DuPont Boosts Profit Forecast Amid Rise in Revenue -- Update

October 25 2016 - 7:34AM

Dow Jones News

By Joshua Jamerson

Chemical giant DuPont Co., looking to wrap up its merger with

Dow Chemical Co., boosted its profit outlook for the year as it

reported higher sales from its agriculture and performance

materials segments amid lower costs in the latest period.

DuPont is approaching the one year anniversary of its December

2015 announcement that it would merge with rival Dow Chemical, as

antitrust reviews have raised questions about what businesses Dow

and DuPont may have to shed to get the green light in Brussels,

Washington and other regulatory jurisdictions.

"We continue to work constructively with regulators in key

jurisdictions to close the merger as soon as possible," Ed Breen,

DuPont's chief executive, said in prepared remarks.

The European Union's antitrust authority earlier this month set

a new date of February 2017 to complete its review of the

merger.

"In the event that regulators in those jurisdictions use their

full allotted time, closing would be expected to occur in the first

quarter of 2017," Mr. Breen said.

The company said Tuesday it now sees adjusted earnings coming in

at $3.25 a share, compared with its prior guidance range of $3.15

to $3.20.

DuPont's agricultural unit is among the biggest sellers of corn

and soybean seeds to U.S. farmers. In the September quarter,

DuPont's agriculture sales rose 2% to $1.12 billion. Cost cuts,

higher volumes and a $28 million benefit from currency helped

offset lower local prices and higher product costs.

DuPont, along with rival seed developers like Monsanto Co. and

farm equipment makers like Deere & Co., has struggled against a

three-year slide in major crop prices. But earlier this month,

Monsanto also reported better-than-expected results.

In the performance materials unit, DuPont's largest segment,

sales also increased 2%, to $1.33 billion. Both the agriculture and

performance materials units were helped by 4% higher volume.

Over all, DuPont earned $2 million, compared with $235 million a

year ago. On a per-share basis, the company broke even in the

quarter, compared with a 26 cent-a-share profit in the year-prior

period.

Excluding certain items, the company earned 34 cents a share, up

from 13 cents a year ago. Analysts surveyed by Thomson Reuters had

forecast 21 cents a share.

DuPont's sales in the quarter rose 1% to $4.92 billion. Analysts

projected $4.87 billion in sales.

The company said selling, general and administrative expenses

fell 2.9% in the period, as research and development costs fell

7%.

Shares, which have risen 16% in the past three months, were

unchanged premarket.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

October 25, 2016 07:19 ET (11:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

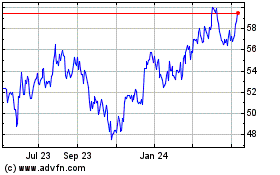

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

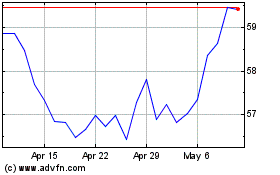

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024