Current Report Filing (8-k)

August 07 2015 - 10:39AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 7, 2015

THE DOW CHEMICAL COMPANY

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction

of incorporation)

|

1-3433

(Commission File Number)

|

38-1285128

(IRS Employer

Identification No.)

|

|

2030 Dow Center, Midland, Michigan

(Address of principal executive offices)

|

48674

(Zip Code)

|

| |

|

|

(989) 636-1000

(Registrant’s telephone number, including area code)

|

| |

| |

|

N.A.

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

The Dow Chemical Company (the “Company”) is filing this Current Report on Form 8-K to provide an updated legality opinion with respect to its Dow Internotes, which may be offered and sold from time to time as described in the prospectus supplement dated February 19, 2013 relating to the Dow Internotes. The Dow Internotes have been registered under the Securities Act of 1933, as amended, pursuant to the Company’s effective registration statement on Form S-3 (File No. 333-186728) (the “Registration Statement”) filed with the Securities and Exchange Commission.

|

Item 9.01

|

Financial Statements and Exhibits

|

The Company hereby files the following exhibits to, and incorporates such exhibits by reference in, the Registration Statement:

|

|

5.1

|

Opinion of Kenneth Hemler, Senior Counsel of the Company, as to the legality of the Dow Internotes

|

|

|

23.1

|

Consent of Kenneth Hemler, Senior Counsel of the Company (included in Exhibit 5.1)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Registrant

Dated: August 7, 2015

| |

By: |

/s/ Ronald C. Edmonds |

|

| |

|

Name: |

Ronald C. Edmonds |

|

| |

|

Title: |

Vice President and Controller |

|

| |

|

|

|

|

EXHIBIT INDEX

|

|

5.1

|

Opinion of Kenneth Hemler, Senior Counsel of the Company, as to the legality of the Dow Internotes

|

|

|

23.1

|

Consent of Kenneth Hemler, Senior Counsel of the Company (included in Exhibit 5.1)

|

| August 7, 2015 |

Exhibit 5.1 |

The Dow Chemical Company

2030 Dow Center

Midland, Michigan 48674

Ladies and Gentlemen:

I am Senior Counsel of The Dow Chemical Company, a Delaware corporation (the “Company”), and I am rendering this opinion in connection with the issuance and sale by the Company of its Dow InterNotes® (the “Securities”), pursuant to the Indenture dated as of May 1, 2008 (the “Indenture”), between the Company, as issuer, and The Bank of New York Mellon Trust Company, N.A. as trustee (the “Trustee”).

In rendering the opinion expressed below, I have examined (or caused to be examined) the following:

|

|

(i)

|

the Restated Certificate of Incorporation of the Company and all amendments thereto;

|

|

|

(ii)

|

the Bylaws of the Company and all amendments thereto;

|

|

|

(iv)

|

the selling agent agreement, dated February 19, 2013, among the Company and Banc of America Securities LLC, Incapital LLC, Citigroup Global Markets Inc., Morgan Stanley & Co. Incorporated, UBS Securities LLC and Wells Fargo Advisors, LLC, as agents (the “Selling Agent Agreement”).

|

I have also examined (or caused to be examined) originals or certified copies of resolutions of the Board of Directors of the Company and such other documents, corporate records, certificates of public authorities, and other documents and instruments as I have deemed necessary or advisable for the purpose of rendering the opinion hereinafter expressed. In such examination, I have assumed (i) the due execution and delivery, pursuant to the due authorization, of the Selling Agent Agreement and the Indenture by all parties thereto other than the Company, (ii) the genuineness of all signatures, (iii) the authenticity of all documents submitted as originals and the conformity to originals of documents submitted as copies, and (iv) the legal capacity of all natural persons executing the Selling Agent Agreement and the Indenture. As to various questions of fact that are material to the opinion hereinafter expressed, I have, when such facts were not independently established by me, relied upon the representations and certificates of officers of the Company and of public officials.

August 7, 2015

Page 2

Based upon the foregoing and upon such investigations as I have deemed necessary, and subject to the qualifications hereinafter set forth, it is my opinion that, when the terms of the Securities have been established by authorized officers of the Company and when the Securities have been completed, executed and issued by the Company, authenticated by the Trustee pursuant to the Indenture and delivered against payment of the consideration therefor in accordance with the provisions of the Selling Agent Agreement, the Securities will be duly authorized and constitute legal, valid and binding obligations of the Company enforceable against the Company in accordance with their terms and entitled to the benefits of the Indenture.

The opinion expressed above is subject to the effect of (a) any applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting creditors’ rights generally (including without limitation all laws relating to fraudulent transfers) and (b) general principles of equity, including without limitation concepts of materiality, reasonableness, good faith and fair dealing (regardless of whether considered in a proceeding in equity or at law).

I do not purport to be an expert on, or to express any opinion concerning matters under or involving any law other than the law of the State of New York and the General Corporation Law of the State of Delaware. The opinion expressed in this letter is based upon the laws in effect on the date hereof, and I assume no obligation to revise or supplement this opinion should such laws be changed by legislative action, judicial decision, or otherwise.

I hereby consent to the incorporation by reference of this opinion as an exhibit to the Company’s Form S-3 ASR Registration Statement (No. 333-186728) and to the reference to me under the caption “Legal Matters” in any prospectus supplement relating to the Securities. I also hereby consent to the inclusion of my opinion as to the legality of specific future issuances of the Securities in the pricing supplement related to such issuances and to the reference to my name therein. In giving such consents, I do not thereby admit that I am in the category of persons whose consent is required under Section 7 of the Securities Act of 1933. This opinion supersedes and replaces the opinion filed as Exhibit 5.1 to the Company’s Current Report on Form 8-K dated May 5, 2015.

| |

Very truly yours,

/s/ Kenneth Hemler

Kenneth Hemler

Senior Counsel

|

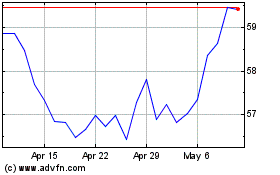

Dow (NYSE:DOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

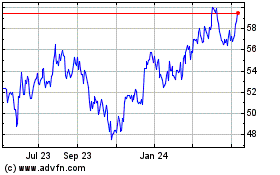

Dow (NYSE:DOW)

Historical Stock Chart

From Apr 2023 to Apr 2024