UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 11-K

(Mark One)

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2015

|

|

|

|

|

|

|

|

OR

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number 1-815

DUPONT RETIREMENT SAVINGS PLAN

(Full title of plan)

E. I. DU PONT DE NEMOURS AND COMPANY

974 Centre Road

Wilmington, Delaware 19805

(Name of issuer of the securities held pursuant to the Plan

and the address of its principal executive office)

DUPONT RETIREMENT SAVINGS PLAN

TABLE OF CONTENTS

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL STATEMENTS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

______________________________________

*

All other schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To

the Administrator of

DuPont Retirement Savings Plan

In our opinion, the accompanying statements of net assets available for benefits and the related statement of changes in net assets available for benefits present fairly, in all material respects, the net assets available for benefits of DuPont Retirement Savings Plan

(the “Plan”) at

December 31, 2015

and

December 31, 2014

, and the changes in net assets available for benefits for the year ended

December 31, 2015

in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

The supplemental Schedule of Assets (Held at End of Year) as of December 31, 2015 and Schedule of Delinquent Participant Contributions for the year ended

December 31, 2015

have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedules are the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedules reconcile to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedules. In forming our opinion on the supplemental schedules, we evaluated whether the supplemental schedules, including their form and content, are presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974.

In our opinion, the Schedule of Assets (Held at End of Year) and Schedule of Delinquent Participant Contributions are fairly stated, in all material respects, in relation to the financial statements as a whole.

As discussed in Note 3, the Solae Savings Investment Plan, MECS, Inc. 401(k) Plan, DuPont 401(k) and Profit Sharing Plan, Belco Technologies Corporation Plan, and Pannar Seed, Inc. USA 401(k) Profit Sharing Plan merged into the Plan as of December 31, 2015. Our opinion has not been modified in respect to this matter.

/s/ PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

June 14, 2016

DUPONT RETIREMENT SAVINGS PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

AS OF

DECEMBER 31, 2015

AND

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

Assets:

|

|

|

|

|

|

|

Investments, at fair value:

|

|

|

|

|

|

|

Participant-directed brokerage account

|

$

|

147,208,227

|

|

|

$

|

658,335,995

|

|

|

Common stock

|

683,348,424

|

|

|

832,274,216

|

|

|

Total investments at fair value

|

830,556,651

|

|

|

1,490,610,211

|

|

|

|

|

|

|

|

Plan interest in DuPont and Related Companies Defined Contribution Plan Master Trust

|

9,391,949,418

|

|

|

9,924,099,123

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

|

Participants’ contributions

|

5,677,009

|

|

|

6,899,523

|

|

|

Employer’s contributions

|

8,166,948

|

|

|

11,712,570

|

|

|

Notes receivable from participants

|

91,873,205

|

|

|

111,141,484

|

|

|

Total receivables

|

105,717,162

|

|

|

129,753,577

|

|

|

|

|

|

|

|

Cash

|

210,544,286

|

|

|

10,071,988

|

|

|

|

|

|

|

|

Total assets

|

10,538,767,517

|

|

|

11,554,534,899

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

Accounts payable

|

76,838

|

|

|

61,900

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$

|

10,538,690,679

|

|

|

$

|

11,554,472,999

|

|

See Notes to the Financial Statements beginning on page 4.

DUPONT RETIREMENT SAVINGS PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

FOR THE YEAR ENDED DECEMBER 31, 2015

|

|

|

|

|

|

|

|

|

2015

|

|

Additions:

|

|

|

|

Investment income (loss):

|

|

|

|

Net investment gain from interest in DuPont and Related Companies Defined Contribution Plan Master Trust

|

$

|

119,431,036

|

|

|

Net depreciation in fair value of investments

|

(82,349,339

|

)

|

|

Dividend income

|

28,012,094

|

|

|

Net investment income

|

65,093,791

|

|

|

|

|

|

|

Contributions:

|

|

|

|

Employer’s contributions

|

220,376,872

|

|

|

Participants’ contributions

|

244,295,145

|

|

|

Rollovers

|

13,678,043

|

|

|

Total contributions

|

478,350,060

|

|

|

|

|

|

|

Interest from notes receivable from participants

|

4,024,139

|

|

|

|

|

|

Total additions

|

547,467,990

|

|

|

|

|

|

|

Deductions:

|

|

|

|

Benefits paid to participants

|

1,788,349,159

|

|

|

Distribution of dividends

|

932,824

|

|

|

Administrative expenses

|

3,129,718

|

|

|

Total deductions

|

1,792,411,701

|

|

|

|

|

|

|

Net decrease prior to Plan mergers

|

(1,244,943,711

|

)

|

|

|

|

|

Plan mergers

|

229,161,391

|

|

|

|

|

|

Net decrease

|

(1,015,782,320

|

)

|

|

|

|

|

|

Net assets available for benefits:

|

|

|

|

Beginning of year

|

11,554,472,999

|

|

|

End of year

|

$

|

10,538,690,679

|

|

See Notes to the Financial Statements beginning on page 4.

DUPONT RETIREMENT SAVINGS PLAN

NOTES TO THE FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2015 AND 2014, AND FOR THE YEAR ENDED DECEMBER 31, 2015

NOTE 1 — DESCRIPTION OF THE PLAN

The following description of the DuPont Retirement Savings Plan (the “Plan”) is provided for general purposes only. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended, and the Internal Revenue Code (“IRC”) established by the Board of Directors of E. I. du Pont de Nemours and Company (“DuPont” or the “Company”). The Plan is a tax-qualified, contributory profit sharing plan.

On July 1, 2015, DuPont completed the separation of its Performance Chemicals segment through the spin-off of all of the issued and outstanding stock of The Chemours Company ("Chemours"). As a result of the separation, participants received one share of common stock of Chemours for every five shares of DuPont common stock they held in the Plan on June 30, 2015. Chemours stock is closed to new investments and will be removed from the investment options on June 30, 2016.

Plan Mergers

Effective December 31, 2015, the Solae Savings Investment Plan (the "Solae Plan"), MECS, Inc. 401(k) Plan (the "MECS Plan"), the DuPont 401(k) and Profit Sharing Plan (the "401(k) Plan"), Belco Technologies Corporation ("Belco"), and the Pannar Seed, Inc. USA 401(k) Profit Sharing Plan (the "Pannar Plan") were merged into the Plan. See Note 3 for further information.

Administration

The Plan Administrator is the Benefit Plan Administrative Committee, whose members are appointed by the Company. The Savings Plan Investment Committee, whose members are also appointed by the Company, has responsibility for selecting and overseeing the Plan investments and determining the Plan's valuation policies utilizing information provided by the investment advisers, custodians and insurance companies. The Company holds authority to appoint trustees and has designated Bank of America, N.A. (“Bank of America”) and Northern Trust Corporation (“Northern Trust”) as trustees for the Plan. Bank of America is the trustee for the balances in common stocks and mutual funds including the participant-directed brokerage account and also provides recordkeeping and participant services. The Plan entered into a Master Trust Agreement with Northern Trust to establish the DuPont and Related Companies Defined Contribution Plan Master Trust (the "Master Trust"). See Note 4 for further information.

Participation

All employees of the Company or the Company’s subsidiaries and general partnerships that have adopted the Plan are eligible to participate in this Plan, except represented employees in a bargaining unit that has not accepted the terms of this Plan and individuals who are classified by the Company as leased employees and independent contractors. Individuals who are receiving severance pay, retainer, or other fees under contract are not eligible to elect or receive contributions in the Plan with respect to such compensation.

In 2014 the Plan was amended, and effective January 1, 2015, no temporary employees are eligible for participation in the Plan. Temporary employees are defined as individuals hired to complete a special project of limited duration or to fill the vacancy of an employee who is on a leave of absence.

Contributions

Eligible employees may participate in the Plan by authorizing the Company to make payroll deductions. Participants may elect to make before-tax or after-tax contributions of

1%

to

90%

of eligible compensation, as defined. Effective January 1, 2014, eligible employees may elect a Roth 401(k) contribution to the Plan. Participants who have attained age

50

before the end of the Plan year are eligible to make catch-up contributions.

Participants are automatically enrolled in the Plan at a

6%

before-tax savings rate and increased

1%

annually, up to a maximum of

15%

of pay, if no action is taken by the employee within

60

days from the date of hire.

Under automatic enrollment the participant assets are invested in accordance with a managed account feature offered by Bank of America. The participant may elect not to participate in the plan at any time. All of the above participant’s savings and elections are subject to regulatory and Plan limitations.

The Company makes a matching contribution equal to

100%

of a participant’s contribution, up to

6%

of eligible compensation. In addition, the Company makes a contribution (“Retirement Savings Contribution”) to each eligible employee account, currently equal to

3%

of eligible pay, regardless of the employee’s contribution election. Contributions to the Plan are subject to certain limits imposed by the Internal Revenue Service ("IRS") and the Plan terms.

Participant Accounts

The Plan’s record-keeper maintains an account in the name of each participant to which each participant’s contributions, Company’s matching contributions, Retirement Savings Contributions and allocations of Plan net earnings and losses, if any, are recorded. Allocations are based on participant earnings or account balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Investments

Participants direct the investment of the contributions into various investment options offered by the Plan. The Plan currently offers DuPont common stock, Chemours common stock, and the self-directed brokerage account where participants can choose from

2,100

funds from

110

mutual fund families. In addition, the Plan currently offers through the Master Trust,

5

passively managed index funds,

6

actively managed custom-designed funds,

10

target retirement funds, and a stable value fund. The Plan also contains an Employee Stock Ownership Plan (“ESOP”) where participants can elect to have dividends from the DuPont common stock paid out to them in cash instead of being reinvested in their Plan account. For the year ended

December 31, 2015

,

$932,824

in dividends were paid to participants in cash.

Vesting

Participant contributions and the Company’s matching contributions are fully and immediately vested. Retirement Savings Contributions are fully vested after any of the following circumstances:

|

|

|

|

•

|

The participant has completed at least

three

years of service with the Company;

|

|

|

|

|

•

|

The participant reaches age

65

while working for the Company;

|

|

|

|

|

•

|

The participant terminates employment with the Company due to becoming totally disabled while working for the Company;

|

|

|

|

|

•

|

The participant’s job with the Company is eliminated;

|

|

|

|

|

•

|

The participant’s spouse is transferred by the Company to an employment location outside the immediate geographic area while the participant is working for the Company, and the participant terminates employment with the Company;

|

|

|

|

|

•

|

The participant dies while actively employed by the Company.

|

Participants who became eligible to participate in the Plan as a result of the Solae Plan, MECS Plan, 401(k) Plan, Belco and Pannar Plan mergers, discussed in Note 3, received credit under the Plan for all service credited under the plans as of December 31, 2015.

Participant balances related to certain prior plan company contributions or prior plan benefits transferred from the Danisco US 401(k) Plan and profit sharing contributions transferred from the DuPont 401(k) and Profit Sharing Plan that were not vested at the time the balances were merged into the Plan will continue to vest according to the previous plans' vesting schedules.

Notes Receivable from Participants

Participants may borrow up to one-half of their non-forfeitable account balances, excluding the Retirement Savings Contribution account, subject to a

$1,000

minimum and up to a maximum equal to the lesser of $50,000 (less the participants highest outstanding loan balance during the previous 12 months) or 50% of their account balance. The loans are executed by promissory notes and have a minimum term of

1

year and a maximum term of

5

years, except for qualified residential loans, which have a maximum term of

10

years. Loans transferred into the Plan on December 31, 2012 from the Danisco US 401(k) Plan could have a maximum original term of 15 years. The rate of interest on loans are commensurate with the prevailing interest rate charged on similar loans made within the same locale and time period and remain fixed for the life of the loan. The loans are repaid over the term in installments of principal and interest by deduction from pay or through ACH account debit. A participant also has the right to repay the loan in full, at any time, without penalty. At

December 31, 2015

, loan interest rates ranged from

3.25%

to

9.75%

.

Payment of Benefits

Participants may request a full distribution of their accounts when they terminate employment with the Company and all affiliates. However, the Retirement Savings Contributions will be paid only to the extent that they are vested in the employee’s account. On separation from service, a participant also may elect to receive the value of their account balance in installment payments. Required minimum distributions will begin in April of the calendar year following the later of the year in which the participant attains age 70

½

or the year following retirement or termination of employment.

Forfeited Accounts

At

December 31, 2015

and

2014

, forfeited nonvested accounts totaled

$42

and

$708,191

, respectively. Forfeitures can be used, as defined by the Plan, to pay administrative expenses, reinstate participant accounts and to reduce the amount of future employer contributions. A participant’s account may be reinstated if the participant becomes a covered employee by the Plan prior to incurring five consecutive one-year breaks in service. The participant account will be reinstated as soon as practical after the date the participant becomes a covered employee. During the year ended

December 31, 2015

,

$2,638,508

of forfeited accounts were used to reduce employer contributions, of which

$714,000

were used to reduce the employer contribution receivable at December 31, 2014. In addition, forfeited accounts were used to reinstate participant’s accounts and pay for administrative expenses in the amounts of

$11,731

and

$255,768

, respectively.

Administrative Expenses

Administrative expenses, including but not limited to, recordkeeping expenses, trustee fees and transactional costs may be paid by the Plan, at the election of the Plan Administrator. Expenses paid by the Plan for the year ended

December 31, 2015

were

$3,129,718

, net of fee reimbursements and excludes expenses paid by the Master Trust. Brokerage fees, transfer taxes, investment fees and other expenses incidental to the purchase and sale of securities and investments shall be included in the cost of such securities or investments, or deducted from the sales proceeds.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The accompanying financial statements of the Plan have been prepared on the accrual basis of accounting in accordance with generally accepted accounting principles in the United States of America (“GAAP”).

Recent Accounting Pronouncements

In July 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standard Update ("ASU") No. 2015-12, "

Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965), Part I Fully Benefit-Responsive Investment Contracts, Part II Plan Investment Disclosures and Part III Measurement Date Practical Expedient

". This ASU provides guidance regarding the measurement and disclosure of fully benefit-responsive investment contracts. The guidance also eliminates certain disclosures including individual investments that represent 5 percent or more of net assets available for benefits and the net appreciation or depreciation by general type of investments. The guidance requires that employee benefit plan investments be grouped only by general type. The guidance generally eliminates disclosure of specific investment strategies, if an investment is measured using the net asset value per share, or its equivalent practical expedient. Part III of this guidance regarding measurement dates for investments and investment-related accounts is not applicable to the company. Part I and II of this guidance is effective for fiscal years beginning after December 15, 2015 and applies retrospectively for all financial statements presented. Early adoption is permissible. Plan management adopted Part I and II of this guidance effective January 1, 2015 on a retrospective basis.

In May 2015, the FASB issued ASU No. 2015-07, "

Fair Value Measurement (Topic 820)- Disclosures for Investments in Certain Entities that Calculate Net Asset Value per Share or its Equivalent.

" This guidance removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient. The guidance also removes the requirement to make certain disclosures for all investments that are eligible to be measured at fair value using the net asset value per share practical expedient. Rather, those disclosures are limited to investments for which the entity has elected to measure the fair value using that practical expedient. The guidance is effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. A reporting entity should apply the amendments retrospectively to all periods presented and earlier application is permitted. Plan management has chosen not to early adopt this guidance. The guidance will only impact disclosure.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Risks and Uncertainties

The Plan utilizes various investment options, which include investments in the Master Trust, in any combination of equities, fixed income securities, individual guaranteed investment contracts ("GICs"), currency and commodities, futures, forwards, options and swaps. Investment securities, in general, are exposed to various risks, such as interest rate risk, credit risk, and overall market volatility. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such change could materially affect participants’ account balances and the amounts reported in the financial statements.

Investment Valuation and Income Recognition

The Plan's investments are stated at fair value, except for fully benefit-responsive investment contracts, which are reported at contract value. Fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Common stocks are valued at the year-end market price of the common stocks. The mutual funds include the participant-directed brokerage account investments which consist of shares of registered investment companies comprised of equity and fixed income funds and are valued at the net asset value of shares held by the Plan at year-end.

Net appreciation (depreciation) includes the Plan's gains and losses on investments bought and sold as well as held during the year.

Purchases and sales of investments are recorded on a trade-date basis. Realized gains and losses on the sale of common stocks are based on average cost of the securities sold. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. Capital gain distributions are included in dividend income.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent participant loans are recorded as distributions based on the terms of the Plan document.

Payment of Benefits

Benefit payments to participants are recorded upon distribution. Amounts allocated to accounts of persons who have elected to withdraw from the Plan, but have not yet been paid, were

$7,361,499

and

$5,014,060

at

December 31, 2015

and

2014

, respectively.

NOTE 3 — PLAN MERGERS

Effective December 31, 2015, the Solae Plan was merged into the Plan. Notes receivable from participants totaling

$4,538,021

and cash proceeds of

$156,223,475

from the liquidation of investments at fair value on December 31, 2015 were transferred into the Plan. The investments liquidated at fair value were primarily mutual funds. The transfer also included

$1,943,395

of DuPont common stock (

41,449

shares) and

$101,587

of Chemours common stock (

8,326

shares) transferred at original cost, with fair market values at December 31, 2015 of

$2,760,142

and

$44,627

, respectively.

Effective December 31, 2015, the MECS Plan was merged into the Plan. Notes receivable from participants totaling

$326,852

cash proceeds of

$32,819,430

from the liquidation of investments at fair value on December 31, 2015 were transferred into the Plan. The investments liquidated at fair value were primarily mutual funds.

Effective December 31, 2015, the 401(k) Plan was merged into the Plan. The transfer into the Plan included in-kind transfers of

$18,816,803

, notes receivable from participants totaling

$517,315

and employer's contributions receivable of

$302,888

. The transfer also included

$576,745

of DuPont common stock (

12,007

shares) and

$27,020

of Chemours common stock (

2,166

shares) transferred at original cost with fair market values at December 31, 2015 of

$799,662

and

$11,610

, respectively.

Effective December 31, 2015, Belco was merged into the Plan. The transfer into the Plan included cash proceeds of

$11,931,572

from the liquidation of investments at fair value on December 31, 2015 and notes receivable from participants totaling

$69,509

. The investments liquidated at fair value were primarily mutual funds.

Effective December 31, 2015, the Pannar Plan was merged into the Plan. The transfer into the Plan included cash proceeds of

$942,594

from the liquidation of investments at fair value on December 31, 2015, notes receivable from participants totaling

$23,900

, and a dividend of

$201

. The investments liquidated at fair value were primarily mutual funds.

The investments liquidated at fair value are held as uninvested cash on the Statement of Net Assets as of December 31, 2015 and subsequently mapped to the Plan investments in January 2016.

NOTE 4 — INTEREST IN MASTER TRUST

The objective of the Master Trust is to allow participants from affiliated plans to invest in several custom designed investment choices through separately managed accounts. The Master Trust contains several actively managed investments pools and commingled index funds offered to participants as “core investment options” and “age-targeted options”. The investment pools are administered by different investment managers through separately managed accounts at Northern Trust. The Master Trust also includes the Master Trust Stable Value Fund (the "Stable Value Fund"). DuPont Capital Management Corporation ("DCMC"), a registered investment adviser and wholly-owned subsidiary of DuPont, has the oversight responsibility for the investments' managers and evaluates the funds' performances under the Master Trust, except for the Stable Value Fund, which is actively managed by DCMC.

At

December 31, 2015

, the Master Trust includes the assets of the DuPont Retirement Savings Plan. At December 31, 2014, the Master Trust included the assets of DuPont Retirement Savings Plan, DuPont 401(k) and Profit Sharing plan and Thrift and Savings Plan for Employees of Sentinel Transportation, LLC.

On July 1, 2015, DuPont completed the separation of its Performance Chemicals segment through the spin-off of all of the issued and outstanding stock of Chemours. As a result of the separation, participants received one share of common stock of Chemours for every five shares of DuPont common stock they held in the Plan on June 30, 2015. Chemours stock is closed to new investments and will be removed from the investment options on June 30, 2016. As a result of the Chemours separation, Sentinel exited the Master Trust on June 30, 2015.

Effective December 31, 2015, the 401(k) Plan was merged into the Plan. As a result of the Plan merger, the 401(k) Plan exited the Master Trust on December 31, 2015.

To participate in the Master Trust, affiliates who sponsor qualified savings plans and who have adopted the Master Trust Agreement are required to make payments to Northern Trust of designated portions of employees’ savings and other contributions by the affiliate. Investment income relating to the Master Trust is allocated based on the individual Plan’s specific interest within the Master Trust. The Plan’s interest in the Master Trust was

100.00%

and

99.32%

as of

December 31, 2015

and

2014

, respectively.

Master Trust Investments

The investments of the Master Trust are reported at fair value, except fully benefit-responsive investment contracts, which are reported at contract value. Purchases and sales of the investments within the Master Trust are reflected on a trade-date basis. Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis.

Cash and short-term investments include cash and short-term interest-bearing investments with initial maturities of three months or less. Such amounts are recorded at cost, plus accrued interest, which approximate fair value.

Mutual funds are valued at the net asset value of shares held by the Master Trust at year-end. Units held in common collective trusts (“CCTs”) are valued at the net asset value as reported by the CCTs’ trustee as a practical expedient to estimate fair value.

Common stock, preferred stock, options and futures traded in active markets on national and international securities exchanges are valued at closing prices on the last business day of each period presented.

Fixed income securities are valued using pricing models maximizing the use of observable inputs for similar securities. This includes basing value on yields currently available on comparable securities of issuers with similar credit ratings.

Forward foreign currency contracts are valued at fair value, as determined by Northern Trust (or independent third parties on behalf of the Master Trust), using quoted forward foreign currency exchange rates. At the end of each period presented, open contracts are valued at the current forward foreign currency exchange rates, and the change in market value is recorded as an unrealized gain or loss. When the contract is closed or delivery taken, the Master Trust records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

Swap contracts are valued at fair value, as determined by Northern Trust (or independent third parties on behalf of the Master Trust) utilizing pricing models and taking into consideration exchange quotations on underlying instruments, dealer quotations and other market information.

Investments denominated in currencies other than the United States dollar are converted using exchange rates prevailing at the end of the periods presented. Purchases and sales of such investments are translated at the rate of exchange on the respective dates of such transactions.

Investment related expenses are included in administrative expenses.

Description of the Master Trust’s Investment Contracts

The Master Trust holds three types of investment contracts that are fully benefit-responsive: traditional GICs, synthetic GICs and separate account GICs. These investment contracts are measured at contract value. Contract value is the relevant measurement attributable for the portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. Contract value represents contributions made under the contracts, plus earnings, less participant withdrawals and administrative expenses.

The Stable Value Fund invests in traditional GICs, synthetic GICs and separate account GICs. Traditional GICs are comprised of assets held in the issuing company’s general account and are backed by the full faith and credit of the issuer. For synthetic GICs, the Master Trust owns the underlying investments, whereas for the separate account GICs, the Master Trust receives title to the annuity contract, but not the direct title to the assets in the separate account. Synthetic and separate account GICs are backed by fixed income assets. The underlying investments held within the synthetic GICs are comprised of DCMC sponsored GEM Trusts and a PIMCO managed separate account fixed income portfolio and a DCMC managed Futures Overlay account. The GEM Trusts are commingled fixed income portfolios managed by DCMC and additional investment managers hired by DCMC that invest in high quality fixed income securities across the short, intermediate and core sectors. The underlying investments wrapped within the separate account contracts are managed by third party fixed income managers and include securities diversified across the broad fixed income market, such as, but not limited to, corporate bonds, mortgage related securities, government bonds, asset-backed securities, cash, cash equivalents, and certain non-leveraged derivatives. The DCMC managed Futures Overlay account is used to reduce the duration of the DCMC Stable Value Global Wrap Tier-5 contracts and consequently of the stable value funds that participate in the contracts. The overlay will be implemented either through a commingled account or separate accounts for each stable value fund. The duration reduction will be achieved through short futures positions. The overlay account will hold the short futures positions and cash or cash equivalents. The account will not always be active; it will only be active when DCMC decides to provide protection to its funds against rising rates through duration reduction.

For traditional GICs, the insurer maintains the assets in a general account. Regardless of the performance of the general account assets, a traditional GIC will provide a fixed rate of return as negotiated when the contract is purchased. Synthetic GICs, backed by underlying assets, are designed to provide principal protection and accrued interest over a specified period of time (i.e., period of time before the crediting rate reset) through benefit-responsive wrapper contracts issued by a third party assuming that the underlying assets meet the requirements of the GIC. Separate account GICs are investment contracts invested in insurance company separate accounts established for the sole benefit of Stable Value Fund participants. The synthetic and separate account GICS are wrapped by the financially responsible insurance company. The Master Trust participates in the underlying experience of the separate account via future periodic rate resets.

Traditional GICs expose the Plan through the Stable Value Fund to direct credit risk associated with each contract issuer. To mitigate this risk, effective June 2014, the investment guidelines were updated to prohibit DCMC from purchasing contracts from issuers with a credit rating lower than A1. In addition, on an ongoing basis, the weighted average credit rating of all contracts must be A1 or higher at all times. Further, on an ongoing basis, at purchase, no single traditional GIC issuer may represent more than 10% of the total Stable Value Fund and no more than 30% of the Stable Value Fund may be invested in Traditional GICs at any time. Additionally, DCMC continually monitors the issuers of these investments through external credit rating agencies. DCMC monitors credit rating history, downgrade/upgrade notifications, and analyst reports for all current and potential issuers. There are no reserves against contract value for credit risk of the contract issuer or otherwise.

The crediting rates for synthetic and separate account GICs are reset periodically throughout the year and are based on the performance of the portfolio of assets underlying these contracts. Inputs used to determine the crediting rate include each contract’s portfolio market value of fixed income assets, current yield-to-maturity, duration (similar to weighted average life) and market value relative to contract value. All contracts have a guaranteed rate of at least

0%

or higher with respect to determining interest rate resets. The crediting interest rates on all investment contracts ranged from

0.18%

to

3.20%

for the year ended

December 31, 2015

and from

0.01%

to

3.73%

for the year ended

December 31, 2014

.

Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value for plan permitted benefit payments. Certain events may limit the ability of the Plan to transact at contract value with the issuer. Such events include the following: (i) amendments to the Plan documents (including complete or partial Plan termination or merger with another plan); (ii) changes to the Plan’s prohibition on competing investment options or deletion of equity wash provisions; (iii) bankruptcy of the Plan sponsor or other Plan sponsor events (i.e. divestitures or spin-offs of a subsidiary) which cause a significant withdrawal from the Plan or (iv) the failure of the Master Trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under ERISA. The Plan Administrator does not believe that the occurrence of any such value event, which would limit the Plan’s ability to transact at contract value, is probable.

Based on certain events specified in fully benefit-responsive investment contracts, both the Plan/Master Trust and issuers of such investment contracts are permitted to terminate the investment contracts. If applicable, such terminations can occur prior to the scheduled maturity date.

Examples of termination events that permit issuers to terminate investment contracts include the following:

|

|

|

|

•

|

The Plan Sponsor’s receipt of a final determination notice from the Internal Revenue Service (“IRS”) that the Plan does not qualify under Section 401(a) of the IRC.

|

|

|

|

|

•

|

The Master Trust ceases to be exempt from federal income taxation under Section 501(a) of the IRC.

|

|

|

|

|

•

|

The Plan/Master Trust or its representative breaches material obligations under the investment contract such as a failure to satisfy its fee payment obligations.

|

|

|

|

|

•

|

The Plan/Master Trust or its representative makes a material misrepresentation.

|

|

|

|

|

•

|

The Plan/Master Trust makes a material amendment to the Plan/Master Trust and/or the amendment adversely impacts the issuer.

|

|

|

|

|

•

|

The Plan/Master Trust, without the issuer’s consent, attempts to assign its interest in the investment contract.

|

|

|

|

|

•

|

The balance of the contract value is zero or immaterial.

|

|

|

|

|

•

|

The termination event is not cured within a reasonable time period, i.e., 30 days.

|

For synthetic and separate account GICs, additional termination events include the following:

|

|

|

|

•

|

The investment manager of the underlying securities is replaced without the prior written consent by the issuer.

|

|

|

|

|

•

|

The underlying securities are managed in a way that does not comply with the investment guidelines.

|

At termination, the contract value is adjusted to reflect a discounted value based on surrender charges or other penalties for GICs.

If the issuer of a synthetic or separate account GIC chooses to terminate the contract, assuming no breach of contract by the contract holder, the issuer is contractually obligated to deliver to the contract holder either book value or market value, whichever is greater at the time of termination, less any unpaid fees or charges. If the contract holder chooses to terminate the contract, they can choose to receive a cash value payout equal to the market value of the assets, or, if the market value is less than the book value, they can choose to enter into a wind-down phase designed to immunize the difference between market and book values over a time period agreed upon by both parties. The contract holder can choose to replace the contract issuer with a new issuer at any time, provided that all involved parties agree to the terms of transition.

Financial Instruments with Off-Balance-Sheet Risk in the Master Trust

In accordance with the investment strategy of the managed accounts, the Master Trust’s investment managers execute transactions in various financial instruments that may give rise to varying degrees of off-balance-sheet market and credit risk. These instruments can be executed on an exchange or negotiated in the over-the-counter market. These financial instruments include futures, forward settlement contracts, swap and option contracts.

Swap contracts include interest rate swap contracts which involve an agreement to exchange periodic interest payment streams (typically fixed vs. variable) calculated on an agreed upon periodic interest rate multiplied by a predetermined notional principal amount.

The Master Trust invests in financial futures contracts solely for the purpose of hedging its existing portfolio securities, or securities that the Master Trust intends to purchase, against fluctuations in fair value caused by changes in prevailing market interest rates. Upon entering into a financial futures contract, the Master Trust is required to pledge to the broker an amount of cash, U.S. government securities, or other assets equal to a certain percentage of the contract amount (initial margin deposit). Subsequent payments, known as variation margin, are made or received by the Master Trust each day, depending on the daily fluctuations in the fair value of the underlying security. The Master Trust recognizes a gain or loss equal to the daily variation margin. If market conditions move unexpectedly, the Master Trust may not achieve the anticipated benefits of the financial futures contracts and may realize a loss. The use of futures transactions involves the risk of imperfect correlation in movements in the price of futures contracts, interest rates, and the underlying hedged assets.

Market risk arises from the potential for changes in value of financial instruments resulting from fluctuations in interest and foreign exchange rates and in prices of debt and equity securities. The gross notional (or contractual) amounts used to express the volume of these transactions do not necessarily represent the amounts potentially subject to market risk. In many cases, these financial instruments serve to reduce, rather than increase, the Master Trust’s exposure to losses from market or other risks. In addition, the measurement of market risk is meaningful only when all related and offsetting transactions are identified. The Master Trust’s investment managers generally limit the Master Trust’s market risk by holding or purchasing offsetting positions.

As a writer of option contracts, the Master Trust receives a premium to become obligated to buy or sell financial instruments for a period of time at the holder’s option. During this period, the Master Trust bears the risk of an unfavorable change in the market value of the financial instrument underlying the option, but has no credit risk, as the counterparty has no performance obligation to the Master Trust once it has paid its cash premium.

The Master Trust is subject to credit risk of counterparty nonperformance on derivative contracts in a gain position, except for written options, which obligate the Master Trust to perform and do not give rise to any counterparty credit risk.

The following presents the Master Trust’s net assets at

December 31, 2015

and

2014

:

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

Assets:

|

|

|

|

|

|

|

Investments, at fair value:

|

|

|

|

|

|

|

Common stocks

|

$

|

2,184,011,954

|

|

|

$

|

1,812,391,877

|

|

|

Preferred stocks

|

678,223

|

|

|

3,693,202

|

|

|

Fixed income securities

|

101,849,733

|

|

|

95,382,946

|

|

|

Mutual funds

|

120,488,415

|

|

|

95,006,769

|

|

|

CCTs

|

2,513,863,261

|

|

|

3,122,650,718

|

|

|

Total investments at fair value

|

4,920,891,586

|

|

|

5,129,125,512

|

|

|

|

|

|

|

|

Investments, at contract value:

|

|

|

|

|

Separate account GICs

|

2,632,401,521

|

|

|

2,998,640,458

|

|

|

Traditional GICs

|

272,169,978

|

|

|

303,640,061

|

|

|

Synthetic GICs

|

1,574,745,664

|

|

|

1,691,851,092

|

|

|

Total investments at contract value

|

4,479,317,163

|

|

|

4,994,131,611

|

|

|

|

|

|

|

|

Cash

|

583,743

|

|

|

228,059

|

|

|

Receivables for securities sold

|

4,503,918

|

|

|

5,158,300

|

|

|

Unrealized gain on foreign exchange contracts

|

418,560

|

|

|

870,828

|

|

|

Accrued income

|

6,260,350

|

|

|

3,641,262

|

|

|

Other assets

|

416,890

|

|

|

40,213

|

|

|

Total assets

|

9,412,392,210

|

|

|

10,133,195,785

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

Payables for securities purchased

|

12,240,618

|

|

|

134,876,176

|

|

|

Accrued expenses and other liabilities

|

7,181,707

|

|

|

5,440,999

|

|

|

Total liabilities

|

19,422,325

|

|

|

140,317,175

|

|

|

|

|

|

|

|

Master Trust net assets

|

$

|

9,392,969,885

|

|

|

$

|

9,992,878,610

|

|

The following presents the net investment gain for the Master Trust for the year ended

December 31, 2015

:

|

|

|

|

|

|

|

|

|

2015

|

|

Net depreciation in fair value of investments

|

$

|

(2,742,382

|

)

|

|

|

|

|

|

Investment income (expense):

|

|

|

|

Interest income

|

100,950,150

|

|

|

Dividend income

|

38,980,198

|

|

|

Administrative expenses

|

(16,284,360

|

)

|

|

Net investment gain

|

$

|

120,903,606

|

|

NOTE 5

—

FAIR VALUE MEASUREMENTS

Accounting Standards Codification 820,

Fair Value Measurements and Disclosures

, provides a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value, as follows: Level 1, which refers to securities valued using unadjusted quoted prices from active markets for identical assets; Level 2, which refers to securities not traded on an active market but for which observable market inputs are readily available; and Level 3, which refers to securities valued based on significant unobservable inputs. Assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement.

Fair value calculations may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The following table sets forth by level, within the fair value hierarchy, the Plan’s and the Master Trust’s assets and liabilities at fair value as of

December 31, 2015

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Fair Value as of December 31, 2015

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Plan’s investments, excluding interest in Master Trust:

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stocks

|

$

|

683,348,424

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

683,348,424

|

|

|

Participant-directed brokerage account

|

147,208,227

|

|

|

—

|

|

|

—

|

|

|

147,208,227

|

|

|

Total Plan’s investments, at fair value

|

$

|

830,556,651

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

830,556,651

|

|

|

|

|

|

|

|

|

|

|

|

Master Trust’s investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stocks

|

2,184,011,954

|

|

|

—

|

|

|

—

|

|

|

2,184,011,954

|

|

|

Preferred stocks

|

678,223

|

|

|

—

|

|

|

—

|

|

|

678,223

|

|

|

Fixed income securities

|

—

|

|

|

101,849,733

|

|

|

—

|

|

|

101,849,733

|

|

|

Mutual funds

|

120,488,415

|

|

|

—

|

|

|

—

|

|

|

120,488,415

|

|

|

CCTs

|

—

|

|

|

2,513,863,261

|

|

|

—

|

|

|

2,513,863,261

|

|

|

Total Master Trust investment assets

|

2,305,178,592

|

|

|

2,615,712,994

|

|

|

—

|

|

|

4,920,891,586

|

|

|

|

|

|

|

|

|

|

|

|

Other financial instruments

1

|

—

|

|

|

729,790

|

|

|

—

|

|

|

729,790

|

|

|

Total Master Trust assets, at fair value

|

$

|

2,305,178,592

|

|

|

$

|

2,616,442,784

|

|

|

$

|

—

|

|

|

$

|

4,921,621,376

|

|

______________________________________

1

Other financial instruments include forwards, futures, options and swaps.

The following table sets forth by level, within the fair value hierarchy, the Plan’s and the Master Trust’s assets and liabilities at fair value as of

December 31, 2014

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Fair Value as of December 31, 2014

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Plan’s investments, excluding interest in Master Trust:

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stocks

|

$

|

832,274,216

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

832,274,216

|

|

|

Participant-directed brokerage account

|

658,335,995

|

|

|

—

|

|

|

—

|

|

|

658,335,995

|

|

|

Total Plan’s investments, at fair value

|

$

|

1,490,610,211

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

1,490,610,211

|

|

|

|

|

|

|

|

|

|

|

|

Master Trust’s investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stocks

|

1,812,391,877

|

|

|

—

|

|

|

—

|

|

|

1,812,391,877

|

|

|

Preferred stocks

|

3,693,202

|

|

|

—

|

|

|

—

|

|

|

3,693,202

|

|

|

Fixed income securities

|

—

|

|

|

95,382,946

|

|

|

—

|

|

|

95,382,946

|

|

|

Mutual funds

|

95,006,769

|

|

|

—

|

|

|

—

|

|

|

95,006,769

|

|

|

CCTs

|

—

|

|

|

3,122,650,718

|

|

|

—

|

|

|

3,122,650,718

|

|

|

Total Master Trust investment assets

|

1,911,091,848

|

|

|

3,218,033,664

|

|

|

—

|

|

|

5,129,125,512

|

|

|

|

|

|

|

|

|

|

|

|

Other financial instruments

1

|

—

|

|

|

885,910

|

|

|

—

|

|

|

885,910

|

|

|

Total Master Trust assets, at fair value

|

$

|

1,911,091,848

|

|

|

$

|

3,218,919,574

|

|

|

$

|

—

|

|

|

$

|

5,130,011,422

|

|

______________________________________

1

Other financial instruments include forwards, futures, and options.

For the years ended

December 31, 2015

and

2014

, there were no significant transfers in or out of Levels 1, 2 or 3.

The following summarizes CCTs measured at fair value based on net asset value per share as of December 31, 2015 and 2014, respectively. Redemption for common collective trusts is permitted daily and there are no unfunded commitments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value

|

Redemption Notice Period

|

|

|

December 31, 2015

|

|

December 31, 2014

|

|

|

Northern Trust Collective Treasury Inflation-Protected Securities (TIPS) Index Fund - Non-Lending

|

$

|

30,705,315

|

|

|

$

|

26,066,625

|

|

By 9:30AM CST on valuation date

|

|

Northern Trust Collective Aggregate Bond Index Fund - Non-Lending

|

274,626,708

|

|

|

295,590,952

|

|

By 9:30AM CST on valuation date

|

|

Northern Trust Collective EAFE

®

Index Fund - Non-Lending

|

341,602,775

|

|

|

304,466,029

|

|

By 9:30AM CST one business day prior to valuation date

|

|

Northern Trust Collective Global Real Estate Index Fund - Non-Lending

|

12,684,236

|

|

|

—

|

|

By 9:30AM CST one business day prior to valuation date

|

|

Northern Trust Collective Russell 2000 Index Fund - Non-Lending

|

269,010,106

|

|

|

291,440,725

|

|

By 9:30AM CST on valuation date

|

|

Northern Trust Collective S&P 400

®

Index Fund - Non-Lending

|

379,438,573

|

|

|

389,067,696

|

|

By 9:30AM CST on valuation date

|

|

Northern Trust Collective S&P 500

®

Index Fund - Non-Lending

|

1,003,572,946

|

|

|

1,039,506,082

|

|

By 9:30AM CST on valuation date

|

|

Northern Trust Collective Government Short Term Investment Fund

|

97,130,616

|

|

|

138,574,530

|

|

By 2:30PM CST on valuation date

|

|

Voya Core Plus Trust Fund Class 1

|

105,091,986

|

|

|

88,746,902

|

|

By 1:00PM EST on valuation date

|

|

T. Rowe Price Structured Research Trust Z

|

—

|

|

|

337,180,181

|

|

By close of business of the NYSE

|

|

AEW Real Estate Securities Diversified Trust

|

—

|

|

|

212,010,996

|

|

The Trustee in its discretion may require the Withdrawing Participating Plan to notify the Trustee in writing five (5) business days prior to the date with respect to which the withdrawal will be made.

|

|

|

$

|

2,513,863,261

|

|

|

$

|

3,122,650,718

|

|

|

NOTE 6 — RELATED PARTY AND PARTY IN INTEREST TRANSACTIONS

Certain Plan investments are shares of mutual funds and units of CCTs managed by Northern Trust and Bank of America, who also serve as trustees of the Master Trust and the participant-directed brokerage account, respectively. In addition, the Plan offers DuPont common stock as an investment option. At

December 31, 2015

, the Plan held

10,115,757

shares of DuPont common stock valued at

$672,669,407

. At

December 31, 2014

, the Plan held

11,256,074

shares of DuPont common stock valued at

$832,274,216

. During the year ended

December 31, 2015

, the Plan purchased and sold

$220,714,788

and

$255,016,800

of DuPont common stock, respectively, and received dividends of

$19,035,552

. Additionally, during the year ended

December 31, 2015

, DuPont common stock depreciated in value by

$60,581,961

. Transactions in these investments qualify as party-in-interest transactions which are exempt from the prohibited transaction rules of ERISA.

The Stable Value Fund assets held by the Plan through the Master Trust are managed by DCMC, under the terms of an investment management agreement between DCMC and the Company. DCMC hires additional investment managers to manage a portion of the fixed income assets backing synthetic GICs allocated to the Stable Value Fund. The amount of DCMC fees accrued and paid by the Stable Value Fund was approximately

$724,913

for the year ended

December 31, 2015

. DCMC fee amounts relate to the Master Trust and are allocated to the plans within the Master Trust based on each plan’s proportional interest in the Stable Value Fund. These fees qualify as party-in-interest transactions, which are exempt from prohibited transaction rules of ERISA.

NOTE 7

—

PLAN TERMINATION

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants would become

100%

vested in the Retirement Savings Contributions.

NOTE 8 — TAX STATUS

The Plan is a qualified plan pursuant to Section 401(a) of the IRC and the related trust is exempt from federal taxation under Section 501(a) of the IRC. A favorable tax determination letter from the IRS dated April 18, 2015, covering the Plan and amendments through December 21, 2010, has been received by the Plan. The Plan administrator believes that the Plan is designed and is currently operated in accordance with the applicable requirements of the IRC. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan and has concluded that as of

December 31, 2015

, there are no uncertain positions taken, or expected to be taken, that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions. The Plan administrator believes the Plan is no longer subject to initiation of any new income tax examinations for years prior to 2013.

NOTE 9 — RECONCILIATION OF FINANCIAL STATEMENTS TO FORM 5500

Amounts allocated to withdrawing participants are recorded on the Form 5500 for benefit claims that have been processed and approved for payment prior to

December 31

st

but are not yet paid as of that date. The following is a reconciliation of net assets available for benefits per the financial statements at

December 31, 2015

and

2014

to the Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

Net assets available for benefits per the financial statements

|

$

|

10,538,690,679

|

|

|

$

|

11,554,472,999

|

|

|

Amounts allocated to withdrawing participants

|

(7,361,499

|

)

|

|

(5,014,060

|

)

|

|

Loan balances considered deemed distributions

|

(445,599

|

)

|

|

(410,521

|

)

|

|

Adjustment from contract value to fair value for fully benefit-responsive investment contracts held in Master Trust

|

39,255,123

|

|

|

98,476,274

|

|

|

Net assets available for benefits per the Form 5500

|

$

|

10,570,138,704

|

|

|

$

|

11,647,524,692

|

|

The following is a reconciliation of notes receivable from participants per the financial statements at

December 31, 2015

and

December 31, 2014

to notes receivable from participants per the Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

Notes receivable from participants per the financial statements

|

$

|

91,873,205

|

|

|

$

|

111,141,484

|

|

|

Loan balances considered deemed distributions

|

(445,599

|

)

|

|

(410,521

|

)

|

|

Notes receivable from participants per the Form 5500

|

$

|

91,427,606

|

|

|

$

|

110,730,963

|

|

The following is a reconciliation of total additions per the financial statements to total income per the Form 5500 for the year ended

December 31, 2015

:

|

|

|

|

|

|

|

|

|

2015

|

|

Total additions per the financial statements

|

$

|

547,467,990

|

|

|

2015 adjustment from contract value to fair value for fully benefit-responsive investment contracts held in Master Trust

|

39,255,123

|

|

|

2014 adjustment from contract value to fair value for fully benefit-responsive investment contracts held in Master Trust

|

(98,476,274

|

)

|

|

Total income per the Form 5500

|

$

|

488,246,839

|

|

The following is a reconciliation of total deductions per the financial statements to total expenses per the Form 5500 for the year ended

December 31, 2015

:

|

|

|

|

|

|

|

|

|

2015

|

|

Total deductions per the financial statements

|

$

|

1,792,411,701

|

|

|

Amounts allocated to withdrawing participants at December 31, 2015

|

7,361,499

|

|

|

Amounts allocated to withdrawing participants at December 31, 2014

|

(5,014,060

|

)

|

|

Current year cumulative deemed distributions

|

445,599

|

|

|

Prior year cumulative deemed distributions

|

(410,521

|

)

|

|

Total expenses per the Form 5500

|

$

|

1,794,794,218

|

|

DUPONT RETIREMENT SAVINGS PLAN

SUPPLEMENTAL SCHEDULE

SCHEDULE OF ASSETS (HELD AT END OF YEAR) AS OF

DECEMBER 31, 2015

ATTACHMENT TO FORM 5500, SCHEDULE H, PART IV, LINE I

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

(a)

|

|

Identity of Issue

|

|

Description of Investment

|

|

Cost

|

|

Current Value

|

|

*

|

|

DuPont common stock

|

|

Common stock

|

|

**

|

|

$

|

672,669,407

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chemours common stock

|

|

Common stock

|

|

**

|

|

10,679,017

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Plan interest in the DuPont and Related Companies Defined Contribution Plan Master Trust

|

|

Master Trust

|

|

**

|

|

9,431,204,541

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Participant-directed brokerage account

|

|

Brokerage account

|

|

**

|

|

147,208,227

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Notes receivable from participants

|

|

3.25% - 9.75% - Maturing from January 2016 - May 2027

|

|

**

|

|

91,427,606

|

|

|

|

|

Total Assets Held At End of Year

|

|

|

|

|

|

$

|

10,353,188,798

|

|

______________________________________

|

|

|

|

|

|

|

*

|

|

Party-in-interest

|

|

**

|

|

Cost not required for participant-directed investments

|

DUPONT RETIREMENT SAVINGS PLAN

SUPPLEMENTAL SCHEDULE

SCHEDULE OF DELINQUENT PARTICIPANT CONTRIBUTIONS FOR THE YEAR ENDED DECEMBER 31, 2015

ATTACHMENT TO FORM 5500, SCHEDULE H, PART IV, LINE A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals that Constitute Nonexempt Prohibited Transactions

|

|

Year

|

|

Participant contributions and loan repayments transferred late to Plan

|

|

Contributions not corrected

|

|

Contributions corrected outside VFCP

|

|

Contributions pending correction in VFCP

|

|

Total fully corrected under VFCP and PTE 2002-51

|

|

2014

|

|

$

|

9,564

|

|

|

$

|

—

|

|

|

$

|

9,564

|

|

|

$

|

—

|

|

|

$

|

—

|

|

Note: In 2014, the Plan identified contributions transmitted to the trustee after the date the DOL may determine as the earliest date such contributions reasonably could have been segregated from the employer's general assets. The only corrections remaining relate to lost earnings which were considered immaterial and fully corrected in 2015. Corrections were made in accordance with the IRS and DOL procedures.

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm

|

SIGNATURE

The Plan.

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

DuPont Retirement Savings Plan

|

|

|

|

|

|

/s/ Jennifer Sloan

|

|

|

Jennifer Sloan

|

|

|

Director — Global Rewards

|

June 14, 2016

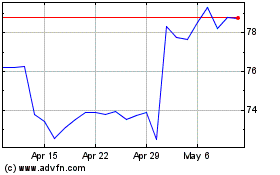

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024