UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 31, 2015

Danaher Corporation

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-08089 |

|

59-1995548 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 2200 Pennsylvania Ave., N.W., Suite 800W,

Washington, D.C. |

|

20037-1701 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

202-828-0850

(Registrant’s Telephone Number, Including Area Code)

Not applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

INTRODUCTORY NOTE

On August 31, 2015, Danaher Corporation (“Danaher”) announced that it completed the acquisition of Pall Corporation

(“Pall”). Pursuant to the terms of the previously announced Agreement and Plan of Merger, dated as of May 12, 2015 (the “Merger Agreement”), by and among Danaher, Pentagon Merger Sub, Inc. (“Merger Sub”)

and Pall, Merger Sub merged with and into Pall, with Pall continuing as the surviving corporation (the “Merger”). As a result of the Merger, Pall became an indirect wholly owned subsidiary of Danaher.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

As disclosed above, on August 31, 2015, Danaher completed the acquisition of Pall. At the effective time of the Merger (the

“Effective Time”), each share of Pall common stock, par value $0.10 (“Pall Common Stock”), issued and outstanding immediately prior to such time, other than those shares of Pall Common Stock owned by Danaher, Merger Sub, Pall or

any of their respective subsidiaries, was automatically cancelled and converted into the right to receive $127.20 in cash, without interest (the “Merger Consideration”). No appraisal rights in connection with the Merger are available to

holders of Pall Common Stock in accordance with Section 910 of the New York Business Corporation Law. At the Effective Time, each Pall stock option, performance stock unit and management stock purchase plan award, whether vested or unvested,

and each Pall time-based restricted stock unit that was vested or became vested in accordance with its terms as of the Effective Time, in each case that was outstanding immediately prior to the Effective Time, was cancelled and converted into the

right to receive the Merger Consideration (in the case of the performance restricted stock units, the number of shares of common stock subject to such award was determined assuming that the greater of target and actual performance through

August 31, 2015 was met) or, in the case of stock options, the excess, if any, of the Merger Consideration over the applicable exercise price of such stock option. At the Effective Time, each time-based restricted stock unit that remained

unvested in accordance with its terms as of the Effective Time was assumed by Danaher on August 31, 2015 and converted, subject to the same terms and conditions as in effect immediately prior to the Effective Time, into a time-based restricted

stock unit relating to the number of shares of the common stock of Danaher determined by multiplying (A) the number of shares of Pall Common Stock previously subject to such restricted stock unit by (B) the quotient of (x) the Merger

Consideration divided by (y) the average of the closing prices of the shares of the common stock of Danaher for the ten trading days immediately preceding August 31, 2015. The aggregate amount paid by Danaher in respect of all Merger

Consideration and all other payments described above was approximately $13.8 billion.

The foregoing description does not purport to be

complete and is subject to, and qualified in its entirety by, the full text of the Merger Agreement, which was filed as Exhibit 2.1 to Danaher’s Current Report on Form 8-K filed with the SEC on May 13, 2015, and which is

incorporated herein by reference.

The Merger Agreement was filed to provide investors with information regarding its terms and is not

intended to provide any factual information about Danaher, Merger Sub, Pall or any of their respective subsidiaries or affiliates. Such information can be found in the public filings that Danaher or Pall, as applicable, files with the SEC. The

representations, warranties and covenants contained in the Merger Agreement were made solely for the purposes of the Merger Agreement and are as of specific dates and solely for the benefit of the parties to the Merger Agreement and:

| |

• |

|

are not intended as statements of fact, but rather as a way of allocating the risk among the parties in the event the statements therein prove to be inaccurate; |

| |

• |

|

have been modified or qualified by certain confidential disclosures that were made among the parties in connection with the negotiation of the Merger Agreement, which disclosures are not reflected in the Merger

Agreement itself; |

| |

• |

|

may no longer be true as of a given date; |

| |

• |

|

may be subject to a contractual standard of materiality in a way that is different from that generally applicable to investors or other stockholders and reports and documents filed with the SEC; and |

| |

• |

|

may be subject in some cases to other exceptions and qualifications (including exceptions that do not result in, and would not reasonably be expected to have, a material adverse effect on the applicable party).

|

2

Accordingly, investors should not rely on the representations, warranties or covenants or any

descriptions thereof as characterizations of the actual state of facts or condition of Danaher, Merger Sub, Pall or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and

warranties may change, or may have changed, after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in Danaher’s or Pall’s public disclosures. Accordingly, the representations and warranties

and other provisions of the Merger Agreement or any description of such provisions should not be read alone, but instead should be read together with the information that each company publicly files in reports and statements with the SEC.

ITEM 3.01 NOTICE OF DELISTING OR FAILURE TO SATISFY A CONTINUED LISTING RULE OR STANDARD; TRANSFER OF LISTING.

The disclosure set forth under Item 2.01 above is incorporated by reference into this Item 3.01.

In connection with the Merger, Pall notified the New York Stock Exchange (the “NYSE”) on August 31, 2015 that, at the Effective

Time, each share of Pall Common Stock issued and outstanding immediately prior to such time, other than shares of Pall Common Stock owned by Danaher, Merger Sub, Pall or any of their respective subsidiaries, was automatically cancelled and converted

into the right to receive $127.20 in cash, without interest. On August 31, 2015, Pall requested the NYSE to promptly file with the SEC a Notification of Removal from Listing and/or Registration under Section 12(b) of the Securities

Exchange Act of 1934 (as amended, the “Exchange Act”) on Form 25 to delist the shares of Pall Common Stock. Upon effectiveness of such Form 25, Pall will file with the SEC a certification on Form 15 under the Exchange Act requesting that

the shares of Pall Common Stock be deregistered and that Pall’s reporting obligations under Sections 13 and 15(d) of the Exchange Act be suspended.

ITEM 8.01 OTHER EVENTS.

On August 31,

2015, Danaher issued a press release announcing the completion of the Merger. A copy of the press release announcing the completion of the merger is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

| (a) |

Financial statements of businesses acquired. |

Danaher will file by amendment to this Current

Report on Form 8-K the financial statements required by Item 9.01(a) of Form 8-K not later than 71 calendar days after the date this Current Report on Form 8-K was required to be filed.

| (b) |

Pro forma financial information. |

Danaher will file by amendment to this Current Report on

Form 8-K the pro forma financial information required by Item 9.01(b) of Form 8-K not later than 71 calendar days after the date this Current Report on Form 8-K was required to be filed.

The following exhibits are filed herewith:

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 2.1 |

|

Agreement and Plan of Merger, dated as of May 12, 2015, by and among Danaher Corporation, Pentagon Merger Sub, Inc. and Pall Corporation (incorporated by reference to Exhibit 2.1 to Danaher’s Current Report on Form 8-K filed with the SEC on May 13, 2015) |

|

|

| 99.1 |

|

Press Release of Danaher Corporation announcing completion of the Merger, dated August 31, 2015 |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

| DANAHER CORPORATION |

|

|

| By: |

|

/s/ Daniel L. Comas |

|

|

Name: |

|

Daniel L. Comas |

|

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

|

| Dated: August 31, 2015 |

4

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 2.1 |

|

Agreement and Plan of Merger, dated as of May 12, 2015, by and among Danaher Corporation, Pentagon Merger Sub, Inc. and Pall Corporation (incorporated by reference to Exhibit 2.1 to Danaher’s Current Report on Form 8-K filed with the SEC on May 13, 2015) |

|

|

| 99.1 |

|

Press Release of Danaher Corporation announcing completion of the Merger, dated August 31, 2015 |

5

Exhibit 99.1

DANAHER COMPLETES ACQUISITION OF PALL CORPORATION

Washington, D.C., August 31, 2015 - Danaher Corporation (“Danaher,” NYSE:DHR) announced today the completion of its acquisition of Pall

Corporation (“Pall,” NYSE: PLL).

On August 31, 2015, Danaher completed the merger of Pentagon Merger Sub, Inc., a New York corporation and

an indirect wholly owned subsidiary of Danaher, into Pall and, as a result, Pall has become an indirect wholly owned subsidiary of Danaher. In the merger, each outstanding share of Pall common stock was cancelled and (except for shares held by

Danaher, Pentagon, Pall and their respective subsidiaries) converted into the right to receive $127.20 per share in cash, without interest.

Pall’s

common stock will cease to be traded on the New York Stock Exchange. Detailed instructions will be sent to former Pall shareholders outlining the steps to be taken to obtain the merger consideration of $127.20 per share in cash, without interest.

ABOUT DANAHER

Danaher is a global science and

technology innovator committed to helping its customers solve complex challenges and improving quality of life around the world. Its family of world-class brands has leadership positions in some of the most demanding and attractive industries,

including health care, environmental and industrial. The Company’s globally diverse team of 71,000 associates is united by a common culture and operating system, the Danaher Business System. In 2014, Danaher generated $19.9 billion in revenue

and its market capitalization exceeded $60 billion. For more information please visit: www.danaher.com.

CONTACT

Matthew E. Gugino

Vice President, Investor Relations

Danaher Corporation

2200 Pennsylvania Avenue, N.W., Suite 800W

Washington, D.C. 20037

Telephone: (202) 828-0850

Fax: (202) 828-0860

FOR THOSE PALL SHAREHOLDERS WHO

NEED INFORMATION ABOUT RECEIVING THEIR MERGER CONSIDERATION, CONTACT

Computershare, Inc.

Toll Free: (800) 568-3476

Outside the U.S.: +1-312-588-4991

MEDIA CONTACT

Delia Cannan

Sard Verbinnen & Co

Telephone: (212) 687-8080

Email: danaher-svc@sardverb.com

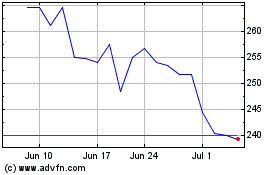

Danaher (NYSE:DHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

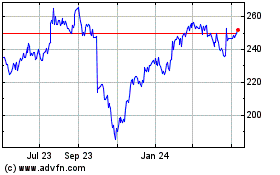

Danaher (NYSE:DHR)

Historical Stock Chart

From Apr 2023 to Apr 2024