Praxair Approaches Linde About Resuming Deal Talks

November 29 2016 - 2:00PM

Dow Jones News

Praxair Inc. moved to restart negotiations with Germany's Linde

AG over a combination that would create a $60 billion

industrial-gas giant, two months after previous talks

dissolved.

Praxair approached Linde last week and negotiations could begin

soon, according to people familiar with the matter. Linde may not

agree to resume talks, one of the people cautioned, and a deal is

far from guaranteed.

The companies, each worth about $30 billion, were nearing an

agreement to combine before talks broke down in September. The

effort, which had been under way for two months, stalled in part

because Munich-based Linde was uncomfortable with a plan to move

the combined company's European headquarters to the U.S., people

familiar with the matter said at the time. These people said then

that the companies could ultimately return to the negotiating

table.

There is no guarantee antitrust regulators would approve a

merger agreement, which could create the world's largest

industrial-gas producer.

The collapse of the last round of talks sparked turmoil in

Linde's executive ranks. Chief Executive Wolfgang Bü chele

announced he wouldn't seek a new term when his contract expires

next April.

"In my professional career, I have always measured myself

according to my ability to attain the objectives I set," he said in

a statement at the time. "Based on that, I was personally

disappointed that I could not reach the goal of creating the number

one globally." Linde also said its chief financial officer, Georg

Denoke, had left the company.

The executives had differences of opinion regarding the plan to

combine with Praxair, people familiar with the matter have said.

Mr. Denoke sided with labor representatives on the supervisory

board in opposing the deal, these people said.

The company hasn't named permanent replacements for either

man.

The last round of talks called for a 50/50 ownership split with

Praxair Chairman and Chief Executive Steve Angel as leader of the

combined entity, which was to be based at Praxair's headquarters in

Danbury, Conn. Linde's supervisory board chairman Wolfgang Reitzle

was expected to become chairman of the merged company.

Linde and Praxair have long pondered a merger.

What is now called Praxair was once part of Linde. Founded as

its American arm in 1907 and then known as Linde Air Products Co.,

the company developed so rapidly that by World War I it was bigger

than the German parent, according to Linde's website. In the early

part of last century, Linde Air Products was acquired by Union

Carbide Corp., which spun the company off in 1992 and named it

Praxair. Union Carbide is now part of Dow Chemical Co. Praxair has

26,000 employees in more than 50 countries.

In May, two major rivals of the companies combined, setting off

another possible wave of consolidation in an industry hit by

declining energy prices and sluggish economic growth. Air Liquide

SA bought Airgas Inc. for about $10 billion, enabling the French

company to reclaim the No. 1 spot among makers of gases used in

manufacturing, food production, health care and the like, with

annual revenue of more than $20 billion.

Linde, which makes industrial and medical gases and builds

plants for chemical producers and others, had taken the No. 1

position from Air Liquide with its $14 billion takeover of the

U.K.'s BOC PLC in 2006. A combined Linde and Praxair would again

leapfrog Air Liquide, creating a company with more than $30 billion

in revenue—before any divestitures.

When the talks broke down, Linde said there was still a

strategic rationale for the tie-up. Combining the companies was

expected to result in more than $1 billion in annual cost savings

and other so-called synergies, a person familiar with the matter

said then.

Since then, Linde's shares have outperformed Praxair's, which

could encourage the German company to return to the negotiating

table

Write to Dana Mattioli at dana.mattioli@wsj.com and Eyk Henning

at eyk.henning@wsj.com

(END) Dow Jones Newswires

November 29, 2016 13:45 ET (18:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

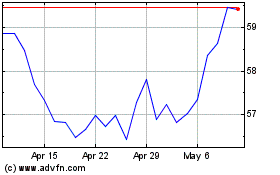

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

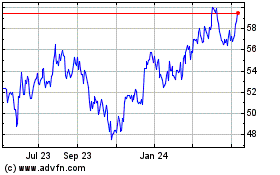

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024