UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 8, 2015

DHI Group, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-33584

|

20-3179218

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

1040 Avenue of the Americas, 8th Floor

New York, NY 10018

(Address of principal executive offices, including zip code)

(212) 725-6550

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01. Other Events.

On September 8, 2015, DHI Group, Inc.

(the “Company”) entered into an amendment (“Amendment No. 1”) to its Credit

Agreement (the “Credit Agreement”) dated October 28, 2013, among the Company., Dice Inc., Dice Career

Solutions, Inc., as Borrowers, the lenders from time to time party thereto and JPMorgan Chase Bank, N.A., as Administrative Agent.

Amendment No. 1 effected a technical

amendment to the definition of “Change of Control” under the Credit Agreement, removing a parenthetical in such definition

which had previously had the effect of causing the election of directors under certain contested and potentially contested circumstances

to constitute a “Change of Control.” The foregoing description of Amendment No. 1 is qualified entirely by reference

to the full text of Amendment No. 1, which is filed as Exhibit 10.1 to this report and is incorporated by reference herein.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits.

| 10.1 |

Amendment No. 1 to the Credit Agreement among DHI Group, Inc. (f/k/a Dice Holdings, Inc.), Dice Inc., Dice Career Solutions, Inc., as Borrowers, the lenders from time to time party thereto, JPMorgan Chase Bank, N.A., as Administrative Agent, Bank of America, N.A., as Syndication Agent and Keybank National Association, as Documentation Agent. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

DHI GROUP, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Brian

Campbell

|

|

|

|

|

Brian

Campbell

|

|

|

|

|

Vice President, Business and Legal Affairs and General Counsel

|

|

|

|

|

|

|

Date: September

21, 2015

EXHIBIT INDEX

| Exhibit No. |

Description |

| 10.1 |

Amendment No. 1 to the Credit Agreement among DHI Group, Inc. (f/k/a Dice Holdings, Inc.), Dice Inc., Dice Career Solutions, Inc., as Borrowers, the lenders from time to time party thereto, JPMorgan Chase Bank, N.A., as Administrative Agent, Bank of America, N.A., as Syndication Agent and Keybank National Association, as Documentation Agent. |

EXHIBIT 10.1

EXECUTION COPY

AMENDMENT NO. 1

Dated as of September 8, 2015

to

CREDIT AGREEMENT

Dated as of October 28, 2013

THIS AMENDMENT NO.

1 (this “Amendment”) is made as of September 8, 2015 by and among DHI Group, Inc. (f/k/a Dice Holdings, Inc.),

Dice Inc. and Dice Career Solutions, Inc. (each individually a “Borrower” and collectively the “Borrowers”),

the financial institutions listed on the signature pages hereof and JPMorgan Chase Bank, N.A., as Administrative Agent (the “Administrative

Agent”), under that certain Credit Agreement dated as of October 28, 2013 by and among the Borrowers, the Lenders and

the Administrative Agent (as amended, restated, supplemented or otherwise modified from time to time, the “Credit Agreement”).

Capitalized terms used herein and not otherwise defined herein shall have the respective meanings given to them in the Credit Agreement.

WHEREAS, the Borrowers

have requested that the requisite Lenders and the Administrative Agent agree to certain amendments to the Credit Agreement;

WHEREAS, the Borrowers,

the Lenders party hereto and the Administrative Agent have so agreed on the terms and conditions set forth herein;

NOW, THEREFORE, in

consideration of the premises set forth above, the terms and conditions contained herein, and other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Borrowers, the Lenders party hereto and the Administrative Agent

hereby agree to enter into this Amendment.

1.

Amendments to the Credit Agreement. Effective as of the date of

satisfaction of the conditions precedent set forth in Section 2 below, the parties hereto agree that the Credit Agreement

is hereby amended as follows:

(a)

Section 1.01 of the Credit Agreement is hereby amended to add the following definition

thereto in the appropriate alphabetical order:

“Amendment No. 1 Effective Date” means September 8, 2015.

(b) The

definition of “Change of Control” appearing in Section 1.01 of the Credit Agreement is hereby amended

to delete the parenthetical “(excluding, in the case of both clause (ii) and clause (iii), any individual whose

initial nomination for, or assumption of office as, a member of that board or equivalent governing body occurs as a result of an

actual or threatened solicitation of proxies or consents for the election or removal of one or more directors by any person or

group other than a solicitation for the election of one or more directors by or on behalf of the board of directors)” appearing

therein.

(c) Section

2.17 of the Credit Agreement is hereby amended to add a new clause (j)

thereto as follows:

“(j) Certain

FATCA Matters. For purposes of determining withholding Taxes imposed under FATCA, from and after the Amendment No. 1 Effective

Date, the Loan Parties and the Administrative Agent shall treat (and the Lenders hereby authorize the Administrative Agent to treat)

this Agreement and the Loans as not qualifying as “grandfathered obligations” within the meaning of Treasury Regulation

Section 1.1471-2(b)(2)(i) or 1.1471-2T(b)(2)(i).”

2. Conditions

of Effectiveness. The effectiveness of this Amendment is subject to the conditions precedent that the Administrative Agent

shall have received (i) counterparts of this Amendment duly executed by the Borrowers, the Required Lenders and the Administrative

Agent, (ii) counterparts of the Consent and Reaffirmation attached as Exhibit A hereto duly executed by the Subsidiary Guarantors

and (iii) payment and/or reimbursement of the Administrative Agent’s and its affiliates’ reasonable and documented

out-of-pocket fees and expenses (including, to the extent invoiced, reasonable and documented fees and expenses of counsel for

the Administrative Agent) in connection with the Loan Documents.

3. Representations

and Warranties of the Borrowers. Each Borrower hereby represents and warrants as follows:

(a) This

Amendment and the Credit Agreement as modified hereby constitute legal, valid and binding obligations of such Borrower and are

enforceable against such Borrower in accordance with their terms, except as may be limited by applicable Debtor Relief Laws and

general principles of equity.

(b) As

of the date hereof and after giving effect to the terms of this Amendment, (i) no Default or Event of Default has occurred and

is continuing and (ii) the representations and warranties of such Borrower set forth in the Credit Agreement, as amended hereby,

shall be true and correct in all material respects (or in all respects if the applicable representation or warranty is qualified

by materiality or Material Adverse Effect), except to the extent that such representations and warranties specifically refer to

an earlier date, in which case they shall be true and correct in all material respects as of such earlier date.

4. Reference

to and Effect on the Credit Agreement.

(a) Upon

the effectiveness hereof, each reference to the Credit Agreement in the Credit Agreement or any other Loan Document shall mean

and be a reference to the Credit Agreement as amended hereby.

(b) Each

Loan Document and all other documents, instruments and agreements executed and/or delivered in connection therewith shall remain

in full force and effect and are hereby ratified and confirmed.

(c) Except

with respect to the subject matter hereof, the execution, delivery and effectiveness of this Amendment shall not operate as a waiver

of any right, power or remedy of the Administrative Agent or the Lenders, nor constitute a waiver of any provision of the Credit

Agreement, the Loan Documents or any other documents, instruments and agreements executed and/or delivered in connection therewith.

(d) This

Amendment is a Loan Document under (and as defined in) the Credit

2

Agreement.

5. Governing

Law. This Amendment shall be construed in accordance with and governed by the law of the State of New York.

6. Headings.

Section headings in this Amendment are included herein for convenience of reference only, are not part of this Amendment and shall

not affect the construction of, or be taken into consideration in interpreting, this Amendment.

7. Counterparts.

This Amendment may be executed in counterparts (and by different parties hereto on different counterparts), each of which shall

constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed counterpart

of a signature page to this Amendment by telecopy, e-mailed .pdf or any other electronic means that reproduces an image of the

actual executed signature page shall be effective as delivery of a manually executed counterpart of this Amendment.

[Signature Pages Follow]

3

IN WITNESS WHEREOF,

the parties hereto have caused this Amendment to be duly executed and delivered by their respective authorized officers as of the

day and year first above written.

| |

DHI GROUP, INC. (F/K/A DICE HOLDINGS, INC.), |

| |

as Borrower |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John Roberts |

|

| |

Name: |

John Roberts |

|

| |

Title: |

CFO |

|

| |

|

|

|

| |

|

|

|

| |

DICE INC., |

|

| |

as Borrower |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John Roberts |

|

| |

Name: |

John Roberts |

|

| |

Title: |

CFO |

|

| |

|

|

|

| |

|

|

|

| |

DICE CAREER SOLUTIONS, INC., |

|

| |

as Borrower |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John Roberts |

|

| |

Name: |

John Roberts |

|

| |

Title: |

CFO |

|

Signature Page to Amendment No. 1 to

Credit Agreement dated as of October 28, 2013

DHI Group, Inc.

| |

JPMORGAN CHASE BANK, N.A., |

|

| |

individually as a Lender and as Administrative Agent |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ David F. Gibbs |

|

| |

Name: |

David F. Gibbs |

|

| |

Title: |

Managing Director |

|

Signature Page to Amendment No. 1 to

Credit Agreement dated as of October 28, 2013

DHI Group, Inc.

| |

BANK OF AMERICA, N.A., |

|

| |

as a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Kristine M. Parker |

|

| |

Name: |

Kristine M. Parker |

|

| |

Title: |

Vice President |

|

Signature Page to Amendment No. 1 to

Credit Agreement dated as of October 28, 2013

DHI Group, Inc.

| |

KEYBANK NATIONAL ASSOCIATION, |

|

| |

as a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Meghan Starr |

|

| |

Name: |

Meghan Starr |

|

| |

Title: |

Vice President |

|

Signature Page to Amendment No. 1 to

Credit Agreement dated as of October 28, 2013

DHI Group, Inc.

| |

CAPITAL ONE, NATIONAL ASSOCIATION, |

|

| |

as a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Nellya Davydova |

|

| |

Name: |

Nellya Davydova |

|

| |

Title: |

Vice President |

|

Signature Page to Amendment No. 1 to

Credit Agreement dated as of October 28, 2013

DHI Group, Inc.

| |

SILICON VALLEY BANK, |

|

| |

as a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Jon Wolter |

|

| |

Name: |

Jon Wolter |

|

| |

Title: |

Vice President |

|

Signature Page to Amendment No. 1 to

Credit Agreement dated as of October 28, 2013

DHI Group, Inc.

| |

BMO HARRIS BANK N.A. |

|

| |

as a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Larry R. Guenther |

|

| |

Name: |

Larry R. Guenther |

|

| |

Title: |

Director |

|

Signature Page to Amendment No. 1 to

Credit Agreement dated as of October 28, 2013

DHI Group, Inc.

| |

FIRST NIAGARA BANK, N.A., |

|

| |

as a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Robert Dellatorre |

|

| |

Name: |

Robert Dellatorre |

|

| |

Title: |

First Vice President |

|

Signature Page to Amendment No. 1 to

Credit Agreement dated as of October 28, 2013

DHI Group, Inc.

EXHIBIT A

Consent and Reaffirmation

Each of the undersigned

hereby acknowledges receipt of a copy of the foregoing Amendment No. 1 to the Credit Agreement (as the same may be amended, restated,

supplemented or otherwise modified from time to time, the “Credit Agreement”), dated as of October 28, 2013,

by and among DHI Group, Inc. (f/k/a Dice Holdings, Inc.), Dice Inc. and Dice Career Solutions, Inc. (each individually a “Borrower”

and collectively the “Borrowers”), the Lenders and JPMorgan Chase Bank, N.A., as Administrative Agent (the “Administrative

Agent”), which Amendment No. 1 is dated as of September 8, 2015 and is by and among the Borrowers, the financial institutions

listed on the signature pages thereof and the Administrative Agent (the “Amendment”). Capitalized terms used

in this Consent and Reaffirmation and not defined herein shall have the meanings given to them in the Credit Agreement. Without

in any way establishing a course of dealing by the Administrative Agent or any Lender, each of the undersigned consents to the

Amendment and reaffirms the terms and conditions of the Subsidiary Guaranty and any other Loan Document executed by it and acknowledges

and agrees that the Subsidiary Guaranty and each and every such Loan Document executed by the undersigned in connection with the

Credit Agreement remains in full force and effect and is hereby reaffirmed, ratified and confirmed. All references to the Credit

Agreement contained in the above-referenced documents shall be a reference to the Credit Agreement as so modified by the Amendment

and as the same may from time to time hereafter be amended, modified or restated.

Dated September 8, 2015

[Signature Page Follows]

IN WITNESS WHEREOF, this Consent and Reaffirmation

has been duly executed and delivered as of the day and year above written.

| |

EFINANCIALCAREERS, INC., |

|

| |

a Delaware corporation |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Brian P. Campbell |

|

| |

Name: |

Brian P. Campbell |

|

| |

Title: |

Vice President |

|

| |

|

|

|

| |

|

|

|

| |

TARGETED JOB FAIRS, INC., |

|

| |

a Delaware corporation |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Brian P. Campbell |

|

| |

Name: |

Brian P. Campbell |

|

| |

Title: |

Vice President |

|

| |

|

|

|

| |

|

|

|

| |

RIGZONE.COM, INC., |

|

| |

a Texas corporation |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Brian P. Campbell |

|

| |

Name: |

Brian P. Campbell |

|

| |

Title: |

Vice President |

|

Signature Page to Consent and Reaffirmation to

Amendment No. 1 to

Credit Agreement dated as of October 28, 2013

DHI Group, Inc.

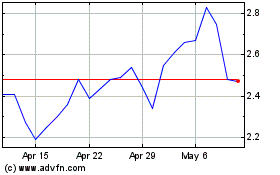

DHI (NYSE:DHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

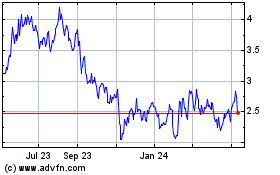

DHI (NYSE:DHX)

Historical Stock Chart

From Apr 2023 to Apr 2024