By Rick Carew, Shayndi Raice and Eyk Henning

China National Chemical Corp. is nearing an agreement to buy

Swiss pesticide and seed giant Syngenta AG for roughly $43 billion,

according to people familiar with the matter--a move that would

mark one of China's most ambitious attempts at an overseas

acquisition.

Big obstacles remain to completing a deal. People familiar with

the matter said an agreement between the two companies could be

announced as soon as Wednesday, but also cautioned that talks could

still fall apart. If an agreement is reached, it would be just the

beginning of what promises to be a fraught process gaining

government and regulatory approval around the world, including in

the U.S., the home of a sizable portion of Syngenta's seed and

crop-spray business.

Another suitor could also emerge. The global agricultural and

chemicals industries have been scrambled in recent months by a bevy

of deal making, kicked off by U.S. seed giant Monsanto Co.'s

unsuccessful $46 billion takeover of Syngenta itself.

Terms of the deal with China National Chemical, known as

ChemChina, call for a price of about 470 Swiss francs in cash, or

$461, a share, according to people familiar with the matter.

Bankers and investors have said it would be difficult for Monsanto,

or any other suitor, to match such an all-cash offer.

If consummated, the transaction would represent the largest

foreign acquisition by a Chinese company by a long shot. That honor

is now held by Cnooc Ltd.'s 2013 purchase of Canada's Nexen, an oil

producer, for $18.2 billion.

Shares in Syngenta rose sharply after The Wall Street Journal

reported the talks earlier Tuesday. Syngenta is due to report 2015

full-year financial results on Wednesday.

A deal would need to pass a gauntlet of regulatory examinations

in Europe and the U.S., which bankers and lawyers said could prove

difficult. They said that U.S. authorities would scrutinize the

transaction. About a quarter of Syngenta's sales come from North

America.

The company is the top pesticide seller in North America in

terms of sales, and it sells 10% of soybean seeds in the U.S. and

6% of U.S. corn seeds. The company was created in 2000 through the

merger of the agribusiness operations of European pharmaceutical

giants Novartis AG and AstraZeneca PLC.

The talks come amid global concerns about China's slowing

economy and Beijing's attempts at managing that slowdown, partly by

orchestrating a gradual easing of the country's currency. That has

whipsawed not only the country's domestic stock markets, but also

global shares, bonds and currencies--while contributing to a sharp

fall in commodities prices world-wide.

Bankers said that a recent flurry of takeovers by Chinese

acquirers may suggest executives there are expecting more

depreciation is on the way. Doing deals now would make more sense

for Chinese buyers then later, when any overseas acquisitions could

be more expensive.

Despite economic headwinds at home, Chinese companies last year

spent more than $112 billion on acquisitions across the globe,

according to Dealogic. ChemChina has been especially prolific. Last

month, it agreed to buy Munich-based equipment maker KraussMaffei

Group for $1 billion. The same month, it took a 12% stake in

Mercuria Energy Group, a large, privately held energy trader, for

an undisclosed sum.

The deal would mark further consolidation of the seed and

pesticide sectors after DuPont Co. and Dow Chemical Co. announced

their merger in December. Monsanto last spring set off the current

deal-making wave in the chemicals sector when it proposed to buy

Syngenta.

After unsuccessfully courting Syngenta investors and sweetening

its offer to $46 billion in cash and stock, Monsanto dropped its

pursuit in August. That left many of Syngenta's shareholders

frustrated because of a steep decline in the Swiss company's share

price amid a grim outlook for the sector.

Syngenta's chief executive at the time retired and John Ramsay,

its interim CEO, has said that the company was discussing possible

deals with multiple parties, a shift in its initial resistance to a

takeover. People familiar with the matter had said that ChemChina

was interested in acquiring Syngenta.

Any deal would likely need to get approval from the Committee on

Foreign Investment in the U.S., or CFIUS, the federal body that

screens corporate takeovers for security concerns. Chinese

acquisitions have undergone more intense scrutiny in the U.S. in

recent years.

CFIUS, for instance, quashed a deal earlier this year by a

Chinese investment fund to buy the lighting business of Philips NV.

The unit had manufacturing, and research-and-development facilities

in the U.S. It is unclear if Syngenta's pesticide and seed

businesses would raise the same sort of national-security issues

that deal raised.

"Regulatory risk appears significant," wrote analysts at Credit

Suisse, citing Syngenta's research and development, and

crop-protection portfolio.

ChemChina is already one of China's biggest and most ambitious

state-owned enterprises. The closely held company employs 140,000

people and delivered sales of 240 billion yuan ($36.5 billion) in

2013, according to its website.

The company, led by founder Ren Jianxin, has worked in recent

years to present itself as an open and globally minded enterprise.

Many of its Chinese state-owned competitors shy away from

international attention.

After ChemChina agreed to buy tire maker Pirelli & C. SpA of

Italy last year, top Chinese executives including Mr. Ren hosted a

nearly three-hour briefing for foreign journalists at ChemChina's

headquarters in Beijing. Executives gushed over their love of

European soccer and history, and pledged at the time to uphold the

Italian company's autonomy.

Mr. Ren is something of an oddity inside the patchwork of

China's mammoth state-owned enterprises. Unlike many state-owned

companies today, which were born out of reforming government

ministries in the 1980s, Mr. Ren built his company from the ground

up.

He first founded a chemical company called China National

Bluestar Group Co. in 1984 with a 10,000 yuan loan in the far-west

industrial city of Lanzhou. As part of a government-initiated

restructuring in 2004, Mr. Ren's company was absorbed by ChemChina,

where Mr. Ren was installed as the company's president.

Jacob Bunge and Brian Spegele contributed to this article.

Write to Rick Carew at rick.carew@wsj.com, Shayndi Raice at

shayndi.raice@wsj.com and Eyk Henning at eyk.henning@wsj.com

(END) Dow Jones Newswires

February 02, 2016 13:53 ET (18:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

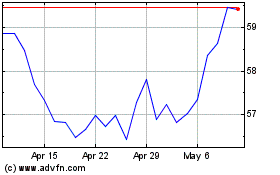

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

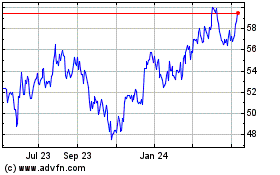

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024