UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Rule 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

THE DOW

CHEMICAL COMPANY

(Name of Subject Company (Issuer) and Filing Person (Offeror))

Common Stock

(Title of

Class of Securities)

260543103

(CUSIP Number of Class of Securities)

Charles J. Kalil

General Counsel and Executive Vice President

The Dow Chemical Company

2030 Dow Center

Midland,

Michigan, 48674

(989) 636-1000

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing persons)

Copies to:

|

|

|

| George A. Casey, Esq.

Richard B. Alsop, Esq.

Heiko Schiwek, Esq.

Shearman & Sterling LLP

599 Lexington Avenue New

York, New York 10022 (212) 848-4000 |

|

George F. Schoen, Esq.

Cravath, Swaine & Moore LLP

Worldwide Plaza 825

Eighth Avenue New York, New York 10019

(212) 474-1000 |

CALCULATION OF FILING FEE

|

|

|

| Transaction Valuation |

|

Amount of Fling Fee |

| $2,585,990.356.04 (1) |

|

$300,492.08 (2) |

| |

| (1) |

Estimated solely for calculating the filing fee, based on the average of the high and low prices of shares of common stock of Olin Corporation (as reported on the New York Stock Exchange on May 6, 2015) into which

shares of common stock of Blue Cube Spinco Inc. being offered in exchange for shares of common stock of The Dow Chemical Company will be converted, and paid in connection with Olin Corporation’s Registration Statement on Form S-4, which was

filed on May 8, 2015 (Registration No. 333- 203990) (the “Olin Form S-4”), calculated as set forth therein, relating to the transactions described in this Schedule TO. |

| (2) |

The amount of the filing fee has been calculated in accordance with Rule 0-11 of the Securities Exchange Act of 1934, as amended, in connection with the Olin Form S-4, as set forth therein. |

| x |

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing. |

|

|

|

| Amount Previously Paid: $300,492.08 |

|

Filing Party: Olin Corporation |

| Form or Registration No.: Form S-4 (No. 333-203990) |

|

Date Filed: May 8, 2015 |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

¨ |

third-party tender offer subject to Rule 14d-1. |

| |

x |

issuer tender offer subject to Rule 13e-4. |

| |

¨ |

going-private transaction subject to Rule 13e-3. |

| |

¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final

amendment reporting the results of the tender offer: ¨

Introductory Statement

This Issuer Tender Offer Statement on Schedule TO (this “Schedule TO”) is filed by The Dow Chemical Company (“TDCC”). This Schedule TO

relates to the offer by TDCC to exchange all shares of common stock of Blue Cube Spinco Inc. (“Splitco common stock”), par value $0.001 per share, for shares of common stock of TDCC, par value $2.50 per share (“TDCC common

stock”), that are validly tendered and not properly withdrawn prior to the expiration of the Exchange Offer (as defined below). Immediately following consummation of the Exchange Offer, Blue Cube Acquisition Corp., a Delaware corporation

(“Merger Sub”), which is a wholly-owned subsidiary of Olin Corporation (“Olin”), will merge (the “Merger”) with and into Blue Cube Spinco Inc. (“Splitco”), whereby the separate corporate existence of Merger

Sub will cease and Splitco will continue as the surviving company and a wholly-owned subsidiary of Olin and each share of Splitco common stock will be converted into the right to receive 0.87482759 shares of common stock, par value $1 per share, of

Olin (“Olin common stock”), upon the terms and subject to the conditions set forth in the Prospectus, dated September 2, 2015 (the “Prospectus”), the Letter of Transmittal and the Exchange and Transmittal Information Booklet,

copies of which are attached hereto as Exhibits (a)(1)(i), (a)(1)(ii) and (a)(1)(iii), respectively (which, together with any amendments or supplements thereto, collectively constitute the “Exchange Offer”). In connection with the Exchange

Offer, Splitco has filed under the Securities Act of 1933, as amended (the “Securities Act”), a registration statement on Form S-4 and Form S-1 (Registration No. 333-204006) (the “Registration Statement”) to register the

shares of Splitco common stock offered in exchange for shares of TDCC common stock tendered in the Exchange Offer and to be distributed in any pro rata dividend to the extent that the Exchange Offer is not fully subscribed. Olin has filed under the

Securities Act a registration statement on Form S-4 (Registration No. 333-203990) to register the shares of Olin common stock into which shares of Splitco common stock will be converted in the Merger.

As permitted by General Instruction F to Schedule TO, the information set forth in the Prospectus, the Letter of Transmittal, the Exchange and Transmittal

Information Booklet and the Notice of Guaranteed Delivery for TDCC common stock, copies of which are attached hereto as Exhibits (a)(1)(i), (a)(1)(ii), (a)(1)(iii) and (a)(1)(vi), respectively, is hereby expressly incorporated by reference in

response to Items 1 through 9 and Item 11 of this Schedule TO.

| Item 1. |

Summary Term Sheet. |

The information set forth in the section of the Prospectus entitled

“Summary” is incorporated herein by reference.

| Item 2. |

Subject Company Information. |

(a) Name and Address. The name of the issuer is The Dow

Chemical Company. The principal executive offices of TDCC are located at 2030 Dow Center, Midland Michigan, 48674. Its telephone number at such office is (989) 636-1000.

(b) Securities. Shares of TDCC common stock, par value $2.50 per share, are the subject securities in the Exchange Offer. At August 25,

2015, 1,158,475,982 shares of TDCC common stock were outstanding. The information set forth in the sections of the Prospectus entitled “Comparison of Rights of Holders of TDCC Common Stock and Olin Common Stock—Authorized Capital

Stock” and “This Exchange Offer—Terms of This Exchange Offer” is incorporated herein by reference.

(c) Trading Market and

Price. The information set forth in the section of the Prospectus entitled “Summary Historical and Pro Forma Financial Data—Summary Historical Common Stock Market Price and Dividend Data” is incorporated herein by reference.

| Item 3. |

Identity and Background of Filing Person. |

(a) Name and Address. The filing person and

subject company is The Dow Chemical Company. The principal executive offices of TDCC are located at 2030 Dow Center, Midland Michigan, 48674. Its telephone number at such office is (989) 636-1000.

2

| Item 4. |

Terms of the Transaction. |

(a) Material Terms. The information set forth in the sections

of the Prospectus entitled “Questions and Answers About this Exchange Offer and the Transactions,” “Summary,” “This Exchange Offer,” “The Transactions,” “The Merger Agreement,” “The Separation

Agreement,” “Other Agreements” and “Comparison of Rights of Holders of TDCC Common Stock and Olin Common Stock” and the cover page of the Prospectus is incorporated herein by reference.

(b) Purchases. The Exchange Offer is open to all holders of shares of TDCC common stock who tender their shares of TDCC common stock in a

jurisdiction where the Exchange Offer is permitted. Therefore, any officer, director or affiliate of TDCC who is a holder of shares of TDCC common stock may participate in the Exchange Offer on the same terms and conditions as all other TDCC

shareholders.

| Item 5. |

Past Contacts, Transactions, Negotiations and Agreements. |

(a) Agreements Involving the Subject

Company’s Securities. The information set forth in the sections entitled “How Executive Compensation is Aligned with Company Performance,” “Certain Relationships and Related Transactions,” “Compensation

Discussion and Analysis,” “Compensation Tables and Narratives,” and “Beneficial Ownership of Company Stock” in TDCC’s Definitive Notice and Proxy Statement filed with the SEC on March 27, 2015 is incorporated

herein by reference. In addition, the information set forth in the section entitled “Summary Compensation Table,” in the Proxy Statement Supplement, as filed with the SEC on March 31, 2015, is incorporated herein by reference.

| Item 6. |

Purposes of the Transaction and Plans or Proposals. |

(a) Purposes. The information set

forth in the sections of the Prospectus entitled “Summary,” “The Transactions—Olin’s Reasons for the Transactions” and “The Transactions—TDCC’s Reasons for the Transactions” is incorporated herein by

reference.

(b) Use of Securities Acquired. Shares of TDCC common stock that are tendered and accepted for exchange in the Exchange Offer

will be held as treasury stock. The information set forth in the section of the Prospectus entitled “Questions and Answers About this Exchange Offer and the Transactions” is incorporated herein by reference.

(c) Plans. The information set forth in the sections of the Prospectus entitled “Questions and Answers About this Exchange Offer and the

Transactions,” “Summary,” “This Exchange Offer,” “The Transactions,” “The Merger Agreement,” “The Separation Agreement,” “Other Agreements,” “Comparison of Rights of Holders of

TDCC Common Stock and Olin Common Stock” and “Certain Relationships and Related Transactions” is incorporated herein by reference.

| Item 7. |

Source and Amount of Funds or Other Consideration. |

(a) Source of Funds. The information

set forth in the sections of the Prospectus entitled “Summary,” “This Exchange Offer,” “The Transactions,” “The Merger Agreement” and “The Separation Agreement” is incorporated herein by reference.

(b) Conditions. The information set forth in the sections of the Prospectus entitled “Summary,” “This Exchange Offer,”

“The Transactions,” “The Merger Agreement” and “The Separation Agreement” is incorporated herein by reference.

(d)

Borrowed Funds. None.

3

| Item 8. |

Interest in Securities of the Subject Company. |

(a) Securities Ownership. The information

set forth in the sections of the Prospectus entitled “Ownership of TDCC Common Stock” is incorporated herein by reference.

(b) Securities

Transactions. Based on the information available to TDCC as of September 2, 2015, the following table sets forth the transactions in TDCC common stock by directors and executive officers of TDCC in the past 60 days.

|

|

|

|

|

|

|

|

|

| Name |

|

Date of

Transaction |

|

Number and Type of Securities |

|

Price Per Share |

|

Type of Transaction* |

| Ronald C. Edmonds |

|

July 30, 2015 |

|

Acquired 56.990 shares of common stock |

|

$47.42 |

|

Dividend reinvestment |

| James R. Fitterling |

|

July 30, 2015 |

|

Acquired 41.043 shares of common stock |

|

$47.42 |

|

Dividend reinvestment |

| Joe E. Harlan |

|

July 30, 2015 |

|

Acquired 14.086 shares of common stock |

|

$47.42 |

|

Dividend reinvestment |

| Charles J. Kalil |

|

July 30, 2015 |

|

Acquired 32.768 shares of common stock |

|

$47.42 |

|

Dividend reinvestment |

| Andrew N. Liveris |

|

July 30, 2015 |

|

Acquired 36.247 shares of common stock |

|

$47.42 |

|

Dividend reinvestment |

| Fernando Ruiz |

|

July 30, 2015 |

|

Acquired 98.415 shares of common stock |

|

$47.42 |

|

Dividend reinvestment |

| Johanna Söderström |

|

July 30, 2015 |

|

Acquired 1.351 shares of

common stock |

|

$47.42 |

|

Dividend reinvestment |

| Attiganal N. Sreeram |

|

July 30, 2015 |

|

Acquired 6.773 shares of

common stock |

|

$47.42 |

|

Dividend reinvestment |

| Howard I. Ungerleider |

|

July 30, 2015 |

|

Acquired 18.134 shares of common stock |

|

$47.42 |

|

Dividend reinvestment |

| Richard K. Davis |

|

July 30, 2015 |

|

Acquired 23.315061 shares of common stock in direct holdings |

|

$47.42 |

|

Dividend reinvestment |

| Peter Holicki |

|

July 30, 2015 |

|

Acquired 23.401 shares of common stock |

|

$47.42 |

|

Dividend reinvestment |

| Mark Loughridge |

|

July 30, 2015 |

|

Acquired 23.315061 shares of common stock in direct holdings |

|

$47.42 |

|

Dividend reinvestment |

| Raymond J. Milchovich |

|

July 30, 2015 |

|

Acquired 23.315061 shares of common stock in direct holdings |

|

$47.42 |

|

Dividend reinvestment |

| Johanna Söderström |

|

July 30, 2015 |

|

Acquired 36.576 shares of common stock |

|

$47.42 |

|

Dividend reinvestment |

| * |

The shares were acquired as a result of dividend reinvestment elections in various accounts including The Dow Chemical Company Employees’ Savings Plan. |

| Item 9. |

Persons/Assets, Retained, Employed, Compensated or Used. |

None.

| Item 10. |

Financial Statements. |

(a) Financial Information. The audited financial statements of TDCC

at December 31, 2014 and 2013 and for the three years ended December 31, 2014 are incorporated herein by reference to TDCC’s Annual Report on Form 10-K, as filed with the SEC on February 13, 2015, and the unaudited financial

statements of TDCC for the quarter ended March 31, 2015 and June 30, 2015 are incorporated herein by reference to TDCC’s Quarterly Report on Form 10-Q, as filed with the SEC on May 4, 2015 and July 29, 2015. The audited

balance sheet of Splitco as of March 13, 2015 and the unaudited balance sheet of Splitco as of June 30, 2015 are incorporated herein by reference to the Registration Statement, as filed with the SEC on September 2, 2015. The

information set forth in the sections of the

Prospectus entitled “Summary Historical and Pro Forma Financial Data,” “Selected Historical Financial Data” and “Unaudited Pro Forma Condensed Combined Financial

Statements of Olin and the Dow Chlorine Products Business” is incorporated herein by reference. The information in Exhibit 12.1 to TDCC’s Annual Report on Form 10-K, as filed with the SEC on February 13, 2015 and Quarterly Reports on

Form 10-Q, as filed with the SEC on May 4, 2015 and July 29, 2015, is incorporated herein by reference. This document incorporates by reference important business and financial information about TDCC from documents filed with the U.S.

Securities and Exchange Commission (“SEC”) that have not been included in or delivered with this document. This information is available at the website that the SEC maintains at www.sec.gov, as well as from other sources (see the section

of the Prospectus entitled “Where You Can Find More Information; Incorporation by Reference”. You also may ask any questions about this exchange offer or request copies of the exchange offer documents from TDCC, without charge, upon

written or oral request to TDCC’s information agent, Georgeson Inc at (888) 566-8006. In order to receive timely delivery of the documents, you must make your requests no later than September 28, 2015.

(b) Pro Forma Information. The information set forth in the sections of the Prospectus entitled “Summary Historical and Pro Forma Financial

Data,” “Summary Comparative Historical and Pro Forma Per Share Data,” “Unaudited Pro Forma Condensed Combined Financial Statements of Olin and the Dow Chlorine Products Business,” and “Comparative Historical and Pro

Forma Per Share Data” is incorporated herein by reference.

(c) Summary Information. The information set forth in the sections of the

Prospectus entitled “Summary Historical and Pro Forma Financial Data” is incorporated herein by reference.

| Item 11. |

Additional Information. |

(a) Agreements, Regulatory Requirements and Legal Proceedings.

None.

(b) Other Material Information. None.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| (a)(1)(i) |

|

Prospectus, dated September 2, 2015 (incorporated by reference to the Registration Statement). |

|

|

| (a)(1)(ii) |

|

Form of Letter of Transmittal for TDCC common stock (incorporated by reference to Exhibit 99.3 to the Registration Statement). |

|

|

| (a)(1)(iii) |

|

Form of Exchange and Transmittal Information Booklet (incorporated by reference to Exhibit 99.4 to the Registration Statement). |

|

|

| (a)(1)(iv) |

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated by reference to Exhibit 99.5 to the Registration Statement). |

|

|

| (a)(1)(v) |

|

Form of Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated by reference to Exhibit 99.6 to the Registration Statement). |

|

|

| (a)(1)(vi) |

|

Form of Notice of Guaranteed Delivery for Shares of TDCC Common Stock (incorporated by reference to Exhibit 99.7 to the Registration Statement). |

|

|

| (a)(1)(vii) |

|

Form of Notice of Withdrawal for Shares of TDCC Common Stock (incorporated by reference to Exhibit 99.8 to the Registration Statement). |

5

|

|

|

|

|

| (a)(1)(viii) |

|

Form of Letter to The Dow Chemical Company Employees’ Savings Plan Participants (incorporated by reference to Exhibit 99.9 to the Registration Statement). |

|

|

| (a)(2) |

|

None. |

|

|

| (a)(3) |

|

None. |

|

|

| (a)(4) |

|

Prospectus, dated September 2, 2015 (incorporated by reference to the Registration Statement). |

|

|

| (a)(5)(i) |

|

Press Release, dated September 2, 2015 (incorporated by reference to Exhibit 99.1 to the Current Report on Form 8-K filed by TDCC with the Securities and Exchange Commission on September 2, 2015). |

|

|

| (b) |

|

None. |

|

|

| (d)(i) |

|

Merger Agreement, dated as of March 26, 2015, among The Dow Chemical Company, Blue Cube Spinco Inc., Olin Corporation and Blue Cube Acquisition Corp. (incorporated by reference to Exhibit 2.1 of The Dow Chemical Company’s

Current Report on Form 8-K filed on March 27, 2015). |

|

|

| (d)(ii) |

|

Separation Agreement, dated as of March 26, 2015, between The Dow Chemical Company and Blue Cube Spinco Inc. (incorporated by reference to Exhibit 2.2 of The Dow Chemical Company’s Current Report on Form 8-K filed on March 27,

2015). |

|

|

| (d)(iii) |

|

Employee Matters Agreement, dated as of March 26, 2015, among The Dow Chemical Company, Blue Cube Spinco Inc. and Olin Corporation (incorporated by reference to Exhibit 99.1 to Blue Cube Spinco Inc.’s Form S-4 and Form S-1

filed on May 8, 2015). |

|

|

| (d)(iv) |

|

Tax Matters Agreement, dated as of March 26, 2015, among The Dow Chemical Company, Blue Cube Spinco Inc. and Olin Corporation (incorporated by reference to Exhibit 99.2 to Blue Cube Spinco Inc.’s Form S-4 and Form S-1 filed on

May 8, 2015). |

|

|

| (g) |

|

None. |

|

|

| (h) |

|

Opinion of Shearman & Sterling LLP as to certain tax matters (incorporated by reference to Exhibit 8.1 to the Registration Statement). |

| Item 13. |

Information Required by Schedule 13E-3. |

Not applicable.

6

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

| THE DOW CHEMICAL COMPANY |

|

|

| By: |

|

/s/ Amy E. Wilson |

| Name: |

|

Amy E. Wilson |

| Title: |

|

Corporate Secretary and Assistant General Counsel |

|

| Dated: September 2, 2015 |

7

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| (a)(1)(i) |

|

Prospectus, dated September 2, 2015 (incorporated by reference to the Registration Statement). |

|

|

| (a)(1)(ii) |

|

Form of Letter of Transmittal for TDCC common stock (incorporated by reference to Exhibit 99.3 to the Registration Statement). |

|

|

| (a)(1)(iii) |

|

Form of Exchange and Transmittal Information Booklet (incorporated by reference to Exhibit 99.4 to the Registration Statement). |

|

|

| (a)(1)(iv) |

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated by reference to Exhibit 99.5 to the Registration Statement). |

|

|

| (a)(1)(v) |

|

Form of Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (incorporated by reference to Exhibit 99.6 to the Registration Statement). |

|

|

| (a)(1)(vi) |

|

Form of Notice of Guaranteed Delivery for Shares of TDCC Common Stock (incorporated by reference to Exhibit 99.7 to the Registration Statement). |

|

|

| (a)(1)(vii) |

|

Form of Notice of Withdrawal for Shares of TDCC Common Stock (incorporated by reference to Exhibit 99.8 to the Registration Statement). |

|

|

| (a)(1)(viii) |

|

Form of Letter to The Dow Chemical Company Employees’ Savings Plan Participants (incorporated by reference to Exhibit 99.9 to the Registration Statement). |

|

|

| (a)(2) |

|

None. |

|

|

| (a)(3) |

|

None. |

|

|

| (a)(4) |

|

Prospectus, dated September 2, 2015 (incorporated by reference to the Registration Statement). |

|

|

| (a)(5)(i) |

|

Press Release, dated September 2, 2015 (incorporated by reference to Exhibit 99.1 to the Current Report on Form 8-K filed by TDCC with the Securities and Exchange Commission on September 2, 2015). |

|

|

| (b) |

|

None. |

|

|

| (d)(i) |

|

Merger Agreement, dated as of March 26, 2015, among The Dow Chemical Company, Blue Cube Spinco Inc., Olin Corporation and Blue Cube Acquisition Corp. (incorporated by reference to Exhibit 2.1 of The Dow Chemical Company’s

Current Report on Form 8-K filed on March 27, 2015). |

|

|

| (d)(ii) |

|

Separation Agreement, dated as of March 26, 2015, between The Dow Chemical Company and Blue Cube Spinco Inc. (incorporated by reference to Exhibit 2.2 of The Dow Chemical Company’s Current Report on Form 8-K filed on March 27,

2015). |

|

|

| (d)(iii) |

|

Employee Matters Agreement, dated as of March 26, 2015, among The Dow Chemical Company, Blue Cube Spinco Inc. and Olin Corporation (incorporated by reference to Exhibit 99.1 to Blue Cube Spinco Inc.’s Form S-4 and Form S-1

filed on May 8, 2015). |

|

|

| (d)(iv) |

|

Tax Matters Agreement, dated as of March 26, 2015, among The Dow Chemical Company, Blue Cube Spinco Inc. and Olin Corporation (incorporated by reference to Exhibit 99.2 to Blue Cube Spinco Inc.’s Form S-4 and Form S-1 filed on

May 8, 2015). |

|

|

| (g) |

|

None. |

|

|

| (h) |

|

Opinion of Shearman & Sterling LLP as to certain tax matters (incorporated by reference to Exhibit 8.1 to the Registration Statement). |

8

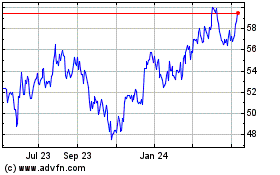

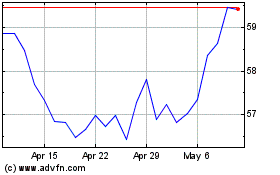

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024