UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): October 5, 2015

E. I. du Pont de Nemours and Company

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

1-815 |

|

51-0014090 |

|

(State or Other Jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

Of Incorporation) |

|

File Number) |

|

Identification No.) |

974 Centre Road

Wilmington, Delaware 19805

(Address of principal executive offices)

Registrant’s telephone number, including area code: (302) 774-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On October 5, 2015, the Registrant announced an update to the 2015 second-half and full-year outlooks. The Registrant continues to expect that about 25% of the second-half outlook will be earned in the third quarter. These expectations are subject to change as the Registrant is in the process of finalizing its financial statements for the third quarter. In addition, the Registrant announced an acceleration and expansion of targeted cost savings from its operational redesign. The Registrant will issue its earnings release for the third quarter on October 27, 2015.

A copy of the Registrant’s press release is furnished herewith on Form 8-K as Exhibit 99.1. The information contained in Item 2.02, including Exhibit 99.1, of this report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and it will not be incorporated by reference into any registration statement or other document filed by the Registrant under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act except as expressly set forth by specific reference in such a filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(b) Today the Registrant and Ellen J. Kullman announced that Ms. Kullman’s tenure as Chief Executive Officer of the Registrant will come to a close on October 16, 2015. After more than 27 years of service, and 7 leading the Registrant as Chair and CEO, Ms. Kullman will separate from service with the Registrant, and resign from the Registrant’s board of directors, effective October 16, 2015, in accordance with the separation agreement, which is attached and described below.

In connection with her cessation of employment, on October 5, 2015, the Registrant and Ms. Kullman entered into a separation agreement, which provides that, upon her separation from service and subject to her execution of a release of claims against the Registrant, she will be entitled to the benefits, described below, which are those available generally to all retirement eligible Registrant employees under the Registrant’s equity plans and all full time employees under the Registrant’s Career Transition Program upon a similar termination of employment.

The separation benefits include continued cash payments for twelve months with a value in the aggregate equal to Ms. Kullman’s annual base salary and 2014 annual bonus ($2,795,000 in the aggregate), continued medical and dental benefits for twelve months at the active employee cost and continued life insurance coverage for twelve months at the Registrant’s expense. In accordance with the terms of the Registrant’s Short-Term Incentive Plan, Ms. Kullman will be paid a pro-rata annual bonus for 2015 based on actual performance of the Registrant, with any such bonus payable at the time it is paid to other senior executives of the Registrant. Ms. Kullman also will receive all other benefits for which she is already eligible, including her vested deferred compensation and pension benefits and retirement-based vesting of her outstanding equity awards.

Ms. Kullman has agreed to provide assistance to the Registrant in connection with any audits, investigations and administrative, regulatory or judicial proceedings, and she remains subject to existing post-employment restrictive covenants, including a one-year noncompete/nonsolicit provision.

A copy of the separation agreement is attached hereto as Exhibit 10.1, and the foregoing description of the separation agreement is qualified in its entirety by reference to the full terms of such agreement.

(c) The Registrant also announced today that the Board has appointed Edward D. Breen, age 59, effective as of October 6, 2015, as Interim Executive Officer, reporting to the Board, serving until the close of business on October 16, 2015, at which time he shall assume the role of Interim Chair of the Board and Interim Chief Executive Officer. Mr. Breen has been Chairman, since July 2002, of Tyco International plc, a leading global provider of security products and services, fire detection and suppression products and services and life safety products. Mr. Breen also served as Chief Executive Officer of Tyco from July 2002 to September 2012. Prior to joining Tyco, Mr. Breen held senior management positions at Motorola, including as President and Chief Operating Officer, and General Instrument Corporation, including as Chairman, President and Chief Executive Officer. Mr. Breen has also served as a director of Comcast Corporation (2005 to 2011 and since 2014).

2

In connection with his appointment as described above, effective October 6, 2015 Mr. Breen was granted restricted stock units covering 100,000 shares of the Registrant’s common stock. The stock units vest monthly on a ratable basis over up to six months of continued service and vest on a pro-rata daily basis during the final month of service.

Item 7.01 Regulation FD Disclosure

On October 5, 2015, the Registrant issued a press release announcing an update to the 2015 second-half and full-year outlooks described in Item 2.02 and the management changes described in Item 5.02 of this Form 8-K. A copy of the Registrant’s press release is furnished herewith on Form 8-K as Exhibit 99.1. The information in Exhibit 99.1 of this report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liability of that section, and it will not be deemed incorporated by reference into any registration statement or other document filed by the Registrant under the Securities Act or the Exchange Act except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No. |

|

Description |

|

10.1 |

|

Separation Agreement, dated October 5, 2015. |

|

|

|

|

|

99.1 |

|

Press Release dated October 5, 2015. |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

E. I. DU PONT DE NEMOURS AND COMPANY |

|

|

(Registrant) |

|

|

|

|

|

|

|

|

/s/ Nicholas C. Fanandakis |

|

|

Executive Vice President and

Chief Financial Officer |

October 5, 2015

4

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No. |

|

Description |

|

10.1 |

|

Separation Agreement, dated October 5, 2015. |

|

|

|

|

|

99.1 |

|

Press Release dated October 5, 2015. |

5

Exhibit 10.1

FORM OF SEPARATION AGREEMENT

This SEPARATION AGREEMENT (the “Agreement”) is made and entered into as of the 5th day of October, 2015 (the “Effective Date”), by and among Ellen J. Kullman (the “Executive”) and E.I. du Pont de Nemours and Company (the “Company”).

WHEREAS, the Executive currently serves as Chief Executive Officer of the Company and as Chair of the Company’s Board of Directors (the “Board”);

WHEREAS, the Executive and the Company desire to enter into a mutually satisfactory arrangement concerning, among other things, the Executive’s separation from service with the Company, and other related matters;

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants and agreements contained in this Agreement, the Executive and the Company agree as follows:

1. Succession.

(a) Separation Date. The Executive hereby acknowledges and agrees that she shall separate from service with, and shall cease to be an employee of, the Company effective as of the close of business on October 16, 2015 (the “Separation Date”).

(b) Resignation of Board and Officer Positions. Effective as of the time described in the foregoing paragraph (a), and without any further action required on the part of the Company or the Executive, the Executive hereby resigns from her positions as (i) an employee and Chief Executive Officer of the Company and as an employee and officer, as applicable, of any subsidiary or affiliate of the Company, (ii) Chair and as a member of the Board of Directors or equivalent governing body, as applicable, of the Company and each of its subsidiaries or affiliates on which she serves and (iii) a member of all committees of each such board of directors or equivalent governing body, as applicable, on which she serves. Although the preceding sentence is intended to be self-executing, the Executive shall execute any documents required by the Company to effectuate the preceding sentence.

2. Separation Payments and Benefits. In consideration of the Executive’s service to the Company and the Executive’s agreement to comply with the terms of this Agreement, the Company and the Executive mutually agree that the Executive’s separation from service from the Company for all purposes shall be treated as a cessation of the Executive’s employment with the Company (i) entitling Executive to the severance benefits under the Company’s Career Transition Program (the “CTP”) which are described below and (ii) as a retirement under the “55/10 Rule” under the Company’s Equity and Incentive Plan and the Executive’s applicable equity-based award agreements thereunder (together, the “Equity Plan”). The Executive hereby waives the 60-day redeployment period under the CTP (which has the effect of waiving any otherwise required advance notice to the Executive by the Company of the Executive’s separation). The Executive and the Company hereby acknowledge and agree that the Executive’s exclusive payments and benefits under the CTP, the Equity Plan, and each other plan, agreement, policy or arrangement of the Company in which the Executive is a participant or to which she is a party (other than any plan, policy or arrangement of the Company providing for pension or deferred compensation benefits in which the Executive is fully vested as of the

Separation Date), in each case, in connection with the Executive’s separation from service on the Separation Date, shall be as set forth below:

(a) Severance Payment. Pursuant to the CTP, the Executive shall receive, through the Career Transition Financial Assistance Plan as in effect from time to time (“CTFAP”), cash payments, payable commencing immediately over the one-year period following the Separation Date in installments on a regular pay-period basis (as prescribed by the CTFAP), with an aggregate value equal to 12 months’ “Pay” (as defined in the CTP). The Company and the Executive agree that 12 months’ Pay is $2,795,000.Notwithstanding the foregoing, (i) payments due on or before March 15, 2016 will be paid on a regular pay-period basis beginning on the first regular pay date following the effective date of the General Release, (ii) payments otherwise due after March 15, 2016 and on or before the six month anniversary of the Separation Date shall be deferred and paid in a single lump sum on the first regular pay date which is more than six months following the Separation Date, and (iii) payments due on or following the first regular pay date which is more than six months following the Separation Date shall be paid on a regular pay period basis in the ordinary course.

(b) Medical and Dental Coverage. Pursuant to the CTP, as of the Separation Date, the Executive may elect to continue medical and dental coverage following the Separation Date as a retirement-eligible employee pursuant to the Company’s Medical Care Assistance Program and the Dental Assistance Plan, which are the Company’s medical and dental plans for retirees. The Executive’s coverage will continue at the same coverage level that the Executive elected as an active employee. The Executive shall receive such coverage through the Company, and will pay the active employee premium for the first 12 months of such coverage.

(c) Life Insurance. Pursuant to the CTP, as of the Separation Date, the Executive’s Company-provided life insurance (or contributory and noncontributory life insurance, as applicable) shall continue at the Company’s expense for one year and, thereafter, the Executive shall participate in the Company’s retiree life insurance program at the applicable retiree premium rates, as generally in effect from time to time.

(d) Equity Plan. Pursuant to the Equity Plan, as of the Separation Date, the Executive shall be entitled to continued vesting of the Executive’s outstanding unvested equity-based awards granted to her under the Equity Plan, as if the Executive had not separated from the Company; provided that as to each of the Executive’s performance-based restricted stock units which continue to vest subject to the achievement of applicable performance goals, the number of performance-based restricted stock units earned at the end of the applicable performance period shall be pro-rated based on the number of months that the Executive was employed with the Company from the date of grant of the applicable performance-based restricted stock unit through the end of the applicable performance period. Each of the Executive’s restricted stock units and performance stock units shall be settled in accordance with the original settlement date and the terms of the Equity Plan. Each of the Executive’s stock options shall remain exercisable for the remaining original term applicable to such stock options. The Company and the Executive agree that the treatment described above is that required pursuant to the terms of the Equity Plan.

2

(e) Short -Term Incentive Plan. The Executive shall be eligible for a pro-rated annual bonus under the Short-Term Incentive Plan for the Company’s 2015 fiscal year based on the number of days that the Executive was employed with the Company during 2015 and based on actual Company performance, with such annual bonus payable at the same time as annual bonuses are paid to senior executives generally.

(f) Effect of Payments on Compensatory Arrangements. The Executive acknowledges that the payments and benefits described in this Section 2, and to which the Executive becomes entitled solely on account of her separation from service with the Company, shall not be considered in determining her benefits under any plan, agreement, policy or arrangement of the Company, including but not limited to pension and other deferred compensation arrangements.

3. Restrictive Covenants Generally; Nondisparagement.

(a) Restrictive Covenants Generally. For the avoidance of doubt, the Executive shall continue to comply with the terms of any restrictive covenants to which she is subject, and be subject to any applicable forfeiture or repayment provisions for the violation of any such restricted covenants, in each case, as set forth in any plan, agreement, policy or arrangement of the Company in which the Executive participates or to which she is a party, and the parties acknowledge that such covenants or provisions shall remain in full force and effect (including any applicable forfeiture or repayment provisions in the event of breach) following the Separation Date in accordance with the terms of such provisions.

(b) Nondisparagement. From and following the Effective Date, the Executive agrees not to make negative comments or otherwise disparage the Company or any of its controlled affiliates, or any of their directors or officers at a level of Vice President or above, in any manner reasonably likely to be harmful to them or their business, business reputation or personal reputation, as applicable. The Company agrees that the Company will not, and the Company will instruct the individuals reporting directly to the Executive as of the Effective Date and the members of the Board as of the Effective Date to not, while employed by the Company or serving as a member of the Board, as the case may be, make negative comments about the Executive or otherwise disparage the Executive in any manner that is reasonably likely to be harmful to her business reputation or personal reputation. The parties hereto will not assist, encourage, discuss, cooperate, incite, or otherwise confer with or aid any others in discrediting the other or in pursuit of a claim or other action against the other, except as required by law. Nothing contained in this Section 3(b) shall prevent any party from making truthful statements in any judicial, arbitration, governmental, or other appropriate forum for adjudication of disputes between the parties or in any response or disclosure by any party compelled by legal process or required by applicable law.

4. Cooperation. In consideration of the payments and benefits set forth in this Agreement, the Executive agrees that, following the Separation Date, she shall provide assistance to the Company and its advisors in connection with any audit, investigation or administrative, regulatory or judicial proceeding involving matters within the scope of her duties and responsibilities to the Company during her employment with the Company, or as to which she otherwise has knowledge (including being available to the Company upon reasonable notice for

3

interviews and factual investigations, and appearing at the Company’s reasonable request to give testimony without requiring service of a subpoena or other legal process). In the event that the Company requires the Executive’s assistance in accordance with this section, the Company shall reimburse the Executive for reasonable out-of-pocket expenses (including travel, lodging and meals) incurred by the Executive in connection with such assistance, subject to reasonable documentation and compliance with the Company’s standard expense reimbursement policy.

5. General Release. The Executive agrees that, in consideration of the payments and benefits set forth in Section 2 of the Agreement, some of which (including without limitation the severance payments described in Section 2(a)) she would not otherwise be entitled to but for this Agreement, on or following the Separation Date, but not later than 21 days following the Separation Date, the Executive shall execute and deliver to the Company the release of claims in the form attached hereto as Exhibit A (the “Release”). Notwithstanding anything in this Agreement, the CTP, the Equity Plan, or in any other plan, policy, agreement or arrangement of the Company to the contrary, whether or not the Executive is a party thereto, if the Executive (i) fails to execute and deliver the Release to the Company within such 21-day period, or (ii) revokes the waiver of age discrimination claims contained in the Release in accordance with the terms thereof, the Executive shall forfeit her right to any compensation or benefits described in Section 2 of this Agreement to which she would not be entitled but for this Agreement (including without limitation the severance payments described in Section 2(a)), and repay to the Company any of such payments or benefits that the Executive previously received.

6. No Mitigation; No Offset. In no event shall the Executive be obligated to seek other employment or take any other action by way of mitigation of the amounts payable to the Executive under any of the provisions of this Agreement and such amounts shall not be reduced whether or not the Executive obtains other employment.

7. Tax Withholding. The Company shall be entitled to withhold from the payments and benefits described in this Agreement all income and employment taxes required to be withheld by applicable law.

8. Notices. All notices, requests, demands or other communications under this Agreement shall be in writing and shall be deemed to have been duly given when delivered in person or deposited in the United States mail, postage prepaid, by registered or certified mail, return receipt requested, to the party to whom such notice is being given as follows:

|

As to the Executive: |

The Executive’s last address on the books and records of the Company |

|

|

|

|

As to the Company: |

E.I. du Pont de Nemours and Company 974 Centre Road Wilmington, DE 19805 Attention: General Counsel |

Any party may change her or its address or the name of the person to whose attention the notice or other communication shall be directed from time to time by serving notice thereof upon the other party as provided in this Agreement.

4

9. Successors. This Agreement shall inure to the benefit of and be enforceable by the Executive’s legal representatives. This Agreement shall inure to the benefit of and be binding upon the Company and its successors and assigns. As used in this Agreement, “Company” shall mean the Company as hereinbefore defined and any successor to its business and/or assets as aforesaid and the Company shall ensure that any successor assumes and agrees to perform this Agreement by operation of law, or otherwise.

10. Section 409A.

(a) General. It is intended that payments and benefits made or provided under this Agreement shall not result in penalty taxes or accelerated taxation pursuant to Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and the Treasury regulations relating thereto and any Internal Revenue Service or Treasury rules or other guidance issued thereunder (collectively, “Section 409A of the Code”). Any payments that qualify for the “short- term deferral” exception, the separation pay exception or another exception under Section 409A of the Code shall be paid under the applicable exception. For purposes of the limitations on nonqualified deferred compensation under Section 409A of the Code, each payment of compensation under this Agreement shall be treated as a separate payment of compensation for purposes of applying the exclusion under Section 409A of the Code for short-term deferral amounts, the separation pay exception or any other exception or exclusion under Section 409A of the Code. All payments to be made upon a termination of employment under this Agreement may only be made upon a “separation from service” under Section 409A of the Code to the extent necessary in order to avoid the imposition of penalty taxes on the Executive pursuant to Section 409A of the Code. In no event may the Executive, directly or indirectly, designate the calendar year of any payment under this Agreement.

(b) Reimbursements and In-Kind Benefits. Notwithstanding anything to the contrary in this Agreement, all reimbursements and in-kind benefits provided under this Agreement that are subject to Section 409A of the Code shall be made in accordance with the requirements of Section 409A of the Code, including, where applicable, the requirement that (i) any reimbursement is for expenses incurred during the Executive’s lifetime (or during a shorter period of time specified in this Agreement); (ii) the amount of expenses eligible for reimbursement, or in-kind benefits provided, during a calendar year may not affect the expenses eligible for reimbursement, or in-kind benefits to be provided, in any other calendar year; (iii) the reimbursement of an eligible expense will be made no later than the last day of the calendar year following the year in which the expense is incurred; and (iv) the right to reimbursement or in- kind benefits is not subject to liquidation or exchange for another benefit.

(c) Delay of Payments. Notwithstanding any other provision of this Agreement to the contrary, if the Executive is considered a “specified employee” for purposes of Section 409A of the Code (as determined in accordance with the methodology established by the Company as in effect on the Separation Date), any payment that constitutes nonqualified deferred compensation within the meaning of Section 409A of the Code that is otherwise due to the Executive under this Agreement during the six-month period immediately following the Executive’s separation from service (as determined in accordance with Section 409A of the Code) on account of the Executive’s separation from service shall be accumulated and paid to the Executive, other than as set forth in Section 2(a) of this Agreement, on the first business day

5

of the seventh month following her separation from service (the “Delayed Payment Date”). If the Executive dies during the postponement period, the amounts and entitlements delayed on account of Section 409A of the Code shall be paid to the personal representative of her estate on the first to occur of the Delayed Payment Date or 30 calendar days after the date of the Executive’s death.

(d) Separation from Service. Despite any contrary provision of this Agreement, any references to separation of employment or termination of employment shall mean and refer to the date of the Executive’s “separation from service,” as that term is defined in Section 409A of the Code and Treasury regulation Section 1.409A-1(h).

11. Governing Law; Venue; Miscellaneous. This Agreement, and the rights and obligations of the parties hereto, shall be governed by and construed in accordance with the laws of the State of Delaware applicable to contracts executed in and to be performed in that State, except to the extent governed by federal laws, and shall be construed according to its fair meaning and not for or against any party. Exclusive jurisdiction for the adjudication of disputes regarding this Agreement shall be the Federal and state courts located in the State of Delaware.If any provision hereof is unenforceable, such provision shall be fully severable, and this Agreement shall be construed and enforced as if such unenforceable provision had never comprised a part hereof, the remaining provisions hereof shall remain in full force and effect, and the court construing the Agreement shall add as a part hereof a provision as similar in terms and effect to such unenforceable provision as may be enforceable, in lieu of the unenforceable provision. The captions of this Agreement are not part of the provisions hereof and shall have no force or effect. This Agreement may not be amended or modified otherwise than by a written agreement executed by the parties hereto or their respective successors and legal representatives. As used in this Agreement, the term (a) “affiliate” means an entity controlled by, controlling or under common control with the Company, and (b) “including” does not limit the preceding words or terms.

[Signature Page Follows]

6

IN WITNESS WHEREOF, the Executive has hereunto set her hand and the Board of Directors of the Company has caused this Agreement to be executed by its duly authorized representative, all as of the date first above written.

|

|

|

|

|

ELLEN J. KULLMAN |

|

|

|

|

|

|

|

|

E.I. DU PONT DE NEMOURS AND COMPANY |

|

|

|

|

|

|

|

|

|

|

|

By: |

|

|

Title: |

EXHIBIT A

General Release

This General Release of all Claims (this “Agreement”) is entered into on , 2015, by Ellen J. Kullman (the “Executive”) and E.I. du Pont de Nemours and Company (the “Company”).

In consideration of the payments and benefits, and mutual covenants set forth in the Separation Agreement (the “Separation Agreement”) between the Executive and the Company, effective October 5, 2015 (the “Effective Date”), the Executive and the Company agree as follows:

1. General Release and Waiver of Claims.

(a) Company Release. The Company, on behalf of itself and its subsidiaries, affiliates, divisions, successors, assigns, officers, directors, agents, partners and current and former employees (collectively, the “Company Releasors”) hereby irrevocably and unconditionally releases and forever discharges the Executive and each of her respective heirs, executors, administrators, representatives, agents, successors and assigns (collectively, the “Executive Releasees”), from any and all Claims, including, without limitation, any Claims under any federal, state, local or foreign law, that the Company Releasors may have, or in the future may possess, arising out of, based upon, in connection with or otherwise relating in any way to (i) the Executive’s employment relationship with and service as an employee, officer or director of the Company, and the termination of such relationship or service and (ii) any event, condition, circumstance or obligation that occurred, existed or arose on or prior to the date hereof; provided, however, that notwithstanding anything else contained in this Agreement to the contrary, this Agreement shall not release any of the Executive Releasees from (x) obligations or restrictions arising under or referred to or described in the Separation Agreement and nothing herein shall impair the right or ability of the Company to enforce such provision in accordance with the terms of the Separation Agreement or other applicable agreement or arrangement, (y) any claims arising out of the Executive’s fraud or willful misconduct the material facts of which were not known to the Board of Directors of the Company prior to the Effective Date, or (z) any claims for a “clawback” of compensation pursuant to (A) rules adopted by the Securities and Exchange Commission or any stock exchange on which the Company’s securities are traded pursuant to the Dodd—Frank Wall Street Reform and Consumer Protection Act or otherwise, (B) any policy adopted by the Company for the purpose of complying with any such rules or (C) the Company’s compensation recovery policy as in effect on the Effective Date.

(b) Executive Release. In consideration of the payments and benefits provided to the Executive under the Separation Agreement, and after consultation with counsel, the Executive, on behalf of herself and each of the Executive’s respective heirs, executors, administrators, representatives, agents, successors and assigns (collectively, the “Executive Releasors” and, together with the Company Releasors, the “Releasing Parties”) hereby irrevocably and unconditionally release and forever discharge the Company and its subsidiaries and affiliates and each of their respective officers, employees, directors, shareholders and agents (“Company Releasees” and, together with the Executive Releasees, the “Releasees”) from any and all claims, actions, causes of action, rights, judgments, obligations, damages, demands,

A-1

accountings or liabilities of whatever kind or character, whether known or unknown (collectively, “Claims”), including, without limitation, any Claims under any federal, state, local or foreign law, that the Executive Releasors may have, or in the future may possess, arising out of, based upon, in connection with or otherwise relating in any way to (i) the Executive’s employment relationship with and service as an employee, officer or director of the Company, and the termination of such relationship or service and (ii) any event, condition, circumstance or obligation that occurred, existed or arose on or prior to the date hereof; provided, however, that notwithstanding anything else contained in this Agreement to the contrary, this Agreement shall not affect: the obligations of the Company or the Executive set forth in the Separation Agreement or any plan, policy or arrangement of the Company providing for pension or deferred compensation benefits, all of which shall remain in effect in accordance with their terms, and any indemnification or similar rights the Executive has as a current or former officer or director of the Company, including, without limitation, any and all rights thereto referenced in the Company’s bylaws, other governance documents, or any rights with respect to directors’ and officers’ insurance policies.

(c) Specific Release of ADEA Claims. In further consideration of the payments and benefits provided to the Executive under the Separation Agreement, the Executive Releasors hereby unconditionally release and forever discharge the Company Releasees from any and all Claims that the Executive Releasors may have as of the date the Executive signs this Agreement arising under the Federal Age Discrimination in Employment Act of 1967, as amended, and the applicable rules and regulations promulgated thereunder (“ADEA”). By signing this Agreement, the Executive hereby acknowledges and confirms the following: (i) the Executive was advised by the Company in connection with her termination to consult with an attorney of her choice prior to signing this Agreement and to have such attorney explain to the Executive the terms of this Agreement, including, without limitation, the terms relating to the Executive’s release of claims arising under ADEA, and the Executive has in fact consulted with an attorney; (ii) the Executive was given a period of not fewer than twenty-one (21) calendar days to consider the terms of this Agreement and to consult with an attorney of her choosing with respect thereto; and (iii) the Executive knowingly and voluntarily accepts the terms of this Agreement. The Executive also understands that she has seven (7) calendar days following the date on which she signs this Agreement within which to revoke the release contained in this paragraph, by providing the Company a written notice of her revocation of the release and waiver contained in this paragraph.

(d) No Assignment. The Releasing Parties represent and warrant that they have not assigned any of the Claims being released under this Agreement.

2. Proceedings. The Releasing Parties have not filed, and agree not to initiate or cause to be initiated on their respective behalf, any complaint, charge, claim or proceeding against the Releasees before any local, state or federal agency, court or other body, other than with respect to the obligations of the Company to the Executive and of the Executive to the Company under, or set forth in, the Separation Agreement, or in respect of any other matter described in the respective provisos to Section 1(a) and Section 1(b) (each, individually, a “Proceeding”), and agrees not to participate voluntarily in any Proceeding. The Releasing Parties waive any right they may have to benefit in any manner from any relief (whether monetary or otherwise) arising out of any Proceeding.

A-2

3. Remedies. In the event the Executive initiates or voluntarily participates in any Proceeding following her receipt of written notice from the Company and a failure to cease such participation within thirty (30) calendar days following receipt of such notice, or if she revokes the ADEA release contained in Paragraph 1(c) of this Agreement within the seven (7)- calendar-day period provided under Paragraph 1(c), the Company may, in addition to any other remedies it may have, reclaim any amounts paid to her, and/or terminate any benefits or payments that are subsequently due, in each case pursuant to the last sentence of Section 5 of the Separation Agreement, without waiving or otherwise forfeiting the benefits of the release otherwise granted in this Agreement. The Executive understands that by entering into this Agreement she will be limiting the availability of certain remedies that she may have against the Company and limiting also her ability to pursue certain claims against the Company.

4. Severability Clause. In the event any provision or part of this Agreement is found to be invalid or unenforceable, only that particular provision or part so found, and not the entire Agreement, will be inoperative.

5. Nonadmission. Nothing contained in this Agreement will be deemed or construed as an admission of wrongdoing or liability on the part of the Company.

6. Governing Law; Venue; Miscellaneous. This Agreement, and the rights and obligations of the parties hereto, shall be governed by and construed in accordance with the laws of the State of Delaware applicable to contracts executed in and to be performed in that State, except to the extent governed by federal laws, and shall be construed according to its fair meaning and not for or against any party. Exclusive jurisdiction for the adjudication of disputes regarding this Agreement shall be the Federal and state courts located in the State of Delaware.If any provision hereof is unenforceable, such provision shall be fully severable, and this Agreement shall be construed and enforced as if such unenforceable provision had never comprised a part hereof, the remaining provisions hereof shall remain in full force and effect, and the court construing the Agreement shall add as a part hereof a provision as similar in terms and effect to such unenforceable provision as may be enforceable, in lieu of the unenforceable provision. The captions of this Agreement are not part of the provisions hereof and shall have no force or effect. This Agreement may not be amended or modified otherwise than by a written agreement executed by the parties hereto or their respective successors and legal representatives.

7. Notices. All notices or communications hereunder shall be in writing, addressed as provided in Section 8 of the Separation Agreement.

THE EXECUTIVE ACKNOWLEDGES THAT SHE HAS READ THIS AGREEMENT AND THAT SHE FULLY KNOWS, UNDERSTANDS AND APPRECIATES ITS CONTENTS, AND THAT SHE HEREBY EXECUTES THE SAME AND MAKES THIS AGREEMENT AND THE RELEASE AND AGREEMENTS PROVIDED FOR IN THIS AGREEMENT VOLUNTARILY AND OF HER OWN FREE WILL.

[Signature Page Follows]

A-3

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the dates set forth below.

|

|

|

|

|

|

|

|

ELLEN J. KULLMAN |

|

|

|

|

|

|

|

|

DATE |

|

|

|

|

|

|

|

|

E.I. DU PONT DE NEMOURS AND COMPANY |

|

|

|

|

|

|

|

|

|

|

|

By: |

|

|

Title: |

|

|

|

|

|

|

|

|

DATE |

Exhibit 99.1

|

Media Contact: |

Dan Turner |

|

|

302-996-8372 |

|

|

daniel.a.turner@dupont.com |

|

|

|

|

Investor Contact: |

302-774-4994 |

Ellen Kullman to Retire as Chair and CEO of DuPont

Edward Breen, DuPont Board Member, to Serve as Interim Chair and CEO

Company Updates Operating Earnings Outlook for Full Year 2015

Increases Targeted Cost Savings from Operational Redesign to $1.6 Billion;

Accelerates Annual Run Rate Cost Savings of $1.3 Billion to 2016

WILMINGTON, Del., Oct. 5, 2015 — Ellen Kullman, Chair and CEO of DuPont, announced that she will retire from the company effective October 16th. On that date, Edward Breen, a current member of the DuPont Board of Directors, will assume the role of Interim Chair and CEO of DuPont. The Board has engaged an executive recruitment firm to identify a full-time replacement.

“Over the past seven years, with the dedication of our entire team, we have transformed this great company by focusing our portfolio, streamlining the organization, and driving innovation that leverages our unique science and engineering capabilities. With a strong foundation in place now is the right time for a new leader to continue to drive the pace of change to capitalize fully on the opportunity ahead,” said Ms. Kullman. “I want to express my sincere thanks and admiration to all of my DuPont colleagues around the world. I have complete confidence that they will realize the enormous potential of the next generation DuPont.”

“We thank Ellen for her extraordinary leadership as Chair and CEO of DuPont. During more than 27 years with the company, Ellen has consistently led constructive change by focusing the organization on identifying and solving our customers’ needs. As our Chair and CEO, Ellen led DuPont through the global recession and the dramatic transformation of the last several years with the highest standard of integrity and commitment,” said Alexander Cutler, DuPont’s Lead Independent Director.

“Ed Breen’s record of achievement and broad experience make him well suited to lead the company while the Board completes its search for the next executive to lead DuPont,” Mr. Cutler said.

“Ellen is an outstanding leader and the entire Board appreciates her long record of accomplishment at DuPont,” said Mr. Breen. “As we confront a challenging environment, she and the management team already have taken actions to accelerate cost reductions. Looking ahead, we will continue to drive productivity, and we plan to conduct a deep dive into the details of our cost structure and allocation of capital to ensure we deliver appropriate returns for shareholders. DuPont’s unique science capabilities and leading positions in attractive growth markets are strong competitive advantages and we are committed to build on that base to drive DuPont’s performance.”

Updated Operating Earnings Outlook

DuPont announced that it now expects operating earnings per share for the full year to be approximately $2.75, compared with the prior guidance of $3.10. The revised outlook primarily reflects continued strengthening of the U.S. dollar versus currencies in emerging markets, particularly the Brazilian Real; and a further weakening of agricultural markets, primarily in Brazil. The new guidance assumes full year currency impacts of $0.72 per share, versus the prior expectation of approximately $0.60 per share. Excluding the impact of currency, the revised guidance for full-year operating earnings per share, including expected benefits from share repurchases and cost savings, represents an approximately 3-percent increase in operating earnings per share year over year. The company now expects second-half operating earnings per share to be approximately $0.40, compared with the prior guidance of $0.75. Approximately 25 percent of expected second-half operating earnings will be earned in the third quarter. Prior year operating earnings were $3.36 and $0.96 per share for the full year and second-half 2014, respectively. Reconciliations of non-GAAP measures are included at the end of this release.

Demand for crop protection and seed products, primarily in Brazil, further weakened in the third quarter impacted by macroeconomic and competitive pressures. In Brazil, where the planting season is in progress, tighter farmer profit margins and credit are causing growers to be more cautious in their spending. The company is experiencing reduced demand for crop protection products reflecting low insect pressure and lower seed volumes as growers are expected to reduce hybrid corn planted area.

2

The U.S dollar continues to strengthen versus currencies in emerging markets. The Brazilian Real has declined more than 60 percent year over year and approximately 20 percent since the company reported second-quarter results.

In response to these macro conditions, the company announced that it is accelerating, by one year, its operational redesign cost saving actions and as result, expects to achieve $1.3 billion of savings on a run rate basis by the end of 2016. In addition, the company announced its commitment to achieving additional cost savings as a part of its operational redesign and is targeting approximately $1.6 billion on a run rate basis by the end of 2017. Plans related to the additional cost savings are expected to be finalized in the fourth quarter.

Nick Fanandakis, DuPont’s Chief Financial Officer, said, “As macro conditions have deteriorated further, we are intensifying our effort to offset these pressures with further productivity improvements and cost savings, while making disciplined and targeted investments in innovation to increase value for shareholders over the long term. While we are experiencing challenging market conditions this season in Brazil, we continue to see long term strategic growth opportunities for our products. Over the long term, we believe our pipeline of new products and our portfolio of capabilities position us well in global agriculture markets.”

Investor Conference Call

DuPont will hold a conference call and webcast on Monday, October 5, 2015, at 5:00 pm EDT to discuss this news release. The call can be accessed by dialing 1-630-827-6818, confirmation number 6030934. The webcast and additional presentation materials can be accessed by visiting the company’s investor website (Events & Presentations) at www.investors.dupont.com. A replay of the conference call webcast will be available for 90 days by calling 1-630-652-3042, Passcode 6030934#.

3

These expectations are subject to change as DuPont finalizes financial statements for the third quarter. DuPont will report its third-quarter financial results on Oct. 27th. For additional information see the investor center at http://www.dupont.com.

About Edward D. Breen

Mr. Breen serves as Chairman of Tyco International plc, a leading global provider of security products and services, fire detection and suppression products and services and life safety products, where he also served as Chief Executive Officer from 2002 to 2012. Prior to joining Tyco, Mr. Breen held senior management positions at Motorola, including as President and Chief Operating Officer, and General Instrument Corporation, including as Chairman, President and Chief Executive Officer. Mr. Breen is a director of Comcast Corporation.

DuPont (NYSE: DD) has been bringing world-class science and engineering to the global marketplace in the form of innovative products, materials, and services since 1802. The company believes that by collaborating with customers, governments, NGOs, and thought leaders, we can help find solutions to such global challenges as providing enough healthy food for people everywhere, decreasing dependence on fossil fuels, and protecting life and the environment. For additional information about DuPont and its commitment to inclusive innovation, please visit www.dupont.com.

Forward Looking Statements: This document contains forward-looking statements which may be identified by their use of words like “plans,” “expects,” “will,” “believes,” “intends,” “estimates,” “anticipates” or other words of similar meaning. All statements that address expectations or projections about the future, including statements about the company’s strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures and financial results, are forward looking statements. Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control. Some of the important factors that could cause the company’s actual results to differ materially from those projected in any such forward-looking statements are: fluctuations in energy and raw material prices; failure to develop and market new products and optimally manage product life cycles; ability to respond to market acceptance, rules, regulations and policies affecting products based on biotechnology; significant litigation and environmental matters; failure to appropriately manage process safety and product stewardship issues; changes in laws and regulations or political conditions; global economic and capital markets conditions, such as inflation, interest and currency exchange rates; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, weather events and natural disasters; ability to protect and enforce the company’s intellectual property rights; successful integration of acquired businesses and separation of underperforming or non-strategic assets or businesses, including timely realization of the expected benefits from the separation of Performance Chemicals. The company undertakes no duty to update any forward-looking statements as a result of future developments or new information.

# # #

4

Use of Non-GAAP Measures

Management believes that certain non-GAAP measurements are meaningful to investors because they provide insight with respect to ongoing operating results of the company. Such measurements are not recognized in accordance with generally accepted accounting principles (GAAP) and should not be viewed as an alternative to GAAP measures of performance. Reconciliations of non-GAAP measures are provided below.

Reconciliation of Operating Earnings Per Share (EPS) Outlook

The reconciliation below represents the company’s second-half and full year 2015 outlook and second-half and full year 2014 on an operating earnings per share basis, defined as earnings from continuing operations excluding significant items and non-operating pension/OPEB costs. On July 1, 2015, the company completed the spin-off of its Performance Chemicals segment. Accordingly, the results of Performance Chemicals are presented as discontinued operations and as such have been excluded from EPS from continuing operations and operating EPS for all periods presented.

|

|

|

Year Ended December 31, |

|

Second Half |

|

|

|

|

2015 Outlook |

|

2014 Actual |

|

2015 |

|

2014 |

|

|

Operating EPS |

|

$ |

2.75 |

|

$ |

3.36 |

|

$ |

0.40 |

|

$ |

0.96 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2015 estimated significant items (1) |

|

0.08 |

|

— |

|

0.10 |

|

|

|

|

2014 significant items(2) |

|

— |

|

0.12 |

|

|

|

0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-operating pension/OPEB costs (3) |

|

(0.30 |

) |

(0.09 |

) |

(0.14 |

) |

(0.05 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

EPS from continuing operations (GAAP) |

|

$ |

2.53 |

|

$ |

3.39 |

|

$ |

0.36 |

|

$ |

0.99 |

|

(1) 2015 estimated significant items includes: (a) full year 2015 transaction costs associated with the separation of the Performance Chemicals segment of $(0.06), (b) customer claims recovery of $0.13, (c) litigation settlement of $0.08, (d) asset impairment charge of $(0.03) and (d) Ukraine devaluation charge of $(0.04). The 2015 second half estimated significant items include separation transaction costs of $(0.01) and customer claims recovery of $0.11.

(2)For detail of 2014 significant items, please see 2014 quarterly earnings news releases for DuPont available at http://www.investors.dupont.com.

(3)Non-operating pension/OPEB costs for 2015 Outlook represents current estimate.

5

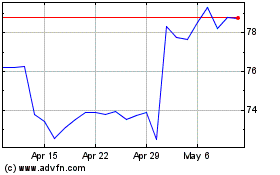

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024