Domino's to Book Liability Charge in Third Quarter

September 28 2015 - 9:00AM

Dow Jones News

Domino's Pizza Inc. said it plans to refinance some of its debt

and that costs related to an increase in workers' compensation and

liability claims would cut into earnings in its most recently-ended

quarter.

The pizza chain said that while its claims activity for workers'

compensation and for automobile and general liabilities has been

fairly steady over the past several years, the company has seen a

recent rise in the frequency and severity of claims.

As a result, Domino's plans to take a $5.7 million pretax charge

in the third quarter ended Sept. 6, which should trim about six

cents from its per-share earnings. Analysts polled by Thomson

Reuters were expecting Domino's to report 75 cents a share in

adjusted earnings for the period.

Domino's also reported strong sales growth for the third

quarter. The company said sales at domestic company-owned stores

grew 11.5%, while international sales grew 7.7%, excluding currency

impacts. The company expects to report full results Oct. 8.

Domino's has seen strong sales momentum in the U.S. lately,

while it also has pushed to grow its business overseas. In India,

for example, Domino's is one of the largest foreign-food chains,

working to stay on top by introducing products like spicy banana

pizza for local palates.

Separately, Domino's said some of its subsidiaries will issue

$1.5 billion in fixed-rate notes and use the proceeds to pay down

some $551 million worth of notes from its 2012

recapitalization.

Shares of Domino's, inactive premarket after an earlier halt,

are up 20% this year.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 28, 2015 08:45 ET (12:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

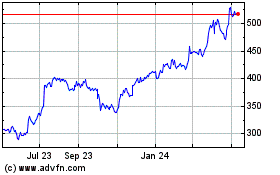

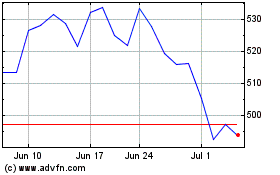

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Apr 2023 to Apr 2024