UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 4, 2015

____________________________

DUCOMMUN INCORPORATED

(Exact name of registrant as specified in its charter)

____________________________

|

| | | |

Delaware | 001-08174 | | 95-0693330 |

(State or other jurisdiction of incorporation) | (Commission File Number) | | (IRS Employer Identification No.) |

| | |

| 23301 Wilmington Avenue, Carson, California | | 90745-6209 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (310) 513-7200

N/A

(Former name or former address, if changed since last report.)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

Ducommun Incorporated issued a press release on November 4, 2015 in the form attached hereto as Exhibit 99.1.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

|

| |

Exhibit No. | Exhibit Title or Description |

99.1 | Ducommun Incorporated press release issued on November 4, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | DUCOMMUN INCORPORATED (Registrant) |

Date: November 4, 2015 | | By: | /s/ James S. Heiser |

| | | James S. Heiser |

| | | Vice President and General Counsel |

EXHIBIT 99.1

|

| | |

23301 Wilmington Avenue | | |

Carson, CA 90745-6209 | |

310.513.7200 | |

www.ducommun.com | |

NEWS RELEASE

FOR IMMEDIATE RELEASE

Ducommun Reports Results for the

Third Quarter Ended October 3, 2015

Backlog Rebounds; Right-Sizing Initiatives Accelerate

LOS ANGELES, California (November 4, 2015) – Ducommun Incorporated (NYSE:DCO) (“Ducommun” or the “Company”) today reported results for its third quarter ended October 3, 2015.

Third Quarter 2015 Recap

| |

• | Third quarter revenue was $161.7 million |

| |

• | Net loss was $9.5 million, or $0.86 per share |

| |

• | EBITDA for the quarter was $5.5 million |

| |

• | New financing structure completed with redemption of the $200 million senior unsecured notes |

| |

• | Backlog increased to $553 million |

“Despite challenging business conditions persisting through the third quarter, we stayed the course in working to transform Ducommun into a leaner, more efficient and focused company -- better positioned for renewed growth,” said Anthony J. Reardon, chairman and chief executive officer. “We are making measurable progress reducing costs across the Company through greater supply chain efficiencies and improved capacity utilization, including strategic facility consolidation. We will close two of our sites within the next few months and anticipate additional right-sizing may result from ongoing evaluation of our portfolio of products and capabilities.

“Although disappointed with the negative top line impact of prolonged weakness in our defense markets, we are excited about the continued growth with the commercial aerospace sector, which drove backlog at the end of the third quarter to more than $550 million -- the best level this year. We remain vigilant in preparing Ducommun to emerge from this challenging period better positioned for improved performance, margin expansion and cash flow generation heading into 2016.”

Third Quarter Results

Net revenue for the third quarter of 2015 was $161.7 million compared to $188.2 million for the third quarter of 2014. The net revenue decrease year-over-year primarily reflects an approximate 27.1% decrease in revenue in the Company’s military and space end-use markets mainly due to the decrease in U.S. government defense spending as well as shifting of their spending priorities which impacted the Company’s fixed-wing and helicopter platforms, combined with a delay in the timing of when these products are required by the Company’s customers, and an approximate 2.2% decrease in revenue in the non-aerospace and defense (“non-A&D”) end-use markets.

The net loss for the third quarter of 2015 was $(9.5) million, or $(0.86) per share, compared to net income of $2.9 million, or $0.26 per diluted share, for the third quarter of 2014. The decrease to a net loss for the third quarter of 2015 compared to net income for the third quarter of 2014 was primarily due to a previously announced pretax charge of approximately $22.7 million that consisted of a loss on extinguishment of debt of approximately $11.9 million related to the redemption of the existing $200.0 million senior unsecured notes, higher forward loss reserves related to a regional jet program in the Ducommun AeroStructures segment of approximately $9.0 million, and restructuring charges related to severance and benefits of approximately $0.8 million, in addition to loss of efficiencies resulting from lower manufacturing volume of approximately $3.9 million, and unfavorable product mix of

approximately $2.1 million, partially offset by lower income tax expense of approximately $8.7 million, lower interest expense of approximately $3.6 million, and lower compensation and benefit costs of approximately $3.0 million. The Company expects to realize approximately $15.0 million in annualized interest savings from the refinancing of debt, annualized savings of approximately $2.0 million to $3.0 million related to the previously announced closure of two facilities, and additional expected cost savings of approximately $4.0 million to $5.0 million annually from other cost savings initiatives already underway.

Operating loss for the third quarter of 2015 was $(1.2) million, or 0.7% of revenue, compared to operating income of $10.1 million, or 5.3% of revenue, in the comparable period last year. The decrease to an operating loss in the third quarter of 2015 was primarily due to the items that affected operating (loss) income described in net loss above.

Interest expense decreased to $3.4 million in the third quarter of 2015, compared to $7.0 million in the previous year’s third quarter, primarily due to lower outstanding debt balances and a lower average interest rate in 2015 as a result of refinancing all the existing debt using the new credit facility.

EBITDA for the third quarter of 2015 was $5.5 million, or 3.4% of revenue, compared to $18.4 million, or 9.8% of revenue, for the comparable period in 2014.

During the third quarter of 2015, the Company used $5.5 million of cash from operations compared to cash generated of $5.3 million during the third quarter of 2014 primarily due to paying the call premium of $9.8 million to retire the $200 million senior unsecured notes.

The Company’s firm backlog as of October 3, 2015 was approximately $553 million.

Ducommun AeroStructures (“DAS”)

The Company’s DAS segment net revenue for the current third quarter was $64.2 million, compared to $81.4 million for the third quarter of 2014. The lower net revenue was primarily due to an approximate 51.6% decrease in military and space revenue mainly due to the decline in demand for military fixed-wing and helicopter platforms as of a result of the reasons described in net revenue above.

DAS segment operating loss for the current third quarter was $6.0 million, or 9.4% of revenue, compared to operating income of $6.9 million, or 8.5% of revenue, for the third quarter of 2014. The decrease to an operating loss was primarily due to higher forward loss reserves related to a regional jet program of approximately $9.0 million, unfavorable product mix of approximately $2.9 million, and loss of efficiencies resulting from lower manufacturing volume of approximately $2.6 million, partially offset by lower compensation and benefit costs of approximately $1.6 million. EBITDA was $(3.6) million for the current quarter, or 5.7% of revenue, compared to $10.8 million, or 13.3% of revenue, for the comparable quarter in the prior year.

Ducommun LaBarge Technologies (“DLT”)

The Company’s DLT segment net revenue for the current third quarter was $97.5 million, compared to $106.8 million for third quarter 2014. The lower net revenue was primarily due to an approximate 14.6% decrease in military and space revenue mainly due to the decline in the military fixed-wing platforms as a result of the reasons described in net revenue above, and an approximate 2.2% decrease in non-A&D revenue, partially offset by an approximate 5.1% increase in commercial aerospace revenue.

DLT’s operating income for the current third quarter was $8.6 million, or 8.8% of revenue, compared to $8.3 million, or 7.8% of revenue, for the third quarter of 2014, primarily due to favorable product mix of approximately $0.8 million and lower compensation and benefit costs of approximately $0.7 million, partially offset by loss of efficiencies resulting from lower manufacturing volume of approximately $1.3 million.

Corporate General and Administrative Expenses (“CG&A”)

CG&A expenses for the third quarter of 2015 were $3.7 million, or 2.3% of total Company revenue, a decrease from $5.1 million, or 2.7% of total Company revenue, in the comparable prior-year period. CG&A expenses decreased primarily due to lower compensation and benefit costs of approximately $0.7 million and lower discretionary expenses as a result of the cost savings initiatives the Company has implemented.

New Capital Structure

As previously reported, on June 26, 2015, the Company completed a new five year, $475 million credit agreement. On July 27, 2015, the Company completed the redemption of all $200 million of its senior unsecured notes by paying a call premium of $9.8 million and wrote off the associated unamortized debt issuance costs of approximately $2.1 million in the Company’s fiscal third quarter.

Year-To-Date Results

Net revenue for the nine months ended October 3, 2015 was $509.4 million compared to $554.4 million for the nine months ended September 27, 2014. The net revenue decrease year-over-year primarily reflects an approximate 22.2% decrease in revenue in the Company’s military and space end-use markets mainly due to the decrease in U.S. government defense spending as well as shifting of their spending priorities which impacted the Company’s fixed-wing and helicopter platforms, combined with a delay in the timing of when these products are required by the Company’s customers, partially offset by an approximate 8.3% increase in revenue in the commercial aerospace end-use markets and an approximate 2.8% increase in revenue in the non-A&D end-use markets.

The net loss for the nine months ended October 3, 2015 was $(9.7) million, or $(0.88) per share compared to net income of $14.7 million, or $1.31 per diluted share, for the nine months ended September 27, 2014. The lower net income for the first nine months of 2015 was primarily due to a loss on extinguishment of debt of approximately $14.7 million as part of the Company’s new debt structure, higher forward loss reserves related to a regional jet program of approximately $12.1 million, unfavorable product mix of approximately $10.4 million, loss of efficiencies resulting from lower manufacturing volume of approximately $7.4 million, and restructuring charges related to severance and benefits of approximately $0.8 million, partially offset by lower income tax expense of approximately $14.2 million, lower interest expense of approximately $4.6 million, lower compensation and benefit costs of approximately $2.6 million, and $1.5 million of other income for insurance recoveries related to property and equipment.

Operating income for the nine months ended October 3, 2015 was $13.3 million, or 2.6% of revenue, compared to $41.7 million, or 7.5% of revenue, in the comparable period last year. The decrease in operating income in the first nine months of 2015 was primarily due to the items that affected operating (loss) income described in net loss above.

Interest expense decreased to $16.5 million for the nine months ended October 3, 2015, compared to $21.1 million in the previous year’s comparable nine months, primarily due to lower outstanding debt balances and a lower average interest rate in 2015 as a result of refinancing all the existing debt.

EBITDA for the nine months ended October 3, 2015 was $34.9 million, or 6.8% of revenue, compared to $65.1 million, or 11.7% of revenue, for the comparable period in 2014.

During the nine months ended October 3, 2015, the Company generated $12.1 million of cash from operations compared to $20.8 million during the comparable period in 2014.

Ducommun AeroStructures (“DAS”)

The Company’s DAS segment net revenue for the nine months ended October 3, 2015 was $212.3 million, compared to $241.6 million for the nine months ended September 27, 2014. The lower net revenue was primarily due to an approximate 40.5% decrease in military and space revenue mainly due to the reasons described in net revenue above that was partially offset by approximate 6.9% increase in commercial aerospace revenue.

DAS segment operating income for the nine months ended October 3, 2015 was $3.0 million, or 1.4% of revenue, compared to operating income of $28.1 million, or 11.6% of revenue, for the nine months ended September 27, 2014. The lower operating income was primarily due to higher forward loss reserves related to a regional jet program of approximately $12.1 million, unfavorable product mix of approximately $7.9 million, and loss of efficiencies resulting from lower manufacturing volume of approximately $5.2 million, partially offset by lower compensation and benefit costs of approximately $1.5 million. EBITDA was $11.5 million for the current nine month period, or 5.4% of revenue, compared to $37.9 million, or 15.7% of revenue, for the comparable nine month period in the prior year.

Ducommun LaBarge Technologies (“DLT”)

The Company’s DLT segment net revenue for the nine months ended October 3, 2015 was $297.1 million, compared to $312.8 million for nine months ended September 27, 2014. The lower net revenue was primarily due to an approximate 12.6% decrease

in military and space revenue mainly due to the reasons described in net revenue above, partially offset by an approximate 14.3% increase in commercial aerospace revenue and an approximate 2.8% increase in non-A&D revenue.

DLT’s operating income for the nine months ended October 3, 2015 was $22.6 million, or 7.6% of revenue, compared to $26.1 million, or 8.3% of revenue, for the nine months ended September 27, 2014, primarily due to unfavorable product mix of approximately $2.5 million and loss of efficiencies resulting from lower manufacturing volume of approximately $2.2 million, partially offset by lower manufacturing costs of approximately $1.3 million and lower compensation and benefit costs of approximately $1.1 million. EBITDA was $35.5 million for the current nine month period, or 11.9% of revenue, compared to $39.5 million, or 12.6% of revenue, in the comparable nine month period of the prior year.

Corporate General and Administrative Expenses (“CG&A”)

CG&A expenses for the nine months ended October 3, 2015 were $12.3 million, or 2.4% of total Company revenue, a decrease from $12.5 million, or 2.2% of total Company revenue, in the comparable nine month period in prior-year. CG&A expenses decreased primarily due to lower discretionary expenses.

Conference Call

A teleconference hosted by Anthony J. Reardon, the Company’s chairman and chief executive officer, and Joseph P. Bellino, the Company’s vice president, chief financial officer and treasurer, will be held today, November 4, 2015 at 2:00 p.m. PT (5:00 p.m. ET) to review these financial results. To participate in the teleconference, please call 877-786-6947 (international 530-379-4718) approximately ten minutes prior to the conference time. The participant passcode is 57476588. Mr. Reardon and Mr. Bellino will be speaking on behalf of the Company and anticipate the meeting and Q&A period to last approximately 45 minutes.

This call is being webcast by Thomson Reuters and can be accessed directly at the Ducommun website at www.ducommun.com. Conference call replay will be available after that time at the same link or by dialing 855-859-2056, passcode 57476588.

About Ducommun Incorporated

Founded in 1849, Ducommun Incorporated provides engineering and manufacturing services to the aerospace, defense, and other industries through a wide spectrum of electronic and structural applications. The company is an established supplier of critical components and assemblies for commercial aircraft and military and space vehicles as well as for the energy market, medical field, and industrial automation. It operates through two primary business units – Ducommun AeroStructures (“DAS”) and Ducommun LaBarge Technologies (“DLT”). Additional information can be found at www.ducommun.com.

Forward Looking Statements

Statements contained in this press release regarding other than recitation of historical facts are forward-looking statements. These statements are identified by words such as “may,” “will,” “ begin,” “ look forward,” “expect,” “believe,” “intend,” “anticipate,” “should,” “potential,” “estimate,” “continue,” “momentum” and other words referring to events to occur in the future. These statements reflect the Company’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control, including, but not limited to, the state of the world financial, credit, commodities and stock markets, and uncertainties regarding the Company, its businesses and the industries in which it operates, which are described in the Company’s filings with the Securities and Exchange Commission. The Company is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

Note Regarding Non-GAAP Financial Information

This release contains non-GAAP financial measures, EBITDA (which excludes depreciation and amortization, interest expense, loss on extinguishment of debt, and income tax (benefit) expense), and Adjusted EBITDA (EBITDA, excluding restructuring charges).

The Company believes the presentation of these non-GAAP measures provide important supplemental information to management and investors regarding financial and business trends relating to its financial condition and results of operations. The Company’s management uses these non-GAAP financial measures along with the most directly comparable GAAP financial measures in evaluating the Company’s actual and forecasted operating performance, capital resources and cash flow. The non-GAAP financial information presented herein should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

CONTACTS:

|

| | | | | | |

Joseph P. Bellino, Vice President, Chief Financial Officer and Treasurer, 310.513.7211 |

Chris Witty, Investor Relations, 646.438.9385, cwitty@darrowir.com |

[Financial Tables Follow]

DUCOMMUN INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands)

|

| | | | | | | | |

| | October 3,

2015 | | December 31,

2014 |

Assets | | | | |

Current Assets | | | | |

Cash and cash equivalents | | $ | 12,241 |

| | $ | 45,627 |

|

Accounts receivable, net | | 86,235 |

| | 91,060 |

|

Inventories | | 137,317 |

| | 142,842 |

|

Production cost of contracts | | 11,609 |

| | 11,727 |

|

Deferred income taxes | | 12,432 |

| | 13,783 |

|

Other current assets | | 22,700 |

| | 23,702 |

|

Total Current Assets | | 282,534 |

| | 328,741 |

|

Property and Equipment, Net | | 98,335 |

| | 99,068 |

|

Goodwill | | 157,569 |

| | 157,569 |

|

Intangibles, Net | | 147,580 |

| | 155,104 |

|

Other Assets | | 6,383 |

| | 7,117 |

|

Total Assets | | $ | 692,401 |

| | $ | 747,599 |

|

Liabilities and Shareholders’ Equity | | | | |

Current Liabilities | | | | |

Current portion of long-term debt | | $ | 2,215 |

| | $ | 26 |

|

Accounts payable | | 50,852 |

| | 58,979 |

|

Accrued liabilities | | 43,434 |

| | 52,066 |

|

Total Current Liabilities | | 96,501 |

| | 111,071 |

|

Long-Term Debt, Less Current Portion | | 257,820 |

| | 290,026 |

|

Deferred Income Taxes | | 69,696 |

| | 69,448 |

|

Other Long-Term Liabilities | | 18,913 |

| | 20,484 |

|

Total Liabilities | | 442,930 |

| | 491,029 |

|

Commitments and Contingencies | | | | |

Shareholders’ Equity | | | | |

Common stock | | 111 |

| | 110 |

|

Additional paid-in capital | | 74,395 |

| | 72,206 |

|

Retained earnings | | 181,199 |

| | 190,905 |

|

Accumulated other comprehensive loss | | (6,234 | ) | | (6,651 | ) |

Total Shareholders’ Equity | | 249,471 |

| | 256,570 |

|

Total Liabilities and Shareholders’ Equity | | $ | 692,401 |

| | $ | 747,599 |

|

DUCOMMUN INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | October 3,

2015 | | September 27,

2014 | | October 3,

2015 | | September 27,

2014 |

| | | | As Restated | | | | As Restated |

Net Revenues | | $ | 161,670 |

| | $ | 188,164 |

| | $ | 509,435 |

| | $ | 554,433 |

|

Cost of Sales | | 141,642 |

| | 155,052 |

| | 431,439 |

| | 447,728 |

|

Gross Profit | | 20,028 |

| | 33,112 |

| | 77,996 |

| | 106,705 |

|

Selling, General and Administrative Expenses | | 21,205 |

| | 23,050 |

| | 64,707 |

| | 65,005 |

|

Operating (Loss) Income | | (1,177 | ) |

| 10,062 |

|

| 13,289 |

|

| 41,700 |

|

Interest Expense | | (3,392 | ) | | (6,975 | ) | | (16,499 | ) | | (21,094 | ) |

Loss on Extinguishment of Debt | | (11,878 | ) | | — |

| | (14,720 | ) | | — |

|

Other Income | | — |

| | 1,600 |

| | 1,510 |

| | 1,600 |

|

(Loss) Income Before Taxes | | (16,447 | ) | | 4,687 |

| | (16,420 | ) | | 22,206 |

|

Income Tax (Benefit) Expense | | (6,932 | ) | | 1,754 |

| | (6,714 | ) | | 7,495 |

|

Net (Loss) Income | | $ | (9,515 | ) | | $ | 2,933 |

| | $ | (9,706 | ) | | $ | 14,711 |

|

(Loss) Earnings Per Share | | | | | | | | |

Basic (loss) earnings per share | | $ | (0.86 | ) | | $ | 0.27 |

| | $ | (0.88 | ) | | $ | 1.35 |

|

Diluted (loss) earnings per share | | $ | (0.86 | ) | | $ | 0.26 |

| | $ | (0.88 | ) | | $ | 1.31 |

|

Weighted-Average Number of Common Shares Outstanding | | | | | | | | |

Basic | | 11,083 |

| | 10,921 |

| | 11,035 |

| | 10,902 |

|

Diluted | | 11,083 |

| | 11,150 |

| | 11,035 |

| | 11,202 |

|

| | | | | | | | |

Gross Profit % | | 12.4 | % | | 17.6 | % | | 15.3 | % | | 19.2 | % |

SG&A % | | 13.1 | % | | 12.2 | % | | 12.7 | % | | 11.7 | % |

Operating (Loss) Income % | | (0.7 | )% | | 5.3 | % | | 2.6 | % | | 7.5 | % |

Net (Loss) Income % | | (5.9 | )% | | 1.6 | % | | (1.9 | )% | | 2.7 | % |

Effective Tax (Benefit) Rate | | (42.1 | )% | | 37.4 | % | | (40.9 | )% | | 33.8 | % |

DUCOMMUN INCORPORATED AND SUBSIDIARIES

BUSINESS SEGMENT PERFORMANCE

(Unaudited)

(In thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | % Change | | October 3,

2015 | | September 27,

2014 | | % of Net Revenues 2015 | | % of Net Revenues 2014 | | % Change | | October 3,

2015 | | September 27,

2014 | | % of Net Revenues 2015 | | % of Net Revenues 2014 |

| | | | | | As Restated | | | | As Restated | | | | | | As Restated | | | | As Restated |

Net Revenues | | | | | | | | | | | | | | | | | | | | |

DAS | | (21.1 | )% | | $ | 64,170 |

| | $ | 81,357 |

| | 39.7 | % | | 43.2 | % | | (12.1 | )% | | $ | 212,306 |

| | $ | 241,627 |

| | 41.7 | % | | 43.6 | % |

DLT | | (8.7 | )% | | 97,500 |

| | 106,807 |

| | 60.3 | % | | 56.8 | % | | (5.0 | )% | | 297,129 |

| | 312,806 |

| | 58.3 | % | | 56.4 | % |

Total Net Revenues | | (14.1 | )% | | $ | 161,670 |

| | $ | 188,164 |

| | 100.0 | % | | 100.0 | % | | (8.1 | )% | | $ | 509,435 |

| | $ | 554,433 |

| | 100.0 | % | | 100.0 | % |

Segment Operating (Loss) Income | | | | | | | | | | | | | | | | | | | | |

DAS | | | | $ | (6,028 | ) | | $ | 6,908 |

| | (9.4 | )% | | 8.5 | % | | | | $ | 2,980 |

| | $ | 28,067 |

| | 1.4 | % | | 11.6 | % |

DLT | | | | 8,598 |

| | 8,288 |

| | 8.8 | % | | 7.8 | % | | | | 22,575 |

| | 26,089 |

| | 7.6 | % | | 8.3 | % |

| | | | 2,570 |

| | 15,196 |

| | | | | | | | 25,555 |

| | 54,156 |

| | | | |

Corporate General and Administrative Expenses (1) | | | | (3,747 | ) | | (5,134 | ) | | (2.3 | )% | | (2.7 | )% | | | | (12,266 | ) | | (12,456 | ) | | (2.4 | )% | | (2.2 | )% |

Total Operating (Loss) Income | | | | $ | (1,177 | ) | | $ | 10,062 |

| | (0.7 | )% | | 5.3 | % | | | | $ | 13,289 |

| | $ | 41,700 |

| | 2.6 | % | | 7.5 | % |

EBITDA | | | | | | | | | | | | | | | | | | | | |

DAS | | | | | | | | | | | | | | | | | | | | |

Operating (Loss) Income | | | | $ | (6,028 | ) | | $ | 6,908 |

| | | | | | | | $ | 2,980 |

| | $ | 28,067 |

| | | | |

Other Income (2) | | | | — |

| | 1,600 |

| | | | | | | | 1,510 |

| | 1,600 |

| | | | |

Depreciation and Amortization | | | | 2,386 |

| | 2,272 |

| | | | | | | | 7,009 |

| | 8,242 |

| | | | |

| | | | (3,642 | ) | | 10,780 |

| | (5.7 | )% | | 13.3 | % | | | | 11,499 |

| | 37,909 |

| | 5.4 | % | | 15.7 | % |

DLT | | | | | | | | | | | | | | | | | | | | |

Operating Income | | | | 8,598 |

| | 8,288 |

| | | | | | | | 22,575 |

| | 26,089 |

| | | | |

Depreciation and Amortization | | | | 4,207 |

| | 4,391 |

| | | | | | | | 12,928 |

| | 13,442 |

| | | | |

| | | | 12,805 |

| | 12,679 |

| | 13.1 | % | | 11.9 | % | | | | 35,503 |

| | 39,531 |

| | 11.9 | % | | 12.6 | % |

Corporate General and Administrative Expenses | | | | | | | | | | | | | | | | | | | | |

Operating loss | | | | (3,747 | ) | | (5,134 | ) | | | | | | | | (12,266 | ) | | (12,456 | ) | | | | |

Depreciation and Amortization | | | | 42 |

| | 41 |

| | | | | | | | 127 |

| | 145 |

| | | | |

| | | | (3,705 | ) | | (5,093 | ) | | | | | | | | (12,139 | ) | | (12,311 | ) | | | | |

EBITDA | | | | $ | 5,458 |

| | $ | 18,366 |

| | 3.4 | % | | 9.8 | % | | | | $ | 34,863 |

| | $ | 65,129 |

| | 6.8 | % | | 11.7 | % |

Adjusted EBITDA | | | | | | | | | | | | | | | | | | | | |

Restructuring charges (3) | | | | 806 |

| | — |

| | | | | | | | 806 |

| | — |

| | | | |

Adjusted EBITDA | | | | $6,264 | | $18,366 | | 3.9 | % | | 9.8 | % | | | | $35,669 | | $65,129 | | 7.0 | % | | 11.7 | % |

Capital Expenditures | | | | | | | | | | | | | | | | | | | | |

DAS | | | | $ | 2,329 |

| | $ | 1,266 |

| | | | | | | | $ | 8,080 |

| | $ | 3,986 |

| | | | |

DLT | | | | 758 |

| | 1,761 |

| | | | | | | | 3,196 |

| | 4,736 |

| | | | |

Corporate Administration | | | | 4 |

| | 1 |

| | | | | | | | 10 |

| | 25 |

| | | | |

Total Capital Expenditures | | | | $ | 3,091 |

| | $ | 3,028 |

| | | | | | | | $ | 11,286 |

| | $ | 8,747 |

| | | | |

| |

(1) | Includes costs not allocated to either the DLT or DAS operating segments. |

| |

(2) | Insurance recoveries related to property and equipment. |

| |

(3) | Includes restructuring charges for severance and benefits of approximately $0.5 million and $0.3 million recorded in the DLT and DAS operating segments, respectively. |

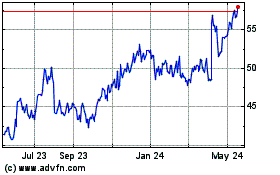

Ducommun (NYSE:DCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

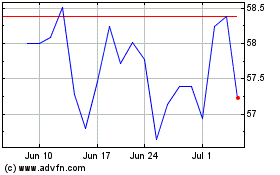

Ducommun (NYSE:DCO)

Historical Stock Chart

From Apr 2023 to Apr 2024