UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | |

| | |

Date of Report (Date of Earliest Event Reported): | | October 25, 2015 |

Diebold, Incorporated

__________________________________________

(Exact name of registrant as specified in its charter)

|

| | |

| | |

Ohio | 1-4879 | 34-0183970 |

_____________________ (State or other jurisdiction | _____________ (Commission | ______________ (I.R.S. Employer |

of incorporation) | File Number) | Identification No.) |

| | |

5995 Mayfair Road, P.O.Box 3077, North Canton, Ohio | | 44720-8077 |

_______________________________ (Address of principal executive offices) | | ___________ (Zip Code) |

|

| | |

| | |

Registrant’s telephone number, including area code: | | (330) 490-4000 |

Not Applicable

_____________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On October 25, 2015, Diebold, Incorporated (“Diebold”) and certain of its affiliates, entered into a definitive Asset Purchase Agreement (the “Purchase Agreement”) with a wholly owned subsidiary of Securitas AB (“Securitas Electronic Security”) to divest Diebold’s electronic security business located in the United States and Canada for an aggregate purchase price of approximately $350 million in cash, $35 million of which is contingent and payable over a twelve-month period beginning at closing based on the successful transition of certain customer relationships.

The closing purchase price is subject to a customary working capital adjustment. The Purchase Agreement provides for customary representations, warranties, covenants and agreements, including, among others, that each party will use commercially reasonable efforts to complete the transaction expeditiously.

The closing of the transaction is expected to occur in the first quarter of 2016 subject to the expiration or termination of any waiting period under certain antitrust filings and the satisfaction or waiver of other customary closing conditions.

Diebold has also agreed to provide certain transition services to Securitas Electronic Security after the closing, including providing the Securitas Electronic Security a $6 million credit for such services.

On October 25, 2015, Diebold issued a press release announcing the signing of the Purchase Agreement. A copy of this press release is attached to this Report as Exhibit 99.1 and is incorporated herein by reference.

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

| | | |

Exhibit Number | | Description |

| | |

99.1 | | Press Release |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 27, 2015

DIEBOLD, INCORPORATED

By /s/Christopher A. Chapman

Name: Christopher A. Chapman

Title: Senior Vice President and Chief Financial Officer

EXHIBIT INDEX

|

| | |

|

| | |

Exhibit Number | Description |

| |

99.1 | | Press Release |

pressrelease

pressrelease

Diebold Media Relations Diebold Investor Relations

Mike Jacobsen, APR Steve Virostek

+1-330-490-3796 +1-330-490-6319

michael.jacobsen@diebold.com stephen.virostek@diebold.com

Securitas Media Relations Securitas Investor Relations

Gisela Lindstrand Micaela Sjökvist

+46 (0) 10 470 30 11 +46 (0)10 470 30 13

gisela.lindstrand@securitas.com micaela.sjokvist@securitas.com

FOR IMMEDIATE RELEASE:

Oct. 25, 2015

Diebold AGREES TO SELL NORTH AMERICA ELECTRONIC SECURITY BUSINESS TO SECURITAS

| |

• | Divestiture accelerates Diebold’s transformation, enhancing focus on opportunities in dynamic self-service industry |

| |

• | Deal valued at approximately $350 million |

| |

• | Securitas to serve as Diebold’s preferred electronic security provider in North America, combining expertise and facilitating a smooth transition for Diebold customers |

NORTH CANTON, Ohio - Diebold, Incorporated (NYSE: DBD) today announced it has entered into an agreement to divest its North America-based electronic security business to accelerate its transformation and better position the company to pursue growth opportunities in the dynamic self-service industry. Securitas AB, an $8 billion Stockholm-based global provider of security services and solutions, has agreed to acquire the business in a transaction with a purchase price of $350 million. Ten percent of the price is contingent on successful transference of certain customer relationships to Securitas. The sale is subject to regulatory approvals, customary closing conditions and working capital adjustments, and is expected to be completed during the first quarter 2016.

The two companies have also agreed to a strategic business alliance in which Securitas will serve as Diebold’s preferred supplier for electronic security solutions in North America. This will help ensure a seamless transition for Diebold’s electronic security customers, as well as drive further security innovation and services for the industries in which both companies operate.

“Given the transformation that is occurring in the self-service industry, this strategic decision will enable us to accelerate our own transformation and focus on the exciting opportunities we’re seeing for growth and innovation in that market,” said Andy W. Mattes, Diebold president and chief executive officer.

“Over the years, we grew the electronic security business organically into one of the leading providers in the North America commercial and financial markets through innovative software and services,” Mattes continued. “As a highly capable global leader in the security industry, Securitas has the scale and resources to take electronic security to the next level for our customers. We also look forward to continuing the relationship with Securitas to provide compelling expertise that further leverages our combined capabilities in services and security moving forward. This will enable a smooth transition for our customers and employees alike.”

Diebold’s electronic security business in North America includes a full portfolio of intrusion, fire, video, access control and systems integration services, as well as monitoring, maintenance and other security-related services for commercial and financial markets. Revenue for this business was approximately $330 million from June 30, 2014 to June 30, 2015. Diebold is retaining all its physical and consumer transaction security businesses related to its core financial market, including automated teller machine security, anti-fraud card solutions, bank branch facility and drive-up systems, and related services.

“The acquisition of Diebold’s electronic security business supports Securitas’s global strategy and substantially strengthens our position as the global knowledge leader in security solutions and technology. Securitas Electronic Security -- previously Diebold Electronic Security -- will continue to be a leader in the North American electronic security industry. We also plan for the North America headquarters of the electronic security business and its employees to remain based in Green, Ohio. We believe that we can leverage Diebold’s electronic security expertise to the existing Securitas’ customer base and offer our customers possibilities of security solutions by optimizing the equation between different services,” says Alf Göransson, president and CEO Securitas AB.

Diebold will provide transitional services to Securitas during the closing phase of the agreement to help ensure a smooth integration. Diebold’s advisors for the transaction were Bank of America Merrill Lynch and Jones Day. Securitas was advised by K&L Gates.

SPECIAL NOTE: Please refer to the Securitas press release titled “Securitas agrees to acquire Diebold’s North America Electronic Security business,” also issued today, for related information.

About Securitas

Securitas is a global knowledge leader in security. From a broad range of services of specialized guarding, technology solutions and consulting and investigations, we customize offerings that are suited to the individual customer’s needs, in order to deliver the most effective security solutions. Everywhere from small stores to airports, our 320,000 employees are making a difference.

More information on Securitas can be found at www.securitas.com.

About Diebold

Diebold, Incorporated (NYSE: DBD) provides the technology, software and services that connect people around the world with their money - bridging the physical and digital worlds of cash conveniently, securely and efficiently. Since its founding in 1859, Diebold has evolved to become a leading provider of exceptional self-service innovation, security and services to financial, commercial, retail and other markets.

Diebold has approximately 16,000 employees worldwide and is headquartered near Canton, Ohio, USA. Visit Diebold at www.diebold.com or on Twitter: http://twitter.com/DieboldInc.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements can generally be identified as forward-looking because they include words such as "believes," "anticipates," "expects," "could," "should" or words of similar meaning. Statements that describe the company's future plans, objectives or goals are also forward-looking statements. Forward-looking statements are subject to assumptions, risks and uncertainties that may cause actual results to differ materially from those contemplated by such forward-looking statements. The factors that may affect the company's results include, among others: the company’s ability to complete the sale of its North America electronic security business and to realize any of the contingent purchase price consideration; the success of the company’s strategic business alliance with Securitas; the impact of market and economic conditions on the financial services industry; the capacity of the company's technology to keep pace with a rapidly evolving marketplace; pricing and other actions by competitors; the impact of the company's strategic initiatives; and other factors included in the company's filings with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2014 and in other documents that the company files with the SEC. You should consider these factors carefully in evaluating forward-looking statements and are cautioned not to place undue reliance on such statements. The company assumes no obligation to update any forward-looking statements, which speak only as of the date of this press release.

###

PR/15-3749

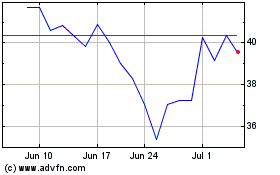

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

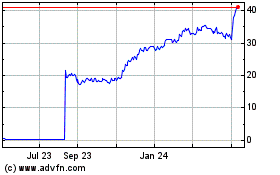

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024