UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o Filed

by a Party other than the Registrant x

Check the appropriate box:

| o |

Preliminary Proxy Statement |

| |

|

| o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| o |

Definitive Proxy Statement |

| |

|

| x |

Definitive Additional Materials |

| |

|

| o |

Soliciting Material under §240.14a-12 |

E. I. du Pont de Nemours and Company

(Name of Registrant as Specified In Its Charter)

Trian Fund Management, L.P.

Trian Fund Management GP, LLC

Trian Partners, L.P.

Trian Partners Strategic Investment Fund,

L.P.

Trian Partners Strategic Investment Fund

II, L.P.

Trian Partners Master Fund, L.P.

Trian Partners Parallel Fund I, L.P.

Trian Partners Master Fund (ERISA), L.P.

Trian Partners Strategic Investment Fund-A,

L.P.

Trian Partners Strategic Investment Fund-D,

L.P.

Trian Partners Strategic Investment Fund-N,

L.P.

Trian SPV (SUB) VIII, L.P.

Trian Partners Fund (Sub)-G, L.P.

Trian Partners Fund (Sub)-G II, L.P.

Nelson Peltz

Peter W. May

Edward P. Garden

John H. Myers

Arthur B. Winkleblack

Robert J. Zatta

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

| x |

No fee required |

| |

|

|

| o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

|

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant

to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| |

|

| o |

Fee paid previously with preliminary materials. |

| |

|

|

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

|

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

4) |

Date Filed: |

| |

|

|

Trian Fund Management, L.P. placed the following advertisement

in the print edition of Barron’s on May 2, 2015 and may from time to time place such advertisement in

additional publications:

Note: Trian has neither sought nor obtained consent from any third party to use previously published information in this advertisement.

© 2015 Trian Fund Management, L.P. All rights reserved. Trian Fund Management, L.P. (“Trian”) and the investment funds that it manages that hold shares of E.I. du Pont de Nemours and Company (the “Company”), together with other Participants (as defined below), filed a definitive proxy statement and an accompanying proxy card with the Securities and Exchange Commission (the “SEC”) on March 25, 2015 to be used to solicit proxies in connection with the 2015 Annual Meeting of Stockholders of the Company, including any adjournments or postponements thereof or any special meeting that may be called in lieu thereof (the “2015 Annual Meeting”). Information relating to the participants in such proxy solicitation (the “Participants”) has been included in that definitive proxy statement and in any other amendments to that definitive proxy statement. Stockholders are advised to read the definitive proxy statement and any other documents related to the solicitation of stockholders of the Company in connection with the 2015 Annual Meeting because they contain important information, including additional information relating to the Participants. The Participants’ definitive proxy statement and a form of proxy have been mailed to stockholders of the Company. These materials and other materials filed by the Participants in connection with the solicitation of proxies are available at no charge at the SEC’s website at www.sec.gov. The definitive proxy statement and other relevant documents filed by the Participants with the SEC are also available, without charge, by directing a request to Trian’s proxy solicitor, MacKenzie Partners, Inc. 105 Madison Avenue, New York, New York 10016 (call collect: 212-929-5500; call toll free: 800-322-2885) or email: proxy@mackenziepartners.com.

BOTH LEADING PROXY ADVISORY FIRMS RECOMMEND DUPONT STOCKHOLDERS

VOTE ON TRIAN’S GOLD CARD FOR NELSON PELTZ

It is clear to us that change is needed on the DuPont Board,

and Trian is deeply gratified that the two leading proxy advisory firms, Institutional Shareholder Services Inc. (“ISS”)

and Glass, Lewis & Co., LLC (“Glass Lewis”), agree.

ISS and Glass Lewis support Trian’s efforts to hold the

Board accountable for DuPont’s consistent underperformance – ISS has recommended that DuPont stockholders vote the

GOLD proxy card FOR Trian’s nominees Nelson Peltz and John H. Myers, and Glass Lewis has recommended a vote FOR

Nelson Peltz at DuPont’s Annual Meeting on May 13, 2015.

ISS and Glass Lewis’ recommendations to vote on the GOLD

card underscores Trian’s view that increased oversight is needed in the DuPont boardroom to improve performance and enhance

stockholder value.

ISS...

...CALLS FOR TRIAN TO BRING CHANGE TO THE BOARDROOM

“The evidence of this contest strongly suggests that the

extensive preparation of the Trian method — providing its executives who go on boards with extensive analytic support throughout

their tenures — may be not simply desirable, but necessary to drive the appropriate change. Ultimately this appears to be

less a ’shadow management team’ than about a commitment to informed and effective participation in the boardroom. Peltz’

election thus seems clearly in the best interest of all shareholders.”

...HIGHLIGHTS THE QUALIFICATIONS OF TRIAN’S FOUR NOMINEES

“Like Peltz, [Myers] brings an investor perspective to

the boardroom – but he also has significant, long-term experience managing and growing a business within a larger conglomerate

structure.” “Both Zatta and Winkleblack appear well-qualified nominees, particularly given their experience as CFO’s

with significant strategic responsibilities. In an engagement with the dissident nominees as part of our research process, their

CFO experiences seem sufficiently diverse to believe they would be complementary, not duplicative in the boardroom.”

GLASS LEWIS...

...RECOGNIZES THAT THERE IS MUCH MORE VALUE TO BE CREATED AT

DUPONT

“In this case, we believe Trian has identified legitimate

concerns at DuPont, primarily related to operational execution and management accountability, which we believe substantiate the

Dissident’s central thesis that the Company is not performing to its full potential -- and that significant value may yet

be created by further addressing Trian’s ongoing criticisms. In particular, we believe shareholders should be concerned with

management’s inability in recent years to meet its own long-term growth targets or its initial earnings guidance in any of

the last three years.”

TRIAN BELIEVES ALL FOUR OF ITS HIGHLY QUALIFIED NOMINEES ARE

NEEDED IN THE BOARDROOM TO HELP DUPONT BE GREAT AGAIN.

PROTECT AND ENHANCE YOUR INVESTMENT — VOTE GOLD TODAY

###

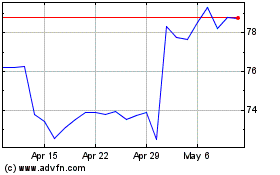

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024