Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

May 20 2015 - 4:04PM

Edgar (US Regulatory)

Filed by: Danaher Corporation

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Danaher Corporation

Commission File No.: 1-08089

The

following communication was sent to Danaher employees on May 20, 2015.

Anyone holding Danaher common stock (including shares held in a personal

brokerage account, in the Danaher Savings Plan or in the Danaher Retirement and Savings Plan) has received or will receive materials relating to participating in an exchange offer related to the merger of Danaher’s Communications business

(including Tektronix Communications, Arbor Networks, and Fluke Networks) with NetScout Systems, Inc. (NASDAQ: NTCT). The exchange offer is designed to permit Danaher stockholders to exchange all or a portion of their shares of Danaher common

stock for common units of Potomac Holding LLC (which will convert into shares of NetScout common stock) at a discount of 7 percent to the per-share value of NetScout common stock, subject to an upper limit of 2.2522 Potomac Holding LLC common units

for each share of Danaher common stock tendered in the exchange offer. For additional information regarding the exchange offer, please refer to the paragraph below titled “Additional Information and Where to Find It.” Please note

that this exchange offer is not related in any way to the anticipated separation transaction that Danaher announced on May 13, 2015.

Additional

Information and Where to Find It

This communication does not constitute an offer to buy, or a solicitation of an offer to sell, any securities of

NetScout, Danaher’s Communications Business or Danaher. In connection with the Transaction, Potomac Holding LLC has filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 and Form S-1 in

connection with its separation from Danaher, and NetScout has filed with the SEC a registration statement on Form S-4, each of which includes a prospectus. NetScout has also filed a definitive proxy statement which has been sent to the NetScout

stockholders in connection with their vote required in connection with the Transaction. Investors and security holders are urged to read the registration statements, the prospectus, the proxy statement and any other relevant documents, because they

contain important information about NetScout, the Communications Business of Danaher and the Transaction. The registration statements, the prospectus, the proxy statement and other relevant documents relating to the Transaction can be obtained free

of charge from the SEC’s website at www.sec.gov. These documents can also be obtained free of charge from Danaher upon written request to Danaher Corporation, Investor Relations, 2200 Pennsylvania Ave, NW Suite 800W, Washington, DC

20037, or by calling (202) 828- 0850 or upon written request to NetScout Systems, Inc., Investor Relations, 310 Littleton Road Westford, MA 01886 or by calling 978-614-4279.

Tender Offer Documents

On May 14, 2015, Danaher

filed with the SEC a tender offer statement on Schedule TO regarding the exchange offer for the split-off of the Communications Business as part of the

proposed Transaction. Investors and security holders are urged to read the tender offer statement because it contains important information about the Transaction. Investors and security holders

may obtain a free copy of the tender offer statement and other documents filed by Danaher with the SEC on the SEC’s web site at www.sec.gov. The tender offer statement and other documents may also be obtained free of charge from Danaher

by directing a request to Danaher Corporation, Investor Relations, 2200 Pennsylvania Ave, NW Suite 800W, Washington, DC 20037 or by calling (202) 828-0850.

Participants in the Solicitation

NetScout, Danaher, and

certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from NetScout stockholders in respect of the Transaction under the rules of the

SEC. Information regarding NetScout’s directors and executive officers is available in its Annual Report on Form 10-K filed with the SEC on May 20, 2014, and in its definitive proxy statement filed with the SEC on May 8, 2015, in

connection with the Transaction. Information regarding Danaher’s directors and executive officers is available in its Annual Report on Form 10-K filed with the SEC on February 25, 2015, and in its definitive proxy statement filed with the

SEC on March 27, 2015, in connection with its 2015 annual meeting of stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or

otherwise, has been included in the registration statements, the prospectus, the proxy statement and other relevant materials filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

2

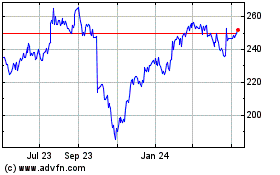

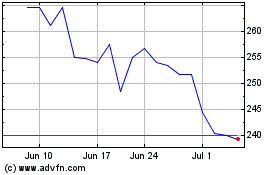

Danaher (NYSE:DHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Danaher (NYSE:DHR)

Historical Stock Chart

From Apr 2023 to Apr 2024