Current Report Filing (8-k)

November 13 2015 - 11:46AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 13, 2015

THE DOW

CHEMICAL COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-3433 |

|

38-1285128 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 2030 Dow Center, Midland, Michigan |

|

48674 |

| (Address of principal executive offices) |

|

(Zip Code) |

(989) 636-1000

(Registrant’s telephone number, including area code)

N.A.

(Former name or

former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure |

On November 13, 2015, The Dow Chemical Company

(the “Company”) announced a full redemption of each the following outstanding Dow InterNotes (the “Notes”), in the aggregate principal amount of $328,342,000.00, issued pursuant to an Indenture dated as of May 1, 2008 (the

“Indenture”) between the Company and The Bank of New York Mellon Trust Company, N.A., as trustee:

|

|

|

| Notes Being Redeemed |

|

CUSIP Number |

| 1.75% InterNotes due 06/15/2018 |

|

26054LSZ7 |

| 1.85% InterNotes due 12/15/2017 |

|

26054LRJ4 |

| 1.85% InterNotes due 12/15/2017 |

|

26054LRM7 |

| 1.85% InterNotes due 12/15/2017 |

|

26054LRQ8 |

| 1.85% InterNotes due 06/15/2018 |

|

26054LTC7 |

| 2.00% InterNotes due 06/15/2018 |

|

26054LTJ2 |

| 2.05% InterNotes due 06/15/2018 |

|

26054LTF0 |

| 2.10% InterNotes due 06/15/2019 |

|

26054LWZ2 |

| 2.15% InterNotes due 06/15/2019 |

|

26054LXC2 |

| 2.25% InterNotes due 06/15/2019 |

|

26054LXF5 |

| 2.25% InterNotes due 06/15/2019 |

|

26054LXJ7 |

| 2.30% InterNotes due 12/15/2018 |

|

26054LVC4 |

| 2.30% InterNotes due 12/15/2018 |

|

26054LVF7 |

| 2.35% InterNotes due 12/15/2018 |

|

26054LVJ9 |

| 2.35% InterNotes due 12/15/2019 |

|

26054LZJ5 |

| 2.35% InterNotes due 12/15/2019 |

|

26054LZQ9 |

| 2.40% InterNotes due 06/15/2017 |

|

26054LQZ9 |

| 2.45% InterNotes due 06/15/2017 |

|

26054LQW6 |

| 2.45% InterNotes due 12/15/2019 |

|

26054LRN5 |

| 2.45% InterNotes due 12/15/2019 |

|

26054LRR6 |

| 2.50% InterNotes due 12/15/2016 |

|

26054LNQ2 |

| 2.50% InterNotes due 06/15/2017 |

|

26054LQM8 |

| 2.50% InterNotes due 12/15/2019 |

|

26054LRK1 |

| 2.50% InterNotes due 12/15/2019 |

|

26054LZF3 |

| 2.55% InterNotes due 06/15/2017 |

|

26054LQT3 |

| 2.55% InterNotes due 12/15/2019 |

|

26054LZM8 |

| 2.60% InterNotes due 12/15/2016 |

|

26054LNT6 |

| 2.60% InterNotes due 12/15/2016 |

|

26054LNW9 |

| 2.60% InterNotes due 12/15/2016 |

|

26054LNZ2 |

| 2.60% InterNotes due 12/15/2016 |

|

26054LPC1 |

| 2.60% InterNotes due 06/15/2017 |

|

26054LQQ9 |

| 2.60% InterNotes due 06/15/2020 |

|

26054LTA1 |

| 2.70% InterNotes due 06/15/2016 |

|

26054LMJ9 |

| 2.75% InterNotes due 06/15/2016 |

|

26054LLW1 |

| 2.75% InterNotes due 06/15/2016 |

|

26054LLZ4 |

| 2.75% InterNotes due 06/15/2016 |

|

26054LMC4 |

| 2.75% InterNotes due 06/15/2020 |

|

26054LTD5 |

| 2.80% InterNotes due 06/15/2016 |

|

26054LMF7 |

|

|

|

| Notes Being Redeemed |

|

CUSIP Number |

| 2.85% InterNotes due 06/15/2020 |

|

26054LTG8 |

| 2.85% InterNotes due 06/15/2020 |

|

26054LTK9 |

| 2.90% InterNotes due 06/15/2021 |

|

26054LXA6 |

| 2.90% InterNotes due 12/15/2021 |

|

26054LZK2 |

| 2.95% InterNotes due 06/15/2021 |

|

26054LXD0 |

| 2.95% InterNotes due 06/15/2021 |

|

26054LXK4 |

| 3.00% InterNotes due 06/15/2019 |

|

26054LRA3 |

| 3.00% InterNotes due 06/15/2021 |

|

26054LXG3 |

| 3.00% InterNotes due 12/15/2021 |

|

26054LZR7 |

| 3.05% InterNotes due 06/15/2019 |

|

26054LQX4 |

| 3.05% InterNotes due 12/15/2022 |

|

26054LRP0 |

| 3.05% InterNotes due 12/15/2022 |

|

26054LRS4 |

| 3.10% InterNotes due 12/15/2021 |

|

26054LZG1 |

| 3.10% InterNotes due 12/15/2022 |

|

26054LRL9 |

| 3.15% InterNotes due 06/15/2019 |

|

26054LQU0 |

| 3.15% InterNotes due 12/15/2021 |

|

26054LZN6 |

| 3.20% InterNotes due 06/15/2019 |

|

26054LQN6 |

| 3.25% InterNotes due 06/15/2019 |

|

26054LQR7 |

| 3.30% InterNotes due 12/15/2020 |

|

26054LVD2 |

| 3.30% InterNotes due 12/15/2020 |

|

26054LVG5 |

| 3.30% InterNotes due 06/15/2023 |

|

26054LTB9 |

| 3.35% InterNotes due 12/15/2018 |

|

26054LPD9 |

| 3.35% InterNotes due 06/15/2023 |

|

26054LTE3 |

| 3.40% InterNotes due 12/15/2020 |

|

26054LVK6 |

| 3.40% InterNotes due 12/15/2024 |

|

26054LZS5 |

| 3.45% InterNotes due 12/15/2024 |

|

26054LZL0 |

| 3.50% InterNotes due 12/15/2018 |

|

26054LNR0 |

| 3.50% InterNotes due 06/15/2023 |

|

26054LTH6 |

| 3.50% InterNotes due 06/15/2023 |

|

26054LTL7 |

| 3.55% InterNotes due 06/15/2022 |

|

26054LRB1 |

| 3.55% InterNotes due 06/15/2024 |

|

26054LXL2 |

| 3.60% InterNotes due 12/15/2018 |

|

26054LNU3 |

| 3.60% InterNotes due 12/15/2018 |

|

26054LPA5 |

| 3.60% InterNotes due 06/15/2022 |

|

26054LQY2 |

| 3.60% InterNotes due 06/15/2024 |

|

26054LXB4 |

| 3.60% InterNotes due 06/15/2024 |

|

26054LXE8 |

| 3.60% InterNotes due 06/15/2024 |

|

26054LXH1 |

| 3.60% InterNotes due 12/15/2024 |

|

26054LZH9 |

| 3.60% InterNotes due 12/15/2024 |

|

26054LZP1 |

| 3.65% InterNotes due 12/15/2018 |

|

26054LNX7 |

| 4.05% InterNotes due 12/15/2023 |

|

26054LVE0 |

| 4.05% InterNotes due 12/15/2023 |

|

26054LVH3 |

| 4.10% InterNotes due 12/15/2023 |

|

26054LVL4 |

Pursuant to the terms of the Indenture and the Notes, the Notes will be redeemed in full on

December 15, 2015 (the “Redemption Date”), at a redemption price equal to 100% of the principal amount thereof, along with accrued and unpaid interest up to, but not including, the Redemption Date. The amount of regular interest that

will be payable with respect to these Notes being redeemed on the Redemption Date will be calculated based upon the per annum interest rate then payable on each of these Notes, and the redemption price, which includes such interest, will be paid on

the Redemption Date. On the Redemption Date and upon the Company’s payment of the redemption price, all rights of holders with respect to the Notes being redeemed will terminate, except for the right to receive payment of the applicable

redemption price upon surrender of the Notes for redemption.

Copies of the notice of redemption can be obtained from The Bank of New York

Mellon Trust Company, N.A. by calling Bondholder Relations at (800) 254-2826.

This information is furnished pursuant to

Item 7.01 of Form 8-K. The information in this report shall not be treated as filed for purposes of the Securities Exchange Act of 1934, as amended.

The furnishing of the information in this Item 7.01 is not intended to, and does not, constitute a representation that such furnishing is

required by Regulation FD or that the information in this Item 7.01 is material information that is not otherwise publicly available.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

THE DOW CHEMICAL COMPANY

Registrant

Dated: November 13, 2015

|

|

|

| By: |

|

/S/ RONALD C. EDMONDS |

|

|

Name: Ronald C. Edmonds |

|

|

Title: Vice President and Controller |

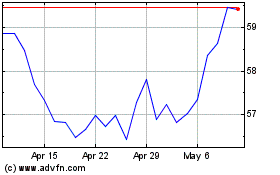

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

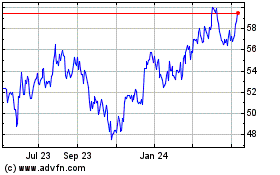

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024