DuPont Profit Slides on Weak Ag Market, Strong Dollar -- Update

October 27 2015 - 10:27AM

Dow Jones News

By Lisa Beilfuss

DuPont Co. said profit nearly halved in the latest quarter, as

the chemical giant remained under pressure from weakness in

agricultural markets and from adverse exchange rates.

Shares fell 1.4% in early trading to $59.50, pushing the stock's

year-to-date loss to 15%.

"We are not pleased with our results this quarter," said Chief

Financial Officer Nick Fanandakis. "We saw significant negative

impacts from currency as well as market weakness in agriculture,

emerging market industrial production, and oil and gas."

Amid those headwinds, interim Chief Executive Ed Breen said

DuPont is taking a fresh look at its cost structure and capital

allocation strategy. Earlier this year, DuPont raised its

cost-cutting targets and said it would reach its goal of slashing

$1 billion in expenses by the end of 2015, ahead of schedule. In

the most recent period, the company said cost cuts added 10 cents

to per-share operating earnings, keeping it on track to report 40

cents a share in cost savings this year.

The maker of Pioneer corn seeds and Kevlar fibers earlier this

year defeated a campaign by activist investor Nelson Peltz and his

Trian Fund Management L.P. to secure seats on DuPont's board.

Trian, which has maintained its 2.7% stake, has expressed

dissatisfaction over DuPont's progress in meeting financial

targets.

DuPont has slashed its full-year earnings projection several

times this year, most recently at the beginning of this month. On

Tuesday, the company said it still expects to report an adjusted

$2.75 a share this year, which would reflect an 18% decline from

2014. Adverse currency rates are expected to shave 72 cents a share

off the bottom line this year, DuPont said, and the outlook also

reflects a further weakening of agricultural markets, primarily in

Brazil.

In the latest quarter, DuPont's operating loss in its Ag segment

ballooned to $210 million from $56 million a year earlier as

revenue slid 30% to $1.09 billion. DuPont isn't alone in grappling

with a softer ag market. Tractor seller Deere & Co., for

example, has been suffering from slumping commodity prices and said

profit tumbled 40% in its most recent quarter.

Sales across each of the company's operating and geographic

segments declined, with revenue from Latin America--dogged by

Brazil--dropping 33% to $769 million. The Brazilian economy,

plagued by slow growth and soaring inflation, has been blamed by a

host of other companies for weak results. Whirlpool Corp. has

struggled in that market, and on Tuesday engine maker Cummins Inc.

said it would slash jobs this year largely on account of weakness

in that country.

In the U.S. and Canada, revenue fell 9% to $1.58 billion.

Overall, DuPont reported a profit of $235 million, or 26 cents a

share, down from $434 million, or 47 cents, a year earlier.

Excluding certain items, earnings fell to 13 cents from 39 cents.

Revenue declined 17% to $4.87 billion.

Analysts projected 10 cents in per-share earnings on $5.30

billion in revenue, according to Thomson Reuters.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 27, 2015 10:12 ET (14:12 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

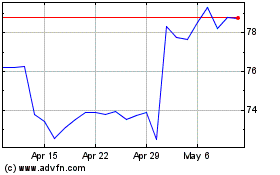

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024