Current Report Filing (8-k)

April 24 2015 - 10:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) April 24, 2015

Domino’s Pizza, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

|

|

|

001-32242 |

38-2511577 |

|

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

30 Frank Lloyd Wright Drive

Ann Arbor, Michigan |

48105 |

|

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant's telephone number, including area code (734) 930-3030

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure.

The document attached hereto as Exhibit 99.1 is a copy of a report provided by Domino’s Pizza, Inc. (the “Company”) to holders of the Series 2012-1 5.216% Fixed Rate Senior Secured Notes, Class A-2 of Domino’s Pizza Master Issuer LLC, a subsidiary of the Company. The information in this Form 8-K and the Exhibit attached hereto are being furnished pursuant to Item 7.01 of Form 8-K and therefore shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

Exhibit

Number |

|

Description |

|

|

99.1 |

|

Domino’s Pizza Master Issuer LLC Quarterly Noteholders’ Statement for the first quarter of 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

DOMINO’S PIZZA, INC. |

|

|

|

|

(Registrant) |

|

|

|

|

|

|

Date: April 24, 2015 |

|

/s/ Michael T. Lawton |

|

|

|

|

Michael T. Lawton

Chief Financial Officer |

Exhibit 99.1

Domino's Pizza Master Issuer LLC

Domino's SPV Canadian Holding Company Inc.

Domino's Pizza Distribution LLC

Domino's IP Holder LLC

Quarterly Noteholders' Statement

|

Quarterly Collection Period Starting: |

|

December 29, 2014 |

|

Quarterly Collection Period Ending: |

|

March 22, 2015 |

|

Quarterly Payment Date: |

|

April 27, 2015 |

|

Debt Service Coverage Ratios and Senior ABS Leverage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Senior ABS Leverage |

|

|

Quarterly DSCR |

|

|

|

Current Period |

|

|

|

3.92 |

x |

|

|

4.23 |

x |

|

|

One Period Prior |

|

|

|

4.21 |

x |

|

|

3.94 |

x |

|

|

Two Periods Prior |

|

|

|

4.36 |

x |

|

|

3.70 |

x |

|

|

Three Periods Prior |

|

|

|

4.47 |

x |

|

|

3.81 |

x |

|

|

|

|

System Performance |

|

|

|

|

|

|

Domestic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchise |

|

|

Company-Owned |

|

|

Total Domestic |

|

|

|

Open Stores at end of prior Quarterly Collection Period |

|

|

4,690 |

|

|

|

377 |

|

|

|

5,067 |

|

|

|

Store Openings during Quarterly Collection Period |

|

|

20 |

|

|

|

2 |

|

|

|

22 |

|

|

|

Store Transfers during Quarterly Collection Period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

Permanent Store Closures during Quarterly Collection Period |

|

|

(5 |

) |

|

|

— |

|

|

|

(5 |

) |

|

|

Net Change in Open Stores during Quarterly Collection Period |

|

|

15 |

|

|

|

2 |

|

|

|

17 |

|

|

|

Open Stores at end of Quarterly Collection Period |

|

|

4,705 |

|

|

|

379 |

|

|

|

5,084 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchise |

|

|

Company-Owned |

|

|

Total International |

|

|

|

Open Stores at end of prior Quarterly Collection Period |

|

|

6,562 |

|

|

|

— |

|

|

|

6,562 |

|

|

|

Store Openings during Quarterly Collection Period |

|

|

140 |

|

|

|

— |

|

|

|

140 |

|

|

|

Permanent Store Closures during Quarterly Collection Period |

|

|

(47 |

) |

|

|

— |

|

|

|

(47 |

) |

|

|

Net Change in Open Stores during Quarterly Collection Period |

|

|

93 |

|

|

|

— |

|

|

|

93 |

|

|

|

Open Stores at end of Quarterly Collection Period |

|

|

6,655 |

|

|

|

— |

|

|

|

6,655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchise |

|

|

Company-Owned |

|

|

International |

|

|

|

Same-Store Sales Growth for Quarterly Collection Period |

|

|

14.4 |

% |

|

|

15.9 |

% |

|

|

7.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Potential Events |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Material Concern |

|

|

|

i. Potential Rapid Amortization Event |

|

|

No |

|

|

|

ii. Potential Manager Termination Event |

|

|

No |

|

|

Cash Trapping |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of |

|

|

|

Commenced |

|

Commencement |

|

|

i. a. Partial Cash Trapping Period |

|

No |

|

N/A |

|

|

b. Full Cash Trapping Period |

|

No |

|

N/A |

|

|

ii. Series 2012-1 Cash Trapping Percentage during Quarterly Collection Period |

|

|

|

N/A |

|

|

iii. Series 2012-1 Cash Trapping Percentage following current Quarterly Payment Date |

|

|

|

N/A |

|

|

iv. Series 2012-1 Cash Trapping Percentage during prior Quarterly Collection Period |

|

|

|

N/A |

|

|

v. Series 2012-1 Partial Cash Trapping Release Event |

|

|

|

N/A |

|

|

vi. Series 2012-1 Full Cash Trapping Release Event |

|

|

|

N/A |

|

|

|

Occurrence Dates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of |

|

|

|

Commenced |

|

Commencement |

|

|

i. Rapid Amortization Event |

|

No |

|

N/A |

|

|

ii. Default |

|

No |

|

N/A |

|

|

iii. Event of Default |

|

No |

|

N/A |

|

|

iv. Manager Termination Event |

|

No |

|

N/A |

|

|

|

Non-Amortization Test |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of |

|

|

|

Commenced |

|

Commencement |

|

|

i. Non-Amortization Period |

|

Yes |

|

January 26, 2015 |

|

|

|

Extension Periods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of |

|

|

|

Commenced |

|

Commencement |

|

|

i. Series 2012-1 Class A-1 first renewal period |

|

No |

|

N/A |

|

|

ii. Series 2012-1 Class A-1 second renewal period |

|

No |

|

N/A |

|

Allocation of Funds |

|

|

1. Outstanding Notes and Reserve Account Balances as of Prior Quarterly Payment Date: |

|

|

|

|

|

|

i. Outstanding Principal Balances |

|

|

|

|

|

|

|

a. Advances Under Series 2012-1 Class A-1 Notes |

|

$ |

— |

|

|

|

|

b. Series 2012-1 Class A-2 Notes |

|

$ |

1,521,843,750.00 |

|

|

|

|

c. Senior Subordinated Notes |

|

$ |

— |

|

|

|

|

d. Subordinated Notes |

|

$ |

— |

|

|

|

ii. Reserve Account Balances |

|

|

|

|

|

|

|

a. Available Senior Notes Interest Reserve Account Amount (1) |

|

$ |

20,777,917.51 |

|

|

|

|

b. Available Senior Subordinated Notes Interest Reserve Account Amount |

|

$ |

— |

|

|

|

|

c. Available Cash Trap Reserve Account Amount (1) |

|

$ |

— |

|

|

2. Retained Collections for Current Quarterly Payment Date: |

|

|

|

|

|

|

i. Franchisee Payments |

|

|

|

|

|

|

|

a. Domestic Continuing Franchise Fees |

|

$ |

115,107,392.63 |

|

|

|

|

b. International Continuing Franchise Fees |

|

$ |

34,782,661.46 |

|

|

|

|

c. Initial Franchise Fees |

|

$ |

— |

|

|

|

|

d. Other Franchise Fees |

|

$ |

— |

|

|

|

|

e. PULSE Maintenance Fees |

|

$ |

3,784,969.93 |

|

|

|

|

f. PULSE License Fees |

|

$ |

275,606.70 |

|

|

|

|

g. Technology Fees |

|

|

4,495,394.63 |

|

|

|

|

h. Franchisee Insurance Proceeds |

|

$ |

— |

|

|

|

|

i. Other Franchisee Payments |

|

$ |

— |

|

|

|

ii. Company-Owned Stores License Fees |

|

$ |

4,962,199.45 |

|

|

|

iii. Third-Party License Fees |

|

$ |

— |

|

|

|

iv. Product Purchase Payments |

|

$ |

338,906,106.03 |

|

|

|

v. Co-Issuers Insurance Proceeds |

|

$ |

— |

|

|

|

vi. Asset Disposition Proceeds |

|

$ |

— |

|

|

|

vii. Excluded Amounts |

|

$ |

1,702,875.81 |

|

|

|

viii. Other Collections |

|

$ |

150,261.00 |

|

|

|

ix. Investment Income |

|

$ |

6,289.87 |

|

|

|

x. HoldCo L/C Agreement Fee Income |

|

$ |

91,392.36 |

|

|

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

xiii. Excluded Amounts |

|

$ |

61,497,279.74 |

|

|

|

|

a. Advertising Fees |

|

$ |

59,794,403.93 |

|

|

|

|

b. Company-Owned Store Advertising Fees |

|

$ |

— |

|

|

|

|

c. Third-Party Matching Expenses |

|

$ |

1,702,875.81 |

|

|

|

xiv. Product Purchase Payments |

|

$ |

338,906,106.03 |

|

|

|

xiv. Bank Account Expenses |

|

$ |

38,102.61 |

|

|

|

|

Plus: |

|

|

|

|

|

|

xvi. Aggregate Weekly Distributor Profit Amount |

|

$ |

24,533,361.06 |

|

|

|

xvii. Retained Collections Contributions |

|

$ |

— |

|

|

|

xviii. Total Retained Collections |

|

$ |

128,357,022.55 |

|

|

3. Adjusted Net Cash Flow for Current Quarterly Payment Date: |

|

|

|

i. Retained Collections for Quarterly Collection Period |

|

$ |

128,357,022.55 |

|

|

|

|

Less: |

|

|

|

|

|

|

ii. Servicing Fees, Liquidation Fees and Workout Fees |

|

$ |

78,296.94 |

|

|

|

iii. Securitization Entities Operating Expenses paid during Quarterly Collection Period |

|

$ |

7,469.00 |

|

|

|

iv. Weekly Manager Fee Amounts paid during Quarterly Collection Period |

|

$ |

13,309,267.92 |

|

|

|

v. Manager Advances Reimbursement Amounts |

|

$ |

— |

|

|

|

vi. PULSE Maintenance Fees |

|

$ |

3,784,969.93 |

|

|

|

vii. Technology Fees |

|

$ |

4,495,394.63 |

|

|

|

viii. Administrative Expenses |

|

$ |

25,000.00 |

|

|

|

vix. Investment Income |

|

$ |

6,289.87 |

|

|

|

vx. Retained Collections Contributions, if applicable, received during Quarterly Collection Period |

|

$ |

— |

|

|

|

viii. Net Cash Flow for Quarterly Collection Period |

|

$ |

106,650,334.26 |

|

|

|

ix. Net Cash Flow for Quarterly Collection Period / Number of Days in Quarterly Collection Period |

|

$ |

1,269,646.84 |

|

|

|

x. Multiplied by 91 if 52 week fiscal year or 92.75 if 53 week fiscal year |

|

|

93 |

|

|

|

xi. Adjusted Net Cash Flow for Quarterly Collection Period |

|

$ |

117,759,744.08 |

|

|

1. Amounts calculated as of the close of business on the last Business Day of the preceding Quarterly Collection Period. |

|

|

4. Debt Service / Payments to Noteholders for Current Quarterly Payment Date: |

|

|

|

|

|

|

i. Required Interest on Senior and Senior Subordinated Notes |

|

|

|

|

|

|

|

|

|

Series 2012-1 Class A-1 Quarterly Interest |

|

$ |

73,488.22 |

|

|

|

|

|

|

Series 2012-1 Class A-2 Quarterly Interest |

|

$ |

19,844,842.50 |

|

|

|

|

|

|

Series 2012-1 Senior Subordinated Quarterly Interest |

|

$ |

— |

|

|

|

ii. Required Principal on Senior and Senior Subordinated Notes |

|

|

|

|

|

|

|

|

|

Series 2012-1 Class A-2 Quarterly Scheduled Principal |

|

$ |

7,875,000.00 |

|

|

|

|

|

|

Series 2012-1 Senior Subordinated Scheduled Principal |

|

$ |

— |

|

|

|

iii. Other |

|

|

|

|

|

|

|

|

|

Series 2012-1 Class A-1 Quarterly Commitment Fees |

|

$ |

72,987.07 |

|

|

|

iv. Total Debt Service |

|

$ |

27,866,317.79 |

|

|

|

v. Other Payments to Noteholders Relating to Notes |

|

|

|

|

|

|

|

|

|

Series 2012-1 Subordinated Quarterly Interest |

|

$ |

— |

|

|

|

|

|

|

Series 2012-1 Subordinated Quarterly Scheduled Principal |

|

$ |

— |

|

|

|

|

|

|

Series 2012-1 Class A-1 Quarterly Contingent Additional Interest |

|

$ |

— |

|

|

|

|

|

|

Series 2012-1 Class A-2 Quarterly Contingent Additional Interest |

|

$ |

— |

|

|

|

|

|

|

Senior Subordinated Quarterly Contingent Additional Interest |

|

$ |

— |

|

|

|

|

|

|

Subordinated Quarterly Contingent Additional Interest |

|

$ |

— |

|

|

5. Aggregate Weekly Allocations to Distribution Accounts for Current Quarterly Payment Date: |

|

|

|

|

|

|

i. All available deposits in Series 2012-1 Class A-1 Distribution Account |

|

$ |

171,475.29 |

|

|

|

ii. All available deposits in Series 2012-1 Class A-2 Distribution Account |

|

$ |

19,844,842.50 |

|

|

|

iii. All available deposits in Senior Subordinated Distribution Account |

|

$ |

— |

|

|

|

iv. All available deposits in Subordinated Distribution Account |

|

$ |

— |

|

|

|

v. Total on Deposit in Distribution Accounts |

|

$ |

20,016,317.79 |

|

|

6. Distributions for Current Quarterly Payment Date: |

|

|

|

|

|

|

Series 2012-1 Class A-1 Distribution Account |

|

|

|

|

|

|

i. Payment of interest and fees related to Series 2012-1 Class A-1 Notes |

|

$ |

171,475.29 |

|

|

|

ii. Indemnification and Real Estate Disposition Proceeds Payments to reduce commitments under Series 2012-1 Class A-1 Notes |

|

$ |

— |

|

|

|

iii. Principal payments to Series 2012-1 Class A-1 Notes |

|

$ |

— |

|

|

|

iv. Payment of Series 2012-1 Class A-1 Notes Breakage Amounts |

|

$ |

— |

|

|

|

Series 2012-1 Class A-2 Distribution Account |

|

|

|

|

|

|

i. Payment of interest related to Series 2012-1 Class A-2 Notes |

|

$ |

19,844,842.50 |

|

|

|

ii. Indemnification and Real Estate Disposition Proceeds payments to Series 2012-1 Class A-2 Notes |

|

$ |

— |

|

|

|

iii. Principal payment to Series 2012-1 Class A-2 Notes |

|

$ |

— |

|

|

|

iv. Make-Whole Premium related to Series 2012-1 Class A-2 Notes |

|

$ |

— |

|

|

|

Senior Subordinated Distribution Account |

|

|

|

|

|

|

i. Payment of interest related to Senior Subordinated Notes |

|

$ |

— |

|

|

|

ii. Indemnification and Real Estate Disposition Proceeds payments to Senior Subordinated Notes |

|

$ |

— |

|

|

|

iii. Principal payment to Senior Subordinated Notes |

|

$ |

— |

|

|

|

iv. Make-Whole Premium related to Senior Subordinated Notes |

|

$ |

— |

|

|

|

Subordinated Distribution Account |

|

|

|

|

|

|

i. Payment of interest related to Subordinated Notes |

|

$ |

— |

|

|

|

ii. Indemnification and Real Estate Disposition Proceeds payments to Subordinated Notes |

|

$ |

— |

|

|

|

iii. Principal payment to Subordinated Notes |

|

$ |

— |

|

|

|

iv. Make-Whole Premium related to Subordinated Notes |

|

$ |

— |

|

|

|

|

Total Allocations from Distribution Accounts |

|

$ |

20,016,317.79 |

|

|

7. Senior Notes Interest Reserve Account Deposits, Draws and Releases as of Current Quarterly Payment Date: |

|

|

|

|

|

|

i. Deposits into Senior Notes Interest Reserve Account during Quarterly Collection Period |

|

$ |

6,075.00 |

|

|

|

ii. Less draws on / releases from Available Senior Notes Interest Reserve Account Amount |

|

$ |

— |

|

|

|

iii. Total Increase (Reduction) of Available Senior Notes Interest Reserve Account Amount |

|

$ |

6,075.00 |

|

|

8. Senior Subordinated Notes Interest Reserve Account Deposits, Draws and Releases as of Current Quarterly Payment Date: |

|

|

|

|

|

|

i. Deposits into Senior Subordinated Notes Interest Reserve Account during Quarterly Collection Period |

|

$ |

— |

|

|

|

ii. Less draws on Available Senior Subordinated Notes Interest Reserve Account Amount |

|

$ |

— |

|

|

|

iii. Total Increase (Reduction) of Available Senior Subordinated Notes Interest Reserve Account Amount |

|

$ |

— |

|

|

9. Cash Trap Reserve Account Deposits, Draws and Releases as of Current Quarterly Payment Date: |

|

|

|

|

|

|

i. Deposits into Cash Trap Reserve Account during Quarterly Collection Period |

|

$ |

— |

|

|

|

ii. Less draws on Available Cash Trap Reserve Account Amount |

|

$ |

— |

|

|

|

iii. Less Cash Trapping Release Amount |

|

$ |

— |

|

|

|

iv. Total Increase (Reduction) of Available Cash Trap Reserve Account Amount |

|

$ |

— |

|

|

10. Real Estate Disposition Proceeds |

|

|

|

|

|

|

i. Aggregate Real Estate Disposition Proceeds as of Prior Quarterly Payment Date |

|

$ |

— |

|

|

|

ii. Aggregate Real Estate Disposition Proceeds as of Current Quarterly Payment Date |

|

$ |

— |

|

|

11. Scheduled Principal Catch-Up Amounts |

|

|

|

|

|

|

i. Series 2012-1 Class A-2 aggregate Scheduled Principal Catch-Up Amounts as of Prior Quarterly Payment Date |

|

$ |

— |

|

|

|

ii. Series 2012-1 Class A-2 aggregate Scheduled Principal Catch-Up Amounts as of Current Quarterly Payment Date |

|

$ |

7,875,000.00 |

|

|

12. Outstanding Balances as of Current Quarterly Payment Date (after giving effect to payments to be made on such date): |

|

|

|

|

|

|

i. Series 2012-1 Class A-1 Notes |

|

$ |

44,095,014.00 |

|

|

|

ii. Series 2012-1 Class A-2 Notes |

|

$ |

1,521,843,750.00 |

|

|

|

iii. Senior Subordinated Notes |

|

$ |

— |

|

|

|

iv. Subordinated Notes |

|

$ |

— |

|

|

|

v. Reserve account balances: |

|

|

|

|

|

|

|

a. Available Senior Notes Interest Reserve Account Amount |

|

$ |

20,783,992.51 |

|

|

|

|

b. Available Senior Subordinate Notes Interest Reserve Account Amount |

|

$ |

— |

|

|

|

|

c. Available Cash Trap Reserve Account Amount |

|

$ |

— |

|

|

IN WITNESS HEREOF, the undersigned has duly executed and delivered this Quarterly Noteholders' Statement this April 23, 2015. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Domino's Pizza LLC as Manager on behalf of the Master Issuer and certain subsidiaries thereto, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

by: |

|

|

|

|

|

|

|

|

Jeffrey D. Lawrence - Treasurer |

|

|

|

|

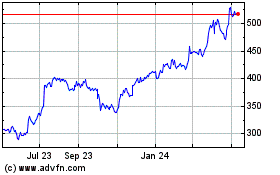

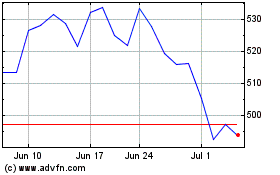

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Apr 2023 to Apr 2024