UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): April 21, 2015

E. I. du Pont de Nemours and Company

(Exact Name of Registrant as Specified in Its Charter)

|

| | | | |

Delaware | | 1-815 | | 51-0014090 |

(State or Other Jurisdiction | | (Commission | | (I.R.S. Employer |

Of Incorporation) | | File Number) | | Identification No.) |

1007 Market Street

Wilmington, Delaware 19898

(Address of principal executive offices)

Registrant’s telephone number, including area code: (302) 774-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On April 21, 2015, the Registrant announced its consolidated financial results for the quarter ended March 31, 2015. A copy of the Registrant’s press release is furnished on Form 8-K. The information contained in Item 2.02, including Exhibit 99.1, of this report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and it will not be incorporated by reference into any registration statement or other document filed by the Registrant under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

99.1 Press Release dated April 21, 2015

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| E. I. DU PONT DE NEMOURS AND COMPANY |

| (Registrant) |

| |

| |

| /s/ Barry J. Niziolek |

| Barry J. Niziolek |

| Vice President and Controller |

April 21, 2015

|

| | | | | |

| | | | | Exhibit 99.1 |

| | | | | |

| | | | | |

April 21, 2015 | | | | Media Contact: | Dan Turner |

WILMINGTON, Del. | | | | | 302-774-0081 |

| | | | | daniel.a.turner@dupont.com |

| | | | Investor Contact: | 302-774-4994 |

DuPont Reports 1Q Operating EPS of $1.34

Announces 4 percent increase in 2Q 2015 dividend

First Quarter Highlights

| |

• | Delivered first-quarter operating earnings per share of $1.34, which includes a $0.25 per share negative impact from currency in segment results. |

| |

• | Delivered volume growth and operating margin improvement in Performance Materials, Safety & Protection, Nutrition & Health, and Industrial Biosciences and introduced over 600 new products in the first quarter, a 5 percent increase from prior year. |

| |

• | Sales were $9.2 billion, down 9 percent versus prior year primarily due to impacts from currency (6 percent), portfolio changes (2 percent) and expected near-term industry-wide challenges in Agriculture and Performance Chemicals. |

| |

• | Cost reductions from operational redesign contributed $0.10 per share to first-quarter operating earnings; 2015 total cost savings expected to increase to approximately $0.40 per share. |

| |

• | Estimated negative currency impact in 2015 increased to approximately $0.80 per share, up from the $0.60 per share we previously communicated; Company now expects to be at the low end of the previously communicated outlook range of $4.00-$4.20 operating earnings per share, including Performance Chemicals segment. |

WILMINGTON, Del., April 21, 2015 - DuPont (NYSE: DD), a science company that brings world-class, innovative products, materials, and services to the global marketplace, today announced first quarter 2015 operating earnings of $1.34 per share, which includes a $0.25 per share negative currency impact, compared to $1.58 per share in the prior year. GAAP1 earnings were $1.0 billion, or $1.13 per share, compared to $1.4 billion, or $1.54 per share, in the prior year.

DuPont also announced that its board of directors approved a second quarter dividend of 49 cents per share, a 4 percent increase over the 47 cents paid last quarter. This is the fourth increase since the beginning of 2012. The second quarter dividend of 49 cents per share of common stock is payable on June 12, 2015 to stockholders of record at the close of business on May 15, 2015.

1Generally Accepted Accounting Principles (GAAP)

E.I. du Pont de Nemours and Company

“DuPont delivered volume and margin improvements in the majority of our post-spin segments through intense focus on innovation, disciplined execution and ongoing efficiency improvements and cost reduction, even in the midst of challenging currency and market environments.” said Ellen Kullman, DuPont Chair and CEO. “We expect performance in the remainder of the year to build on this momentum, driven by new product sales and benefits from our accelerated operational redesign. We are also announcing our fourth quarterly dividend increase since the beginning of 2012, reflecting our confidence in the continued strength of our ongoing, post-spin business and our ability to advance our record of stable growth while returning capital to shareholders.”

“2015 is an important year in our transformation. The spin-off of Chemours is on track for the middle of this year, and we expect to return to shareholders substantially all of the approximately $4 billion of one-time dividend proceeds within 12 to 18 months of the separation, a portion of which will occur before the end of 2015. Following the separation, DuPont will be fully focused on three highly attractive strategic focus areas where our science and engineering capabilities can deliver the greatest value for shareholders. We are confident that DuPont will continue its momentum, growing value for shareholders by leveraging our innovation platform, focusing intently on operational efficiency and costs, actively managing our portfolio, and through the disciplined return of capital.”

Global Consolidated Net Sales - 1st Quarter

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | |

| | March 31, 2015 | Percentage Change Due to: |

(Dollars in millions) | | $ | | % Change | | Local Price and Product Mix | | Currency | | Volume | | Portfolio/Other |

U.S. & Canada | | $ | 4,319 |

| | (3 | ) | | (1 | ) | | — |

| | — |

| | (2 | ) |

EMEA* | | 2,418 |

| | (18 | ) | | 3 |

| | (16 | ) | | (3 | ) | | (2 | ) |

Asia Pacific | | 1,643 |

| | (6 | ) | | (1 | ) | | (3 | ) | | — |

| | (2 | ) |

Latin America | | 792 |

| | (18 | ) | | (1 | ) | | (6 | ) | | (9 | ) | | (2 | ) |

| | | | | | | | | | | | |

Total Consolidated Sales | | $ | 9,172 |

| | (9 | ) | | — |

| | (6 | ) | | (1 | ) | | (2 | ) |

| | | | | | | | | | | | |

* Europe, Middle East & Africa | | | | | | | | | | | | |

Segment Sales - 1st Quarter

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | March 31, 2015 | Percentage Change Due to: |

(Dollars in millions) | | $ | | % Change | | Local Price and Product Mix | | Currency | | Volume | | Portfolio/Other |

Agriculture | | $ | 3,937 |

| | (10 | ) | | 3 |

| | (8 | ) | | (5 | ) | | — |

|

Electronics & Communications | | 521 |

| | (10 | ) | | (5 | ) | | (2 | ) | | (3 | ) | | — |

|

Industrial Biosciences | | 285 |

| | (5 | ) | | — |

| | (6 | ) | | 1 |

| | — |

|

Nutrition & Health | | 813 |

| | (6 | ) | | — |

| | (8 | ) | | 2 |

| | — |

|

Performance Chemicals | | 1,364 |

| | (14 | ) | | (3 | ) | | (3 | ) | | (6 | ) | | (2 | ) |

Performance Materials | | 1,411 |

| | (8 | ) | | (3 | ) | | (5 | ) | | 8 |

| | (8 | ) |

Safety & Protection | | 909 |

| | (4 | ) | | (1 | ) | | (4 | ) | | 6 |

| | (5 | ) |

Other | | 1 |

| | | | | | | | | | |

Total segment sales | | 9,241 |

| | (9 | ) | | — |

| | (6 | ) | | (1 | ) | | (2 | ) |

Elimination of transfers | | (69 | ) | | | | | | | | | | |

Consolidated net sales | | $ | 9,172 |

| | | | | | | | | | |

Operating Earnings - 1st Quarter

|

| | | | | | | | | | | | | | | |

| | | | | | Change vs. 2014 |

(Dollars in millions) | | 1Q15 | | 1Q14 | | $ | | % |

Agriculture | | $ | 1,139 |

| | $ | 1,442 |

| | $ | (303 | ) | | -21 | % |

Electronics & Communications | | 85 |

| | 75 |

| | 10 |

| | 13 | % |

Industrial Biosciences | | 56 |

| | 56 |

| | — |

| | — | % |

Nutrition & Health | | 89 |

| | 93 |

| | (4 | ) | | -4 | % |

Performance Chemicals (1) | | 129 |

| | 206 |

| | (77 | ) | | -37 | % |

Performance Materials (1) | | 327 |

| | 293 |

| | 34 |

| | 12 | % |

Safety & Protection | | 184 |

| | 175 |

| | 9 |

| | 5 | % |

Other | | (66 | ) | | (92 | ) | | 26 |

| | 28 | % |

Total segment operating earnings (2) | | 1,943 |

| | 2,248 |

| | (305 | ) | | -14 | % |

| | | | | | | |

|

Exchange gains (losses) (2),(3) | | 127 |

| | (96 | ) | | 223 |

| |

|

|

Corporate expenses | | (164 | ) | | (201 | ) | | 37 |

| |

|

Interest expense | | (84 | ) | | (103 | ) | | 19 |

| |

|

Operating earnings before income taxes | | 1,822 |

| | 1,848 |

| | (26 | ) | | -1 | % |

| | | | | | | |

|

Provision for income taxes on operating earnings | | (590 | ) | | (370 | ) | | (220 | ) | |

|

|

Net income attributable to noncontrolling interests | | 4 |

| | 6 |

| | (2 | ) | |

|

Operating earnings | | $ | 1,228 |

| | $ | 1,472 |

| | $ | (244 | ) | | -17 | % |

| | | | | | | |

|

Operating earnings per share | | $ | 1.34 |

| | $ | 1.58 |

| | $ | (0.24 | ) | | -15 | % |

| | | | | | | | |

(1) Prior period reflects the reclassifications of the Viton® fluoroelastomer product line from Performance Materials to Performance Chemicals. |

(2) See Schedules B and C for listing of significant items and their impact by segment. |

(3) See Schedule D for additional information on exchange gains and losses. |

The following is a summary of business results for each of the company’s reportable segments comparing first quarter with the prior year, unless otherwise noted.

Agriculture - Operating earnings of $1,139 million decreased $303 million, or 21 percent, as improved product mix in Pioneer, pricing actions taken in parts of Europe and Asia and productivity improvements were more than offset by the negative impact of currency, decreased volumes from expected reduction in global corn planted area, lower insecticide demand in Latin America and timing of seed shipments.

Electronics & Communications - Operating earnings of $85 million increased $10 million, or 13 percent, driven by increased demand in consumer electronics and productivity gains which were partially offset by competitive pressures impacting Solamet® paste and the negative impact of currency.

Industrial Biosciences - Operating earnings of $56 million were even with prior year as increased enzyme demand, principally in food markets, was offset by the negative impact of currency and lower biomaterials sales.

Nutrition & Health - Operating earnings of $89 million decreased $4 million, or 4 percent, as volume gains and improved product mix were more than offset by the negative impact of currency.

Performance Chemicals - Operating earnings of $129 million decreased $77 million, or 37 percent, driven by lower prices and volumes for titanium dioxide, and the negative impact of currency.

Performance Materials - Operating earnings of $327 million increased $34 million, or 12 percent, driven by volume growth for ethylene and improved product mix, partially offset by lower ethylene prices and the negative impact of currency. Prior year ethylene sales were constrained in advance of a scheduled outage at the Orange, Texas ethylene unit.

Safety & Protection - Operating earnings of $184 million increased $9 million, or 5 percent, on broad-based volume growth in global industrial markets, continued strong public sector demand in Europe and productivity improvements partially offset by the negative impact of currency. Higher costs associated with lower plant utilization at the Chambers Works facility were largely offset by a benefit in connection with the advancement of an ongoing claim.

Outlook

Given the continued strengthening of the U.S. dollar relative to an average basket of exchange rates for our business for the week beginning April 13th, the company now estimates an approximately $0.80 per share negative currency impact in 2015, up from the $0.60 per share the Company estimated on January 23rd. The company also now anticipates that the operational redesign will deliver savings of approximately $0.40 per share in 2015. As a result, the company expects to be at the low end of its previously communicated outlook range of $4.00-$4.20 operating earnings per share for 2015, including the full year outlook for the Performance Chemicals segment.

The 2015 outlook does not reflect the planned separation of the Performance Chemicals segment or the impact of the expected return of capital related to the separation.

DuPont will hold a conference call and webcast on Tuesday, April 21, 2015, at 9:00 AM EDT to discuss this news release. The webcast and additional presentation materials can be accessed by visiting the company’s investor website (Events & Presentations) at www.investors.dupont.com. A replay of the conference call webcast will be available for 90 days by calling 1-630-652-3042, Passcode 38251527#. For additional information see the investor center at http://www.dupont.com.

Use of Non-GAAP Measures

Management believes that certain non-GAAP measurements are meaningful to investors because they provide insight with respect to ongoing operating results of the company. Such measurements are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. Reconciliations of non-GAAP measures to GAAP are provided in schedules A, C and D.

About DuPont

DuPont (NYSE: DD) has been bringing world-class science and engineering to the global marketplace in the form of innovative products, materials, and services since 1802. The company believes that by collaborating with customers, governments, NGOs, and thought leaders we can help find solutions to such global challenges as providing enough healthy food for people everywhere, decreasing dependence on fossil fuels, and protecting life and the environment. For additional information about DuPont and its commitment to inclusive innovation, please visit http://www.dupont.com.

Forward Looking Statements: This document contains forward-looking statements which may be identified by their use of words like “plans,” “expects,” “will,” “believes,” “intends,” “estimates,” “anticipates” or other words of similar meaning. All statements that address expectations or projections about the future, including statements about the company’s strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures and financial results, are forward looking statements. Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control. Some of the important factors that could cause the company’s actual results to differ materially from those projected in any such forward-looking statements are: fluctuations in energy and raw material prices; failure to develop and market new products and optimally manage product life cycles; ability to respond to market acceptance, rules, regulations and policies affecting products based on biotechnology; significant litigation and environmental matters; failure to appropriately manage process safety and product stewardship issues; changes in laws and regulations or political conditions; global economic and capital markets conditions, such as inflation, interest and currency exchange rates; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, weather events and natural disasters; ability to protect and enforce the company’s intellectual property rights; successful integration of acquired businesses and separation of underperforming or non-strategic assets or businesses and successful completion of the proposed spinoff of the Performance Chemicals segment including ability to fully realize the expected benefits of the proposed spinoff. The company undertakes no duty to update any forward-looking statements as a result of future developments or new information.

# # #

04/21/15

6

E.I. du Pont de Nemours and Company

Consolidated Income Statements

(Dollars in millions, except per share amounts)

|

| | | | | | | |

SCHEDULE A | | | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

Net sales | $ | 9,172 |

| | $ | 10,128 |

|

Other income, net (1) | 198 |

| | 17 |

|

Total | 9,370 |

| | 10,145 |

|

| | | |

Cost of goods sold | 5,553 |

| | 6,000 |

|

Other operating charges (1) | 283 |

| | 286 |

|

Selling, general and administrative expenses | 1,312 |

| | 1,436 |

|

Research and development expense | 499 |

| | 518 |

|

Interest expense | 84 |

| | 103 |

|

Employee separation / asset related charges, net (1) | 38 |

| | — |

|

Total | 7,769 |

| | 8,343 |

|

| | | |

Income before income taxes | 1,601 |

| | 1,802 |

|

Provision for income taxes (1) | 566 |

| | 357 |

|

Net income | 1,035 |

| | 1,445 |

|

| | | |

Less: Net income attributable to noncontrolling interests | 4 |

| | 6 |

|

| | | |

Net income attributable to DuPont | $ | 1,031 |

| | $ | 1,439 |

|

| | | |

Basic earnings per share of common stock | $ | 1.13 |

| | $ | 1.56 |

|

| | | |

Diluted earnings per share of common stock | $ | 1.13 |

| | $ | 1.54 |

|

| | | |

Dividends per share of common stock | $ | 0.47 |

| | $ | 0.45 |

|

| | | |

Average number of shares outstanding used in earnings per share (EPS) calculation: | | | |

Basic | 906,835,000 |

| | 923,461,000 |

|

Diluted | 913,819,000 |

| | 930,732,000 |

|

| | | |

|

| | | | | | | | | | |

Reconciliation of Non-GAAP Measures | | | | | |

Summary of Earnings Comparison | | | | | |

| Three Months Ended March 31, |

| 2015 | | 2014 | | % Change |

Net income (GAAP) | $ | 1,035 |

| | $ | 1,445 |

| | (28 | )% |

Less: Significant items charge (benefit), after-tax, included in net income (per Schedule B) | (126 | ) | | (12 | ) | | |

Non-operating pension/OPEB costs, after-tax, included in net income (2) | (71 | ) | | (21 | ) | | |

Net income attributable to noncontrolling interest | 4 |

| | 6 |

| | |

Operating earnings (Non-GAAP) | $ | 1,228 |

| | $ | 1,472 |

| | (17 | )% |

| | | | | |

EPS attributable to DuPont (GAAP) | $ | 1.13 |

| | $ | 1.54 |

| | (27 | )% |

Significant items charge (benefit) included in EPS (per Schedule B) | (0.14 | ) | | (0.01 | ) | | |

Non-operating pension/OPEB costs included in EPS (2) | (0.07 | ) | | (0.03 | ) | | |

Operating EPS (Non-GAAP) | $ | 1.34 |

| | $ | 1.58 |

| | (15 | )% |

| | | | | |

7

E.I. du Pont de Nemours and Company

Condensed Consolidated Balance Sheets

(Dollars in millions, except per share amounts)

|

| | | | | | | | |

SCHEDULE A (continued) | | |

| | March 31, 2015 | | December 31, 2014 |

Assets | | | | |

Current assets | | | | |

Cash and cash equivalents | | $ | 3,622 |

| | $ | 6,910 |

|

Marketable securities | | 125 |

| | 124 |

|

Accounts and notes receivable, net | | 7,651 |

| | 6,005 |

|

Inventories | | 7,051 |

| | 7,841 |

|

Prepaid expenses | | 366 |

| | 279 |

|

Deferred income taxes | | 504 |

| | 589 |

|

Total current assets | | 19,319 |

| | 21,748 |

|

Property, plant and equipment, net of accumulated depreciation (March 31, 2015- $20,057; December 31, 2014 - $19,942) | | 12,873 |

| | 13,386 |

|

Goodwill | | 4,365 |

| | 4,529 |

|

Other intangible assets | | 4,307 |

| | 4,580 |

|

Investment in affiliates | | 929 |

| | 886 |

|

Deferred income taxes | | 3,244 |

| | 3,349 |

|

Other assets | | 1,138 |

| | 1,096 |

|

Total | | $ | 46,175 |

| | $ | 49,574 |

|

| | | | |

Liabilities and Equity | | | | |

Current liabilities | | | | |

Accounts payable | | $ | 3,706 |

| | $ | 4,822 |

|

Short-term borrowings and capital lease obligations | | 1,621 |

| | 1,423 |

|

Income taxes | | 654 |

| | 547 |

|

Other accrued liabilities | | 4,751 |

| | 5,848 |

|

Total current liabilities | | 10,732 |

| | 12,640 |

|

Long-term borrowings and capital lease obligations | | 8,763 |

| | 9,271 |

|

Other liabilities | | 13,329 |

| | 13,819 |

|

Deferred income taxes | | 489 |

| | 466 |

|

Total liabilities | | 33,313 |

| | 36,196 |

|

| | | | |

Commitments and contingent liabilities | | | | |

| | | | |

Stockholders' equity | | | | |

Preferred stock | | 237 |

| | 237 |

|

Common stock, $0.30 par value; 1,800,000,000 shares authorized; Issued at March 31, 2015 - 992,224,000; December 31, 2014 - 992,020,000 | | 298 |

| | 298 |

|

Additional paid-in capital | | 11,311 |

| | 11,174 |

|

Reinvested earnings | | 17,405 |

| | 17,045 |

|

Accumulated other comprehensive loss | | (9,722 | ) | | (8,707 | ) |

Common stock held in treasury, at cost (87,041,000 shares at March 31, 2015 and December 31, 2014) | | (6,727 | ) | | (6,727 | ) |

Total DuPont stockholders' equity | | 12,802 |

| | 13,320 |

|

Noncontrolling interests | | 60 |

| | 58 |

|

Total equity | | 12,862 |

| | 13,378 |

|

Total | | $ | 46,175 |

| | $ | 49,574 |

|

8

E.I. du Pont de Nemours and Company

Condensed Consolidated Statement of Cash Flows

(Dollars in millions)

|

| | | | | | | |

SCHEDULE A (continued) | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

Total Company | | | |

Net income | $ | 1,035 |

| | $ | 1,445 |

|

Adjustments to reconcile net income to cash used for operating activities: | | | |

Depreciation | 306 |

| | 312 |

|

Amortization of intangible assets | 140 |

| | 125 |

|

Net periodic pension benefit cost | 147 |

| | 100 |

|

Contributions to pension plans | (124 | ) | | (101 | ) |

Other operating activities - net | (2 | ) | | 212 |

|

Change in operating assets and liabilities - net | (3,625 | ) | | (4,514 | ) |

Cash used for operating activities | (2,123 | ) | | (2,421 | ) |

| | | |

Investing activities | | | |

Purchases of property, plant and equipment | (565 | ) | | (320 | ) |

Investments in affiliates | (45 | ) | | (22 | ) |

Proceeds from sales of businesses - net | 16 |

| | — |

|

Proceeds from sales of assets - net | 9 |

| | 7 |

|

Net decrease in short-term financial instruments | — |

| | 80 |

|

Foreign currency exchange contract settlements | 442 |

| | 15 |

|

Other investing activities - net | 3 |

| | 4 |

|

Cash used for investing activities | (140 | ) | | (236 | ) |

| | | |

Financing activities | | | |

Dividends paid to stockholders | (429 | ) | | (420 | ) |

Net decrease in borrowings | (309 | ) | | (1,127 | ) |

Repurchase / prepayments of common stock | (282 | ) | | (1,061 | ) |

Proceeds from exercise of stock options | 170 |

| | 153 |

|

Other financing activities - net | (1 | ) | | (14 | ) |

Cash used for financing activities | (851 | ) | | (2,469 | ) |

| | | |

Effect of exchange rate changes on cash | (174 | ) | | (33 | ) |

| | | |

Decrease in cash and cash equivalents | (3,288 | ) | | (5,159 | ) |

| | | |

Cash and cash equivalents at beginning of period | 6,910 |

| | 8,941 |

|

| | | |

Cash and cash equivalents at end of period | $ | 3,622 |

| | $ | 3,782 |

|

| | | |

Reconciliation of Non-GAAP Measure | | | |

Calculation of Free Cash Flow - Total Company | | | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

Cash used for operating activities | $ | (2,123 | ) | | $ | (2,421 | ) |

Purchases of property, plant and equipment | (565 | ) | | (320 | ) |

Free cash flow | $ | (2,688 | ) | | $ | (2,741 | ) |

| | | |

(1) See Schedule B for detail of significant items. |

(2) First quarter 2015 includes the impact of an after-tax exchange loss on non-operating pension of $23. |

9

E.I. du Pont de Nemours and Company

Schedule of Significant Items

(Dollars in millions, except per share amounts)

|

| | | | | | | | | | | | | | | | | | | | | | | | |

SCHEDULE B | | | | | | | | | | |

SIGNIFICANT ITEMS | | | | |

| | | | | | | | | | | | |

| | Pre-tax | | After-tax | | ($ Per Share) |

| | 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | 2014 |

1st Quarter | | | | | | | | | | | |

Separation transaction costs (1) | $ | (81 | ) | | $ | (16 | ) | | $ | (80 | ) | | $ | (12 | ) | | $ | (0.09 | ) | | $ | (0.01 | ) |

Customer claims recovery (2) | 35 |

| | — |

| | 22 |

| | — |

| | 0.02 |

| | — |

|

Asset impairment charge (3) | (37 | ) | | — |

| | (30 | ) | | — |

| | (0.03 | ) | | — |

|

Ukraine devaluation (4) | (40 | ) | | — |

| | (38 | ) | | — |

| | (0.04 | ) | | — |

|

1st Quarter - Total | $ | (123 | ) | | $ | (16 | ) | | $ | (126 | ) | | $ | (12 | ) | | $ | (0.14 | ) | | $ | (0.01 | ) |

|

| | | | | | | | | | | | |

(1) | First quarter 2015 and 2014 included charges of $(81) and $(16), respectively recorded in other operating charges associated with transaction costs related to the separation of the Performance Chemicals segment.

|

| |

(2) | The company recorded insurance recoveries of $35 in other operating charges, in the first quarter 2015 in the Agriculture segment, for recovery of costs for customer claims related to the use of the Imprelis® herbicide. The company had accruals of $231 related to these customer claims at March 31, 2015. The company has submitted and will continue to submit requests for payment to its insurance carriers for costs associated with this matter. To date, the company has recognized $318 of insurance recoveries from its insurance carriers and continues to seek recovery although the timing and outcome remain uncertain.

|

| |

(3) | During first quarter of 2015, a $(37) pre-tax impairment charge was recorded in employee separation / asset related charges, net for a cost basis investment within the Other segment. The assessment resulted from the venture's revised operating plan reflecting underperformance of its European wheat based ethanol facility and deteriorating European ethanol market conditions. One of the primary investors has communicated they would not fund the revised operating plan of the investee. As a result, the carrying value of our 6% equity investment in this venture exceeds its fair value.

|

| |

(4) | First quarter 2015 included a charge of $(40) in other income, net associated with remeasuring the company’s Ukrainian hryvnia net monetary assets. Ukraine’s central bank adopted a decision to no longer set the indicative hryvnia exchange rate. The hryvnia became a free-floating exchange rate and lost approximately a third of its value through the quarter.

|

10

E.I. du Pont de Nemours and Company

Consolidated Segment Information

(Dollars in millions)

|

| | | | | | | |

SCHEDULE C | | | |

| Three Months Ended March 31, |

SEGMENT SALES (1) | 2015 | | 2014 |

Agriculture | $ | 3,937 |

| | $ | 4,394 |

|

Electronics & Communications | 521 |

| | 580 |

|

Industrial Biosciences | 285 |

| | 301 |

|

Nutrition & Health | 813 |

| | 861 |

|

Performance Chemicals (2) | 1,364 |

| | 1,591 |

|

Performance Materials (2) | 1,411 |

| | 1,534 |

|

Safety & Protection | 909 |

| | 947 |

|

Other | 1 |

| | 1 |

|

Total Segment sales | 9,241 |

| | 10,209 |

|

| | | |

Elimination of transfers | (69 | ) | | (81 | ) |

Consolidated net sales | $ | 9,172 |

| | $ | 10,128 |

|

| | | |

11

E.I. du Pont de Nemours and Company

Consolidated Segment Information

(Dollars in millions)

|

| | | | | | | | |

SCHEDULE C (continued) | | | | |

| | Three Months Ended March 31, |

INCOME BEFORE INCOME TAXES (GAAP) | 2015 | | 2014 |

Agriculture | | $ | 1,174 |

| | $ | 1,442 |

|

Electronics & Communications | | 85 |

| | 75 |

|

Industrial Biosciences | | 56 |

| | 56 |

|

Nutrition & Health | | 89 |

| | 93 |

|

Performance Chemicals (2) | | 129 |

| | 206 |

|

Performance Materials (2) | | 327 |

| | 293 |

|

Safety & Protection | | 184 |

| | 175 |

|

Other | | (103 | ) | | (92 | ) |

Total Segment PTOI | | 1,941 |

| | 2,248 |

|

Corporate expenses | | (245 | ) | | (217 | ) |

Interest expense | | (84 | ) | | (103 | ) |

Non-operating pension/OPEB costs | | (75 | ) | | (30 | ) |

Net exchange gains (losses) | | 64 |

| | (96 | ) |

Income before income taxes | | $ | 1,601 |

| | $ | 1,802 |

|

| | | | |

| | Three Months Ended March 31, |

SIGNIFICANT ITEMS BY SEGMENT (PRE-TAX) (4) | | 2015 | | 2014 |

Agriculture | | $ | 35 |

| | $ | — |

|

Electronics & Communications | | — |

| | — |

|

Industrial Biosciences | | — |

| | — |

|

Nutrition & Health | | — |

| | — |

|

Performance Chemicals (2) | | — |

| | — |

|

Performance Materials (2) | | — |

| | — |

|

Safety & Protection | | — |

| | — |

|

Other | | (37 | ) | | — |

|

Total significant items by segment | | (2 | ) | | — |

|

Corporate expenses | | (81 | ) | | (16 | ) |

Net exchange gains (losses) | | (40 | ) | | — |

|

Total significant items before income taxes | | $ | (123 | ) | | $ | (16 | ) |

| | | | |

| | Three Months Ended March 31, |

OPERATING EARNINGS (NON-GAAP) | | 2015 | | 2014 |

Agriculture | | $ | 1,139 |

| | $ | 1,442 |

|

Electronics & Communications | | 85 |

| | 75 |

|

Industrial Biosciences | | 56 |

| | 56 |

|

Nutrition & Health | | 89 |

| | 93 |

|

Performance Chemicals (2) | | 129 |

| | 206 |

|

Performance Materials (2) | | 327 |

| | 293 |

|

Safety & Protection | | 184 |

| | 175 |

|

Other | | (66 | ) | | (92 | ) |

Total segment operating earnings | | 1,943 |

| | 2,248 |

|

Corporate expenses | | (164 | ) | | (201 | ) |

Interest expense | | (84 | ) | | (103 | ) |

Operating earnings before income taxes and exchange gains (losses) | | 1,695 |

| | 1,944 |

|

Net exchange gains (losses) (3) | | 127 |

| | (96 | ) |

Operating earnings before income taxes | | $ | 1,822 |

| | $ | 1,848 |

|

| | | | |

(1) Segment sales include transfers. |

(2) Prior periods reflect the reclassifications of the Viton® product line from Performance Materials to Performance Chemicals. |

(3) See Schedule D for additional information on exchange gains and losses. First quarter 2015 exchange gains, on an operating earnings basis (Non-GAAP), excludes the impact of a $23 exchange loss on non-operating pension.

|

(4) See Schedule B for detail of significant items. |

12

E.I. du Pont de Nemours and Company

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

|

| | | | | | | | | |

SCHEDULE D | | | | | |

Reconciliations of Adjusted EBIT / EBITDA to Consolidated Income Statements |

| | | | | |

| | | Three Months Ended March 31, |

| | | 2015 | | 2014 |

Income before income taxes | | $ | 1,601 |

| | $ | 1,802 |

|

Add: Significant items before income taxes | | 123 |

| | 16 |

|

Add: Non-operating pension/OPEB costs(1) | | 98 |

| | 30 |

|

Operating earnings before income taxes | | $ | 1,822 |

| | $ | 1,848 |

|

Less: Net income attributable to noncontrolling interests | | 4 |

| | 6 |

|

Add: Interest expense | | | 84 |

| | 103 |

|

Adjusted EBIT from operating earnings | | 1,902 |

| | 1,945 |

|

Add: Depreciation and amortization | | 446 |

| | 437 |

|

Adjusted EBITDA from operating earnings | | $ | 2,348 |

| | $ | 2,382 |

|

| | | | | |

| | | | | |

Reconciliation of Operating Earnings Per Share (EPS) Outlook |

The reconciliation below represents the company's outlook on an operating earnings basis, defined as earnings excluding significant items and non-operating pension/OPEB costs. |

| | | | | |

| | | Year Ended December 31, |

| | | 2015 Outlook | | 2014 Actual |

Operating EPS (Non-GAAP) | | | $4.00-$4.20 |

| | $ | 4.01 |

|

| | | | | |

Significant items | | | | | |

Separation transaction costs | | | (0.30 | ) | | (0.14 | ) |

Gain on sale of business | | | | | 0.47 |

|

Restructuring charge | | | | | (0.42 | ) |

Venezuela devaluation | | | | | (0.06 | ) |

Tax items | | | | | — |

|

Customer claims recovery | | | 0.02 |

| | 0.14 |

|

Restructuring charge/adjustments | | | | — |

|

Litigation settlement | | | | | — |

|

Asset impairment charge | | | (0.03 | ) | | — |

|

Ukraine devaluation | | | (0.04 | ) | | — |

|

| | | | | |

Non-operating pension/OPEB costs - estimate | | | (0.21 | ) | | (0.10 | ) |

| | | | | |

EPS (GAAP) | | | $3.44-$3.64 |

| | $ | 3.90 |

|

| | | | | |

13

E.I. du Pont de Nemours and Company

Reconciliation of Non-GAAP Measures

(Dollars in millions, except per share amounts)

|

| | | | | | | | |

SCHEDULE D (continued) | | | | |

| | | | |

Exchange Gains/Losses on Operating Earnings(2) | | | | |

The company routinely uses forward exchange contracts to offset its net exposures, by currency, related to the foreign currency denominated monetary assets and liabilities of its operations. The objective of this program is to maintain an approximately balanced position in foreign currencies in order to minimize, on an after-tax basis, the effects of exchange rate changes. The net pre-tax exchange gains and losses are recorded in other income, net and the related tax impact is recorded in provision for (benefit from) income taxes on the Consolidated Income Statements. |

| | | | |

| | Three Months Ended March 31, |

| | 2015 | | 2014 |

Subsidiary Monetary Position Gain (Loss) | | | | |

Pre-tax exchange losses | | $ | (120 | ) | | $ | (50 | ) |

Local tax (expenses) benefits | | (123 | ) | | 12 |

|

Net after-tax impact from subsidiary exchange losses | | $ | (243 | ) | | $ | (38 | ) |

| | | | |

Hedging Program Gain (Loss) | | | | |

Pre-tax exchange gains (losses) | | $ | 247 |

| | $ | (46 | ) |

Tax (expenses) benefits | | (89 | ) | | 16 |

|

Net after-tax impact from hedging program exchange gains (losses) | | $ | 158 |

| | $ | (30 | ) |

| | | | |

Total Exchange Gain (Loss) | | | | |

Pre-tax exchange gains (losses) (3) | | $ | 127 |

| | $ | (96 | ) |

Tax (expenses) benefits | | (212 | ) | | 28 |

|

Net after-tax exchange losses | | $ | (85 | ) | | $ | (68 | ) |

| | | | |

As shown above, the "Total Exchange Gain (Loss)" is the sum of the "Subsidiary Monetary Position Gain (Loss)" and the "Hedging Program Gain (Loss)." |

| | | | |

Reconciliation of Base Income Tax Rate to Effective Income Tax Rate |

Base income tax rate is defined as the effective income tax rate less the effect of exchange gains (losses), as defined above, significant items and non-operating pension/OPEB costs. |

| | | | |

| | Three Months Ended March 31, |

| | 2015 | | 2014 |

Income before income taxes | | $ | 1,601 |

| | $ | 1,802 |

|

Add: Significant items - charge (2) | | 123 |

| | 16 |

|

Non-operating pension/OPEB costs | | 98 |

| | 30 |

|

Less: Net exchange gains (losses) | | 127 |

| | (96 | ) |

Income before income taxes, significant items, | | | |

exchange gains (losses), and non-operating pension/OPEB costs | | $ | 1,695 |

| | $ | 1,944 |

|

| | | | |

Provision for income taxes | | $ | 566 |

| | $ | 357 |

|

Add: Tax (expenses) benefits on significant items | | (3 | ) | | 4 |

|

Tax benefits on non-operating pension/OPEB costs | 27 |

| | 9 |

|

Tax (expenses) benefits on exchange gains/losses | (212 | ) | | 28 |

|

Provision for income taxes on operating earnings, excluding exchange gains (losses) | $ | 378 |

| | $ | 398 |

|

| | | | |

Effective income tax rate | | 35.4 | % | | 19.8 | % |

Significant items effect and non-operating pension/OPEB costs effect | | (3.0 | )% | | 0.2 | % |

Tax rate, before significant items and non-operating pension/OPEB costs | 32.4 | % | | 20.0 | % |

Exchange gains (losses) effect | | (10.1 | )% | | 0.5 | % |

Base income tax rate | | 22.3 | % | | 20.5 | % |

| | | | |

(1) First quarter, 2015, non-operating pension/OPEB costs includes a $23 exchange loss on foreign pension balances. |

(2) See Schedule B for detail of significant items. |

(3) First quarter 2015 exchange gains, on an operating earnings basis (Non-GAAP), excludes a $23 exchange loss on non-operating pension. |

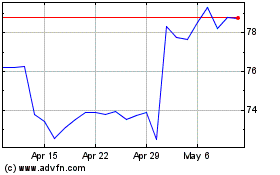

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024