Dow Chemical Results Top Expectations

April 28 2016 - 7:56AM

Dow Jones News

By Joshua Jamerson

Dow Chemical Co. said its revenue fell sharply amid pricing and

currency headwinds in the latest quarter, as the company works to

complete its merger with DuPont Co.

Still, the results, including adjusted per-share profit, topped

expectations.

Dow on Thursday blamed local price declines in hydrocarbons and

energy for the first-quarter sales decline, in addition to the

stronger dollar, which makes its products more expensive

abroad.

Dow Chief Executive and Chairman Andrew Liveris said he saw

"strong demand signals in North America, gradual recovery in Europe

and ongoing sustainable urbanization in China," though he warned

that "pockets of volatility will persist, including near-term

geopolitical and economic uncertainty, most notably in Brazil."

Midland, Mich.-based Dow, a giant in the chemical and

agriculture industries and maker of products ranging from corn

seeds to plastic, in December struck a deal to combine with rival

DuPont into a $120 billion company that will have about $90 billion

in sales.

The deal, which would create a company with a combined market

value of about $104 billion, aims to eliminate $3 billion in

combined costs before separating into three publicly traded

companies within three years.

DuPont Chief Executive Ed Breen said this week that regulatory

reviews of the deal in the U.S., Europe, China and Brazil are

proceeding on schedule. Mr. Breen said U.S. regulators looking over

the DowDuPont merger plan should clear it by the end of June, and

that special shareholder meetings to vote on the merger would

likely happen by the end of the second quarter.

Mr. Liveris said Thursday that the DuPont transaction was "on

track."

In the March quarter, Dow's plastics segment, its largest, was

reported sales of $4.2 billion, down from $4.3 billion a year ago,

hurt by lower hydrocarbon pricing.

Over all, Dow reported a profit of $254 million, or 15 cents a

share, down from $1.48 billion, or $1.18 cents, a year earlier.

Excluding items, such a 70 cents a share on a legal settlement,

per-share earnings were 89 cents.

Revenue declined 13% to $10.7 billion. Analysts had projected 83

cents in adjusted earnings per share on $10.66 billion in revenue,

according to Thomson Reuters.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

April 28, 2016 07:41 ET (11:41 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

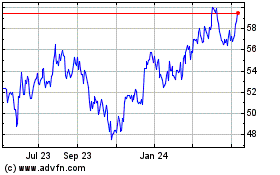

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

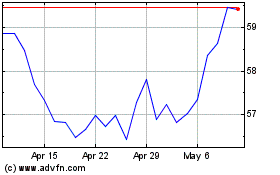

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024