UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 29, 2015

Diebold, Incorporated

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

| | | | |

Ohio | | 1-4879 | | 34-0183970 |

| | | | |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

5995 Mayfair Road, P.O. Box 3077, North Canton, Ohio | | | | 44720-8077 |

| | | | |

(Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code: (330) 490-4000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| | |

| | |

Item 2.02 Results of Operations and Financial Condition | |

On October 29, 2015, Diebold, Incorporated (the “Company”) issued a news release announcing its results for the third quarter of 2015. The news release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this report shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section and shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

|

| | |

| | |

Item 9.01 Financial Statements and Exhibits | | |

|

| | | | |

(d) Exhibits. | | |

| | |

Exhibit | | |

Number | | Description |

99.1 | | News release of Diebold, Incorporated dated October 29, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | Diebold, Incorporated | |

October 29, 2015 | By: | /s/ Christopher A. Chapman | |

| | Name: | Christopher A. Chapman | |

| | Title: | Senior Vice President and Chief Financial Officer | |

EXHIBIT INDEX

|

| | |

| | |

Exhibit | | |

Number | | Description |

99.1 | | News release of Diebold, Incorporated dated October 29, 2015 |

|

| | |

| pressrelease |

Media contact: | | Investor contact: |

Mike Jacobsen, APR | | Steve Virostek |

+1 330 490 3796 | | +1 330 490 6319 |

michael.jacobsen@diebold.com | | stephen.virostek@diebold.com |

FOR IMMEDIATE RELEASE:

Oct. 29, 2015

DIEBOLD REPORTS 2015 THIRD QUARTER FINANCIAL RESULTS

| |

• | GAAP EPS attributable to Diebold was $0.33; non-GAAP EPS was $0.36 |

| |

• | Financial self-service revenue decreased 7.4%, or increased 0.8% in constant currency |

| |

• | Security revenue grew 4.9%, or 6.8% in constant currency |

| |

• | Company narrows 2015 non-GAAP earnings per share guidance to $1.75 to $1.85 |

NORTH CANTON, Ohio - Diebold, Incorporated (NYSE: DBD) today reported its third quarter 2015 financial results.

"We continue to make achievements in our Diebold 2.0 transformation journey, and our recent strategic announcements support our objective to become a truly services-led, software-enabled company,” said Andy W. Mattes, Diebold president and chief executive officer. “We announced an agreement to divest our electronic security business in North America in a transaction valued at approximately $350 million. We also decided to narrow the scope of our Brazil other business primarily to lottery and election equipment to help rationalize our solution set in that market. These portfolio-shaping moves will sharpen the company's focus on the dynamic self-service industry, where we see a great deal of opportunity to grow and further solidify our position as a market leader.

“Our operational performance for the third quarter was in line with our expectations," Mattes continued. "Revenue was impacted by Brazil and China, given the political and economic environment in both countries. I'm encouraged by our constant currency total order growth, which increased in the high single digits, excluding the impact of China.

"In addition, we also continued our progress to become a more services-led company by winning major multi-vendor service contracts in North America," said Mattes. "This brings the total number of non-Diebold ATMs added under contract in North America to more than 11,000 this year."

Operational Highlights

| |

• | Won a five-year multi-vendor service agreement with a top-three U.S.-based bank to service more than 6,000 non-Diebold ATMs in North America. Diebold will provide device-agnostic services and related hardware support. |

| |

• | Signed a contract with Banco Internacional de Ecuador to modernize its fleet with 400 ATMs, software and related maintenance services. As part of the agreement, Diebold will provide advisory and installation services. |

| |

• | Entered into a product agreement with Riyad Bank in Saudi Arabia to deliver 100 of the company's new 5500 series ATMs. |

| |

• | Achieved a five-year managed services contract with a major multi-national bank in Mexico, covering their entire fleet of approximately 2,200 ATMs in that country. |

Financial Results of Operations

Revenue

Total revenue for the third quarter 2015 was $680.9 million, a decrease of $87.1 million or 11.3% from the prior-year period, and a decrease of 2.6% in constant currency. The currency impact was mainly driven by a weakening of the Brazil real and the euro. Total decrease in revenue in constant currency was driven primarily by lower volume in the Brazil other business and China.

Financial self-service revenue decreased 7.4%, or increased 0.8% in constant currency. Security revenue grew 4.9%, or 6.8% in constant currency.

Gross Margin

Total gross margin for the third quarter 2015 was 24.6%, a decrease of 150 basis points from the third quarter 2014, driven by a decrease in service margin of 20 basis points and a 480 basis point decline in product margin. The minor change in service margin was primarily attributable to solution and geographic mix. The product margin decrease was primarily due to lower Brazil other business, which had higher volume in the prior year period, and an inventory reserve increase of $4.7 million in the third quarter of 2015, also associated with the Brazil other business.

Operating Margin

Total operating expenses were $147.7 million, or 21.7% of revenue, for the third quarter 2015, compared with $153.9 million, or 20.0% of revenue, in the third quarter 2014. Operating expenses in the third quarter 2015 included restructuring and non-routine charges of $9.8 million, consisting primarily of severance costs related to the company's transformation, legal, indemnification and professional fees related to the corporate monitor efforts, and fees related to potential acquisitions and divestitures. In addition, our third quarter results include a bad debt reserve of $4.6 million related to the Brazil other business. The third quarter 2014 included restructuring charges of $0.5 million and non-routine expense of $3.6 million, which primarily related to legal, indemnification and professional fees related to the corporate monitor efforts.

Operating profit of $19.6 million, or 2.9% of revenue, was realized in the third quarter 2015, compared with operating profit of $46.7 million, or 6.1% of revenue, in the third quarter 2014. Non-GAAP operating profit in the third quarter 2015 was $31.6 million, or 4.6% of revenue, compared with $51.3 million, or 6.7% of revenue, in the third quarter 2014.

Income Tax

The effective tax rate on continuing operations for the three months ended September 30, 2015 was a benefit of(34.7)%, attributable to the repatriation of foreign earnings and the associated recognition of foreign tax credits, compared with an expense of 26.8% for the same period of 2014.

Net Income / (Loss) Attributable to Diebold

Net income attributable to Diebold was $21.7 million, or 3.2% of revenue, in the third quarter 2015, compared with net income attributable to Diebold of $33.1 million, or 4.3% of revenue, in the third quarter 2014.

Balance Sheet, Cash Flow

The company's net debt was $401.5 million at September 30, 2015, an increase of $354.8 million from December 31, 2014. The increase in net debt is largely attributable to the acquisition of Phoenix Interactive Design, adverse exchange rate impact on cash balances, as well as seasonal working capital expansion. The company's net debt to capital ratio was 36.5% at September 30, 2015, and 4.5% at December 31, 2014.

Free cash flow (use) in the third quarter 2015 was $(38.4) million, an increase in cash use of $(4.2) million from the third quarter 2014.

Full-year 2015 Outlook

The company is updating its previous outlook for full-year 2015 revenue to be down approximately 7% to 8%, with earnings per share of approximately $1.75 to $1.85 on a non-GAAP basis. The company expects a non-GAAP effective tax rate of approximately 21% for the full year.

|

| | |

| Previous Guidance | Current Guidance |

Total Revenue | ~ (5%) to (6%) | ~ (7%) to (8%) |

2015 EPS (GAAP) | $1.09 - $1.33 | $1.03 - $1.16 |

Restructuring charges & non-routine expense | $0.61 - $0.57 | $0.72 - $0.69 |

Total EPS (non-GAAP measure) | $1.70 - $1.90 | $1.75 - $1.85 |

Overview Presentation and Conference Call

More information on Diebold's quarterly earnings is available on Diebold's Investor Relations website. Andy W. Mattes, president and chief executive officer, and Christopher A. Chapman, senior vice president and chief financial officer, will discuss the company's financial performance during a conference call today at 8:30 a.m. (ET). Both the presentation and access to the call / webcast are available at http://www.diebold.com/earnings. The replay of the webcast can be accessed on the web site for up to three months after the call.

About Diebold

Diebold, Incorporated (NYSE: DBD) provides the technology, software and services that connect people around the world with their money - bridging the physical and digital worlds of cash conveniently, securely and efficiently. Since its founding in 1859, Diebold has evolved to become a leading provider of exceptional self-service innovation, security and services to financial, commercial, retail and other markets.

Diebold has approximately 16,000 employees worldwide and is headquartered near Canton, Ohio, USA. Visit Diebold at www.diebold.com or on Twitter: http://twitter.com/DieboldInc.

Non-GAAP Financial Measures and Other Information

To supplement our condensed consolidated financial statements presented in accordance with GAAP, the company considers certain financial measures that are not prepared in accordance with GAAP, including non-GAAP results, adjusted diluted earnings per share, free cash flow/(use) and net investment/(debt). The company uses these non-GAAP financial measures, in addition to GAAP financial measures, to evaluate our operating and financial performance and to compare such performance to that of prior periods and to the performance of our competitors. Also, the company uses these non-GAAP financial measures in making operational and financial decisions and in establishing operational goals. The company also believes providing these non-GAAP financial measures to investors, as a supplement to GAAP financial measures, helps investors evaluate our operating and financial performance and trends in our business, consistent with how management evaluates such performance and trends. The company also believes these non-GAAP financial measures may be useful to investors in comparing its performance to the performance of other companies, although its non-GAAP financial measures are specific to the company and the non-GAAP financial measures of other companies may not be calculated in the same manner. Effective January 1, 2015, the company made a change to the method used to calculate its quarterly non-GAAP effective tax rate to allocate the tax effect of its discrete tax items ratably throughout the year. This change does not have an impact on the annual non-GAAP effective tax rate treatment, and would not have materially impacted previously reported quarterly non-GAAP tax rates. For more information, please refer to the section, "Notes for Non-GAAP Measures".

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding anticipated adjusted revenue growth, adjusted internal revenue growth, adjusted diluted earnings per share, and adjusted earnings per share growth. Statements can generally be identified as forward-looking because they include words such as "believes," "anticipates," "expects," "could," "should" or words of similar meaning. Statements that describe the company's future plans, objectives or goals are also forward-looking statements. Forward-looking statements are subject to assumptions, risks and uncertainties that may cause actual results to differ materially from those contemplated by such forward-looking statements. The factors that may affect the company's results include, among others: the company's ability to successfully enter into a definitive agreement for the purchase of Wincor Nixdorf and its ability to consummate such purchase including obtaining the necessary financing and satisfying closing conditions; the company's ability to complete its sale of its NA electronic security business and to realize any of the contingent purchase price consideration related thereto; the success of the company's strategic business alliance with Securitas AB; the impact of market and economic conditions on the financial services industry; the capacity of the company's technology to keep pace with a rapidly evolving marketplace; pricing and other actions by competitors; the effect of legislative and regulatory actions in the United States and internationally; the company's ability to comply with government regulations; the impact of a security breach or operational failure on the company's business; the company's ability to successfully integrate acquisitions into its operations, including the company's ability to successfully integrate Phoenix Interactive Design and realize the benefits of the acquisition; the impact of the company's strategic initiatives; and other factors included in the company's filings with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2014 and in other documents that the company files with the SEC. You should consider these factors carefully in evaluating forward-looking statements and are cautioned not to place undue reliance on such statements. The company assumes no obligation to update any forward-looking statements, which speak only as of the date of this press release.

Revenue Summary by Service, Product and Segment |

| | | | | | | | | | | | | | |

| | | | | | |

(Dollars In Millions) | | | | | | % Change | | % Change Constant Currency |

| | Q3 2015 | | Q3 2014 | |

Financial self-service | | | | | | | | |

Services | | $ | 293.3 |

| | $ | 310.7 |

| | (5.6 | )% | | 2.4 | % |

Products | | 216.6 |

| | 239.7 |

| | (9.6 | )% | | (1.4 | )% |

Total financial self-service | | 509.9 |

| | 550.4 |

| | (7.4 | )% | | 0.8 | % |

Security | | | | | | | | |

Services | | 111.1 |

| | 105.8 |

| | 5.0 | % | | 7.0 | % |

Products | | 54.7 |

| | 52.2 |

| | 4.8 | % | | 6.5 | % |

Total security | | 165.8 |

| | 158.0 |

| | 4.9 | % | | 6.8 | % |

Total financial self-service and security | | 675.7 |

| | 708.4 |

| | (4.6 | )% | | 2.2 | % |

Brazil other | | 5.2 |

| | 59.6 |

| | (91.3 | )% | | (86.5 | )% |

Total revenue | | $ | 680.9 |

| | $ | 768.0 |

| | (11.3 | )% | | (2.6 | )% |

| | | | | | | | |

| | | | | | |

Revenue summary by segment | | | | % Change | | % Change Constant Currency |

| | Q3 2015 | | Q3 2014 | |

NA | | $ | 361.4 |

| | $ | 361.5 |

| | — | % | | 0.8 | % |

AP | | 107.6 |

| | 135.0 |

| | (20.3 | )% | | (15.7 | )% |

EMEA | | 89.5 |

| | 99.8 |

| | (10.3 | )% | | 7.3 | % |

LA | | 122.4 |

| | 171.7 |

| | (28.7 | )% | | (5.6 | )% |

Total revenue | | $ | 680.9 |

| | $ | 768.0 |

| | (11.3 | )% | | (2.6 | )% |

|

| | | | | | | | | | | | | | |

| | | | | | | | |

(Dollars In Millions) | | | | | | % Change | | % Change Constant Currency |

| | YTD 9/30/2015 | | YTD 9/30/2014 | |

Financial self-service | | | | | | | | |

Services | | $ | 883.9 |

| | $ | 901.8 |

| | (2.0 | )% | | 4.9 | % |

Products | | 689.3 |

| | 658.0 |

| | 4.8 | % | | 13.4 | % |

Total financial self-service | | 1,573.2 |

| | 1,559.8 |

| | 0.9 | % | | 8.5 | % |

Security | | | | | | | | |

Services | | 324.6 |

| | 307.9 |

| | 5.4 | % | | 7.0 | % |

Products | | 154.8 |

| | 145.6 |

| | 6.3 | % | | 7.2 | % |

Total security | | 479.4 |

| | 453.5 |

| | 5.7 | % | | 7.1 | % |

Total financial self-service and security | | 2,052.6 |

| | 2,013.3 |

| | 2.0 | % | | 8.1 | % |

Brazil other | | 17.2 |

| | 176.5 |

| | (90.3 | )% | | (86.8 | )% |

Total revenue | | $ | 2,069.8 |

| | $ | 2,189.8 |

| | (5.5 | )% | | 2.1 | % |

| | | | | | | | |

| | | | | | |

Revenue summary by segment | | | | | | % Change | | % Change Constant Currency |

| | YTD 9/30/2015 | | YTD 9/30/2014 | |

NA | | $ | 1,092.7 |

| | $ | 1,025.0 |

| | 6.6 | % | | 7.1 | % |

AP | | 327.5 |

| | 361.5 |

| | (9.4 | )% | | (6.3 | )% |

EMEA | | 282.4 |

| | 302.3 |

| | (6.6 | )% | | 12.1 | % |

LA | | 367.2 |

| | 501.0 |

| | (26.7 | )% | | (9.7 | )% |

Total revenue | | $ | 2,069.8 |

| | $ | 2,189.8 |

| | (5.5 | )% | | 2.1 | % |

DIEBOLD, INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS - UNAUDITED

(IN MILLIONS EXCEPT EARNINGS PER SHARE)

|

| | | | | | | | | | | | | | | | |

| | Q3 2015 | | Q3 2014 | | YTD 9/30/2015 | | YTD 9/30/2014 |

Net sales | | | | | | | | |

Services | | $ | 404.4 |

| | $ | 416.5 |

| | $ | 1,208.5 |

| | $ | 1,209.7 |

|

Products | | 276.5 |

| | 351.5 |

| | 861.3 |

| | 980.1 |

|

Total | | 680.9 |

| | 768.0 |

| | 2,069.8 |

| | 2,189.8 |

|

Cost of sales | | | | | | | | |

Services | | 282.5 |

| | 290.3 |

| | 836.2 |

| | 849.2 |

|

Products | | 231.1 |

| | 277.1 |

| | 703.5 |

| | 789.1 |

|

Total | | 513.6 |

| | 567.4 |

| | 1,539.7 |

| | 1,638.3 |

|

Gross profit | | 167.3 |

| | 200.6 |

| | 530.1 |

| | 551.5 |

|

Gross margin | | 24.6 | % | | 26.1 | % | | 25.6 | % | | 25.2 | % |

Operating expenses | | |

| | |

| | | | |

Selling and administrative expense | | 127.6 |

| | 129.9 |

| | 392.5 |

| | 371.2 |

|

Research, development and engineering expense | | 20.0 |

| | 24.5 |

| | 66.2 |

| | 66.2 |

|

Loss (gain) on sale of assets, net | | 0.1 |

| | (0.5 | ) | | (1.4 | ) | | (13.1 | ) |

Impairment of assets | | — |

| | — |

| | 18.9 |

| | — |

|

Total | | 147.7 |

| | 153.9 |

| | 476.2 |

| | 424.3 |

|

Percent of net sales | | 21.7 | % | | 20.0 | % | | 23.0 | % | | 19.4 | % |

Operating profit | | 19.6 |

| | 46.7 |

| | 53.9 |

| | 127.2 |

|

Operating margin | | 2.9 | % | | 6.1 | % | | 2.6 | % | | 5.8 | % |

Other income (expense) | | | | | | | | |

Investment income | | 5.9 |

| | 7.9 |

| | 20.6 |

| | 26.6 |

|

Interest expense | | (8.5 | ) | | (8.3 | ) | | (24.1 | ) | | (23.1 | ) |

Foreign exchange gain (loss), net | | 1.3 |

| | 1.0 |

| | (9.2 | ) | | (10.4 | ) |

Miscellaneous, net | | (1.3 | ) | | 0.5 |

| | (1.7 | ) | | 0.4 |

|

Other income (expense), net | | (2.6 | ) | | 1.1 |

| | (14.4 | ) | | (6.5 | ) |

Income before taxes | | 17.0 |

| | 47.8 |

| | 39.5 |

| | 120.7 |

|

Income tax (benefit) expense | | (5.9 | ) | | 12.8 |

| | (1.7 | ) | | 37.7 |

|

Net income | | 22.9 |

| | 35.0 |

| | 41.2 |

| | 83.0 |

|

Net income (loss) attributable to noncontrolling interests | | 1.2 |

| | 1.9 |

| | 0.1 |

| | (1.5 | ) |

Net income attributable to Diebold, Incorporated | | $ | 21.7 |

| | $ | 33.1 |

| | $ | 41.1 |

| | $ | 84.5 |

|

| | | | | | | | |

Basic weighted-average shares outstanding | | 65.0 |

| | 64.6 |

| | 64.9 |

| | 64.5 |

|

Diluted weighted-average shares outstanding | | 65.6 |

| | 65.3 |

| | 65.5 |

| | 65.1 |

|

| | | | | | | | |

Basic earnings per share | | $ | 0.33 |

| | $ | 0.51 |

| | $ | 0.63 |

| | $ | 1.31 |

|

Diluted earnings per share | | $ | 0.33 |

| | $ | 0.51 |

| | $ | 0.63 |

| | $ | 1.30 |

|

| | | | | | | | |

Cash dividends paid per share | | $ | 0.2875 |

| | $ | 0.2875 |

| | $ | 0.8625 |

| | $ | 0.8625 |

|

DIEBOLD, INCORPORATED

CONDENSED CONSOLIDATED BALANCE SHEETS - UNAUDITED

(IN MILLIONS)

|

| | | | | | | |

| YTD 9/30/2015 | | YTD 12/31/2014 |

| | | |

ASSETS | | | |

Current assets | | | |

Cash and cash equivalents | $ | 198.5 |

| | $ | 322.0 |

|

Short-term investments | 99.2 |

| | 136.7 |

|

Trade receivables, less allowances for doubtful accounts | 565.6 |

| | 477.9 |

|

Inventories | 420.6 |

| | 405.2 |

|

Other current assets | 324.3 |

| | 313.7 |

|

Total current assets | 1,608.2 |

| | 1,655.5 |

|

| | | |

|

Securities and other investments | 82.2 |

| | 83.6 |

|

Property, plant and equipment, net | 177.0 |

| | 169.5 |

|

Goodwill | 197.4 |

| | 172.0 |

|

Other assets | 210.3 |

| | 261.5 |

|

Total assets | $ | 2,275.1 |

| | $ | 2,342.1 |

|

| | | |

LIABILITIES AND EQUITY | | | |

Current liabilities | | | |

Notes payable | $ | 80.9 |

| | $ | 25.6 |

|

Accounts payable | 283.9 |

| | 261.7 |

|

Other current liabilities | 601.7 |

| | 740.4 |

|

Total current liabilities | 966.5 |

| | 1,027.7 |

|

|

|

| | |

Long-term debt | 618.3 |

| | 479.8 |

|

Long-term liabilities | 263.8 |

| | 279.7 |

|

| | | |

Total Diebold, Incorporated shareholders' equity | 401.4 |

| | 531.6 |

|

Noncontrolling interests | 25.1 |

| | 23.3 |

|

Total equity | 426.5 |

| | 554.9 |

|

| | | |

Total liabilities and equity | $ | 2,275.1 |

| | $ | 2,342.1 |

|

DIEBOLD, INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS - UNAUDITED

(IN MILLIONS)

|

| | | | | | | | |

| | YTD 9/30/2015 | | YTD 9/30/2014 |

Cash flow from operating activities | | | | |

Net income | | $ | 41.2 |

| | $ | 83.0 |

|

Adjustments to reconcile net income to cash flow used in operating activities: | | | | |

Depreciation and amortization | | 49.2 |

| | 55.4 |

|

Devaluation of Venezuela balance sheet | | 7.5 |

| | 12.1 |

|

Impairment of assets | | 18.9 |

| | — |

|

Other | | 9.2 |

| | 2.6 |

|

| | | | |

Cash flow from changes in certain assets and liabilities | | | | |

Trade receivables | | (133.3 | ) | | (164.7 | ) |

Inventories | | (66.4 | ) | | (156.3 | ) |

Accounts payable | | 39.3 |

| | 87.6 |

|

Prepaid income taxes | | (30.5 | ) | | 7.5 |

|

Deferred revenue | | (29.7 | ) | | 30.4 |

|

Deferred income taxes | | 9.0 |

| | (6.5 | ) |

Certain other assets and liabilities | | (34.5 | ) | | (61.8 | ) |

Net cash used in operating activities | | (120.1 | ) | | (110.7 | ) |

| | | | |

Cash flow from investing activities | | | | |

Payments for acquisitions, net of cash acquired | | (59.4 | ) | | (11.7 | ) |

Net investment activity | | (6.1 | ) | | 106.4 |

|

Capital expenditures | | (42.9 | ) | | (33.6 | ) |

Increase in certain other assets | | 2.6 |

| | 3.9 |

|

Net cash (used in) provided by investing activities | | (105.8 | ) | | 65.0 |

|

| | | | |

Cash flow from financing activities | | | | |

Dividends paid | | (56.5 | ) | | (56.2 | ) |

Net debt borrowings | | 189.4 |

| | 114.9 |

|

Repurchase of common shares | | (3.0 | ) | | (1.8 | ) |

Other | | 3.5 |

| | 12.5 |

|

Net cash provided by financing activities | | 133.4 |

| | 69.4 |

|

| | | | |

Effect of exchange rate changes on cash and cash equivalents | | (31.0 | ) | | (14.0 | ) |

| | | | |

(Decrease) increase in cash and cash equivalents | | (123.5 | ) | | 9.7 |

|

Cash and cash equivalents at the beginning of the period | | 322.0 |

| | 230.7 |

|

Cash and cash equivalents at the end of the period | | $ | 198.5 |

| | $ | 240.4 |

|

Notes for Non-GAAP Measures

To supplement our condensed consolidated financial statements presented in accordance with GAAP, the company considers certain financial measures that are not prepared in accordance with GAAP, including non-GAAP results, adjusted earnings per share, free cash flow/(use) and net investment/(debt).

| |

1. | Profit/loss summary (Dollars in millions): |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q3 2015 | | Q3 2014 |

| | Rev | Gross Profit | % of Sales | OPEX | OP | % of Sales | | Rev | Gross Profit | % of Sales | OPEX | OP | % of Sales |

GAAP results | | $680.9 | $167.3 | 24.6 | % | $147.7 | $19.6 | 2.9 | % | | $768.0 | $200.6 | 26.1 | % | $153.9 | $46.7 | 6.1 | % |

Restructuring | | | 1.8 |

| | (5.8 | ) | 7.6 |

| | | | 0.5 |

| | (0.5 | ) | 1.0 |

| |

Non-routine income/expense: | | | | | | | | | | | | | | |

Venezuela divestiture | | | — |

| | 0.4 |

| (0.4 | ) | | | | — |

| | — |

| — |

| |

Legal, indemnification and professional fees | | | — |

| | (1.9 | ) | 1.9 |

| | | | — |

| | (3.6 | ) | 3.6 |

| |

Acquisition/divestiture fees | | | — |

| | (2.6 | ) | 2.6 |

| | | | — |

| | — |

| — |

| |

Brazil indirect tax | | | 0.3 |

| | — |

| 0.3 |

| | | | — |

| | — |

| — |

| |

Total non-routine income/expense | | — |

| 0.3 |

| | (4.1 | ) | 4.4 |

| | | — |

| — |

| | (3.6 | ) | 3.6 |

| |

Non-GAAP results | | $680.9 | $169.4 | 24.9 | % | $137.8 | $31.6 | 4.6 | % | | $768.0 | $201.1 | 26.2 | % | $149.8 | $51.3 | 6.7 | % |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | YTD 9/30/2015 | | YTD 9/30/2014 |

| | Rev | Gross Profit | % of Sales | OPEX | OP | % of Sales | | Rev | Gross Profit | % of Sales | OPEX | OP | % of Sales |

GAAP results | | $2,069.8 | $530.1 | 25.6 | % | $476.2 | $53.9 | 2.6 | % | | $2,189.8 | $551.5 | 25.2 | % | $424.3 | $127.2 | 5.8 | % |

Restructuring | | | 4.2 |

| | (13.7 | ) | 17.9 |

| | | | 1.4 |

| | (5.4 | ) | 6.8 |

| |

Non-routine income/expense: | | | | | | | | | | | | | | |

Software impairment | | | — |

| | (9.1 | ) | 9.1 |

| | | | — |

| | — |

| — |

| |

Venezuela divestiture | | | — |

| | (9.7 | ) | 9.7 |

| | | | — |

| | — |

| — |

| |

Legal, indemnification and professional fees | | | — |

| | (10.6 | ) | 10.6 |

| | | | — |

| | (6.2 | ) | 6.2 |

| |

Acquisition/divestiture fees | | | — |

| | (2.6 | ) | 2.6 |

| | | | — |

| | — |

| — |

| |

Gain on sale of Eras | | | — |

| | — |

| — |

| | | | — |

| | 13.7 |

| (13.7 | ) | |

Brazil indirect tax | | | 0.8 |

| | — |

| 0.8 |

| | | | — |

| | — |

| — |

| |

Other | | | — |

| | (0.5 | ) | 0.5 |

| | | | — |

| | — |

| — |

| |

Total non-routine income/expense | | — |

| 0.8 |

| | (32.5 | ) | 33.3 |

| | | — |

| — |

| | 7.5 |

| (7.5 | ) | |

Non-GAAP results | | $2,069.8 | $535.1 | 25.9 | % | $430.0 | $105.1 | 5.1 | % | | $2,189.8 | $552.9 | 25.3 | % | $426.4 | $126.5 | 5.8 | % |

Restructuring expenses relate to the multi-year realignment focused on globalizing the company's service organization and creating a unified center-led global organization for research and development, as well as transforming the company's general and administrative cost structure. Non-routine income/expense relate to the company's decision to exit its Venezuela joint venture, a non-cash impairment associated with legacy Diebold software following the acquisition of Phoenix Interactive Design, legal, indemnification and professional fees paid by the company in connection with ongoing obligations related to prior regulatory settlements, including the cost of the independent monitor, potential acquisition and divestiture fees and ongoing interest charges related to the Brazil indirect tax matter.

2. Reconciliation of diluted GAAP EPS to non-GAAP EPS from continuing operations measures:

|

| | | | | | | | | | | | | | | |

| Q3 2015 | | Q3 2014 | | YTD 9/30/2015 | | YTD 9/30/2014 |

Total diluted EPS attributable to Diebold, Incorporated (GAAP measure) | $ | 0.33 |

| | $ | 0.51 |

| | $ | 0.63 |

| | $ | 1.30 |

|

Restructuring | 0.08 |

| | 0.01 |

| | 0.21 |

| | 0.07 |

|

Non-routine (income)/expense: | | | | | | | |

Software impairment | — |

| | — |

| | 0.09 |

| | — |

|

Venezuela divestiture | — |

| | — |

| | 0.07 |

| | — |

|

Venezuela devaluation | — |

| | — |

| | 0.07 |

| | — |

|

Legal, indemnification and professional fees | 0.02 |

| | 0.03 |

| | 0.10 |

| | 0.05 |

|

Gain on sale of Eras | — |

| | — |

| | — |

| | (0.19 | ) |

Acquisition/divestiture fees | 0.03 |

| | — |

| | 0.03 |

| | — |

|

Brazil indirect tax | — |

| | — |

| | 0.01 |

| | — |

|

Other (inclusive of allocation of discrete tax items) | (0.10 | ) | | (0.01 | ) | | (0.12 | ) | | 0.02 |

|

Total non-routine (income)/expense | (0.05 | ) | | 0.02 |

| | 0.25 |

| | (0.12 | ) |

Total adjusted EPS (non-GAAP measure) | $ | 0.36 |

| | $ | 0.54 |

| | $ | 1.09 |

| | $ | 1.25 |

|

Restructuring expenses relate to the multi-year realignment focused on globalizing the company's service organization and creating a unified center-led global organization for research and development, as well as transforming the company's general and administrative cost structure. Non-routine (income)/expenses are related to the company's decision to exit its Venezuela joint venture, currency devaluation of the Venezuela bolivar, a non-cash impairment associated with legacy Diebold software following the acquisition of Phoenix Interactive Design, legal, indemnification and professional fees paid by the company in connection with ongoing obligations related to prior regulatory settlements, including the cost of the independent monitor, potential acquisition and divestiture fees and ongoing interest charges recorded for the Brazil indirect tax matter. As a result of the company's decision to exit its direct presence in Venezuela and move to an indirect sales model, management is excluding the Venezuela impairment and currency devaluation from its 2015 non-GAAP results. Both the GAAP and non-GAAP results for year-to-date 2014 included $0.09 per share negative impact attributable to the devaluation of the Venezuelan bolivar.

| |

3. | Free cash use is calculated as follows (Dollars in millions): |

|

| | | | | | | | | | | | | | | |

| Q3 2015 | | Q3 2014 | | YTD 9/30/2015 | | YTD 9/30/2014 |

Net cash used in operating activities

(GAAP measure) | $ | (20.9 | ) | | $ | (19.0 | ) | | $ | (120.1 | ) | | $ | (110.7 | ) |

Capital expenditures | (17.5 | ) | | (15.2 | ) | | (42.9 | ) | | (33.6 | ) |

Free cash use (non-GAAP measure) | $ | (38.4 | ) | | $ | (34.2 | ) | | $ | (163.0 | ) | | $ | (144.3 | ) |

We define free cash flow/(use) as net cash provided by operating activities less capital expenditures. We consider free cash flow/(use) to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that, after the purchase of property and equipment, can be used for strategic opportunities, including investing in the business, making strategic acquisitions, strengthening the balance sheet, and paying dividends.

| |

4. | Net debt is calculated as follows (Dollars in millions): |

|

| | | | | | | | | | | |

| 9/30/2015 | | 12/31/2014 | | 9/30/2014 |

Cash, cash equivalents and short-term investments

(GAAP measure) | $ | 297.7 |

| | $ | 458.7 |

| | $ | 374.2 |

|

Debt instruments | (699.2 | ) | | (505.4 | ) | | (638.7 | ) |

Net debt

(non-GAAP measure) | $ | (401.5 | ) | | $ | (46.7 | ) | | $ | (264.5 | ) |

The company's management believes that given the significant cash, cash equivalents and other investments on its balance sheet that net cash against outstanding debt is a meaningful net debt calculation. More than 95% of the company's cash and cash equivalents and short-term investments reside in international tax jurisdictions for all periods presented.

###

PR/15-3753

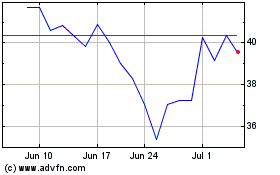

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024