Diebold's $1.8 Billion Acquisition of Wincor Nixdorf Could Impact UK Competition-Regulator

August 19 2016 - 3:14AM

Dow Jones News

By Ian Walker

LONDON--The U.K. Competition and Markets Authority said Friday

that the completed $1.8 billion acquisition by U.S.-based cashpoint

supplier Diebold Inc. (DBD) of its German peer Wincor Nixdorf AG

(WIN.XE) may lessen competition in the U.K., and is asking Diebold

to offer a solution to address its concerns.

The U.K. regulator said the companies compete closely in the

supply of customer-operated ATMs in the U.K. with only one other

credible competitor and limited prospect of other companies

entering the U.K. market in the near future.

Diebold has until Aug. 26 to offer proposals to resolve the

issues. However, if none are offered, or those given don't satisfy

the CMA's concerns it will refer the merger for an in-depth Phase 2

investigation.

"This merger would reduce the number of credible competitors in

the market from three to two. Based on our initial investigation,

this reduction in the number of credible bidders for the supply of

ATMs could significantly reduce customers' ability to obtain

competitive bids," Sheldon Mills, senior director of mergers, and

the decision maker in this case, said.

"These concerns warrant an in-depth investigation which we will

start shortly, unless the companies can offer undertakings to

address these concerns," she added.

Diebold agreed to buy Wincor Nixdorf in a cash and share deal

last November and the deal completed on Monday.

Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

August 19, 2016 02:59 ET (06:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

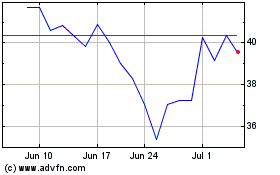

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

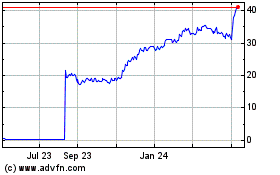

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024