pi

data, but said there is always the chance that popular items will

sell out on peak days. Target said it continues to restock

inventory throughout the season. Wal-Mart declined to comment.

Mr. Brandon concedes that Toys "R" Us's digital platforms, which

account for about 10% of its more than $12 billion in annual sales,

are "clumsy." After years of outsourcing its e-commerce sites, the

company is now building its own platforms.

Mr. McGowan, the Oppenheimer analyst, said Mr. Brandon is saying

all the right things, but so did his predecessors. "Other people

identified the problems," Mr. McGowan said. "They just couldn't fix

them."

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

December 14, 2015 20:45 ET (01:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

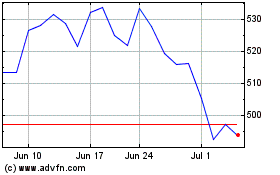

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

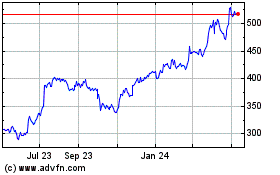

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Apr 2023 to Apr 2024