Washington, D.C. 20549

PAYMENT OF FILING FEE (Check the appropriate box):

| o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

4) |

Proposed maximum aggregate value of transaction: |

| o |

Fee paid previously with preliminary materials. |

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

2) |

Form, Schedule or Registration Statement No.: |

On April 13, 2015, a representative of Trian Fund

Management, L.P. (“Trian”) presented materials at 13D Monitor’s Active-Passive Investor Summit. The materials

are attached hereto as Exhibit 1 and may be provided to stockholders of E.I. du Pont de Nemours and Company (the “Company”)

from time to time. The materials are being filed by Trian in HTML and PDF formats as a convenience for readers.

###

EXHIBIT 1

13D Monitor Materials April 13, 2015 © 2015 Trian Fund Management, L.P. All rights reserved.

Disclosure Statement And Disclaimers 2 Additional Information Trian Fund Management, L.P. (“Trian”) and the investment funds that it manages that hold shares of E.I. du Pont de Nemours an d C ompany (collectively, Trian with such funds, “Trian Partners”) together with other Participants (as defined below), filed a definitive proxy statem ent and an accompanying proxy card with the Securities and Exchange Commission (the “SEC”) on March 25, 2015 to be used to solicit proxies in connection wi th the 2015 Annual Meeting of Stockholders of E.I. du Pont de Nemours and Company (the “Company”), including any adjournments or postponements thereof o r a ny special meeting that may be called in lieu thereof (the “2015 Annual Meeting”). Information relating to the participants in such proxy solici tat ion (the “Participants”) has been included in that definitive proxy statement and in any other amendments to that definitive proxy statement. Stockholders are adv ised to read the definitive proxy statement and any other documents related to the solicitation of stockholders of the Company in connection with the 201 5 A nnual Meeting because they contain important information, including additional information relating to the Participants. Trian Partners’ definitive pr oxy statement and a form of proxy have been mailed to stockholders of the Company. These materials and other materials filed by Trian Partners in connection wi th the solicitation of proxies are available at no charge at the SEC’s website at www.sec.gov. The definitive proxy statement and other relevant documents f ile d by Trian Partners with the SEC are also available, without charge, by directing a request to Trian’s proxy solicitor, MacKenzie Partners, Inc. 105 Madison Avenue, New York, New York 10016 (call collect: 212 - 929 - 5500; call toll free: 800 - 322 - 2885) or email: proxy@mackenziepartners.com General Considerations This presentation is for general informational purposes only, is not complete and does not constitute an agreement, offer, a sol icitation of an offer, or any advice or recommendation to enter into or conclude any transaction or confirmation thereof (whether on the terms shown herein or otherwise). This presentation should not be construed as legal, tax, investment, financial or other advice. The views expressed in this presen tat ion represent the opinions of Trian Partners, and are based on publicly available information with respect to the Company and the other companies referred to herein. Trian Pa rtners recognizes that there may be confidential information in the possession of the companies discussed in this presentation that cou ld lead such companies to disagree with Trian Partners’ conclusions. Certain financial information and data used herein have been derived or obtained f rom filings made with the SEC or other regulatory authorities and from other third party reports. Trian Partners currently beneficially owns shares of the Com pany. Trian Partners has not sought or obtained consent from any third party to use any statements or information indicated herein as having been obtained or derived from statements made or published by third parties. Any such statements or information should not be viewed as indica tin g the support of such third party for the views expressed herein. Trian Partners does not endorse third - party estimates or research which are used in this p resentation solely for illustrative purposes. No warranty is made that data or information, whether derived or obtained from filings made with the S EC or any other regulatory agency or from any third party, are accurate. Past performance is not an indication of future results. Neither the Participants nor any of their affiliates shall be responsible or have any liability for any misinformation contai ned in any third party, SEC or other regulatory filing or third party report. Unless otherwise indicated, the figures presented in this presentation, including re tur n on invested capital (“ROIC”) and investment values have not been calculated using generally accepted accounting principles (“GAAP”) and have not been audited by independent accountants. Such figures may vary from GAAP accounting in material respects and there can be no assurance that the unrealize d v alues reflected in this presentation will be realized. This is not meant to be, nor is it, a prediction of the future trading price or market value of securities of the Company. T here is no assurance or guarantee with respect to the prices at which any securities of the Company will trade, and such securities m ay not trade at prices that may be implied herein. The estimates, projections, pro forma information and potential impact of the opportunities identified by Trian Partners herein are based on assumptions that Trian Partners believes to be reasonable as of the date of this presentation, but there can be no assurance or guarantee that actua l results or performance of the Company will not differ, and such differences may be material. This presentation does not recommend the purchase or sale of any security. Trian Partners reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Trian Partners disclaims any obligation to update the data, information or opinions contained in this presentation. Note: Disclosure Statement and Disclaimers are continued on the next page

Disclosure Statement And Disclaimers (cont’d) 3 Forward - Looking Statements This presentation contains forward - looking statements. All statements contained in this presentation that are not clearly histor ical in nature or that necessarily depend on future events are forward - looking, and the words “anticipate,” “believe,” “expect,” “potential,” “opportun ity,” “estimate,” “plan,” and similar expressions are generally intended to identify forward - looking statements . The projected results and statements contained in this presentation that are not historical facts are based on current expectations, speak only as of the date of this presentation and involve risks, un certainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or ac hievements expressed or implied by such projected results and statements . Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predic t a ccurately and many of which are beyond the control of Trian Partners . Although Trian Partners believes that the assumptions underlying the projected results or forward - looking statements are reasonable as of the date of this presentation, any of the assumptions could be inaccurate and, therefore, the re can be no assurance that the projected results or forward - looking statements included in this presentation will prove to be accurate . In light of the significant uncertainties inherent in the projected results and forward - looking statements included in this presentation, the inclusion of such information should not be regarded as a representation as to future results or that the objectives and initiatives expressed or implied by such projected results and forward - looking statements will be achieved . Trian Partners will not undertake and specifically declines any obligation to disclose the results of any revisions that may be mad e t o any projected results or forward - looking statements in this presentation to reflect events or circumstances after the date of such p rojected results or statements or to reflect the occurrence of anticipated or unanticipated events . Not An Offer to Sell or a Solicitation of an Offer to Buy Under no circumstances is this presentation intended to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy any security. Funds managed by Trian are in the business of trading -- buying and selling -- securities. It is possible that there will be developments in the future that cause one or more of such funds from time to time to sell all or a portion of their holdings in open market transactions or o the rwise (including via short sales), buy additional shares (in open market or privately negotiated transactions or otherwise), or trade in options, puts, cal ls or other derivative instruments relating to such shares . Consequently , Trian Partners’ beneficial ownership of shares of, and/or economic interest in, the Company‘s common stock may vary over time depending on various factors, with or without regard to Trian Partners’ views of the Company’s business, prospects or valuation (including the market price of the Company ’s common stock), including without limitation, other investment opportunities available to Trian Partners, concentration of positions in the portfolios managed by Trian, conditions in the securities markets and general economic and industry conditions . Trian Partners also reserves the right to change its intentions with respect to its investments in the Company and take any actions with respect to investments in the Company as it may deem appropriate. Concerning Intellectual Property All registered or unregistered service marks, trademarks and trade names referred to in this presentation are the property of th eir respective owners, and Trian Partners’ use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and trade names.

Trian’s Investment Thesis For DuPont ▪ When Trian issued its Summary White Paper (September 2014), Trian arrived at an implied target value per share in excess of $120 (1) by the end of 2017, a 21% internal rate of return (IRR) for shareholders holding DuPont stock during this period ▪ Key Assumptions for Trian’s Analysis: – Valuation: 9.9x blended NTM EBITDA multiple (2 ) – Best - in - class operating performance : Revenue growth and margins in - line with peers and management long - term targets o If one assumes a ~30% flow - through on incremental revenue, model implies less than $1bn of cost savings – Prudent Leverage: 2x net debt/EBITDA across the businesses as a whole; maintain investment grade rating – Focus on Returns to Shareholders: Grow dividend at 10% CAGR; assuming all excess free cash flow returned to shareholders – Tax Rate: 33% tax rate (up from 22% expected in 2015 (3) ) across the business to provide flexibility with free cash flow 4 (1) Please see the Open Letter to the DuPont Board (Trian Summary White Paper) dated September 16, 2014 , which is available at www.DuPontCanBeGreat.com , for further information regarding Trian’s analysis . This is not meant to be, nor is it, a prediction of the future trading price or market value of DuPont stock. There can be no assurance or guarantee with respect to the prices at which DuPont stock will trade, and such stock may not trade at prices that may be implied herein. (2) Assumes 6% increase in next twelve months EV/EBITDA multiple based on DuPont’s consensus valuation as of September 2014. (3) Base tax rate per Company’s Investor Presentation dated January 27, 2015. Trian believes the implied value calculation could have additional upside based on our view of $2 - 4bn of excess costs

Management’s Plan For DuPont 5

The CEO Seems to Lack Confidence In DuPont’s Share Price 6 Source: Capital IQ, Bloomberg and SEC Filings . (1) Information based on Form 4 filings and Company proxy statements. Trian’s analysis is conducted on a “net share - settled basis”. As such, when calculating ownership and share sales, Trian deducts the cash/shares required to exercise the options (i.e., Trian uses “treasury stock method” to calculate the CEO’s ownership). For options exercised, Trian uses t he share price on the date the options were exercised to estimate the net shares sold / owned. Trian’s analysis takes into account ( i ) shares directly owned at the beginning of Trian’s investment, (ii) RSUs that have vested over the period of Trian’s ownersh ip, (iii) performance - based stock units that have vested over the period (net of taxes), and (iv) net shares from options exercisable over the period . (2) Information based on DuPont Form 4 filings. The $80 million estimate reflects the gross amount of stock sold by Ellen Kullman for reasons other than the payment of taxes since Trian first invested. The estimate is based on the average dollar amount specified in the applicable Form 4 multiplied by the number of shares sold. According to SEC filings, most of these sales of DuPont shares were made purs uan t to Rule 10b5 - 1 trading plans. While Rule 10b5 - 1 trading plans provide for automatic purchases or sales pursuant to formula or similar method for determining the amount, price and/or date of the transaction, Rule 10b5 - 1 trading plans may generally be terminated or amended prior to their predetermined end. For additional information, see page 91 of the Trian White Paper dated February 17, 2015, available at www .Du PontCanBeGreat.com. Kullman exercises & sells options worth ~23% of her stake, at a 15 - year high Option exercised & sold ▪ The CEO sold ~54 % (1) of her stock after Trian first invested (~$80m) (2) ▪ 23 % (1) of her equity position was sold in the week after the release of Trian’s Summary White Paper (September 2014), when the stock hit a new 15 - year - high of $72.83 ▪ Despite rhetoric about a “higher growth, higher value strategy,” the CEO is not willing to “put her money where her mouth is” ▪ Sold from long - term incentives and from stock options she had been granted, most of which did not expire until 2016 or 2017 ▪ We believe the reason management receives equity as part of compensation is to ensure their interests are aligned with the long - term interests of shareholders. The intention is not for management to sell prematurely ▪ Ask yourself: If the CEO and Board members truly believed in their strategy wouldn’t they be buying stock? Ellen Kullman’s Cumulative Share Sales Over Time Stockholders award management long - term incentives to ensure an alignment of interests. The intention is not for management to sell prematurely. Trian Summary White Paper released

$71.67 $4.32 $3.77 $3.88 $4.01 $4.10 $3.00 $3.50 $4.00 $4.50 $5.00 $5.50 $6.00 $6.50 $7.00 $38.00 $48.00 $58.00 $68.00 $78.00 DuPont Stock Price Actual/Guided EPS 2011 2012 2013 2014 2015E Recent Stock Price Strength Not Driven By Fundamentals 7 Stock Price vs Actual/Guided EPS DuPont Stock Price $ ▪ DuPont’s stock price has risen almost 45% since Trian’s initial investment, yet EPS is below 2011 levels − While DuPont boasts about its total return of 266% from 12/31/08 to 12/31/14, 116% of that return resulted from share price appreciation after Trian invested (1) ▪ DuPont’s share price appreciation over the last two years has not been driven by fundamentals (2) − Since January 1, 2009, DuPont’s two largest one - day stock price increases on a percentage basis relative to the S&P 500 occurred on July 17, 2013, the day CNBC first reported Trian had invested in DuPont, and on September 17, 2014, the day we publicly released our September 16, 2014 open letter (Summary White Paper) to the DuPont Board Trian invested in DuPont Trian Summary White Paper released $5bn share repurchase a nnounced ($2bn in 2014) DuPont announced PChem spin 2014 guidance reduced by 6%, projecting 3 - 6% growth. Announced $625m cost savings initiative (3) Source: Capital IQ, DuPont Press Releases and transcripts of earnings release conference calls. (1) Source: DuPont presentation filed 1/9/15. 116% accounts for impact of share price appreciation from March 15, 2013 (date of Trian’s initial investment) to December 31, 2014. (2) While Trian believes that such share price appreciation is attributable to Trian’s involvement as a DuPont stockholder, t her e is no objective method to confirm what portion of such appreciation was attributable to Trian’s involvement and what portion may have been attributable to other factors. (3) Represents announcement of Fresh Start Initiative, a $1bn cost saving plan, at the time, that includes $375m of costs transferred to Performance Chemicals. DuPont increased total program size to $1.3bn on 1/27/2015. Actual/Guided EPS Trian investment publicly disclosed

Disparate Businesses And Overwhelming Complexity: New DuPont (1) Remains A Conglomerate With 44% Of Sales In Low Growth Businesses 8 Sales Growth Has Been Non - Existent (07 - 14) ($bns) (2) Growth in Adjusted PTOI (3) Has Been Anemic ($ bns ) 0 % CAGR $2.1 $1.3 $0.7 $2.1 $2.1 $2.1 $2.3 $2.4 0% 5% 10% 15% 20% 25% $0 $1 $2 $3 2007 2008 2009 2010 2011 2012 2013 2014 2.5 % CAGR This is Despite Performance Materials Over - Earnings As a Result of Record - High Ethylene Spreads Margin %: 16.5 11.0 7.9 17.5 15.2 16.2 18.2 19.7 Ethylene Spread Profit Over Time (07 - 14) ($m) (4) Excluding the ethylene spreads, PTOI was flat and margins only expanded ~58bps Source: SEC Filings, Investor Presentations, Trian Estimates. PTOI before non - operating pension expense. (1) “New DuPont” as defined by management (DuPont excluding Performance Chemicals segment). (2) 2013 and 2014 figures are adjusted for Viton, which is transferred to Performance Chemicals in spin off. (3) “PTOI” defined as pre - tax operating income. (4) Ethylene spread calculations from Trian, market data sourced from Bloomberg and JP Morgan research. Assumes 95% operating rate of 1,500m pound ethylene facility, assumes its cracking 100% ethane vs propane. ▪ The Performance Materials, Safety and Protection and Electronics and Communications segments have historically been low growth and volatile. Margins have deteriorated despite the significant increase in ethylene spreads $204 $282 $186 $283 $296 $443 $504 $538 2007 2008 2009 2010 2011 2012 2013 2014 $12.5 $12.1 $9.4 $12.2 $13.7 $12.7 $12.7 $12.4 2007 2008 2009 2010 2011 2012 2013 2014

$5.7 $11.3 2007 2014 12.6% 7.7% 2010 Margins 2014 Margins Improving Margins (4) The Other 56%: One Proven Growth Business, Two With Potential Nutrition & Health (12% of sales ) Industrial Biosciences ( 4 % of sales ) Agriculture (40% of sales ) Organic Revenue Growth Has Been Below Target and Weakening Organic Revenue Growth Consistently Below Target Contracting EBIT Margins Since Acquisition (1) 7 - 9% 5.0% 3.1% 1.7% Target Growth Q2-Q4 '12 Growth 2013 Growth 2014 Growth 7 - 9% 3.4% 3.5% 2.7% Target Growth Q2-Q4 '12 Growth 2013 Growth 2014 Growth ($ bns ) Strong Revenue Growth: 10% CAGR 15.4% 16.7% 17.5% 19.5% 20.5% 21.2% 20.8% 2008 2009 2010 2011 2012 2013 2014 18.1% 13.7% 2010 Margins 2014 Margins Contracting EBIT Margins Since Acquisition (1) Unproven 9 Source: SEC Filings, Investor Presentations, Trian Estimates. Note: Compares organic growth to target growth. Danisco acquisition closed in Q2 2011, organic growth starts a year after acquisiti on closes. (1) Margins are post - corporate to make figures comparable. Breaks out Danisco into Industrial Biosciences (its Genencor business) and Nutrition & Health. (2) Blended margin of DuPont legacy nutrition and Danisco. (3) Margins are pro forma for announced synergies of $130m. Synergies are allocated to Nutrition & Health and Industrial Biosciences on a % of sales basis. (4) Adjusted PTOI margins. Starts in 2008, the first year DuPont reported Agriculture on a standalone basis.

Excess Corporate Costs: The Coatings Case Study ▪ In 2012, DuPont announced the sale of Coatings to private equity buyers ▪ At the time, Coatings generated $339m (1) of EBITDA (2011A). Today, that same business, renamed Axalta , generates $851m (2) of EBITDA, an improvement of >150% ▪ In 2014, the new owners filed a Form S - 1 to take Axalta public. The S - 1 disclosed that Pro Forma EBITDA in 2011 was $568m (3) , $229m higher than originally reported by DuPont in the same year – this implies that DuPont burdened the Coatings segment with $229m of excess corporate costs 10 EBITDA Under DuPont ( 2007 - 2011) $339 $568 2011 (As Reported by DuPont) 2011 (As Reported by Axalta S-1) EBITDA – Different Owners, Same Year EBITDA Under New Owners – Improvement ( 2011 - 2014) $380 $339 2007 2011 $568 $851 2011 2014 Source: DuPont and Axalta SEC Filings. (1) Coatings adjusted PTOI plus depreciation expense less an allocation of unallocated corporate costs plus an addback for non - cash items and certain pension expense in - line with Axalta’s current addbacks to make it comparable to Axalta’s figures. Assigns unallocated corporate expense at ~2% of sales (DuPont’s FY2011 unallocated corporate expense and Other as % of FY2011 segment sales) to make margins comparable. (2) Represents Axalta’s Adjusted Operating Income plus Depreciation & Amortization expense for 2014. Metric differs slightly from Axalta’s Adjusted EBITDA (as reported) as it excludes other expense (income) and dividend to non - controlling interest to make EBITDA comp arable . (3) Represents Axalta’s Adjusted Operating Income plus Depreciation & Amortization expense for 2011. Metric differs slightly from Axalta’s Adjusted EBITDA (as reported) as it excludes other expense (income) and dividend to non - controlling interest to make EBITDA comp arable. (4) Coatings 2007 EBITDA not adjusted for pension, because non - operating pension / OPEB (other post - employment benefits) expense was not disclosed by DuPont (DuPont had small pension income in 2007 ). (5) For more detail, please see pages 71 and 72.of the February 17, 2015 presentation “A Referendum on Performance and Accountabi lit y”, which is available at www.DuPontCanBeGreat.com . (1) (3) (3) (2) (1) (4) • DuPont transferred ~ $7bn of shareholder wealth to private equity owners by not running Coatings efficiently and selling the business for cash rather than doing a tax - free spin • We estimate that consolidated DuPont is burdened by $ 2 - $4 bn of excess corporate costs (5 )

Substantial Agriculture R&D Has Yielded Negative Results 11 Source: SEC filings. (1) Monsanto press release 8/1/12. (2) DuPont press release 3/26/2013. (3) Free Press, “EPA: DuPont failed to warn of popular herbicide’s danger to trees”. Charges taken by DuPont related to customer claims of damage caused by the Imprelis herbicide. (4) Pioneer press release, 12/14/2010. (5) 2010 - 2014 based on Company Data Book and 2014 Form 10 - K. ~$5bn (5) in Agriculture R&D over last 5 years Results ▪ No new biotech traits, of significance, discovered ▪ $1bn jury verdict against DuPont for patent infringement ― A federal jury found that DuPont willfully infringed on Monsanto’s RoundUp Ready 2 patent and owed Monsanto $1bn in damages (1) ― In lieu of this, DuPont and Monsanto agreed to a settlement whereby DuPont will pay a minimum of $1.75bn in royalty payments for Roundup Ready 2 and dicamba (from 2014 through 2023 ) (2) ▪ $1.2bn in charges relating to Imprelis, despite estimated sales of only ~$7m (3) ▪ Paying competitors for science capabilities ― DuPont licenses Bayer’s LibertyLink, Dow’s Herculex, Monsanto’s Roundup Ready, and Syngenta’s Agrisure ― Agrisure license could exceed $ 400m in cumulative payments (4)

Trian Will Seek To End “ Crony” Compensation ▪ The Board’s compensation practices have rewarded management for failing to meet its targets. In 2013, management’s long - term incentive plan had a payout of 113% of target despite a TSR in the 25th percentile of DuPont’s peers ▪ That same year, short - term compensation payout was almost 90% despite adjusted EPS growth of 3%, significantly below the Company’s long - term target of 12% EPS growth ▪ In 2014, the Board’s Human Resources and Compensation Committee acknowledged poor operating performance as it exercised “negative discretion” and gave management a 0% payout factor for “corporate performance” under DuPont’s short - term incentive program. However, the Human Resources and Compensation Committee still found a way to pay management by giving an 80 - 100% payout factor for “individual performance” 12 Corporate Performance Rating 0% Individual Performance Rating 80% - 100% Source: DuPont 2015 proxy statement page 55 Does this make sense? How can it be that the Company is doing poorly operationally but management as individuals are each doing great? Source: Source: DuPont SEC filings and 2011 and 2013 Investor Day Transcripts.

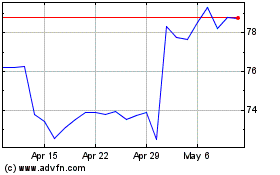

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024