Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

March 01 2017 - 5:28PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-212597

Pricing Term Sheet

March 1, 2017

The Walt Disney Company

1.950% Notes Due 2020

2.450% Notes Due 2022

This free writing prospectus relates only to the securities of The Walt Disney Company (the “Company”) described below and should be read together with the Company’s prospectus supplement dated July 20, 2016 (the “Prospectus Supplement”), the accompanying prospectus dated July 20, 2016 (the “Prospectus”) and the documents incorporated and deemed to be incorporated by reference therein. We sometimes refer to this free writing prospectus as “this term sheet.”

|

Issuer:

|

|

The Walt Disney Company

|

|

|

|

|

|

Title of Securities:

|

|

1.950% Notes Due 2020 (the “2020 Notes”)

2.450% Notes Due 2022 (the “2022 Notes”)

The 2020 Notes and the 2022 Notes (collectively, the “Notes”) will be part of a single series of the Company’s senior debt securities under the indenture (as defined in the Prospectus Supplement) designated as Medium-Term Notes, Series G. The 2020 Notes and the 2022 Notes are sometimes referred to, individually, as a “tranche” of Notes.

|

|

|

|

|

|

Ratings:

|

|

A2 by Moody’s (stable outlook) / A by S&P (stable outlook) / A by Fitch (stable outlook)*

|

|

|

|

|

|

Trade Date:

|

|

March 1, 2017

|

|

|

|

|

|

Settlement Date (T+3):

|

|

March 6, 2017

|

|

|

|

|

|

Use of Proceeds:

|

|

The Company intends to use the net proceeds from the sale of the Notes and the Other Notes (as defined below under “—Concurrent Offering”) for general corporate purposes, which may include among others, the general corporate purposes identified under the caption “Use of Proceeds” in the Prospectus.

|

|

|

|

|

|

Proceeds to the Company:

|

|

The net proceeds from the sale of the Notes and the Other Notes will be $1,993,504,000 (after deducting the underwriting discounts and commissions but before deducting estimated offering expenses payable by the Company).

|

|

|

|

|

|

Maturity Date:

|

|

2020

Notes: March 4, 2020

2022 Notes:

March 4, 2022

|

|

|

|

|

|

Aggregate Principal Amount Offered:

|

|

2020

Notes: $600,000,000

2022

Notes: $500,000,000

|

*

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be revised or withdrawn at any time.

|

Benchmark Treasury:

|

|

2020 Notes:

1.375% due February 15, 2020

2022 Notes:

1.875% due February 28, 2022

|

|

|

|

|

|

Benchmark Treasury Price and Yield:

|

|

2020 Notes:

99-15; 1.559%

2022 Notes:

99-15 ¼; 1.986%

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

2020 Notes:

plus 40 basis points

2022 Notes: p

lus 50 basis points

|

|

|

|

|

|

Price to Public (Issue Price):

|

|

2020 Notes:

99.974% plus accrued interest, if any, from March 6, 2017

2022 Notes:

99.832% plus accrued interest, if any, from March 6, 2017

|

|

|

|

|

|

Interest Rate:

|

|

2020 Notes:

1.950% per annum, accruing from March 6, 2017

2022 Notes:

2.450% per annum, accruing from March 6, 2017

|

|

|

|

|

|

Interest Payment Dates:

|

|

2020 Notes: Semi-annually on each March 4 and September 4, commencing on September 4, 2017

2022 Notes: Semi-annually on each March 4 and September 4, commencing on September 4, 2017

|

|

|

|

|

|

Regular Record Dates:

|

|

2020

Notes: February 17 or August 20, as the case may be, immediately preceding the applicable interest payment date

2022 Notes: February 17

or August 20, as the case may be, immediately preceding the applicable interest payment date

|

|

|

|

|

|

Underwriting Discounts and Commissions:

|

|

2020 Notes:

0.200%

2022 Notes:

0.350%

|

|

|

|

|

|

CUSIP No.:

|

|

2020

Notes: 25468P DP8

2022

Notes: 25468P DQ6

|

|

|

|

|

|

ISIN No.:

|

|

2020

Notes: US25468PDP80

2022

Notes: US25468PDQ63

|

|

|

|

|

|

Optional Redemption:

|

|

The Notes of any tranche may be redeemed, in whole or in part, at the option of the Company, at any time or from time to time prior to their final maturity date, at a redemption price equal to the greater of the following amounts:

|

|

|

|

|

|

|

|

(1)

100% of the principal amount of the Notes of such tranche to be redeemed; or

|

|

|

|

|

|

|

|

(2)

as determined by the Independent Investment Banker (as defined below), the sum of the present values of the remaining scheduled payments of principal of and interest on the Notes of such tranche to be redeemed (not including any portion of any payments of interest accrued to the applicable redemption date) discounted to such redemption date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate (as defined below) plus 7.5 basis points in the case of the 2020 Notes or 10 basis points in the case of the 2022 Notes,

|

|

|

|

|

|

|

|

plus, in the case of both clauses (1) and (2) above, accrued and unpaid interest on the principal amount of the Notes of such tranche being redeemed to such redemption date.

|

2

|

|

|

Notwithstanding the foregoing, installments of interest on the Notes of any tranche that are due and payable on an interest payment date falling prior to a redemption date for the Notes of such tranche shall be payable to the registered holders of such Notes (or one or more predecessor Notes of such tranche) of record at the close of business on the relevant regular record date, all as provided in the indenture.

|

|

|

|

|

|

|

|

“Treasury Rate” means, with respect to any redemption date for the Notes of any tranche, the rate per annum equal to the semiannual equivalent yield to maturity of the Comparable Treasury Issue, assuming a price for the Comparable Treasury Issue (expressed as a percentage of its principal amount) equal to the Comparable Treasury Price for such redemption date.

|

|

|

|

|

|

|

|

The Treasury Rate will be calculated on the third business day preceding the applicable redemption date. As used in the preceding sentence and in the definition of “Reference Treasury Dealer Quotation” below, the term “business day” means any day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on which commercial banks are authorized or required by law, regulation or executive order to close in The City of New York.

|

|

|

|

|

|

|

|

“Comparable Treasury Issue” means, with respect to any redemption date for the Notes of any tranche, the United States Treasury security selected by the Independent Investment Banker as having an actual or interpolated maturity comparable to the remaining term of the Notes of such tranche that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining term of such Notes.

|

|

|

|

|

|

|

|

“Comparable Treasury Price” means, with respect to any redemption date for the Notes of any tranche, (i) if the Independent Investment Banker obtains

four Reference Treasury Dealer Quotations for that redemption date, the average of those Reference Treasury Dealer Quotations after excluding the highest and lowest of those Reference Treasury Dealer Quotations, (ii) if the Independent Investment Banker obtains fewer than four but more than one such Reference Treasury Dealer Quotations, the average of all of those quotations, or (iii) if the Independent Investment Banker obtains only one such Reference Treasury Dealer Quotation, such quotation.

|

|

|

|

|

|

|

|

“Independent Investment Banker” means one of

Citigroup Global Markets Inc., J.P. Morgan Securities LLC, BNP Paribas Securities Corp. and SunTrust Robinson Humphrey, Inc. and their respective successors appointed by the Company to act as the Independent Investment Banker from time to time, or if any such firm is unwilling or unable to serve in that capacity, an independent investment banking institution of national standing appointed by the Company.

|

|

|

|

|

|

|

|

“Reference Treasury Dealer” means, with respect to any redemption date for the Notes of any tranche, (A)

Citigroup Global Markets Inc., J.P. Morgan Securities LLC and BNP Paribas Securities Corp. and their respective successors, provided that, if any such firm ceases to be a primary U.S. Government securities dealer in the United States (a “Primary Treasury Dealer”), the Company will substitute another Primary Treasury Dealer and (B) one Primary Treasury Dealer selected by SunTrust Robinson Humphrey, Inc. and its successors.

|

3

|

|

|

“Reference Treasury Dealer Quotation” means, with respect to each Reference Treasury Dealer and any redemption date for the Notes of any tranche, the average, as determined by the Independent Investment Banker, of the bid and asked prices for the Comparable Treasury Issue (expressed in each case as a percentage of its principal amount) quoted in writing to the Independent Investment Banker by such Reference Treasury Dealer at 5:00 p.m. (New York City time) on the third business day preceding that redemption date.

|

|

|

|

|

|

|

|

Unless the Company defaults in payment of the redemption price, interest on each Note or portion thereof called for redemption will cease to accrue on the applicable redemption date.

|

|

|

|

|

|

|

|

Notice of any redemption will be mailed at least 30 days but not more than 60 days before the redemption date to each holder of the Notes of any tranche to be redeemed. If fewer than all of the Notes of any tranche and all Additional Notes (as defined in the Prospectus Supplement), if any, with the same stated maturity, interest rate and other terms (other than original issue date and, if applicable, issue price, date from which interest shall accrue and first payment of interest) as the Notes of such tranche are to be redeemed at any time, selection of such Notes and Additional Notes, if any, for redemption will be made, in the case of Notes evidenced by global Notes (as defined below), in accordance with the procedures of the applicable Depositary (as defined below) or, in the case of definitive Notes, by the trustee (as defined in the Prospectus Supplement) by such method as the trustee shall deem fair and appropriate. If any Note is to be redeemed in part, such Note must be redeemed in a minimum principal amount of $2,000 or a multiple of $1,000 in principal amount in excess thereof; provided that the unredeemed portion of such Note must be an authorized denomination.

|

|

|

|

|

|

Form of Notes:

|

|

The Notes of each tranche will be issued in the form of one or more global Notes (each, a “global Note”) in book-entry form and will be delivered to investors through the facilities of The Depository Trust Company, as depositary for the global Notes (the “Depositary”), for the accounts of its participants, which may include Clearstream Banking, société anonyme, and Euroclear Bank S.A./N.V., against payment. Investors will not be entitled to receive physical delivery of Notes in definitive form except under the limited circumstances described in the Prospectus Supplement under “Description of the Notes— Book-Entry Notes and Information Relating to DTC.”

|

|

|

|

|

|

Currency:

|

|

The Notes will be denominated and payable in U.S. dollars.

|

|

|

|

|

|

Other:

|

|

The Notes will not be entitled to the benefit of any sinking fund and the Company will not be required to repurchase Notes at the option of the holders. The Notes are “fixed rate notes” as defined in the Prospectus Supplement.

|

|

|

|

|

|

Material United States Federal Income Tax Considerations:

|

|

For a discussion of the material United States federal income tax considerations related to the acquisition, ownership and disposition of the Notes, please see “Material United States Federal Income Tax Considerations” in the Prospectus Supplement.

|

4

|

Joint Book-Running Managers:

|

|

Citigroup Global Markets Inc.

J.P. Morgan Securities LLC

BNP Paribas Securities Corp.

SunTrust Robinson Humphrey, Inc.

|

|

|

|

|

|

Co-Managers:

|

|

Société Générale

Standard Chartered Bank

SMBC Nikko Securities America, Inc.

U.S. Bancorp Investments, Inc.

|

|

|

|

|

|

Junior Co-Managers:

|

|

C.L. King & Associates, Inc.

Multi-Bank Securities, Inc.

Samuel A. Ramirez & Company, Inc.

Siebert Cisneros Shank & Co., L.L.C.

|

Concurrent Offering.

Concurrently with the offering of the Notes, the Company is offering $400,000,000 aggregate principal amount of its Floating Rate Notes Due 2020 and $500,000,000 aggregate principal amount of its Floating Rate Notes Due 2022 (collectively, the “Other Notes”) pursuant to separate pricing term sheets. The Notes and the Other Notes will be part of a single series of the Company’s senior debt securities under the indenture designated as Medium-Term Notes, Series G.

Plan of Distribution.

The following information supplements the information appearing under the caption “Plan of Distribution” in the Prospectus Supplement. Pursuant to a terms agreement dated the date hereof, the joint book-running managers, co-managers and junior co-managers (collectively, the “underwriters”) named above, acting as principal, have severally agreed to purchase the Notes and the Other Notes from the Company. The several obligations of the underwriters to purchase the Notes and the Other Notes are subject to conditions and they are obligated to purchase all of the Notes and the Other Notes if any are purchased. If an underwriter defaults, the terms agreement provides that the purchase commitments of the non-defaulting underwriters may be increased or the terms agreement may be terminated.

The Company estimates that expenses of the offering of the Notes and the Other Notes payable by the Company, excluding underwriting discounts and commissions, will be $

1,180,000

.

Société Générale is not a U.S. registered broker-dealer and, therefore, to the extent that it intends to effect any sales of the Notes in the United States, it will do so through its registered U.S. broker-dealer SG Americas Securities, LLC.

Standard Chartered Bank is not a U.S. registered broker-dealer and will not effect any offers or sales of any Notes in the United States unless it is through one or more U.S. registered broker-dealers as permitted by the regulations of FINRA.

Canada.

The Notes may be sold only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the Notes must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this document (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with a legal advisor.

5

Pursuant to section 3A.3 (or, in the case of securities issued or guaranteed by the government of a non-Canadian jurisdiction, section 3A.4) of National Instrument 33-105 Underwriting Conflicts (“NI 33-105”), the underwriters are not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this offering.

European Economic Area.

This free writing prospectus is not a prospectus for the purposes of the Prospectus Directive (as defined below). This free writing prospectus has been prepared on the basis that all offers of the Notes offered hereby made to persons in the European Economic Area will be made pursuant to an exemption under the Prospectus Directive from the requirement to produce a prospectus in connection with offers of such Notes. Neither the Company nor the underwriters have authorized, nor does it or do they authorize, the making of any offer of the Notes through any financial intermediary, other than offers made by the underwriters which constitute the final placement of the Notes contemplated in this free writing prospectus. In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”), each underwriter has severally represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the “Relevant Implementation Date”) it has not made and will not make an offer of Notes which are the subject of the offering contemplated by the Prospectus, the Prospectus Supplement, this free writing prospectus and any related pricing supplement to the public in that Relevant Member State except that it may, with effect from and including the Relevant Implementation Date, make an offer of such Notes to the public in that Relevant Member State at any time:

(a)

to any legal entity which is a qualified investor as defined in the Prospectus Directive;

(b)

to fewer than 150 natural or legal persons (other than qualified investors as defined in the Prospectus Directive), subject to obtaining the prior consent of the representatives of the underwriters for any such offer; or

(c)

in any other circumstances falling within Article 3(2) of the Prospectus Directive,

provided that no such offer of Notes shall require the Company or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive.

For the purposes of this provision, the expression an “offer of Notes to the public” in relation to any Notes in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the Notes to be offered so as to enable an investor to decide to purchase or subscribe for the Notes, as the same may be varied in that Relevant Member State by any measure implementing the Prospectus Directive in that Relevant Member State, and the expression “Prospectus Directive” means Directive 2003/71/EC (as amended, including by Directive 2010/73/EU), and includes any relevant implementing measure in the Relevant Member State.

United Kingdom.

This free writing prospectus, the Prospectus Supplement, the Prospectus and any related pricing supplement do not constitute an offer of Notes to the public in the United Kingdom. No prospectus has been or will be approved in the United Kingdom in respect of the Notes. The communication of this free writing prospectus, the Prospectus Supplement, the Prospectus, any related pricing supplement and any other document or materials relating to the issue of any Notes offered hereby is not being made, and such documents and/or materials have not been approved, by an authorized person for the purposes of Section 21 of the United Kingdom’s Financial Services and Markets Act 2000, as amended. Accordingly, such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. The communication of such documents and/or materials is only being made to those persons in the United Kingdom falling within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Financial Promotion Order”)), or within Article 49(2)(a) to (d) of the Financial Promotion Order, or to any other persons to whom it may otherwise lawfully be made under the Financial Promotion Order (all such persons together being referred to as “relevant persons”). In the United Kingdom, the Notes offered hereby are only available to, and any investment or investment activity to which this free writing prospectus, the Prospectus Supplement, the Prospectus and any related pricing supplement relate will be engaged in only with, relevant persons. Any person in the United Kingdom that is not a relevant person should not act or rely on this free

6

writing prospectus, the Prospectus Supplement, the Prospectus and any related pricing supplement or any of their contents.

Each underwriter severally has represented and agreed that:

·

it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000, as amended (the “FSMA”)) received by it in connection with the issue or sale of the Notes in circumstances in which Section 21(1) of the FSMA does not apply to the Company; and

·

it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the Notes in, from or otherwise involving the United Kingdom.

Hong Kong.

The contents of the Prospectus, the Prospectus Supplement and this term sheet have not been reviewed or approved by any regulatory authority in Hong Kong. The Prospectus, the Prospectus Supplement and this term sheet do not constitute an offer or invitation to the public in Hong Kong to acquire the Notes. Accordingly, unless permitted by the securities laws of Hong Kong, no person may issue or have in its possession for the purpose of issue, the Prospectus, the Prospectus Supplement or this term sheet or any advertisement, invitation or document relating to the Notes, whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong other than in relation to the Notes which are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” (as such term is defined in the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong) (“SFO”) and the subsidiary legislation made thereunder) or in circumstances which do not result in the Prospectus, the Prospectus Supplement and this term sheet being a “prospectus” as defined in the Companies (Winding Up and Miscellaneous Provisions) Ordinance of Hong Kong (Cap. 32 of the Laws of Hong Kong) (“CO”) or which do not constitute an offer or an invitation to the public for the purposes of the SFO or the CO. The offer of the Notes is personal to the person to whom the Prospectus, the Prospectus Supplement or this term sheet has been delivered by or on behalf of the Company, and a subscription for the Notes will only be accepted from such person. No person to whom a copy of the Prospectus, the Prospectus Supplement or this term sheet is issued may issue, circulate or distribute the Prospectus, the Prospectus Supplement or this term sheet in Hong Kong or make or give a copy of the Prospectus, the Prospectus Supplement or this term sheet to any other person. You are advised to exercise caution in relation to the offer. If you are in any doubt about the contents of the Prospectus, the Prospectus Supplement or this term sheet, you should obtain independent professional advice.

Japan.

The Notes have not been and will not be registered for a public offering in Japan pursuant to Article 4, Paragraph 1 of the Financial Instruments and Exchange Act of Japan (Act No. 25 of 1948, as amended; the “FIEA”). The Notes may not be offered or sold, directly or indirectly, in Japan or to or for the benefit of any resident of Japan (including any person resident in Japan or any corporation or other entity organized under the laws of Japan or having its principal office in Japan) or to others for reoffering or resale, directly or indirectly, in Japan or to or for the benefit of any resident of Japan, except pursuant to an exemption from the registration requirements of the FIEA and otherwise in compliance with, the FIEA and any other applicable laws, regulations and ministerial guidelines of Japan in effect at the relevant time.

Singapore.

The Prospectus Supplement, the Prospectus and this term sheet have not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, the Prospectus Supplement, the Prospectus and this term sheet and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the Notes may not be circulated or distributed, nor may the Notes be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”)) under Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1) of the SFA, or any person pursuant to an offer referred to in Section 275(1A) of the SFA, and in accordance with the conditions specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA, in each case subject to conditions set forth in the SFA.

7

Where the Notes are subscribed or purchased under Section 275 of the SFA by a relevant person which is a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor, the securities (as defined in Section 239(1) of the SFA) of that corporation shall not be transferable for 6 months after that corporation has acquired the Notes under Section 275 of the SFA except: (1) to an institutional investor under Section 274 of the SFA or to a relevant person (as defined in Section 275(2) of the SFA), (2) where such transfer arises from an offer pursuant to Section 275(1A) of the SFA, (3) where no consideration is or will be given for the transfer, (4) where the transfer is by operation of law, (5) as specified in Section 276(7) of the SFA, or (6) as specified in Regulation 32 of the Securities and Futures (Offers of Investments) (Shares and Debentures) Regulations 2005 of Singapore (“Regulation 32”).

Where the Notes are subscribed or purchased under Section 275 of the SFA by a relevant person which is a trust (where the trustee is not an accredited investor (as defined in Section 4A of the SFA)) whose sole purpose is to hold investments and each beneficiary of the trust is an accredited investor, the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferable for 6 months after that trust has acquired the Notes under Section 275 of the SFA except: (1) to an institutional investor under Section 274 of the SFA or to a relevant person (as defined in Section 275(2) of the SFA), (2) where such transfer arises from an offer pursuant to Section 276(4)(i)(B) of the SFA, (3) where no consideration is or will be given for the transfer, (4) where the transfer is by operation of law, (5) as specified in Section 276(7) of the SFA, or (6) as specified in Regulation 32.

The issuer has filed a Registration Statement (including a prospectus) with the Securities and Exchange Commission for the offering to which this communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents the issuer has filed with the Securities and Exchange Commission for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and prospectus supplement if you request it by contacting Citigroup Global Markets Inc. by telephone (toll free) at 1-800-831-9146, J.P. Morgan Securities LLC (collect) at 1-212-834-4553, BNP Paribas Securities Corp. (toll free) at 1-800-854-5674 or SunTrust Robinson Humphrey, Inc. (toll free) at 1-800-685-4786.

8

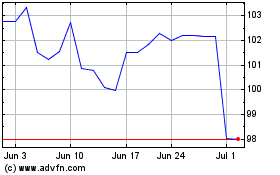

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

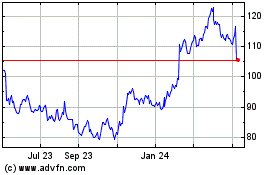

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Apr 2023 to Apr 2024