Current Report Filing (8-k)

March 09 2015 - 5:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2015

Dice Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-33584

|

20-3179218

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

1040 Avenue of the Americas, 8th Floor

New York, NY 10018

(Address of principal executive offices, including zip code)

(212) 725-6550

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

ITEM 5.02.

|

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

|

Performance-Based Restricted Stock Unit Awards to Named Executive Officers

Effective March 3, 2015, our Compensation Committee approved the grant of performance-based restricted stock units (PSUs) with respect to the Company’s common stock, $0.01 par value per share, pursuant to the Dice Holdings, Inc. 2012 Omnibus Equity Award Plan to our named executive officers as follows:

|

Name

|

PSUs Granted

|

|

Michael Durney

|

140,000

|

|

Shravan Goli

|

|

| John Roberts |

37,500

|

|

James Bennett

|

22,500

|

|

Brian Campbell

|

12,500

|

The PSUs will generally vest on the dates the Compensation Committee certifies the Company’s achievement of stock price performance relative to the Russell 2000 Index, provided that the executive remains employed through such date. Performance will be measured over three separate measurement periods: a one-year measurement period, a two-year measurement period and a three-year measurement period. The number of PSUs that will vest will vary based on the level of achievement: ranging from 0% if the Company’s stock price performance is 34 or more percentage points worse than the performance of the Russell 2000 Index, to 100% (target) if the Company’s stock price performance is the same as the performance of the Russell 2000 Index, and up to a maximum of 150% if the Company’s stock price performance is 25 or more percentage points better than the performance of the Russell 2000 Index; provided, that the ability to earn an above target number of PSUs is tied solely to relative performance for the full three-year measurement period. Stock price performance is determined by the average adjusted closing stock price for the Company and the Russell 2000 Index for the 30 trading days prior to the grant date and the average adjusted closing stock price for the 30 trading days prior to the end of the applicable measurement period.

In the event of a change in control, the measurement periods will be truncated and end on the date of the change in control. The Company will determine the amount of PSUs deemed earned based on performance through the end of the truncated measurement period, and the executive will vest in a prorated portion of the earned PSUs based on the portion of the three-year measurement period that has elapsed, provided that the executive remains employed through the completion of the change in control. The remaining earned PSUs will convert into service-based restricted stock units which will vest, without regard to performance, ratably on a monthly basis through the end of the scheduled three-year measurement period, provided that the executive remains employed through each such date.

The foregoing summary does not purport to be complete and is qualified in its entirety by reference to the actual award agreements for the named executive officers.

The grants disclosed herein are separate from, and in addition to, the grants of time-based vesting restricted stock reported by the named executive officers on their statements of changes in beneficial ownership on Form 4, filed with the Securities and Exchange Commission (the “SEC”) on March 5, 2015. Acquisition of beneficial ownership of the shares of common stock underlying the PSUs will be reported by the named executive officers upon the issuance of such shares, in accordance with the rules of the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

DICE HOLDINGS, INC.

|

|

| |

|

|

|

| |

By:

|

/s/ Brian Campbell

|

|

| |

|

Brian Campbell

|

|

| |

|

Vice President, Business and Legal Affairs

and General Counsel

|

|

| |

|

|

|

Date: March 9, 2015

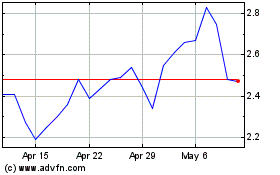

DHI (NYSE:DHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

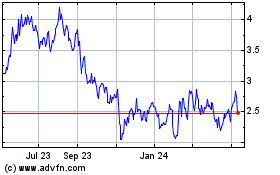

DHI (NYSE:DHX)

Historical Stock Chart

From Apr 2023 to Apr 2024