Current Report Filing (8-k)

March 30 2015 - 7:44AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): March 30, 2015

E. I. du Pont de Nemours and Company

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

1-815 |

|

51-0014090 |

|

(State or Other Jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

Of Incorporation) |

|

File Number) |

|

Identification No.) |

1007 Market Street

Wilmington, Delaware 19898

(Address of principal executive offices)

Registrant’s telephone number, including area code: (302) 774-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

The DuPont Board of Directors has approved changes to the corporate governance structure at The Chemours Company (“Chemours”), following discussions with a wide range of shareholders and further evaluation, including with respect to the recent treatment of governance at spin-off companies in other situations. As previously announced, DuPont plans to execute the separation of its Performance Chemicals Segment through a tax-free spin-off to shareholders to create Chemours. The corporate governance changes at Chemours include that:

· Chemours’ classified board structure will be submitted to a shareholder vote at Chemours’ first Annual Meeting in 2016. If the classified structure is not approved by shareholders at that meeting, Chemours would immediately declassify its Board such that all directors would be up for annual election beginning with the 2017 Annual Meeting; and

· The ownership threshold for shareholders to call special meetings has been lowered to 25%.

DuPont remains on track to complete the spin-off of Chemours in mid-2015. The spin-off is the latest step in the company’s multi-year strategy to transform DuPont and deliver higher growth and higher value for shareholders. Additional details regarding the separation and Chemours will be outlined in the registration statement on Form 10 expected to be filed by Chemours at the end of April 2015 with the U.S. Securities and Exchange Commission.

Forward Looking Statements

This document contains forward-looking statements which may be identified by their use of words like “plans,” “expects,” “will,” “believes,” “intends,” “estimates,” “anticipates” or other words of similar meaning. All statements that address expectations or projections about the future, including statements about the company’s strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures and financial results, are forward looking statements. Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control. Some of the important factors that could cause the company’s actual results to differ materially from those projected in any such forward-looking statements are: fluctuations in energy and raw material prices; failure to develop and market new products and optimally manage product life cycles; ability to respond to market acceptance, rules, regulations and policies affecting products based on biotechnology; significant litigation and environmental matters; failure to appropriately manage process safety and product stewardship issues; changes in laws and regulations or political conditions; global economic and capital markets conditions, such as inflation, interest and currency exchange rates; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, weather events and natural disasters; ability to protect and enforce the company’s intellectual property rights; successful integration of acquired businesses and separation of underperforming or non-strategic assets or businesses and successful completion of the proposed spinoff of the Performance Chemicals segment including ability to fully realize the expected benefits of the proposed spinoff. The company undertakes no duty to update any forward-looking statements as a result of future developments or new information.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

E. I. DU PONT DE NEMOURS AND COMPANY |

|

|

(Registrant) |

|

|

|

|

|

|

|

|

/s/ Nicholas C. Fanandakis |

|

|

Nicholas C. Fanandakis |

|

|

Executive Vice President and Chief Financial Officer |

|

|

|

|

March 30, 2015 |

|

3

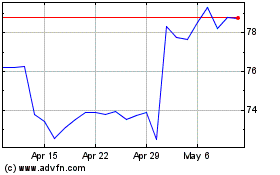

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024