Monsanto Rebuffs Bayer's Sweetened Merger Offer

July 19 2016 - 9:00AM

Dow Jones News

Monsanto Co. on Tuesday rejected Bayer AG's revised $65 billion

takeover proposal as "financially inadequate" and "insufficient to

ensure deal certainty."

The U.S. seed giant, however, said it remains open to discussing

a tie-up with the German life-sciences company "and other

parties."

Last week, Bayer boosted its offer for Monsanto in a bid to

overcome the company's resistance to the merger and join a parade

of consolidation in the agriculture industry.

Bayer made the new $125-a-share offer verbally on July 1 and

more formally eight days later, it said in a statement Thursday

confirming an earlier report by The Wall Street Journal. The new

bid represents a $3-a-share bump from an earlier proposal Monsanto

rejected as too low.

Bayer is pursuing what would be the latest in a succession of

multibillion-dollar merger agreements in the $100 billion global

market for agricultural seeds and pesticides, which has struggled

with a slide in crop prices. Dow Chemical Co. and DuPont Co. struck

a merger deal in December, and Switzerland's Syngenta AG-which

Monsanto unsuccessfully pursued last year-agreed in February to a

$43 billion takeover by China National Chemical Corp.

A deal would also reshape Bayer itself, making agriculture

roughly half its overall sales, which has rattled some investors

who view the company more as a health-care player than a producer

of crop seeds.

Shares of Monsanto fell 1.5% in premarket trading to

$104.80.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

July 19, 2016 08:45 ET (12:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

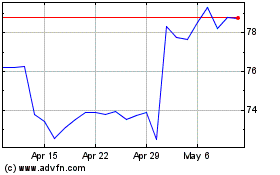

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024