Current Report Filing (8-k)

September 01 2016 - 6:11AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: (Date of earliest event reported): August 30, 2016

Diamond Offshore Drilling, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-13926

|

|

76-0321760

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

file number)

|

|

(I.R.S. Employer

Identification No.)

|

15415 Katy Freeway

Houston, Texas 77094

(Address of principal executive offices, including Zip Code)

(281) 492-5300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 7.01. Regulation FD Disclosure

On August 30, 2016, a subsidiary of Diamond Offshore Drilling, Inc. (the “Company”) received notice of termination from

Petróleo Brasileiro S.A. (“Petrobras”) of its drilling contract on the

Ocean Valor

. The drilling contract, which was extended in 2014, was estimated to conclude in accordance with its terms in October 2018. The Company does

not believe that Petrobras had a valid or lawful basis for terminating the contract, and the Company intends to defend the rights of its subsidiary under the contract.

The Company hereby incorporates by reference into this Item 7.01 the summary report of the status, as of September 1, 2016, of the

Company’s offshore drilling rigs attached as Exhibit 99.1.

The information contained in Item 7.01 and Exhibit 99.1 of this

report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any previous or future registration

statement filed under the Securities Act of 1933, as amended (the “Securities Act”), unless specifically identified therein as being incorporated by reference.

Statements made in this report or in the summary report furnished as Exhibit 99.1 to this report that are not historical facts are

“forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Such statements may include, but are not limited to, statements regarding the future term of the Petrobras

drilling contract; the enforcement of the rights of the Company’s subsidiary under the Petrobras contract; drilling rig deliveries, operations and timing; contract effectiveness, effective dates and estimated duration; plans regarding

retirement and scrapping of drilling rigs; expectations of future backlog, revenue, operating costs and performance; revenue expected to result from backlog; future dayrates, future status, start and end dates and future contracts and availability;

future contract opportunities and termination rights; contract noncompliance by customers and other third parties; utilization, surveys, downtime and other aspects of the Company’s drilling rigs; customer discussions and outcomes thereof and

the impact of these and related events on the Company’s operations and revenues; and other statements that are not of historical fact. Forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and

uncertainties that could cause actual results to differ materially from those currently anticipated or expected by management of the Company. A discussion of the risk factors and other considerations that could materially impact these matters as

well as the Company’s overall business and financial performance can be found in the Company’s reports filed with the Securities and Exchange Commission, and readers of this report are urged to review those reports carefully when

considering these forward-looking statements. These risk factors include, among others, risks associated with worldwide demand for drilling services, level of activity in the oil and gas industry, renewing or replacing expired or terminated

contracts, contract cancellations and terminations, maintenance and realization of backlog, and various other factors, many of which are beyond the Company’s control. Given these risk factors, investors and analysts should not place undue

reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of such statement, and the Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any

forward-looking statement to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

2

Item 9.01. Financial Statements and Exhibits

|

|

|

|

|

Exhibit number

|

|

Description

|

|

|

|

|

99.1

|

|

Rig Status Report as of September 1, 2016

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: September 1, 2016

|

|

|

|

DIAMOND OFFSHORE DRILLING, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ DAVID L. ROLAND

|

|

|

|

|

|

|

|

David L. Roland

Senior Vice President,

General Counsel and Secretary

|

4

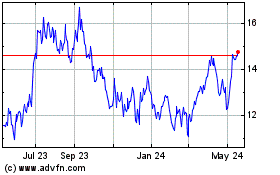

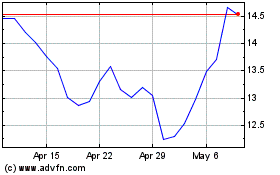

Diamond Offshore Drilling (NYSE:DO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Diamond Offshore Drilling (NYSE:DO)

Historical Stock Chart

From Apr 2023 to Apr 2024