Alcoa to Split Into Two Companies

September 28 2015 - 7:20AM

Dow Jones News

Aluminum maker Alcoa Inc. said Monday that it will split into

two publicly traded companies, joining the recent wave of companies

looking to spur growth by breaking up.

Shares of Alcoa gained 4.2% in premarket trading.

Alcoa said its upstream company will include its bauxite,

alumina, aluminum, casting and energy business.

The other company will include its global rolled products,

engineered products and solutions, and transportation and

construction solutions businesses.

The deal is expected to close in the second half of next

year.

Alcoa shareholders will own all shares outstanding of both

companies.

Alcoa has struggled as the price for raw aluminum remains under

pressure amid China flooding the global markets with steel,

aluminum and other industrial metals.

Companies from industrial conglomerate Danaher Corp. to

Hewlett-Packard Co. have announced plans to break up their

businesses recently. The trend has been fueled by the idea that

companies with a narrower focus perform better. The moves in many

cases have been well received by shareholders - and sometimes

actively sought by them.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 28, 2015 07:05 ET (11:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

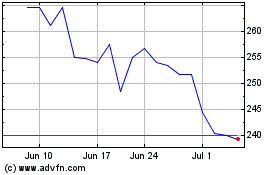

Danaher (NYSE:DHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

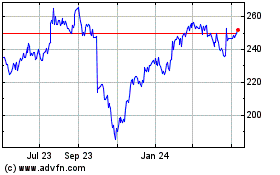

Danaher (NYSE:DHR)

Historical Stock Chart

From Apr 2023 to Apr 2024