Additional Proxy Soliciting Materials (definitive) (defa14a)

April 14 2015 - 6:04AM

Edgar (US Regulatory)

|

UNITED STATES |

|

SECURITIES AND EXCHANGE COMMISSION |

|

Washington, D.C. 20549 |

|

|

|

SCHEDULE 14A INFORMATION |

|

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

|

|

Filed by the Registrant x |

|

|

|

Filed by a Party other than the Registrant o |

|

|

|

Check the appropriate box: |

|

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

o |

Definitive Proxy Statement |

|

x |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

|

|

E. I. du Pont de Nemours and Company |

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

|

|

Payment of Filing Fee (Check the appropriate box): |

|

x |

No fee required. |

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

o |

Fee paid previously with preliminary materials. |

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

|

|

|

The email below was sent to certain employees of E. I. du Pont de Nemours and Company (“DuPont”) on April 13, 2015:

To: Wilmington Area Employees

Dear Colleagues:

The next few weeks will be very active as we advance the move to Chestnut Run, approach the official launch of Chemours and enter the final phase of the proxy contest with Trian Fund Management. That is a lot to absorb and navigate, and we all need to stay focused on our core values, our commitment to customers and on each other to guide us through this period.

With the move to Chestnut Run, our changes in location undoubtedly make more real the impending division of DuPont and Chemours. I believe deeply that the best times are ahead for both organizations. The separation will create two strong companies, each with its own identity, based on distinct profiles and characteristics. Each entity will invest appropriately in its future, and each will build on an incredibly strong foundation of industry leadership.

That confidence in the future—and in all we have accomplished together—is what will also drive our progress through this final phase of the proxy contest. Nick and I, together with a group of our highly engaged directors, have been meeting and speaking with our shareholders. With increasing clarity about how our strategy is working and how it will continue to deliver increasing value, shareholders are very supportive of our strategic path forward.

Our progress will continue to be driven by our powerful innovation platform, expanding our global reach and ongoing improvements in productivity. Streamlined, agile and responsive to customers—all of these characteristics require cost discipline and constant attention to the size and structure of our organization. As we scale the organization for the next generation DuPont, related changes are impacting our people. We will continue to address changes and impacts on our people as respectfully and sensitively as we can, in a time when we must focus on being as competitive as possible—especially in light of the challenging markets in which we are operating.

The next few weeks of the proxy contest might feel increasingly intense as Trian continues to press its case publicly and with our shareholders. The primary reason we are so actively opposing having Trian on the Board is their risky, value-destructive agenda to breakup the Company and add excessive debt—which relies on a campaign that significantly misrepresents and distorts the facts.

One example is Trian’s attempt to question my confidence in our long term potential by making misleading statements about my stock ownership, including in our local Wilmington newspaper, with references to options exercised last fall under a 10b5-1 plan that exercises options at a pre-determined price. In fact, my ownership of DuPont stock has consistently grown over time. It is four times greater than DuPont’s corporate governance requirement for executive stock ownership and comprises the vast majority of my family’s assets. By any measure, I have a significant stake in our company’s future, and my compensation is closely aligned with the interests of shareholders.

After 26 years with DuPont, and six as its CEO, I am proud of how we have grown value for customers and shareholders, outperforming our peers and major stock indexes. I could not be more committed to DuPont or confident that, working together, we will continue to generate significantly greater value in the years ahead.

I often remind myself, as I am sure you do, of our 212-year history as an iconic American company. During this time of change, I encourage all of us to draw on our heritage, our core values, our history of reinvention—and on each other—to help us stay focused on our customers and on all we will accomplish in the future.

- Ellen

2

Forward Looking Statements

This document contains forward-looking statements which may be identified by their use of words like “plans,” “expects,” “will,” “believes,” “intends,” “estimates,” “anticipates” or other words of similar meaning. All statements that address expectations or projections about the future, including statements about the company’s strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures and financial results, are forward looking statements. Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control. Some of the important factors that could cause the company’s actual results to differ materially from those projected in any such forward-looking statements are: fluctuations in energy and raw material prices; failure to develop and market new products and optimally manage product life cycles; ability to respond to market acceptance, rules, regulations and policies affecting products based on biotechnology; significant litigation and environmental matters; failure to appropriately manage process safety and product stewardship issues; changes in laws and regulations or political conditions; global economic and capital markets conditions, such as inflation, interest and currency exchange rates; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, weather events and natural disasters; ability to protect and enforce the company’s intellectual property rights; successful integration of acquired businesses and separation of underperforming or non-strategic assets or businesses and successful completion of the proposed spinoff of the Performance Chemicals segment including ability to fully realize the expected benefits of the proposed spinoff. The company undertakes no duty to update any forward-looking statements as a result of future developments or new information.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

DuPont has filed a definitive proxy statement with the U.S. Securities and Exchange Commission (the “SEC”) with respect to the 2015 Annual Meeting. DUPONT STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS AND SUPPLEMENTS), THE ACCOMPANYING WHITE PROXY CARD AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

DuPont, its directors, executive officers and other employees may be deemed to be participants in the solicitation of proxies from DuPont stockholders in connection with the matters to be considered at DuPont’s 2015 Annual Meeting. Information about DuPont’s directors and executive officers is available in DuPont’s definitive proxy statement, filed with the SEC on March 23, 2015, for its 2015 Annual Meeting. To the extent holdings of DuPont’s securities by such directors or executive officers have changed since the amounts printed in the proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is set forth in the definitive proxy statement and, to the extent applicable, will be updated in other materials to be filed with the SEC in connection with DuPont’s 2015 Annual Meeting. Stockholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by DuPont with the SEC free of charge at the SEC’s website at www.sec.gov. Copies also will be available free of charge at DuPont’s website at www.dupont.com or by contacting DuPont Investor Relations at (302) 774-4994.

3

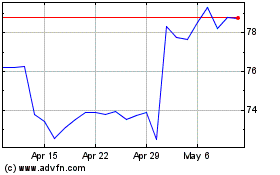

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024