Completes New Credit Facility, Strengthens

Balance Sheet, and Continues to Streamline Operations

Ducommun Incorporated (NYSE:DCO) (“Ducommun” or the “Company”)

today reported results for its second quarter ended July 4,

2015.

Second Quarter 2015 Recap

- Second quarter revenue was $174.8

million

- Net income was $1.8 million, or $0.16

per diluted share

- EBITDA for the quarter was $18.9

million

- New $475 million credit facility

completed and, on July 27, redeemed all $200 million of the

Company’s senior unsecured notes

“During the second quarter, Ducommun made solid progress on a

number of fronts to further strengthen the Company’s position going

forward,” said Anthony J. Reardon, chairman and chief executive

officer. “While again posting revenue growth in commercial

aerospace and winning new business on several key aircraft, we are

executing on initiatives to right-size certain operations, reduce

costs and working capital, and expand overall margins. Our military

and oil and gas end-use markets continue to be down year-over-year,

but we expect to see run rates stabilize in the second half of

2015.

“Cash flow remains strong, and we completed a new credit

facility that is expected to save Ducommun a significant amount of

interest expense annually -- a major accomplishment that will have

an immediate, positive impact on net income. Given our improved

financial profile, continued focus on margins, and additional

streamlining activities, we are setting the stage for Ducommun to

be on sound footing heading into 2016.”

Second Quarter Results

Net revenue for the second quarter of 2015 was $174.8 million

compared to $186.5 million for the second quarter of 2014. The net

revenue decrease year-over-year primarily reflects 16.9% lower

revenue in the Company’s military and space end-use markets and

4.3% lower revenue in the Company’s non-aerospace and defense

(“non-A&D”) end-use markets, partially offset by 9.4% higher

revenue in the Company’s commercial aerospace end-use markets.

The net income for the second quarter of 2015 was $1.8 million,

or $0.16 per diluted share compared to $6.6 million, or $0.60 per

diluted share, for the second quarter of 2014. The lower net income

for the second quarter of 2015 was primarily due to lower revenue,

loss of efficiencies resulting from lower manufacturing volume,

loss on extinguishment of debt, unfavorable product mix, and higher

forward loss reserves, partially offset by lower income tax

expense, lower compensation and benefit costs, insurance recoveries

related to property and equipment, and lower interest expense. The

current quarter effective income tax rate was 41.8% compared to an

effective income tax rate of 32.6% for the comparable prior year’s

quarter.

Operating income for the second quarter of 2015 was $10.8

million, or 6.2% of revenue, compared to $16.8 million, or 9.0% of

revenue, in the comparable period last year. The decrease in

operating income in the second quarter of 2015 was primarily due to

lower revenue, loss of efficiencies resulting from lower

manufacturing volume, unfavorable product mix, and higher forward

loss reserves, partially offset by lower compensation and benefit

costs.

During the three months ended July 4, 2015, the Company recorded

a $2.8 million loss on extinguishment of debt as part of paying off

the existing senior secured term loan and $1.5 million of other

income for insurance recoveries related to property and equipment

and none in the comparable prior year period.

Interest expense decreased to $6.4 million in the second quarter

of 2015, compared to $7.0 million in the previous year’s second

quarter, primarily due to lower outstanding debt balances as a

result of voluntary principal prepayments on the term loan each

quarter during 2014 and the first quarter of 2015 as the Company

continued to de-lever its balance sheet.

EBITDA for the second quarter of 2015 was $18.9 million, or

10.8% of revenue, compared to $24.5 million, or 13.1% of revenue,

for the comparable period in 2014.

During the second quarter of 2015, the Company generated $14.1

million of cash from operations compared to $25.3 million during

the second quarter of 2014.

The Company’s firm backlog as of July 4, 2015 was approximately

$524 million.

Ducommun AeroStructures (“DAS”)

The Company’s DAS segment net revenue for the current second

quarter was $76.1 million, compared to $78.6 million for the second

quarter of 2014. The lower net revenue was primarily due to a 25.5%

decrease in military and space revenue, partially offset by a 10.8%

increase in commercial aerospace revenue.

DAS segment operating income for the current second quarter was

$6.9 million, or 9.0% of revenue, compared to operating income of

$10.1 million, or 12.8% of revenue, for the second quarter of 2014.

The lower operating income was primarily due to unfavorable product

mix, higher forward loss reserves, loss of efficiencies resulting

from lower manufacturing volume, and lower revenue, partially

offset by lower compensation and benefit costs. EBITDA was $10.5

million for the current quarter, or 13.8% of revenue, compared to

$13.6 million, or 17.3% of revenue, for the comparable quarter in

the prior year.

Ducommun LaBarge Technologies

(“DLT”)

The Company’s DLT segment net revenue for the current second

quarter was $98.8 million, compared to $107.9 million for second

quarter 2014. The lower net revenue reflected a 12.8% decrease in

military and space revenue and a 4.3% decrease in non-A&D

revenue.

DLT’s operating income for the current second quarter was $7.7

million, or 7.8% of revenue, compared to $10.8 million, or 10.0% of

revenue, for the second quarter of 2014, primarily due to loss of

efficiencies resulting from lower manufacturing volume and lower

revenue. EBITDA was $12.1 million for the current quarter, or 12.2%

of revenue, compared to $14.8 million, or 13.7% of revenue, in the

comparable quarter of the prior year.

Corporate General and Administrative

Expenses (“CG&A”)

CG&A expenses for the second quarter of 2015 were $3.7

million, or 2.1% of total Company revenue, a decrease from $4.0

million, or 2.2% of total Company revenue in the comparable

prior-year period. CG&A expenses decreased primarily due to

lower compensation and benefit costs.

New Five Year, $475 Million Credit

Facility

As announced on June 26, 2015, the Company completed a new five

year, $475 million credit agreement (“New Credit Facility”)

consisting of a $200 million revolving credit facility (“New

Revolving Credit Facility”) and a $275 million term loan facility

(“New Term Loan Facility”). The New Credit Facility has a final

maturity date of June 2020. Upon closing of the New Credit

Facility, the Company repaid the $80 million existing term loan.

Subsequent to the quarter end, on July 27, 2015, the Company

completed the redemption of all $200 million of its senior

unsecured notes by paying a call premium of $9.75 million and will

also write off the associated unamortized debt issuance costs of

approximately $2.1 million in the Company’s fiscal third quarter.

The variable interest rate on the New Revolving Credit Facility and

the New Term Loan Facility will initially be at LIBOR plus 2.50%,

subject to adjustments based on the Company’s leverage ratio. The

Company estimates the initial effective interest rate will be

approximately 3.50%.

Year-To-Date Results

Net revenue for the six months ended July 4, 2015 was $347.8

million compared to $366.3 million for the six months ended June

28, 2014. The net revenue decrease year-over-year primarily

reflects 19.7% lower revenue in the Company’s military and space

end-use markets partially offset by 12.4% higher revenue in the

Company’s commercial aerospace end-use markets and 5.2% higher

revenue in the Company’s non-A&D end-use markets.

The net loss for the six months ended July 4, 2015 was $(0.2)

million, or $(0.02) per share compared to net income of $11.8

million, or $1.06 per diluted share, for the six months ended June

28, 2014. The lower net income for the first six months of 2015 was

primarily due to unfavorable product mix, lower revenue, loss of

efficiencies resulting from lower manufacturing volume, loss on

extinguishment of debt, and higher professional service fees,

partially offset by lower income tax expense, insurance recoveries

related to property and equipment, and lower interest expense. The

current six month period effective income tax rate was 807.4%

compared to an income tax rate of 32.8% for the comparable period

of 2014.

Operating income for the six months ended July 4, 2015 was $14.5

million, or 4.2% of revenue, compared to $31.6 million, or 8.6% of

revenue, in the comparable period last year. The decrease in

operating income in the first six months of 2015 was primarily due

to unfavorable product mix, lower revenue, loss of efficiencies

resulting from lower manufacturing volume, higher compensation and

benefit costs, and higher professional service fees.

During the six months ended July 4, 2015, the Company recorded a

$2.8 million loss on extinguishment of debt as part of paying off

the existing senior secured term loan and $1.5 million of other

income for insurance recoveries related to property and equipment

and none in the comparable prior year period.

Interest expense decreased to $13.1 million for the six months

ended July 4, 2015, compared to $14.1 million in the previous

year’s comparable six months, primarily due to lower outstanding

debt balances as a result of voluntary principal prepayments on the

term loan each quarter during 2014 and the first quarter of 2015 as

the Company continued to de-lever its balance sheet.

EBITDA for the six months ended July 4, 2015 was $29.4 million,

or 8.5% of revenue, compared to $46.8 million, or 12.8% of revenue,

for the comparable period in 2014.

During the six months ended July 4, 2015, the Company generated

$17.6 million of cash from operations compared to $15.5 million

during the comparable period in 2014.

Ducommun AeroStructures (“DAS”)

The Company’s DAS segment net revenue for the six months ended

July 4, 2015 was $148.1 million, compared to $160.3 million for the

six months ended June 28, 2014. The lower net revenue was primarily

due to a 34.9% decrease in military and space revenue, partially

offset by a 10.8% increase in commercial aerospace revenue.

DAS segment operating income for the six months ended July 4,

2015 was $9.0 million, or 6.1% of revenue, compared to operating

income of $21.2 million, or 13.2% of revenue, for the six months

ended June 28, 2014. The lower operating income was primarily due

to unfavorable product mix, loss of efficiencies resulting from

lower manufacturing volume, higher forward loss reserves, and lower

revenue. EBITDA was $15.1 million for the current six month period,

or 10.2% of revenue, compared to $27.1 million, or 16.9% of

revenue, for the comparable six month period in the prior year.

Ducommun LaBarge Technologies

(“DLT”)

The Company’s DLT segment net revenue for the six months ended

July 4, 2015 was $199.6 million, compared to $206.0 million for six

months ended June 28, 2014. The lower net revenue reflected a 11.5%

decrease in military and space revenue, partially offset by a 19.7%

increase in commercial aerospace electronics revenue and a 5.2%

increase in non-A&D revenue.

DLT’s operating income for the six months ended July 4, 2015 was

$14.0 million, or 7.0% of revenue, compared to $17.8 million, or

8.6% of revenue, for the six months ended June 28, 2014, primarily

due to loss of efficiencies resulting from lower manufacturing

volume, lower revenue, higher forward loss reserves, and

unfavorable product mix. EBITDA was $22.7 million for the current

six month period, or 11.4% of revenue, compared to $26.9 million,

or 13.0% of revenue, in the comparable six month period of the

prior year.

Corporate General and Administrative

Expenses (“CG&A”)

CG&A expenses for the six months ended July 4, 2015 were

$8.5 million, or 2.4% of total Company revenue, an increase from

$7.3 million, or 2.0% of total Company revenue in the comparable

six month period in prior-year. CG&A expenses increased

primarily due to higher professional service fees and higher

compensation and benefit costs.

Conference Call

A teleconference hosted by Anthony J. Reardon, the Company’s

chairman and chief executive officer, and Joseph P. Bellino, the

Company’s vice president, chief financial officer and treasurer,

will be held today, August 5, 2015 at 2:00 p.m. PT (5:00 p.m. ET)

to review these financial results. To participate in the

teleconference, please call 866-271-6130 (international

617-213-8894) approximately ten minutes prior to the conference

time. The participant passcode is 23701061. Mr. Reardon and Mr.

Bellino will be speaking on behalf of the Company and anticipate

the meeting and Q&A period to last approximately 45

minutes.

This call is being webcast by Thomson Reuters and can be

accessed directly at the Ducommun website at www.ducommun.com. Conference call replay will be

available after that time at the same link or by dialing

888-286-8010, passcode 65449729.

About Ducommun

Incorporated

Founded in 1849, Ducommun Incorporated provides engineering and

manufacturing services to the aerospace, defense, and other

industries through a wide spectrum of electronic and structural

applications. The company is an established supplier of critical

components and assemblies for commercial aircraft and military and

space vehicles as well as for the energy market, medical field, and

industrial automation. It operates through two primary business

units – Ducommun AeroStructures (“DAS”) and Ducommun LaBarge

Technologies (“DLT”). Additional information can be found at

www.ducommun.com.

Statements contained in this press release regarding other than

recitation of historical facts are forward-looking statements.

These statements are identified by words such as “may,” “will,” “

begin,” “ look forward,” “expect,” “believe,” “intend,”

“anticipate,” “should,” “potential,” “estimate,” “continue,”

“momentum” and other words referring to events to occur in the

future. These statements reflect the Company’s current view of

future events and are based on its assessment of, and are subject

to, a variety of risks and uncertainties beyond its control,

including, but not limited to, the state of the world financial,

credit, commodities and stock markets, and uncertainties regarding

the Company, its businesses and the industries in which it

operates, which are described in the Company’s filings with the

Securities and Exchange Commission. The Company is under no

obligation to (and expressly disclaims any such obligation to)

update or alter its forward-looking statements whether as a result

of new information, future events or otherwise.

[Financial Tables Follow]

DUCOMMUN INCORPORATED AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited) (In thousands) July

4,2015 December 31,2014

Assets Current Assets Cash and cash

equivalents $ 26,842 $ 45,627 Accounts receivable, net 91,194

91,060 Inventories 138,014 142,842 Production cost of contracts

9,772 11,727 Deferred income taxes 12,371 13,783 Other current

assets 16,835 23,702 Total Current Assets 295,028

328,741 Property and Equipment, Net 99,347 99,068 Goodwill 157,569

157,569 Intangibles, Net 150,088 155,104 Other Assets 7,938

7,117

Total Assets $ 709,970 $ 747,599

Liabilities and Shareholders’ Equity Current Liabilities

Current portion of long-term debt $ 27 $ 26 Accounts payable 55,313

58,979 Accrued liabilities 41,901 52,066 Total

Current Liabilities 97,241 111,071 Long-Term Debt, Less Current

Portion 265,012 290,026 Deferred Income Taxes 69,613 69,448 Other

Long-Term Liabilities 19,583 20,484 Total Liabilities

451,449 491,029 Commitments and Contingencies

Shareholders’ Equity Common stock 111 110 Additional paid-in

capital 74,069 72,206 Retained earnings 190,714 190,905 Accumulated

other comprehensive loss (6,373 ) (6,651 ) Total Shareholders’

Equity 258,521 256,570

Total Liabilities and

Shareholders’ Equity $ 709,970 $ 747,599

DUCOMMUN INCORPORATED AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (In thousands,

except per share amounts) Three Months Ended Six Months

Ended July 4,2015 June 28,2014 July 4,2015 June

28,2014 As Restated As Restated Net Revenues $

174,845 $ 186,516 $ 347,765 $ 366,269 Cost of Sales 143,638

148,838 289,797 292,676 Gross Profit 31,207

37,678 57,968 73,593 Selling, General and Administrative Expenses

20,368 20,868 43,502 41,955 Operating

Income 10,839 16,810 14,466 31,638 Interest Expense (6,446 ) (6,994

) (13,107 ) (14,119 ) Loss on Extinguishment of Debt (2,842 ) —

(2,842 ) — Other Income 1,510 — 1,510 —

Income Before Taxes 3,061 9,816 27 17,519 Income Tax Expense 1,279

3,197 218 5,741 Net Income (Loss) $

1,782 $ 6,619 $ (191 ) $ 11,778 Earnings

(Loss) Per Share Basic earnings (loss) per share $ 0.16 $ 0.61 $

(0.02 ) $ 1.08 Diluted earnings (loss) per share $ 0.16 $ 0.60 $

(0.02 ) $ 1.06 Weighted-Average Number of Common Shares Outstanding

Basic 11,062 10,871 11,012 10,864 Diluted 11,276 11,045 11,012

11,122 Gross Profit % 17.8 % 20.2 % 16.7 % 20.1 % SG&A %

11.6 % 11.2 % 12.5 % 11.5 % Operating Income % 6.2 % 9.0 % 4.2 %

8.6 % Net Income (Loss) % 1.0 % 3.5 % (0.1 )% 3.2 % Effective Tax

Rate 41.8 % 32.6 % 807.4 % 32.8 % DUCOMMUN

INCORPORATED AND SUBSIDIARIES BUSINESS SEGMENT PERFORMANCE

(Unaudited) (In thousands) Three Months Ended Six Months

Ended %

Change

July 4,2015 June 28,2014 %

of Net Revenues

2015

%

of Net Revenues

2014

%

Change

July 4,2015 June 28,2014 %

of Net Revenues

2015

%

of Net Revenues

2014

As Restated As Restated As Restated As

Restated

Net Revenues DAS (3.2 )% $ 76,078 $ 78,616 43.5 %

42.1 % (7.6 )% $ 148,136 $ 160,270 42.6 % 43.8 % DLT (8.5 )% 98,767

107,900 56.5 % 57.9 % (3.1 )% 199,629 205,999

57.4 % 56.2 % Total Net Revenues (6.3 )% $ 174,845 $

186,516 100.0 % 100.0 % (5.1 )% $ 347,765 $ 366,269

100.0 % 100.0 %

Segment Operating Income DAS $ 6,870

$ 10,068 9.0 % 12.8 % $ 9,008 $ 21,159 6.1 % 13.2 % DLT 7,692

10,757 7.8 % 10.0 % 13,977 17,801 7.0 %

8.6 % 14,562 20,825 22,985 38,960

Corporate General and

Administrative Expenses (1) (3,723 ) (4,015 ) (2.1 )%

(2.2 )% (8,519 ) (7,322 ) (2.4 )% (2.0 )% Total Operating Income $

10,839 $ 16,810 6.2 % 9.0 % $ 14,466 $ 31,638

4.2 % 8.6 %

EBITDA DAS Operating Income $ 6,870 $

10,068 $ 9,008 $ 21,159 Other Income (2) 1,510 — 1,510 —

Depreciation and Amortization 2,111 3,554 4,624

5,970 10,491 13,622 13.8 % 17.3 % 15,142 27,129 10.2

% 16.9 % DLT Operating Income 7,692 10,757 13,977 17,801

Depreciation and Amortization 4,361 4,043 8,720

9,051 12,053 14,800 12.2 % 13.7 % 22,697 26,852 11.4

% 13.0 % Corporate General and Administrative Expenses Operating

loss (3,723 ) (4,015 ) (8,519 ) (7,322 ) Depreciation and

Amortization 42 102 84 104 (3,681 )

(3,913 ) (8,435 ) (7,218 ) EBITDA $ 18,863 $ 24,509

10.8 % 13.1 % $ 29,404 $ 46,763 8.5 % 12.8 %

Capital Expenditures DAS $ 2,417 $ 1,435 $ 5,751 $ 2,720 DLT

948 2,078 2,438 2,975 Corporate Administration 2 14 6

24 Total Capital Expenditures $ 3,367 $ 3,527

$ 8,195 $ 5,719

(1) Includes costs not allocated to either the DLT or DAS

operating segments.(2) Insurance recoveries related to property and

equipment.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150805006420/en/

Ducommun IncorporatedJoseph P. Bellino, Vice President, Chief

Financial Officer and Treasurer310.513.7211orChris Witty, Investor

Relations646.438.9385cwitty@darrowir.com

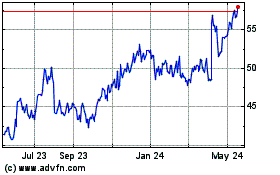

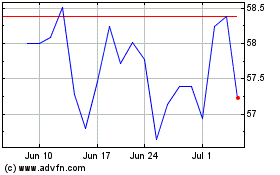

Ducommun (NYSE:DCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ducommun (NYSE:DCO)

Historical Stock Chart

From Apr 2023 to Apr 2024