UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of

1934

Date of report (Date of earliest event reported): March 18, 2015

Diamond Offshore Drilling, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

1-13926 |

|

76-0321760 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

15415 Katy Freeway

Houston, Texas 77094

(Address of Principal Executive Offices and Zip

Code)

Registrant’s telephone number, including area code: (281) 492-5300

Not Applicable

(Former name or former address, if changed since last report)

Check the

appropriate line below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01. Regulation FD Disclosure

Diamond Offshore Drilling, Inc. (the “Company”) hereby incorporates by reference into this Item 7.01 the summary report of

the status, as of March 18, 2015, of the Company’s offshore drilling rigs attached as Exhibit 99.1.

The information

contained in Item 7.01 and Exhibit 99.1 to this report is being furnished in accordance with Rule 101(e)(1) under Regulation FD and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), and shall not be incorporated by reference into any previous or future registration statement filed under the Securities Act of 1933, as amended (the “Securities Act”), unless specifically identified

therein as being incorporated by reference.

Statements in the summary report furnished as Exhibit 99.1 to this report that

are not historical facts are “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Such statements include, but are not limited to, statements concerning

drilling rig deliveries, operations and timing; contract effectiveness, effective dates and estimated duration; plans regarding retirement and scrapping of drilling rigs; expectations of future backlog, revenue, operating costs and performance;

revenue expected to result from backlog; current term, future dayrates, future status, start and end dates and future contracts and availability; future contract opportunities and termination rights; contract noncompliance by customers and other

third parties; letters of intent; utilization, surveys, downtime and other aspects of the Company’s drilling rigs; statements concerning customer discussions and outcomes thereof and the impact of these and related events on the Company’s

operations and revenues; rigs being upgraded or to be upgraded and rigs under construction; and other statements that are not of historical fact. Forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and

uncertainties that could cause actual results to differ materially from those currently anticipated or expected by management of the Company. A discussion of the risk factors and other considerations that could materially impact these matters as

well as the Company’s overall business and financial performance can be found in the Company’s reports filed with the Securities and Exchange Commission, and readers of this report are urged to review those reports carefully when

considering these forward-looking statements. These risk factors include, among others, risks associated with worldwide demand for drilling services, level of activity in the oil and gas industry, renewing or replacing expired or terminated

contracts, contract cancellations and terminations, maintenance and realization of backlog, competition and industry fleet capacity, impairments and retirements, declaration of dividends, operating risks, changes in tax laws and rates, regulatory

initiatives and compliance with governmental regulations, timing of construction of new builds, casualty losses and various other factors, many of which are beyond the Company’s control. Given these risk factors, investors and analysts should

not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of such statement, and the Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to

any forward-looking statement to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

2

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

|

|

|

| Exhibit number |

|

Description |

|

|

| 99.1 |

|

Rig Status Report as of March 18, 2015 |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| DIAMOND OFFSHORE DRILLING, INC. |

|

|

| By: |

|

/s/ David L. Roland |

|

|

David L. Roland |

|

|

Senior Vice President, General Counsel and Secretary |

Dated: March 18, 2015

4

Exhibit 99.1

|

|

|

|

|

Diamond Offshore Drilling, Inc. Rig Status Report March 18, 2015

Updated information noted in bold print |

RECENT COMMITMENTS (See Body of Report For Contract Details)

No new contract commitments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Water1

Depth |

|

|

|

|

Year 3 |

|

|

|

|

|

Contract

Dayrate |

|

Estimated |

|

Estimated |

|

|

|

|

Planned Downtime

4

(For Periods Lasting >10 days) |

|

|

|

| Rig Name |

|

(feet) |

|

|

Type2 |

|

Built |

|

Location |

|

Operator |

|

(USD) |

|

Start Date |

|

End Date |

|

Status |

|

|

1Q15 E |

|

|

2Q15 E |

|

|

3Q15 E |

|

|

4Q15 E |

|

|

Comments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals: |

|

|

|

563 |

|

|

|

356 |

|

|

|

190 |

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gulf of Mexico - U.S. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Star |

|

|

5,500 |

|

|

SS 15K |

|

1997 |

|

US GOM |

|

— |

|

— |

|

— |

|

— |

|

|

Actively marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Victory |

|

|

5,500 |

|

|

SS 15K |

|

1997 |

|

US GOM |

|

— |

|

— |

|

— |

|

— |

|

|

Customer Prep/

Standby |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US GOM |

|

— |

|

— |

|

late Mar 2015 |

|

early May 2015 |

|

|

Mobe to Trinidad;

customs clearance |

|

|

|

10 |

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

Mobe |

|

|

|

|

|

|

|

|

|

|

Trinidad |

|

BP |

|

398,000 |

|

early May 2015 |

|

early May 2017 |

|

|

2-year term + 1-

year unpriced

option |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Onyx |

|

|

6,000 |

|

|

SS 15K |

|

2014 |

|

US GOM |

|

— |

|

— |

|

late Feb 2015 |

|

mid Apr 2015 |

|

|

Prep, mobe to

Trinidad,

acceptance |

|

|

|

32 |

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

Prep, mobe, acceptance |

|

|

|

|

|

|

|

|

|

|

Trinidad |

|

BG International |

|

390,000 |

|

mid Apr 2015 |

|

mid Aug 2015 |

|

|

One well |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trinidad |

|

BG International |

|

360,000 |

|

mid Aug 2015 |

|

mid Oct 2015 |

|

|

One well |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean BlackHawk |

|

|

12,000 |

|

|

DS 15K DP |

|

2014 |

|

US GOM |

|

Anadarko |

|

495,000 |

|

late May 2014 |

|

mid Jun 2019 |

|

|

5-year term +

unpriced option |

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Installation of 2nd BOP |

| Ocean BlackHornet |

|

|

12,000 |

|

|

DS 15K DP |

|

2014 |

|

S. Korea |

|

— |

|

— |

|

early Dec 2014 |

|

late Mar 2015 |

|

|

Mobe to GOM;

customer

acceptance |

|

|

|

85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobe, acceptance testing |

|

|

|

|

|

|

|

|

|

|

US GOM |

|

Anadarko |

|

495,000 |

|

late Mar 2015 |

|

late Mar 2020 |

|

|

5-year term +

unpriced option |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean BlackRhino |

|

|

12,000 |

|

|

DS 15K DP |

|

2014 |

|

S. Korea |

|

— |

|

— |

|

mid Dec 2014 |

|

late Apr 2015 |

|

|

Mobe to GOM;

customer

acceptance |

|

|

|

90 |

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

Mobe, acceptance testing |

|

|

|

|

|

|

|

|

|

|

US GOM |

|

Murphy |

|

550,000 |

|

late Apr 2015 |

|

late Jan 2016 |

|

|

265-day term; prior

to commencement

of contract, may be

converted

into term

lasting until Jun

2016 at

$485,000/day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US GOM |

|

— |

|

— |

|

Jan 2016 |

|

Q4 2016 |

|

|

Actively marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US GOM |

|

Hess |

|

400,000 |

|

Q4 2016 |

|

Q4 2019 |

|

|

3-year Term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gulf of Mexico - Mexico |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Nugget (note 5) |

|

|

300 |

|

|

JU IC |

|

1976 |

|

Mexico |

|

Pemex |

|

97,000 |

|

early Jul 2013 |

|

mid Aug 2016 |

|

|

1,136-day term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Summit (note 5) |

|

|

300 |

|

|

JU IC |

|

1972 |

|

Mexico |

|

Pemex |

|

85,999 |

|

mid Sep 2012 |

|

late May 2015 |

|

|

985-day term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Scepter |

|

|

350 |

|

|

JU 15K IC |

|

2008 |

|

Mexico |

|

Pemex |

|

158,000 |

|

early Jun 2014 |

|

early Mar 2016 |

|

|

639-day term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Ambassador (note 5) |

|

|

1,100 |

|

|

SS |

|

1975 |

|

Mexico |

|

Pemex |

|

211,445 |

|

early Mar 2014 |

|

early Mar 2016 |

|

|

730-day term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North Sea / Mediterranean / W. Africa |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Nomad

(note 6) |

|

|

1,200 |

|

|

SS |

|

1975 |

|

UK |

|

— |

|

— |

|

— |

|

— |

|

|

Actively marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Guardian |

|

|

1,500 |

|

|

SS 15K |

|

1985 |

|

UK |

|

Shell |

|

352,000 |

|

mid Jan 2015 |

|

mid Jul 2015 |

|

|

Continuation of 1-

year extension |

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

5-Year Special Survey |

| Ocean Princess |

|

|

1,500 |

|

|

SS 15K |

|

1975 |

|

UK |

|

— |

|

— |

|

— |

|

— |

|

|

Actively marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Patriot |

|

|

3,000 |

|

|

SS 15K |

|

1983 |

|

UK |

|

Shell |

|

400,511 |

|

late Oct 2014 |

|

late Oct 2017 |

|

|

3-year term + 2 x 1-

year unpriced

options |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Valiant |

|

|

5,500 |

|

|

SS 15K |

|

1988 |

|

UK |

|

— |

|

— |

|

— |

|

— |

|

|

Contract prep |

|

|

|

90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobe, contract prep |

|

|

|

|

|

|

|

|

|

|

UK |

|

Premier Oil |

|

320,000 |

|

early Apr 2015 |

|

late Aug 2015 |

|

|

Two wells + 4 x 1-

well options |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Endeavor |

|

|

10,000 |

|

|

SS 15K |

|

2007 |

|

Black Sea |

|

ExxonMobil |

|

521,665 |

|

late Jun 2014 |

|

late Dec 2015 |

|

|

18-month term

(dayrate incl. 50%

of potential 6.6%

bonus)

+ 6 x

6-month

unpriced options. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Confidence |

|

|

10,000 |

|

|

SS 15K DP |

|

2001 |

|

Canary Islands |

|

— |

|

— |

|

late Apr 2014 |

|

late Mar 2015 |

|

|

Maintenance |

|

|

|

90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maintenance |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

— |

|

— |

|

— |

|

|

Actively marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Please refer to accompanying disclaimer as well as Diamond Offshore’s 10-K and 10-Q filings with the

SEC. |

|

Page 1 of 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Water1

Depth |

|

|

|

|

Year 3 |

|

|

|

|

|

Contract

Dayrate |

|

Estimated |

|

Estimated |

|

|

|

Planned Downtime

4

(For Periods Lasting >10 days) |

|

|

|

| Rig Name |

|

(feet) |

|

|

Type2 |

|

Built |

|

Location |

|

Operator |

|

(USD) |

|

Start Date |

|

End Date |

|

Status |

|

1Q15 E |

|

|

2Q15 E |

|

|

3Q15 E |

|

|

4Q15 E |

|

|

Comments |

| Australasia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Quest |

|

|

4,000 |

|

|

SS 15K |

|

1973 |

|

Vietnam |

|

PVEP |

|

198,900 |

|

late Apr 2014 |

|

late Apr 2015 |

|

Remainder of 4th well + 6

x one-well priced options |

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

Maintenance |

| Ocean America |

|

|

5,500 |

|

|

SS 15K |

|

1988 |

|

Australia |

|

Chevron |

|

475,000 |

|

late Nov 2013 |

|

late May 2015 |

|

18-month term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Apex |

|

|

6,000 |

|

|

SS 15K |

|

2014 |

|

Vietnam |

|

ExxonMobil |

|

485,000 |

|

late Jan 2015 |

|

mid Apr 2015 |

|

One well |

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobe, acceptance testing |

| Ocean Rover |

|

|

8,000 |

|

|

SS 15K |

|

2003 |

|

Malaysia |

|

Murphy/Nippon |

|

465,000 |

|

early Mar 2014 |

|

early Mar 2016 |

|

2-year term + 1-year

unpriced option |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Monarch |

|

|

10,000 |

|

|

SS 15K |

|

2008 |

|

Malaysia |

|

— |

|

— |

|

mid Sep 2014 |

|

late May 2015 |

|

Mobe; contract prep |

|

|

63 |

|

|

|

55 |

|

|

|

|

|

|

|

|

|

|

Mobe, contract prep |

|

|

|

|

|

|

|

|

|

|

Australia |

|

Apache Corporation |

|

410,000 |

|

late May 2015 |

|

late Nov 2016 |

|

18-month term + 1 year

option |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brazil / S. America |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Spur |

|

|

300 |

|

|

JU IC |

|

1981 |

|

Ecuador |

|

Saipem |

|

30,000 |

|

mid Oct 2012 |

|

late Apr 2015 |

|

bareboat charter

+ 1 x 6-month priced

option |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Lexington (note 5) |

|

|

2,200 |

|

|

SS |

|

1976 |

|

Trinidad |

|

BG Intl / Centrica |

|

300,000 |

|

early Nov 2013 |

|

mid Jun 2015 |

|

Six wells |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US GOM |

|

BG Intl / Centrica |

|

300,000 |

|

mid Jun 2015 |

|

early Jul 2015 |

|

Prep and demobe to US

GOM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US GOM |

|

— |

|

— |

|

early Jul 2015 |

|

late Sep 2015 |

|

Prep, 5-year special

survey, and mobe to

Mexico |

|

|

|

|

|

|

0 |

|

|

|

88 |

|

|

|

|

|

|

Prep, 5-year survey, mobe |

|

|

|

|

|

|

|

|

|

|

Mexico |

|

Pemex |

|

160,000 |

|

late Sep 2015 |

|

mid Apr 2018 |

|

Firm term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Alliance |

|

|

5,250 |

|

|

SS 15K DP |

|

1988 |

|

Brazil |

|

Petrobras |

|

367,089 |

|

late Jul 2010 |

|

mid Jun 2016 |

|

6-year term (incl. 50% of

potential 15% bonus) +

unpriced option |

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

Maintenance |

| Ocean Clipper |

|

|

7,875 |

|

|

DS 15K DP |

|

1997 |

|

Brazil |

|

Petrobras |

|

312,625 |

|

late Jan 2015 |

|

early Dec 2015 |

|

Remainder of 5-year term

contract (incl. 50% of

potential 5% bonus)+

unpriced option |

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under Water in Lieu of

Dry-dock rig inspection |

| Ocean Baroness (note 7) |

|

|

8,000 |

|

|

SS 15K |

|

2002 |

|

Brazil |

|

Petrobras |

|

276,750 |

|

early Sep 2011 |

|

early Sep 2015 |

|

Remainder of 5-year term

(incl. 50% of potential 5%

bonus) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil |

|

Petrobras |

|

310,000 |

|

early Sep 2015 |

|

early Sep 2018 |

|

3-year extension |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Courage |

|

|

10,000 |

|

|

SS 15K DP |

|

2009 |

|

Brazil |

|

Petrobras |

|

567,000 |

|

late Feb 2015 |

|

late Oct 2015 |

|

3-year extension +

$112,000 uplift (incl. 50%

of potential 6% bonus) |

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

Maintenance |

|

|

|

|

|

|

|

|

|

|

Brazil |

|

Petrobras |

|

455,000 |

|

late Oct 2015 |

|

late Feb 2018 |

|

3-year extension |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Valor |

|

|

10,000 |

|

|

SS 15K DP |

|

2009 |

|

Brazil |

|

Petrobras |

|

440,000 |

|

early Sep 2011 |

|

mid Oct 2015 |

|

Remainder of 5-year term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brazil |

|

Petrobras |

|

455,000 |

|

mid Oct 2015 |

|

mid Oct 2018 |

|

3-year extension |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rigs Under Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean BlackLion |

|

|

12,000 |

|

|

DS 15K DP |

|

2015 |

|

S. Korea |

|

— |

|

— |

|

Q2 2012 |

|

Q4 2015 |

|

Hyundai shipyard;

commissioning; mobe;

acceptance |

|

|

|

|

|

|

91 |

|

|

|

92 |

|

|

|

60 |

|

|

Mobe, acceptance testing |

|

|

|

|

|

|

|

|

|

|

US GOM |

|

Hess |

|

400,000 |

|

Q4 2015 |

|

Q4 2019 |

|

4-year Term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean GreatWhite |

|

|

10,000 |

|

|

SS 15K DP |

|

2016 |

|

S. Korea |

|

— |

|

— |

|

Q3 2013 |

|

H2 2016 |

|

Hyundai shipyard;

commissioning; mobe;

acceptance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia |

|

BP |

|

585,000* |

|

H2 2016 |

|

H2 2019 |

|

3-year term + 2 x 1-year

priced options

(@ 585,000 + escalations); *Dayrate to increase for

customer-requested

equipment additions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Please refer to accompanying disclaimer as well as Diamond Offshore’s 10-K and 10-Q filings with the

SEC. |

|

Page 2 of 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Water1

Depth |

|

|

|

|

Year 3 |

|

|

|

|

|

Contract

Dayrate |

|

Estimated |

|

Estimated |

|

|

|

Planned Downtime

4

(For Periods Lasting >10 days) |

|

|

| Rig Name |

|

(feet) |

|

|

Type2 |

|

Built |

|

Location |

|

Operator |

|

(USD) |

|

Start Date |

|

End Date |

|

Status |

|

1Q15 E |

|

|

2Q15 E |

|

3Q15 E |

|

4Q15 E |

|

Comments |

| COLD STACKED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean King |

|

|

300 |

|

|

JU IC |

|

1973 |

|

US GOM |

|

— |

|

— |

|

— |

|

— |

|

Stacked |

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Titan |

|

|

350 |

|

|

JU 15K IC |

|

1974 |

|

US GOM |

|

— |

|

— |

|

— |

|

— |

|

Stacked |

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Vanguard |

|

|

1,500 |

|

|

SS 15K |

|

1982 |

|

UK |

|

— |

|

— |

|

— |

|

— |

|

Stacked, Actively marketing |

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Saratoga |

|

|

2,200 |

|

|

SS |

|

1976 |

|

US GOM |

|

— |

|

— |

|

— |

|

— |

|

Stacked |

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Yorktown |

|

|

2,850 |

|

|

SS |

|

1976 |

|

Mexico |

|

— |

|

— |

|

— |

|

— |

|

Prepare for cold stacking in US GOM |

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean General |

|

|

3,000 |

|

|

SS |

|

1976 |

|

Malaysia |

|

— |

|

— |

|

— |

|

— |

|

Stacked |

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Worker |

|

|

4,000 |

|

|

SS |

|

1982 |

|

US GOM |

|

— |

|

— |

|

— |

|

— |

|

Stacked |

|

|

62 |

|

|

|

|

|

|

|

|

Mobe, prep for stacking |

| RETIRED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Epoch |

|

|

3,000 |

|

|

SS |

|

1977 |

|

Malaysia |

|

— |

|

— |

|

— |

|

— |

|

Sold |

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Yatzy |

|

|

3,300 |

|

|

SS DP |

|

1989 |

|

Brazil |

|

— |

|

— |

|

— |

|

— |

|

Sold |

|

|

|

|

|

|

|

|

|

|

|

|

| Ocean Winner |

|

|

4,000 |

|

|

SS |

|

1976 |

|

Brazil |

|

— |

|

— |

|

— |

|

— |

|

Prep for exportation, scrapping |

|

|

|

|

|

|

|

|

|

|

|

|

NOTES

(1.) Water Depth refers to the rig’s rated operating water depth capability. Often, rigs are capable of drilling or have drilled in greater

water depths.

(2.) Rig Type and capabilities: JU=Jack-up; SS=Semisubmersible; DS=Drillship;

15K=15,000 PSI Well-Control System; DP=Dynamically Positioned Rig; IC=Independent-Leg Cantilevered Rig.

(3.)

Year Built represents when rig was (or is expected to be) built and originally placed in service or year redelivered with significant enhancements that enabled the rig to be classified within a different floater category than when originally

constructed.

(4.) Planned Downtime only includes downtime periods that as of this report date are, or have been, planned and

estimable and do not necessarily reflect actual downtime experienced. Additional downtime may be experienced in the form of possible mobes for new jobs not yet contracted, possible acceptance testing at new jobs,

and unplanned maintenance and repairs. Survey start times may also be accelerated or delayed for various reasons.

(5.) A

representative of PEMEX has verbally informed us of PEMEX’s intention to exercise its contractual right to terminate its drilling contracts on the Ocean Ambassador, the Ocean Nugget and the Ocean

Summit, and to cancel its drilling contract on the Ocean Lexington. As of the date of this report, we have not received written notice of termination or cancellation. We are in discussions with PEMEX regarding the rigs.

(6.) Our subsidiary has received notice of termination of its drilling contract from Dana Petroleum (E&P) Limited, the

customer for the Ocean Nomad. The drilling contract was estimated to conclude in accordance with its terms in August 2015. We do not believe that Dana had a valid basis for terminating the contract, and we intend to defend our rights

under the contract.

(7.) Petrobras has notified us that it has a right to terminate the drilling contract on the Ocean

Baroness and has verbally informed us that it does not intend to continue to use the rig. We are in discussions with Petrobras regarding the rig.

General Notes

Average Utilization: Assume rates of 92% for DP units, 96% for

conventionally moored rigs, and 98% for jack-ups. Rig utilization rates can be adversely impacted by additional downtime due to unscheduled repairs and maintenance, and other factors.

Options should be assumed to be unpriced unless otherwise indicated.

Dayrates

exclude amortized revenue related to amounts earned for certain activities, such as mobe, demobe, contract preparation, etc.

Survey Costs: During surveys, normal operating expense will be incurred, plus additional costs.

US GOM=U.S. Gulf of Mexico

UWILD=Under Water in Lieu of Dry-dock rig inspection.

|

|

|

| Please refer to accompanying disclaimer as well as Diamond Offshore’s 10-K and 10-Q filings with the

SEC. |

|

Page 3 of 4 |

|

|

|

|

|

Diamond Offshore Drilling, Inc. Rig Status Report |

Forward-Looking Statements: This report contains “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, without limitation, any statement that may project, indicate or imply future

results, events, performance or achievements, and may contain or be identified by the words “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate,” believe,”

“should,” “could,” “may,” “might,” “will,” “will be,” “will continue,” “will likely result,” “project,” “budget,” “forecast,” and similar

expressions. Statements by the Company in the rig status report that contain forward-looking statements include, but are not limited to, statements regarding the current term, future dayrates, future status, start and end dates, and comments

concerning future contracts and availability, future contract opportunites and termination rights, letters of intent, utilization, surveys, downtime and other aspects of the Company’s drilling rigs, as well as statements concerning customer

discussions and outcomes thereof, the impact of these and related events on our operations and revenues, rigs being upgraded or to be upgraded and rigs under construction. Such statements are inherently subject to a variety of assumptions, risks and

uncertainties that could cause actual results to differ materially from those anticipated or projected. A discussion of the risk factors that could impact these areas and the Company’s overall business and financial performance can be found in

the Company’s reports and other documents filed with the Securities and Exchange Commission. These factors include, among others, general economic and business conditions, contract cancellations, customer bankruptcy, operating risks, casualty

losses, industry fleet capacity, changes in foreign and domestic oil and gas exploration and production activity, competition, changes in foreign, political, social and economic conditions, regulatory initiatives and compliance with governmental

regulations, customer preferences and various other matters, many of which are beyond the Company’s control. Given these concerns, investors and analysts should not place undue reliance on forward-looking statements. Each forward-looking

statement speaks only as of the date of the rig status report, and the Company undertakes no obligation to publicly update or revise any forward-looking statement.

Page 4 of 4

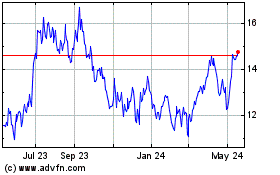

Diamond Offshore Drilling (NYSE:DO)

Historical Stock Chart

From Mar 2024 to Apr 2024

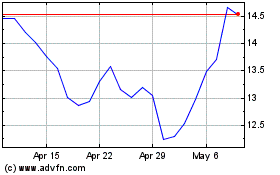

Diamond Offshore Drilling (NYSE:DO)

Historical Stock Chart

From Apr 2023 to Apr 2024