UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐ Filed

by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

E. I. du Pont de Nemours and Company

(Name of Registrant as Specified In Its Charter)

Trian Fund Management, L.P.

Trian Fund Management GP, LLC

Trian Partners, L.P.

Trian Partners Strategic Investment Fund,

L.P.

Trian Partners Strategic Investment Fund

II, L.P.

Trian Partners Master Fund, L.P.

Trian Partners Parallel Fund I, L.P.

Trian Partners Master Fund (ERISA), L.P.

Trian Partners Strategic Investment Fund-A,

L.P.

Trian Partners Strategic Investment Fund-D,

L.P.

Trian Partners Strategic Investment Fund-N,

L.P.

Trian SPV (SUB) VIII, L.P.

Trian Partners Fund (Sub)-G, L.P.

Trian Partners Fund (Sub)-G II, L.P.

Nelson Peltz

Peter W. May

Edward P. Garden

John H. Myers

Arthur B. Winkleblack

Robert J. Zatta

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

4) |

Proposed maximum aggregate value of transaction: |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

2) |

Form, Schedule or Registration Statement No.: |

On March 25, 2015, Trian Fund Management, L.P. (“Trian”)

posted the following additional materials to http://www.DuPontCanBeGreat.com:

1

DUPONT CAN BE GREAT—MEET TRIAN’S

NOMINEES

FILMED ON MARCH 3, 2015

ÓTRIAN FUND MANAGEMENT, L.P. ALL RIGHTS RESERVED

(VIDEO TRANSCRIPT)

PARTICIPANTS:

| · | NELSON PELTZ, TRIAN NOMINEE, TRIAN CEO & FOUNDING PARTNER |

| · | JOHN MYERS, TRIAN NOMINEE, FORMER GE ASSET MANAGEMENT PRESIDENT &

CEO |

| · | ARTHUR “ART” B. WINKLEBLACK, TRIAN NOMINEE, FORMER H.J. HEINZ COMPANY CFO |

| · | ROBERT “BOB” J. ZATTA, TRIAN NOMINEE, FORMER

ROCKWOOD

HOLDINGS, INC. CFO

& ACTING CEO |

2

PART

1: MEET THE TEAM

NELSON PELTZ:

I'm Nelson Peltz. I'm Chairman and

CEO of Trian Partners—investment fund. We have a very large stake in DuPont. We take stakes in large, wonderful

companies that haven't performed. DuPont is on that list and DuPont is one that we think we can help a great deal.

ART WINKLEBLACK:

I'm Art Winkleblack. I've got—more than

30 years' experience operating businesses across a number of industries. And then—spent—almost a dozen years as—executive

vice president and chief financial officer of—H.J. Heinz.

I met Nelson in 2006 during the proxy

contest. As—as Nelson came on the board he became an exceptionally good board—board member. And I think probably our best board

member. And more important than that, he was able to raise the game of the rest of our board members because they knew that Nelson

was very well informed, plugged in, understood the industry and was there to drive shareholder value.

You know, Trian for Heinz was a

catalyst. A catalyst to help us change and help us get better. So it was all about taking a team that had been making

progress but then really turbo charge that progress and accelerate the progress. So Trian helped us get better.

What—what attracted me to come onto this—is that—I frankly think we can help. We as a team have the right

skill sets, the right experience set—to help DuPont become a better company.

BOB ZATTA:

I'm Bob Zatta. I have more than four decades

of business experience—primarily as a financial executive. I've worked for several very well-known consumer products companies:

The Lipton Tea Company, Kraft General Foods, and the Campbell Soup Company. However, I've spent the last 14 and a half years

at the Rockwood Chemical Company.

And—you know, we focused on all of the

things that I think you need to in this industry in order to be successful: Organic revenue growth. Margin enhancement. Total elimination

of bureaucracy. Empowering and motivating management teams to deliver the results that they're—that they're tasked to deliver.

We created a lot of value for our investors.

We also created value for the employees, for the communities in which we work and for our customers, because focusing on the customer

in this industry is extremely important and necessary.

I really look forward to being on the—

the—the DuPont board—serving with each of you—and all the directors. I think DuPont is a company with a long, proud history

and tradition and I think we can make it great.

JOHN MYERS:

I'm John Myers. I joined General Electric

Company—after serving three years in the U.S. Navy—as a guided missile officer—during Vietnam. The last half of my career

at General Electric I ran its investment group. When I got there we had about $20 billion under management. When I retired—January

1, '07, we had $200 billion and we were a very active operating company.

After retiring I had the opportunity to

join Legg Mason board and join Nelson in the boardroom. And—as Art said, Nelson was the most prepared director but he was

kind of cheating. He had the whole staff of Trian supporting him—at each and every board meeting. And that is such an advantage

that Trian brings to the boardroom. It is not just one individual. It is an entire organization.

As a matter of fact, when Nelson—left

the Legg Mason board a few months ago, the CEO asked Nelson if he could still have access to Trian and be able to talk to the Trian—

team—about Treasury matters, about legal matters, about operating matters.

I'm looking forward—to—working with

Bob and Art and Nelson on the DuPont board because I really believe we can make this a great company again.

3

PART 2: TRIAN COLLABORATES WITH

BOARDS AND MANAGEMENT TEAMS

NELSON PELTZ:

So when you say, "Joe Sullivan at

Legg Mason wanted to continue to use Trian as a source after I got off the board," that means so much to me. And, they're bringing

Ed Breen and they're bringing Jim Gallogly on the board. And,

we're thrilled about that. We think they're good guys. We know them very well and we look forward to working with them.

ART WINKLEBLACK:

You know, I was on the—on the front

line of—of—the proxy contest back in 2006—on—on Heinz—with Trian.

NELSON PELTZ:

Right. (LAUGHTER)

ART WINKLEBLACK:

And—and I must admit, when—when Nelson

came on the board I thought, "Ooh, this might not be good."

NELSON PELTZ:

(LAUGHTER)

ART WINKLEBLACK:

But I—I—I gotta tell ya, the—the

first meeting that Nelson and I had, and I don't know if you remember this meeting, but Nelson came in and said—"You know,

you fought a good proxy contest. We fought a good proxy contest. Let's go make some money for the shareholders together."

And that's how we operated ever since then. We've been great partners since then. So it's been a wonderful experience.

NELSON PELTZ:

And we did. With—the stock went from

$30 to $72.50 and Buffett and 3G bought it and that was—that was fine.

We've said publicly that—$2 to $4

billion of excess overhead, underline excess overhead—would fast go away if you broke the company into two pieces. They're—

they're spinning off Chemours, so two new pieces. But we've said also, and we’ve said we're gonna be a minority on the board,

number one, so it's worth the conversation.

And number two, we said, if management

can convince the board that they can achieve the same metrics, meaning sales growth and margin as the standalone comps by holding

it together, we are open minded. We said that day one in our press release.

JOHN MYERS:

And that’s what happened actually

with Ingersoll-Rand, when you joined that board.

4

PART 3: DUPONT NEEDS TO IMPROVE

ACCOUNTABILITY & EMPOWERMENT

JOHN MYERS:

You know, Nelson, I spent the first half

of my 38 year GE career in field operations. And we used to joke that some of the most dangerous words we ever heard was, "I'm

from corporate and I'm here to help you."

NELSON PELTZ:

Right. (LAUGHTER)

JOHN MYERS:

And I think it's the mindset—and a culture

that has to change in order to get the amount of cost reductions that Trian has identified.

ART WINKLEBLACK:

Yeah, It—it does start with

culture. And—and with that culture—to make a change and to make an impact, what often has to happen is that

management needs to take a look at the layers in the organization, set a—set a parameter on the number of layers between

the CEO and the shop floor and also in terms of minimum spans of control so that at the highest—highest level of the

organization there needs to be a broad span of control and it narrows from there. With that kind of parameter you can often

make great progress in terms of not only cost but executional efficiency and empowerment of management.

BOB ZATTA:

Yeah, I agree. It’s all about accountability

and empowerment of management. I don’t think they’ve done a very good job at all on capital allocation. I think both

in terms of M&A, capital expenditures and R&D expenses I think that they've spent a lot of money—billions of dollars,

in fact, and have very little to show for it.

ART WINKLEBLACK:

And that's exactly right. I mean it's—

it's all about cash generation and the capability to drive cash. And—and currently within the compensation system, CAPEX comes

free. Capital spending comes free. I've never seen that work in my 30-plus years of experience. Capital has to have a cost to management

so that it is not—used inappropriately and so that you can get a return. So with that strong cash flow comes the capability to

grow the business through acquisitions, dividends, share buybacks—things that will help the shareholders.

5

PART 4: PAY MUST BE TIED TO PERFORMANCE

JOHN MYERS:

I haven't seen very many successful companies

that base their long-term payments to their executives on revenue.

BOB ZATTA:

I—I have never seen that to be honest

with you.

JOHN MYERS:

I mean it creates the wrong incentive

and it creates a misalignment really between management and shareholders. It should more be based on the income, which is then

used to pay dividends, to buy back stock and return

cash—

ART WINKLEBLACK:

Sure.

JOHN MYERS:

—to the hands of the people that own the company.

NELSON PELTZ:

We want pay for performance. We want them

to get paid 'cause they're hitting the cover off the ball and they are entitled to get outsized compensation as a result of it.

ART WINKLEBLACK:

Exactly.

PART 5: ORIGINS OF THIS PROXY

CONTEST

NELSON PELTZ:

This unfortunately is, or thankfully,

however you wanna look at it, our second proxy fight. We had—the first was Heinz nine years ago. We think they're very unproductive.

We sat patiently for 18 months.

Didn't go public with anything. Just dealt with management. Dealt with the board. Telling them what we thought. Telling them

how we thought this structure was—was bad. Telling them how we thought they couldn't achieve the—the 12% EPS

growth and the 7% revenue growth that they—they promised. We’re in buying their stock. That’s why the stock

went up. It didn't go up because of earnings. Earnings have been flat since—or down since 2011. But when they finally

changed guidance for the third time, took it way down, we said, "Enough is enough. We have to have a board

seat."

Our goal here is to return DuPont to its

former greatness.

DUPONT CAN BE GREAT—NELSON PELTZ

FILMED ON MARCH 3, 2015

© 2015 TRIAN FUND MANAGEMENT, L.P. ALL

RIGHTS RESERVED.

(VIDEO TRANSCRIPT)

PARTICIPANT:

NELSON PELTZ, TRIAN NOMINEE, TRIAN

CEO & FOUNDING PARTNER

NELSON PELTZ:

I'm Nelson Peltz. I'm Chairman and

CEO of Trian Partners—investment fund. We have a very large stake in DuPont. We take stakes in large, wonderful

companies that haven't performed. DuPont is on that list and DuPont is one that we think we can help a great deal.

Prior to this I was at one point in my

life Chairman and CEO of a Fortune 100 company that I, along with my partners, built, ran and then sold very profitably for the

benefit of all shareholders. I was CEO of the company that did the—famous Snapple turnaround when we bought her from Quaker Oats.

And I was also in the chemical business

by being Chairman and CEO of the company that owned Uniroyal Chemical, so I've had my exposure to the chemical industry. I've served

on over a dozen boards and been CEO of about six different public companies.

I don't think people understand how we

work when we get on a board, and it's so different than one might imagine. And—I'm gonna take a second and explain it. When

you go on a company the size of DuPont, and I'm on the Mondelez board. I'm on—a few large company boards. You get these 1,000

pages starting a week prior to the board meeting, through the night before and sometimes the morning of. And with the lawyers today

they want the board to have more rather than less, so you get contracts. You get financing agreements. You get joint venture contracts.

You get all kinds of stuff. That one man, one woman, finds it very difficult, near impossible, to really digest all of that information

in a week’s time.

What we do is different from others. We

insist, if we go on a board, that about 20 people at Trian sign confidentiality agreements. So they have information just like

our Trian representative, our Trian partner who's on that board has. They are restricted like we're restricted. But then when those 1,000 pages come in,

the legal stuff goes to our legal guys, who have been following DuPont. The financial stuff goes to the financial department—those

people have been following DuPont. The business stuff, it goes to the portfolio people who've been looking

at DuPont and writing this white paper and following this company now well over two years. So when—if I'm on the board, I walk

in, I am truly prepared.

Besides that, our guys, between board meetings,

they will develop relationships up and down the line of that corporate. So they'll know the general counsel really well. And they

will develop their relationship. They'll know the CFO really well and they will develop the relationship. So, we're not waiting

board meeting to board meeting.

We have people in there all the time meeting

with their—with their people, their opposites in this company and working together and building relationships. So that's the

difference and that's really the—the sign of how we can know these companies well—There's an information gap that's very,

very wide. And so the board meeting, unless you're up to speed with him, becomes a show and tell. And what are you really, really

contributing to that board in the show and tell? Very little.

DUPONT CAN BE GREAT—JOHN MYERS

FILMED ON MARCH 3, 2015

© 2015 TRIAN FUND MANAGEMENT, L.P. ALL

RIGHTS RESERVED.

(VIDEO TRANSCRIPT)

PARTICIPANTS:

| · | JOHN MYERS, TRIAN NOMINEE, FORMER GE ASSET

MANAGEMENT PRESIDENT & CEO |

| · | ARTHUR “ART” B. WINKLEBLACK, TRIAN NOMINEE, FORMER

H.J. HEINZ

COMPANY CFO |

JOHN MYERS:

I'm John Myers. I joined General Electric

Company—after serving three years in the U.S. Navy—as a guided missile officer—during Vietnam. I spent a 38

year career at General Electric. The first half of my career was in the industrial businesses. Many different assignments. Working

in the field—overseas in Germany and Italy.

And I had the great fortune of—working

with and under—one of the great CEOs in corporate history, Jack Welch. Actually, Nelson Peltz reminds me a lot of Jack in many

ways. And—I've called him—to many of my friends and associates, the—Jack Welch of investing.

I'm looking forward—to—working with

Bob and Art and Nelson on the DuPont board because I really believe we can make this a great company again.

I want to elaborate on something that

really touches a nerve. And that is, this is not about cost cutting for the sake of cost cutting. This is about right sizing an

organization so that it can grow and compete in the future. And then that's going to create more jobs. I think there's four things

that make a great company. It's a company that balances serving its shareholders, serving its employees, serving its customers

and serving its community.

ART WINKLEBLACK:

That's right.

JOHN MYERS:

And if you have a company that can

do all four of those things you've got a great company. You know, I think it's important, our responsibility is gonna be to

all DuPont shareholders. Not necessarily to Trian. But Trian is a DuPont shareholder. Its interests are the same as every

other individual shareholder, whether they own 100 shares or whether they own the block of shares that Trian owns. It's all

the same. We are fiduciaries to all shareholders.

DUPONT CAN BE GREAT—ART WINKLEBLACK

FILMED ON MARCH 3, 2015

© 2015 TRIAN FUND MANAGEMENT, L.P. ALL

RIGHTS RESERVED.

(VIDEO TRANSCRIPT)

PARTICIPANTS:

| · | ARTHUR “ART” B. WINKLEBLACK, TRIAN NOMINEE, FORMER H.J. HEINZ COMPANY CFO |

| · | JOHN MYERS, TRIAN NOMINEE, FORMER GE ASSET MANAGEMENT PRESIDENT & CEO |

| · | NELSON PELTZ, TRIAN NOMINEE, TRIAN CEO & FOUNDING PARTNER |

ART WINKLEBLACK:

I'm Art Winkleblack. I've got—more than

30 years' experience operating businesses across a number of industries. Started out in—what I would call academy-type

companies at PepsiCo—under—Wayne Calloway was the chairman at that point. Spent time at AlliedSignal when Larry Bossidy

was there as chairman. I spent—a little more than six years in private equity following that. And then—spent—almost a dozen

years as—Executive Vice President and Chief Financial Officer of—H.J. Heinz.

At Heinz we—we kind of felt like we

needed to keep it simple. And so as it related to—incentive compensation, management is responsible for fundamentally three things

on an annual basis. Grow the top line, grow profitability and drive cash flow. And so those three things were all in the short-term—

incentive—compensation system. And, by the way, that driving cash flow included capital spending. You had to make sure that

it was paying off. For the long-term incentive we aimed toward two things, really. Return on invested capital, so that you—you

each year had to move that forward and generate stronger and stronger returns. And also we focused on how our shareholder return

related to our peer companies. So if we outperformed our peer companies then—management was paid well. If we didn't, we were

paid—paid low. And that was appropriate.

Let me pick up on the transparency theme.

In my past experience we've worked very, very hard to be transparent with investors and make our numbers very understandable and

very clear. And set forth a scorecard by which we could be judged.

We had a 10 item scorecard. We talked

about that quarter in, quarter out, every time. And what it forced management to do was to be honest with themselves. And even

if a number wasn't particularly good, we had to talk about it.

As I've looked at the DuPont—disclosure

I—I must admit I get very frustrated because I—it's hard to sort through and find out where—where the real performance is.

And in fact if you go to back 2011 we've—we've talked about the—the EPS number,

the earnings per share number—

JOHN MYERS:

Which one? (LAUGHTER)

ART WINKLEBLACK:

Well—apparently there are nine different

ones that have been mentioned. And so—

NELSON PELTZ:

You're 100% right.

ART WINKLEBLACK:

I just—I think that's a key opportunity—for

management, with the board's oversight, to get the transparency to be better.

DUPONT CAN BE GREAT—BOB ZATTA

FILMED ON MARCH 3, 2015

© 2015 TRIAN FUND MANAGEMENT, L.P. ALL

RIGHTS RESERVED.

(VIDEO TRANSCRIPT)

PARTICIPANT:

| · | ROBERT “BOB” J. ZATTA, TRIAN NOMINEE, FORMER

ROCKWOOD

HOLDINGS, INC. CFO

& ACTING CEO |

BOB ZATTA:

I'm Bob Zatta. I have more than four decades

of business experience—primarily as a financial executive. I've worked for several very well-known consumer products companies:

The Lipton Tea Company, Kraft General Foods, and the Campbell Soup Company.

I spent the last 14 and a half years

at the Rockwood Chemical Company. I was Chief Financial Officer for most of that time and acting CEO for the—for the

last while. And, you know, we looked at R&D spending—as really a capital investment in the business, because

generally R&D spending has a longer term potential for the business.

And we were all very supportive of R&D.

In fact from a corporate perspective I spent more time asking the questions, "Are we spending enough? Are we moving quickly

enough? If this is a really winning idea, should we be doing more?" Not should we be pulling back or holding back.

But it—it's really important when you

have an empowered management team that they be responsible for the R&D discussion. That the R&D manager be embedded in

the business. And it's a business discussion, and it's a business discussion which has great benefits long-term, but also you have

accountable people looking at the revenue stream you're gonna generate from it and the earnings you're gonna generate from it, and how is it going to enhance your offering

to your customers?

In these industries like Rockwood—we were in the chemical industry like DuPont, you've got a lot

of relatively old technologies. And in order for you to stay ahead of the game and drive that top line you need to be innovative

with your customer. And it can be done, but it needs to be appropriately managed. And the business unit people are the ones who

are best capable of doing that.

###

Additional Information

Trian and the investment funds that it manages that hold shares of E.I.

du Pont de Nemours and Company (collectively, Trian with such funds, “Trian Partners”) together with other

Participants (as defined below), filed a definitive proxy statement and an accompanying proxy card with the Securities and Exchange

Commission (the “SEC”) on March 25, 2015 to be used to solicit proxies in connection with the 2015 Annual Meeting

of Stockholders of E.I. du Pont de Nemours and Company (the “Company”), including any adjournments or postponements

thereof or any special meeting that may be called in lieu thereof (the “2015 Annual Meeting”). Information

relating to the participants in such proxy solicitation (the “Participants”) has been included in that definitive

proxy statement and in any other amendments to that definitive proxy statement. Stockholders are advised to read the definitive

proxy statement and any other documents related to the solicitation of stockholders of the Company in connection with the 2015

Annual Meeting because they contain important information, including additional information relating to the Participants. Trian

Partners’ definitive proxy statement and a form of proxy will be mailed to stockholders of the Company. These materials

and other materials filed by Trian Partners in connection with the solicitation of proxies will be available at no charge at the

SEC’s website at www.sec.gov. The definitive proxy statement and other relevant documents filed by Trian Partners

with the SEC will also be available, without charge, by directing a request to Trian’s proxy solicitor, MacKenzie Partners,

Inc. 105 Madison Avenue, New York, New York 10016 (call collect: 212-929-5500; call toll free: 800-322-2885) or email: proxy@mackenziepartners.com.

###

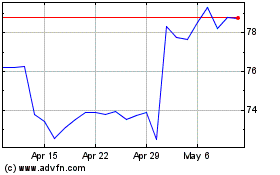

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024