Monsanto Rejects Bayer's Sweetened Merger Offer--Update

July 19 2016 - 2:32PM

Dow Jones News

By Jacob Bunge and Anne Steele

Monsanto Co. on Tuesday again rejected Bayer AG's takeover

proposal, saying Bayer's improved $65 billion bid still undervalued

the biotech seed giant -- but it left the door open to further

talks with Bayer and "other parties."

Monsanto called Bayer's bid, which the German company raised

last week, "financially inadequate" and "insufficient to ensure

deal certainty." Monsanto's board of directors unanimously rejected

it.

"Bayer is looking forward to continued dialogue with Monsanto

under an appropriate confidentiality agreement allowing access to

additional information," Bayer said Tuesday in a press release.

A Bayer spokesman declined to explain if the two companies have

reached a confidentiality agreement, and said that the dialogue

with Monsanto would continue.

Bayer voiced disappointment over Monsanto's decision to reject

Bayer's increased takeover offer.

"The revised all-cash offer is a compelling opportunity and

represents immediate and certain value for Monsanto shareholders

amid recent weak business performance and Monsanto's reduced

mid-term outlook," Bayer said.

Bayer is pursuing what would be the latest in a succession of

multibillion-dollar merger agreements that would reorder the $100

billion global market for agricultural seeds and pesticides, which

has struggled against a slide in crop prices. The German

pharmaceutical maker, which runs an agricultural division heavily

focused on pesticides, sees Monsanto's number-one global position

in seeds and crop genes as a way to create a sector leader that

could develop high-tech seeds, crop sprays and other farm services

in tandem.

After bidding $122 a share for Monsanto in May, Bayer raised its

offer to $125 a share verbally on July 1 and more formally eight

days later, it said in a July 14 statement. Bayer also said it had

lined up financing from a group of banks, and pledged to pay

Monsanto $1.5 billion if regulators torpedoed the deal.

Analysts had expected Monsanto to turn down Bayer's higher

offer, however, estimating a sale price around $135 to $140 a

share.

Some Monsanto investors have said Bayer should pay more for the

world's largest seed company, despite Monsanto's recent struggles

in the slumping farm economy. Monsanto, which is focused entirely

on agriculture compared with more-diversified rivals like Bayer and

DuPont Co., last month reported profit in its latest quarter below

analysts' expectations, as sales fell 8.5%.

While some Monsanto investors say they are interested in a sale

at the right price, they are concerned about selling at a low point

in the cyclical agricultural business, after three straight years

of declining crop prices have U.S. farm income on track to hit its

lowest level since 2002.

Monsanto Chief Executive Hugh Grant told investors on an

earnings conference call last month that Monsanto also had been

discussing alternative deals.

A tie-up between Monsanto and Bayer would be the latest

blockbuster merger in the agricultural sector. Shareholders of Dow

Chemical Co. and DuPont, both major seed and pesticide makers, this

week are scheduled to vote on a merger deal agreed in December.

Switzerland's Syngenta AG -- which Monsanto unsuccessfully pursued

last year -- agreed in February to a $43 billion takeover by China

National Chemical Corp.

Buying Monsanto also would reshape Bayer itself, making

agriculture roughly half its overall sales, which has rattled some

investors who view the company more as a health-care player than a

producer of crop seeds.

Friedrich Geiger contributed to this article.

Write to Jacob Bunge at jacob.bunge@wsj.com and Anne Steele at

Anne.Steele@wsj.com

(END) Dow Jones Newswires

July 19, 2016 14:17 ET (18:17 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

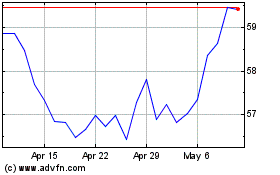

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

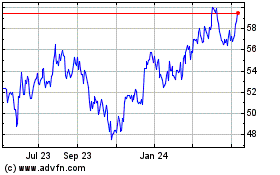

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024