FRANKFURT—Two weeks after taking over as chief executive of

Bayer AG, Werner Baumann has kicked off what could be the biggest

foreign corporate takeover effort ever by a German company—a move

that comes amid a broader effort to focus the pharmaceuticals and

chemical giant more closely on its drugs, health and crop-sciences

businesses.

Bayer confirmed on Thursday that it had reached out to U.S.

rival Monsanto Co. about a possible combination. The move was

disclosed late Wednesday by Monsanto.

While details of the deal are still unclear, any full takeover

offer would be valued at more than $42 billion—Monsanto's current

market capitalization.

It is a bold move for one of the handful of typically cautious

conglomerates that dominate Germany's corporate landscape. But it

also comes on the heels of recently departed Chief Executive Marijn

Dekkers's aggressive efforts to shake up the staid company to

sharpen its focus more squarely on its life-science businesses,

which include consumer health, pharmaceuticals and crop

science.

Mr. Baumann, a 28-year Bayer veteran, inherited from Mr. Dekkers

a slimmed-down and less risk-averse company, but also one with

substantial debt, which could complicate the company's bid for

Monsanto.

"Financially, it is a big stretch," said Markus Manns, a

portfolio manager at Union Investment, a Bayer shareholder. "I'm

not so sure it is a good move."

Bayer's net debt stood at €17.45 billion (about $20 billion) in

2015, more than double its net debt of €7 billion in 2011, before

the company began a string of acquisitions. Its debt level last

year was down roughly 11% from a high in 2014.

Bayer shares closed 8.2% lower at €88.51 on Thursday.

Bayer supervisory board member Reiner Hoffmann, speaking at an

event Thursday, said the bid fit in with a wave of deals in the

sector. "We are currently witnessing a considerable market

consolidation in the crops science business," Mr. Hoffmann said.

"There have been other merger rumors too in the market over the

past months, such as how the Chinese will position themselves."

Dow Chemical Co. and DuPont Co. last year announced a merger

that the companies—together valued at roughly $103 billion—said

would ultimately create one of the world's largest agrochemical

firms.

Earlier this year, Chinese state-owned China National Chemical

Corp. announced a $43 billion cash deal to acquire Syngenta AG,

after a failed attempt by Monsanto to take over the Swiss

agrochemicals group.

Mr. Manns said Bayer may see a deal with Monsanto as its final

opportunity to take part in the consolidation and not be left on

the sidelines as a second-tier crop operator. There have been

published reports that Bayer's German competitor BASF SE is also

interested in Monsanto. BASF declined to comment on the matter.

Bayer's bid, which could create the world's largest agrochemical

company, is "consistent with Bayer's strategy to grow in seeds and

be a life-sciences company," according to analysts at Bryan Garnier

& Co. Bayer's Crop Science business would represent half of the

company's total revenue after a Monsanto deal, the analysts

noted.

While Monsanto's strength in the agrochemical business is in

seeds, Bayer has been more heavily focused on crop chemicals.

Bayer's Mr. Hoffmann said that Monsanto's business is

"complementary" to Bayer's and that a deal would generate

synergies.

Some customers voiced wariness of the deal's potential impact on

agrochemical prices. "We have to have the interests of our members

in view," said Bernd Weber, a representative from the Hessian

Farmers' Association in Germany. "We have to make sure that the

chemicals that they want to use are affordable."

Bayer's agrochemical division posted revenue of €10.37 billion

last year, out of total group sales of €46.3 billion.

Still, other observers see the bid as a significant departure

from the direction in which Mr. Dekkers was steering the

company.

"The deal doesn't fit into the overall strategy Dekkers laid out

for a balanced, diversified life-science company," said one person

close the company. "Baumann played these kinds of strategies

through in his role as head of portfolio and strategy but they were

obviously not pursued by Dekkers," the person said.

In April, Mr. Baumann said the company should be satisfied with

its achievements in recent years and that he saw "no need for a

fundamental change in strategy."

However, a tie-up between Bayer and Monsanto would fit with Mr.

Dekkers's attempt to expand Bayer's presence in the U.S. market.

Mr. Dekkers—who spent 25 years of his career in the U.S. before

joining Bayer in 2010—presided in 2014 over the company's $14.2

billion acquisition of U.S.-based Merck & Co.'s

over-the-counter drug business. He also oversaw the launch of five

new blockbuster drugs, including blood thinner Xarelto, which

operates under a partnership with Johnson & Johnson in the

U.S.

A bid would come less than a year after Mr. Dekkers spun off

Bayer's â,¬11 billion specialty plastics division—now known as

Covestro AG—through an initial public offering. Bayer still holds a

majority stake in Covestro, which primarily produces polyurethanes

and polycarbonates, but has said it wants to eventually fully exit

the business.

A takeover of Monsanto could speed up the timetable for Bayer to

spin off the rest of its stake in Covestro to free up some cash for

the acquisition, said Union's Mr. Manns. But he added that it was

unclear whether the market would accept such a move, since

investors have been expecting Bayer to exit the business in two to

three tranches.

However, an all-cash bid for Monsanto—in which Bayer could issue

$25 billion in new shares and finance the rest with debt—could

allow the German firm to maintain a "bearable debt burden,"

according to analysts at brokerage firm Olivetree Securities.

Instead of an outright acquisition of Monsanto, analysts at

Bernstein speculated, Bayer could pursue a "merger-split" similar

to the Dow Chemical-DuPont deal. Bernstein analysts said this would

create more value for shareholders than a pure takeover. Such a

deal could see Bayer spin off its agrochemical business after a

merger with Monsanto to focus fully on its health-care

business.

--Andrea Thomas, Zeke Turner and Eyk Henning contributed to this

article.

Write to Christopher Alessi at christopher.alessi@wsj.com

(END) Dow Jones Newswires

May 19, 2016 16:05 ET (20:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

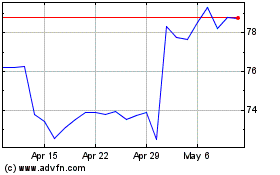

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024