Current Report Filing (8-k)

October 14 2016 - 6:36AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

October 14, 2016

Diebold, Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio

|

|

1-4879

|

|

34-0183970

|

|

|

|

|

|

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

5995 Mayfair Road, P.O. Box 3077,

North Canton, Ohio

|

|

|

|

44720-8077

|

|

|

|

|

|

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (330) 490-4000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

As previously disclosed on April 19, 2016, Diebold, Incorporated (the “Company”), issued $400 million aggregate principal amount of 8.5% Senior Notes due 2024 (the “Notes”) pursuant to the terms of an indenture (the “Indenture”) among the Company, the guarantors party thereto (the “Guarantors”) and U.S. Bank National Association, as trustee (the “Trustee”). The Notes were sold in a private transaction exempt from the registration requirements of the Securities Act of 1933 (the “Securities Act”).

In connection with the issuance of the Notes, the Company entered into a registration rights agreement dated April 19, 2016 (the “Registration Rights Agreement”) among the Company, the Guarantors and the initial purchasers of the Notes. Under the Registration Rights Agreement, Diebold and the Guarantors agreed, for the benefit of the holders of the Notes, that they would (1) file a registration statement (the “Exchange Offer Registration Statement”) on an appropriate registration form with respect to a registered offer to exchange the Notes for notes registered under the Securities Act (the “Exchange Notes”), which shall also be guaranteed by the Guarantors, with terms substantially identical in all material respects to the Notes (except that the Exchange Notes will not contain terms with respect to transfer restrictions or any increase in annual interest rate) and (2) use their commercially reasonable efforts to cause the Exchange Offer Registration Statement to be declared effective under the Securities Act.

Each of the material domestic direct and indirect wholly-owned subsidiaries of the Company (the “Guarantor Subsidiaries”) has fully and unconditionally guaranteed, on a joint and several basis, to pay principal, premium and interest with respect to the Notes. Each of the Guarantor Subsidiaries is “100% owned” as defined by Rule 3-10(h)(1) of Regulation S-X.

In connection with the filing of the Exchange Offer Registration Statement, the unaudited consolidated financial statements included in the Company's Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2016 (the “Original Quarterly Report”) are being updated to provide the following condensed consolidating financial statements in Note 20: Supplemental Guarantor Information of Item 1: Financial Statements:

|

|

|

|

•

|

condensed consolidating balance sheets as of June 30, 2016 and December 31, 2015;

|

|

|

|

|

•

|

condensed consolidating statements of operations and comprehensive income (loss) for the three and six months ended June 30, 2016 and 2015; and

|

|

|

|

|

•

|

condensed consolidating statements of cash flows for the six months ended June 30, 2016 and 2015.

|

Except as specifically noted herein and in the attached exhibits, this Current Report does not reflect events or developments that occurred after July 28, 2016, the date on which the Company filed the Original Quarterly Report with the SEC, and does not modify or update the disclosures in any way other than as described above and set forth in the exhibits hereto. Without limiting the foregoing, this filing does not purport to update or amend the information contained in the Original Quarterly Report for any information, uncertainties, transactions, risks, events or trends occurring or known to management. The information in this Current Report should be read in conjunction with the Form 10-K. Revisions to the Original Quarterly Report included in this Current Report as noted above supersede the corresponding portions of the Original Quarterly Report.

|

|

|

|

|

|

|

|

|

|

|

Item 9.01 Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

(d) Exhibits.

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

99.1

|

|

Updates to our Original Quarterly Report on Form 10-Q for the quarter ended June 30, 2016

Part I. Item 1. Financial Statements

|

|

101.INS

|

|

XBRL Instance Document

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diebold, Incorporated

|

|

|

October 14, 2016

|

By:

|

/s/ Christopher A. Chapman

|

|

|

|

|

Name:

|

Christopher A. Chapman

|

|

|

|

|

Title:

|

Senior Vice President and Chief Financial Officer

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

99.1

|

|

Updates to our Original Quarterly Report on Form 10-Q for the quarter ended June 30, 2016

Part I. Item 1. Financial Statements

|

|

101.INS

|

|

XBRL Instance Document

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

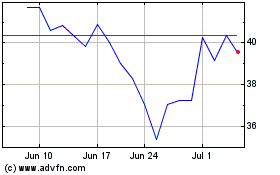

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

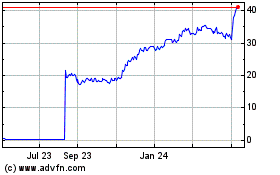

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024