MARKET SNAPSHOT: U.S. Stocks Drop At The Open On Weak U.S. GDP, BOJ Surprise

April 28 2016 - 10:11AM

Dow Jones News

By Ellie Ismailidou and Barbara Kollmeyer, MarketWatch

Dollar tumbles as yen soars; Japanese stocks see worst day since

early February

U.S. stocks opened lower Thursday, following news that the U.S.

economy sputtered in the first quarter to the lowest growth in two

years, as businesses slashed investment by the steepest rate since

the Great Recession.

The drop tracked declines in European and Asia shares, after the

Bank of Japan rattled investors by offering no additional stimulus

measures.

See also:5 charts that show the Bank of Japan market carnage

(http://www.marketwatch.com/story/5-charts-that-show-how-the-bank-of-japan-rocked-markets-2016-04-28)

The S&P 500 shed 4 points, or 0.2%, to 2,090, led by a 1.2%

drop in materials stocks. The technology and consumer-staples

sectors were the only two sectors in positive territory.

The Dow Jones Industrial Average dropped 76 points, or 0.4%, to

17,964, weighed by 1.7% drop in E.I. DuPont de Nemours &

Co.(DD).

The Nasdaq Composite was flirting with positive territory, last

trading up 4 points, or 0.1%, to 4,868.

(END) Dow Jones Newswires

April 28, 2016 09:56 ET (13:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

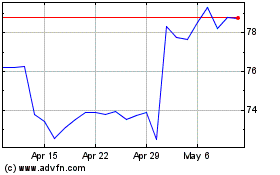

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024