Syngenta Deal Faces Possible Delay -- WSJ

October 25 2016 - 3:03AM

Dow Jones News

By Brian Blackstone and Natalia Drozdiak

Syngenta AG and China National Chemical Corp. didn't submit

proposed remedies to resolve potential antitrust concerns related

to their planned merger by last Friday's deadline, an EU official

said Monday, raising concerns about how quickly the deal would gain

regulatory approval.

Shares in Syngenta were off 5.8% at 397.50 Swiss francs

($400.06) late Monday.

European regulators have set an initial deadline for the merger

probe for Oct. 28 to decide whether to clear the deal

unconditionally, or open an in-depth investigation, which would

last several more months and likely lead the EU to demand

concessions from the parties.

Swiss seed and pesticide maker Syngenta said Monday that

"constructive" discussions with EU regulators over its proposed

purchase by Chinese state-owned ChemChina are continuing and that

an update would be issued by Syngenta on Tuesday, along with a

third-quarter trading statement.

Syngenta has previously said the deal should close by the end of

this year. Analysts at Baader Helvea Equity Research said the

latest developments shouldn't derail the deal, though it could be

delayed.

"Political intervention actions were always expected by us and

therefore we have always stated that the guided closing at the end

of 2016 seems ambitious to us," they said. "However, we do not

think that the deal is at risk" and should close in the first half

of next year, they said.

In February, Syngenta agreed to be acquired by ChemChina for $43

billion in cash. The deal faces regulatory reviews, particularly in

regions with large agriculture sectors that include the EU, U.S.

and Brazil.

The EU's review into the Syngenta-ChemChina deal comes as other

rivals in the industry also plan to merge.

EU antitrust regulators have opened an in-depth investigation

into the proposed merger of Dow Chemical Co. and DuPont Co., which

could require the companies to make bigger concessions to clear

their blockbuster deal. Meanwhile, Monsanto Co. recently agreed to

sell itself to Bayer AG.

While antitrust lawyers have said the deal between Syngenta and

ChemChina is fairly complementary and might be less problematic

than the other deals, other issues might arise in the EU's merger

review.

The EU is likely to examine whether other Chinese state-owned

companies active in the agrochemical sector would have to be

grouped in with ChemChina. If considered to be part of a wider

group of companies, that could then increase the possibility of

ChemChina's overlaps with Syngenta.

Write to Brian Blackstone at brian.blackstone@wsj.com and

Natalia Drozdiak at natalia.drozdiak@wsj.com

(END) Dow Jones Newswires

October 25, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

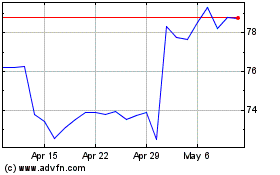

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024