By Ellie Ismailidou and Sara Sjolin, MarketWatch

Energy stocks slump, Valeant jumps after confirming plans for

reorganization

The Nasdaq Composite narrowly logged its second record close of

2016 on Tuesday, as losses in oil prices and weak productivity data

all but erased gains for the broad benchmarks.

The S&P 500 index ended up less than a point at 2,181.74,

after setting a record high of 2,187.69 earlier in the day. Gains

in health-care and consumer-staples stocks were offset by losses in

energy and materials sectors, weighed down by the drop in oil

prices.

The Dow Jones Industrial Average closed up 3.76 points, or less

than 0.1%, at 18,533, supported by gains for Walt Disney

Company(DIS) and Pfizer Inc. (PFE) but weighed down by a 0.7%

decline in E.I. DuPont de Nemours & Co.(DD). The blue-chip

gauge ended 0.3% below the all-time closing high of 18,595.03

established on July 20.

The Nasdaq Composite Index gained 12.34 points, or 0.2%, to

5,225.48--an all-time closing high.

Wall Street struggled to shrug off a weaker-than-expected report

on U.S. productivity, which has now declined in three straight

quarters, according to new data released Tuesday

(http://www.marketwatch.com/story/productivity-declines-for-third-straight-quarter-2016-08-09).

Second-quarter productivity unexpectedly fell 0.5%, well below

expectations.

But a thirst for yield-rich assets continued to support demand

for stocks, analysts said, despite falling corporate earnings and

unsteady economic fundamentals.

"Investors are chasing [yield] anywhere they can find it. As

long as companies keep paying dividends, they're fine. But some are

paying out more than they're earning," said Lamar Villere, a

portfolio manager at investment manager Villere & Co.

Another reason for the sluggish but sustained advance is that

many investors are "hiding out" in the U.S. equity market, piling

into sectors traditionally viewed as safety plays in times of

uncertainty, such as utilities and telecom--two sectors that are

leading the market year-to-date. Telecom is up 19.4% year to date,

while utilities boast a 16.7% gain in 2016.

At the same time, the market has been "quite boring for nearly a

month now, which we can easily blow off as being part of the summer

doldrums," said Frank Cappelleri, technical analyst at Instinet, in

emailed comments.

Cappelleri said investors should view the muted summer moves as

a positive indication that the market is settling into a new

trading range, after breaking out to all-time high levels.

"Low volatility is a classic trait of an uptrend. And uptrends

are boring whether they happen in August or a typically more

emotional period," Cappelleri said, pointing to the market's

seeming inaction in November 2014 as a "classic example" of a

"boring" market showing a positive uptrend.

Some investors were also holding on to lingering optimism

following the stellar jobs report released on Friday, which helped

propel the S&P 500 and the Nasdaq score record highs.

"This mood of optimism has seen a recovery in not only the

dollar, but also risk appetite, that has pulled equities and

commodities such as oil higher. But can these moves continue with a

stronger dollar?" said Richard Perry, analyst at Hantec Markets, in

a note.

Economic news: A flurry of data released on Tuesday painted a

mixed picture of the U.S. economy.

Wholesale inventories rose a revised 0.3% in June, up from the

initial estimate of no change, the Commerce Department said Tuesday

(http://www.marketwatch.com/story/us-wholesale-inventories-rise-revised-03-in-june-2016-08-09),

suggesting that inventories might not be as big a drag on

second-quarter growth as initially estimated.

The NFIB small-business index for July rose 0.1 point to 94.6

(http://www.marketwatch.com/story/small-business-sentiment-ekes-out-a-gain-nfib-says-2016-08-09),

continuing a winning streak that began after it touched a two-year

low.

There are no Federal Reserve speakers this week. The next big

event for the central bank will be Chairwoman Janet Yellen's

appearance at the Jackson Hole conference on Aug. 26.

See:

Movers and shakers: Shares of Resolute Energy Corp.(REN) rallied

16.9% after the oil and gas company late Monday said its loss

narrowed in the second quarter.

Valeant Pharmaceuticals International Inc.(VRX.T) jumped 25.4%

after the drugmaker confirmed its full-year guidance and said it

would reorganize following another weak quarter

(http://www.marketwatch.com/story/valeant-loss-widens-as-company-plans-overhaul-2016-08-09).

Luxury retailer Coach Inc.(COH) posted fiscal fourth-quarter

earnings that beat expectations

(http://www.marketwatch.com/story/coachs-stock-surges-after-profit-north-american-sales-beat-expectations-2016-08-09),

but shares slumped 2.2%.

Walt Disney Co.(DIS), Fossil Group Inc.(FOSL) and Yelp

Inc.(YELP) were slated to report earnings after the close.

Shares in Gap Inc.(GPS) lost 6.3% Tuesday after the clothing

retailer said revenue and same-stores sales slipped

(http://www.marketwatch.com/story/gap-shares-drop-after-sales-slip-same-store-sales-decline-2016-08-08)

in July.

Monster Worldwide Inc.(MWW) rallied 26.4% after Dutch staffing

provider Randstad Holding NV (RAND.AE) said it has agreed to buy

its rival for $3.40 a share in cash

(http://www.marketwatch.com/story/randstad-agrees-to-buy-monster-in-merger-worth-429-million-2016-08-09),

a 22.7% premium on Monday's closing price.

Other markets: Oil priced reversed and closed lower

(http://www.marketwatch.com/story/oil-prices-walk-back-from-sharp-rally-with-focus-on-us-data-2016-08-09)

after a sharp rally on Monday, falling 0.6%.

Metals lost ground across the board, while the dollar traded

mixed

(http://www.marketwatch.com/story/dollar-flattens-out-ahead-of-japan-holiday-2016-08-09)

against other major currencies. The pound slumped to $1.2976, after

data showed the U.K. trade deficit widened in June

(http://www.marketwatch.com/story/uk-trade-deficit-widened-before-brexit-vote-2016-08-09)

as imports hit a record high.

Stock markets in Europe shook off opening losses

(http://www.marketwatch.com/story/european-markets-gain-across-the-board-as-opec-meeting-cheers-oil-stocks-2016-08-09)

and ended higher, while Asian stocks ended mostly higher after

upbeat data from China

(http://www.marketwatch.com/story/asian-stocks-mostly-up-despite-weak-economic-news-from-china-2016-08-08).

(END) Dow Jones Newswires

August 09, 2016 16:28 ET (20:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

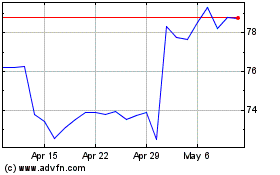

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024