Danaher Profit Soars 33% on Acquisitions

April 21 2016 - 6:57AM

Dow Jones News

By Anne Steele

Industrial conglomerate Danaher Corp. on Thursday raised its

guidance for the year after reporting its profit shot up 33% in the

first quarter of the year and results topped expectations as recent

acquisitions padded results in the face of currency challenges.

For the year, the company now anticipates adjusted earnings of

$4.85 to $4.98 a share, up from its previous forecast for $4.80 to

$4.95 a share. But for the second quarter, the company expects

adjusted earnings in the range of $1.19 to $1.23 a share, just

below analysts' forecast for $1.24 a share.

Chief Executive Thomas Joyce said the company outperformed "in

the face of uncertain and challenging economic conditions,"

pointing to high-teens earnings growth, healthy operating margin

expansion and free cash flow up more than 50% year-on-year.

Acquisitions helped the Washington, D.C.-based company increase

its top-line growth by 16.5%. Still, the company faced

foreign-exchange volatility that it said reduced its top line by

2%.

For the quarter ended April 1, the company posted a profit of

$758.4 million, or $1.09 a share, up from $569.8 million or 79

cents a share a year earlier. Excluding certain items, earnings on

a per-share basis rose to $1.08 from 91 cents a year earlier.

Revenue climbed 15% to $5.39 billion. Revenue excluding the boon

from acquisitions edged up 0.5%.

Danahar had forecast adjusted earnings of $1 to $1.04 a share.

Analysts were looking for $5.33 billion in revenue.

Last May, Danaher Corp said it agreed to buy Pall Corp. for

about $13.6 billion and unveiled plans to split itself into two

separate companies.

Pall, based in Port Washington, N.Y., sells purification and

filtration products to a wide range of customers, including

biopharmaceutical companies, airplane manufactures, brewers and

municipal water suppliers.

The two resulting businesses would be a science and technology

company, which would include Pall, and an industry company. The

science business is slated to keep the Danaher name and include

Danaher's life-sciences and diagnostics and dental segments, as

well as its water-quality and product-identification platforms. The

company hopes to complete the split around the end of 2016.

Shares in the company, inactive premarket, have risen 13% over

the past three months.

Write to Anne Steele at anne.steele@wsj.com.

(END) Dow Jones Newswires

April 21, 2016 06:42 ET (10:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

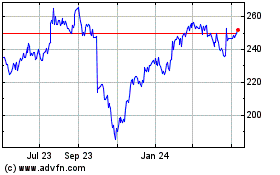

Danaher (NYSE:DHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

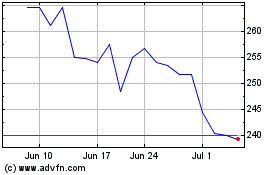

Danaher (NYSE:DHR)

Historical Stock Chart

From Apr 2023 to Apr 2024