UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 30, 2015

Diebold, Incorporated

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

| | | | |

Ohio | | 1-4879 | | 34-0183970 |

| | | | |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

5995 Mayfair Road, P.O. Box 3077, North Canton, Ohio | | | | 44720-8077 |

| | | | |

(Address of principal executive offices) | | | | (Zip Code) |

Registrant's telephone number, including area code: (330) 490-4000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| | |

| | |

Item 2.02 Results of Operations and Financial Condition | |

On July 30, 2015, Diebold, Incorporated (the “Company”) issued a news release announcing its results for the second quarter of 2015. The news release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this report shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section and shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

|

| | |

| | |

Item 9.01 Financial Statements and Exhibits | | |

|

| | | | |

(d) Exhibits. | | |

| | |

Exhibit | | |

Number | | Description |

99.1 | | News release of Diebold, Incorporated dated July 30, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | Diebold, Incorporated | |

July 30, 2015 | By: | /s/ Christopher A. Chapman | |

| | Name: | Christopher A. Chapman | |

| | Title: | Senior Vice President and Chief Financial Officer | |

EXHIBIT INDEX

|

| | |

| | |

Exhibit | | |

Number | | Description |

99.1 | | News release of Diebold, Incorporated dated July 30, 2015 |

|

| | |

| pressrelease |

Media contact: | | Investor contact: |

Mike Jacobsen, APR | | Steve Virostek |

+1 330 490 3796 | | +1 330 490 6319 |

michael.jacobsen@diebold.com | | stephen.virostek@diebold.com |

FOR IMMEDIATE RELEASE:

July 30, 2015

DIEBOLD REPORTS 2015 SECOND QUARTER FINANCIAL RESULTS

| |

• | GAAP EPS attributable to Diebold was $0.34; non-GAAP EPS was $0.44 |

| |

• | Financial self-service revenue grew 4.6%, or 13.1% in constant currency |

| |

• | Security revenue grew 6.9%, or 8.2% in constant currency |

| |

• | GAAP gross margin improvement of 10 basis points; non-GAAP gross margin up 50 basis points |

| |

• | Company maintaining revenue and non-GAAP earnings guidance for 2015 |

NORTH CANTON, Ohio - Diebold, Incorporated (NYSE: DBD) today reported its second quarter 2015 financial results.

"The company delivered solid performance during the second quarter," said Andy W. Mattes, Diebold president and chief executive officer. "We continued to build momentum with customers while effectively executing on our transformation plan. Our financial self-service revenue growth is outpacing the market, as customers value our collaborative approach to innovation and our broadened solutions set in services and software."

Mattes continued, “We're encouraged with the progress we've made since we introduced our Diebold 2.0 transformation in 2013, with a strong emphasis on reducing our cost structure, improving our cash flow, building talent and making the investments necessary to grow the company. These pillars will remain important during the next phase of our transformation. Looking forward, we will place more emphasis on improving our mix of revenue to include a higher ratio of recurring services and software, which typically improves visibility and value. We remain encouraged with our opportunities and are confident in our ability to position Diebold for long-term success.”

Operational Highlights

| |

• | Signed multi-vendor service agreements with a large U.S.-based financial institution, and two other large European banks -- representing an increase of more than 5,000 competitors' automated teller machines (ATMs) to Diebold's global service contract base |

| |

• | Won two significant multi-vendor software projects -- with Banorte in Mexico (the first Phoenix software deployment in Latin America) and a major bank in Australia |

| |

• | Expanded relationship with Al Rajhi Bank in Saudi Arabia for a branch automation solution that is expected to reduce its ATM operating expenses by more than half |

| |

• | Entered into a product and service agreement for 2,200 ATMs with the world's largest independent ATM deployer -- a major competitive win in the U.S. retail market |

| |

• | Secured an order for more than 2,000 ATMs in Mexico by a large Canada-based bank, which includes the company's largest to-date order for its ActivEdgeTM anti-skimming technology |

Financial Results of Operations

Revenue

Total revenue for the second quarter 2015 was $733.4 million, essentially unchanged compared with the prior-year period, and an increase of 7.8% in constant currency. Total revenue growth in constant currency was driven by increased volume in North America, Latin America, and the Europe, Middle East and Africa (EMEA) regions. The currency impact was mainly driven by a weakening of the Brazil real and the euro.

Financial self-service revenue grew 4.6%, or 13.1% in constant currency. Security revenue grew 6.9%, or 8.2% in constant currency. Revenue growth in our core businesses offset a decline in the Brazil other business.

Gross Margin

Total gross margin for the second quarter 2015 was 25.6%, an increase of 10 basis points from the second quarter 2014, driven by an improvement in service margin of 0.7 percentage points, which was partially offset by a 0.7 percentage point decline in product margin. The service margin improvement was primarily attributable to global service transformation efforts. The product margin decrease was primarily due to geographic and solution mix.

Operating Margin

Total operating expenses were $156.8 million, or 21.4% of revenue, for the second quarter 2015, compared with $129.6 million, or 17.7% of revenue, in the second quarter 2014. Operating expenses in the second quarter 2015 included restructuring, non-routine and impairment charges of $9.2 million, consisting primarily of severance costs related to the company's transformation, and legal, indemnification and professional fees related to the corporate monitor. The second quarter 2014 included restructuring charges of $0.5 million and non-routine income of $12.1 million, which primarily related to the gain on the sale of Eras.

Operating profit of $30.7 million, or 4.2% of revenue, was realized in the second quarter 2015, compared with operating profit of $57.2 million, or 7.8% of revenue, in the second quarter 2014. Non-GAAP operating profit in the second quarter 2015 was $42.8 million, or 5.8% of revenue, compared with $45.7 million, or 6.2% of revenue, in the second quarter 2014.

Income Tax

The effective tax rate on continuing operations for the three months ended June 30, 2015 was 19.0%, compared with 29.6% for the same period of 2014, which benefited from a release of an uncertain tax position.

Net Income / (Loss) Attributable to Diebold

Net income attributable to Diebold was $22.2 million, or 3.0% of revenue, in the second quarter 2015, compared with net income attributable to Diebold of $41.6 million, or 5.7% of revenue, in the second quarter 2014.

Balance Sheet, Cash Flow

The company's net debt was $306.1 million at June 30, 2015, an increase of $259.3 million from December 31, 2014. The increase in net debt is largely attributable to the acquisition of Phoenix, adverse exchange rate impact on cash balances, as well as seasonal working capital expansion. The company's net debt to capital ratio was 27.0% at June 30, 2015, and 4.5% at December 31, 2014.

Free cash flow (use) in the second quarter 2015 was ($51.6) million, a decrease in cash use of $19.7 million from the second quarter 2014. The improvement is primarily due to improved working capital.

Full-year 2015 Outlook

The company is maintaining its previous outlook for full-year 2015 revenue to be down approximately 5% to 6%, with earnings of approximately $1.70 to $1.90 per share on a non-GAAP basis. The company continues to expect a non-GAAP effective tax rate of approximately 30% for the full year.

|

| | |

| Previous Guidance | Current Guidance |

Total Revenue | ~ (5%) to (6%) | ~ (5%) to (6%) |

2015 EPS (GAAP) | $1.24 - $1.49 | $1.09 - $1.33 |

Restructuring charges & non-routine expense | $0.46 - $0.41 | $0.61 - $0.57 |

Total EPS (non-GAAP measure) | $1.70 - $1.90 | $1.70 - $1.90 |

Overview Presentation and Conference Call

More information on Diebold's quarterly earnings is available on Diebold's Investor Relations website. Andy W. Mattes, president and chief executive officer, and Christopher A. Chapman, senior vice president and chief financial officer, will discuss the company's financial performance during a conference call today at 8:30 a.m. (ET). Both the presentation and access to the call / webcast are available at http://www.diebold.com/earnings. The replay of the webcast can be accessed on the web site for up to three months after the call.

About Diebold

Diebold, Incorporated (NYSE: DBD) provides the technology, software and services that connect people around the world with their money - bridging the physical and digital worlds of cash conveniently, securely and efficiently. Since its founding in 1859, Diebold has evolved to become a leading provider of exceptional self-service innovation, security and services to financial, commercial, retail and other markets.

Diebold has approximately 16,000 employees worldwide and is headquartered near Canton, Ohio, USA. Visit Diebold at www.diebold.com or on Twitter: http://twitter.com/DieboldInc.

Non-GAAP Financial Measures and Other Information

To supplement our condensed consolidated financial statements presented in accordance with GAAP, the company considers certain financial measures that are not prepared in accordance with GAAP, including non-GAAP results, adjusted diluted earnings per share, free cash flow/(use) and net investment/(debt). The company uses these non-GAAP financial measures, in addition to GAAP financial measures, to evaluate our operating and financial performance and to compare such performance to that of prior periods and to the performance of our competitors. Also, the company uses these non-GAAP financial measures in making operational and financial decisions and in establishing operational goals. The company also believes providing these non-GAAP financial measures to investors, as a supplement to GAAP financial measures, helps investors evaluate our operating and financial performance and trends in our business, consistent with how management evaluates such performance and trends. The company also believes these non-GAAP financial measures may be useful to investors in comparing its performance to the performance of other companies, although its non-GAAP financial measures are specific to the company and the non-GAAP financial measures of other companies may not be calculated in the same manner. Effective January 1, 2015, the company made a change to the method used to calculate its quarterly non-GAAP effective tax rate to allocate the tax effect of its discrete tax items ratably throughout the year. This change does not have an impact on the annual non-GAAP effective tax rate treatment, and would not have materially impacted previously reported quarterly non-GAAP tax rates. For more information, please refer to the section, "Notes for Non-GAAP Measures".

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding anticipated adjusted revenue growth, adjusted internal revenue growth, adjusted diluted earnings per share, and adjusted earnings per share growth. Statements can generally be identified as forward-looking because they include words such as "believes," "anticipates," "expects," "could," "should" or words of similar meaning. Statements that describe the company's future plans, objectives or goals are also forward-looking statements. Forward-looking statements are subject to assumptions, risks and uncertainties that may cause actual results to differ materially from those contemplated by such forward-looking statements. The factors that may affect the company's results include, among others: the impact of market and economic conditions on the financial services industry; the capacity of the company's technology to keep pace with a rapidly evolving marketplace; pricing and other actions by competitors; the effect of legislative and regulatory actions in the United States and internationally; the company's ability to comply with government regulations; the impact of a security breach or operational failure on the company's business; the company's ability to successfully integrate acquisitions into its operations, including the company's ability to successfully integrate Phoenix Interactive Design and realize the benefits of the acquisition; the impact of the company's strategic initiatives; and other factors included in the company's filings with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2014 and in other documents that the company files with the SEC. You should consider these factors carefully in evaluating forward-looking statements and are cautioned not to place undue reliance on such statements. The company assumes no obligation to update any forward-looking statements, which speak only as of the date of this press release.

Revenue Summary by Service, Product and Segment |

| | | | | | | | | | | | | | |

| | | | | | |

(Dollars In Millions) | | | | | | % Change | | % Change Constant Currency |

| | Q2 2015 | | Q2 2014 | |

Financial self-service | | | | | | | | |

Services | | $ | 299.2 |

| | $ | 306.1 |

| | (2.3 | )% | | 5.2 | % |

Products | | 268.9 |

| | 236.8 |

| | 13.6 | % | | 23.6 | % |

Total financial self-service | | 568.1 |

| | 542.9 |

| | 4.6 | % | | 13.1 | % |

Security | | | | | | | | |

Services | | 110.9 |

| | 103.7 |

| | 6.9 | % | | 8.8 | % |

Products | | 52.7 |

| | 49.4 |

| | 6.7 | % | | 7.0 | % |

Total security | | 163.6 |

| | 153.1 |

| | 6.9 | % | | 8.2 | % |

Total financial self-service and security | | 731.7 |

| | 696.0 |

| | 5.1 | % | | 12.0 | % |

Brazil other | | 1.7 |

| | 37.5 |

| | (95.5 | )% | | (93.6 | )% |

Total revenue | | $ | 733.4 |

| | $ | 733.5 |

| | 0.0 | % | | 7.8 | % |

| | | | | | |

Revenue summary by segment | | | | % Change | | % Change Constant Currency |

| | Q2 2015 | | Q2 2014 | |

NA | | $ | 391.4 |

| | $ | 346.0 |

| | 13.1 | % | | 13.5 | % |

AP | | 109.4 |

| | 119.4 |

| | (8.4 | )% | | (6.1 | )% |

EMEA | | 106.1 |

| | 118.4 |

| | (10.4 | )% | | 7.5 | % |

LA | | 126.5 |

| | 149.7 |

| | (15.5 | )% | | 5.0 | % |

Total revenue | | $ | 733.4 |

| | $ | 733.5 |

| | 0.0 | % | | 7.8 | % |

|

| | | | | | | | | | | | | | |

| | | | | | | | |

(Dollars In Millions) | | | | | | % Change | | % Change Constant Currency |

| | YTD 6/30/2015 | | YTD 6/30/2014 | |

Financial self-service | | | | | | | | |

Services | | $ | 590.6 |

| | $ | 591.1 |

| | (0.1 | )% | | 6.2 | % |

Products | | 472.7 |

| | 418.3 |

| | 13.0 | % | | 21.7 | % |

Total financial self-service | | 1,063.3 |

| | 1,009.4 |

| | 5.3 | % | | 12.6 | % |

Security | | | | | | | | |

Services | | 213.5 |

| | 202.1 |

| | 5.6 | % | | 7.0 | % |

Products | | 100.1 |

| | 93.4 |

| | 7.2 | % | | 7.6 | % |

Total security | | 313.6 |

| | 295.5 |

| | 6.1 | % | | 7.2 | % |

Total financial self-service and security | | 1,376.9 |

| | 1,304.9 |

| | 5.5 | % | | 11.3 | % |

Brazil other | | 12.0 |

| | 116.9 |

| | (89.7 | )% | | (86.9 | )% |

Total revenue | | $ | 1,388.9 |

| | $ | 1,421.8 |

| | (2.3 | )% | | 4.5 | % |

| | | | | | | | |

Revenue summary by segment | | | | | | % Change | | % Change Constant Currency |

| | YTD 6/30/2015 | | YTD 6/30/2014 | |

NA | | $ | 731.3 |

| | 663.5 |

| | 10.2 | % | | 10.6 | % |

AP | | 219.9 |

| | 226.5 |

| | (2.9 | )% | | (1.0 | )% |

EMEA | | 192.9 |

| | 202.5 |

| | (4.7 | )% | | 14.5 | % |

LA | | 244.8 |

| | 329.3 |

| | (25.7 | )% | | (11.7 | )% |

Total revenue | | $ | 1,388.9 |

| | $ | 1,421.8 |

| | (2.3 | )% | | 4.5 | % |

DIEBOLD, INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS - UNAUDITED

(IN MILLIONS EXCEPT EARNINGS PER SHARE)

|

| | | | | | | | | | | | | | | |

| Q2 2015 | | Q2 2014 | | YTD 6/30/2015 | | YTD 6/30/2014 |

Net sales | | | | | | | |

Services | $ | 410.1 |

| | $ | 409.8 |

| | $ | 804.1 |

| | $ | 793.2 |

|

Products | 323.3 |

| | 323.7 |

| | 584.8 |

| | 628.6 |

|

Total | 733.4 |

| | 733.5 |

| | 1,388.9 |

| | 1,421.8 |

|

Cost of sales | |

| | |

| | | | |

Services | 280.8 |

| | 283.6 |

| | 553.7 |

| | 558.9 |

|

Products | 265.1 |

| | 263.1 |

| | 472.4 |

| | 512.0 |

|

Total | 545.9 |

| | 546.7 |

| | 1,026.1 |

| | 1,070.9 |

|

Gross profit | 187.5 |

| | 186.8 |

| | 362.8 |

| | 350.9 |

|

Gross margin | 25.6 | % | | 25.5 | % | | 26.1 | % | | 24.7 | % |

Operating expenses | |

| | |

| | | | |

Selling and administrative expense | 135.0 |

| | 121.0 |

| | 264.9 |

| | 241.3 |

|

Research, development and engineering expense | 23.9 |

| | 21.7 |

| | 46.2 |

| | 41.7 |

|

Impairment of assets | (0.5 | ) | | — |

| | 18.9 |

| | — |

|

Gain on sale of assets, net | (1.6 | ) | | (13.1 | ) | | (1.5 | ) | | (12.6 | ) |

Total | 156.8 |

| | 129.6 |

| | 328.5 |

| | 270.4 |

|

Percent of net sales | 21.4 | % | | 17.7 | % | | 23.7 | % | | 19.0 | % |

Operating profit | 30.7 |

| | 57.2 |

| | 34.3 |

| | 80.5 |

|

Operating margin | 4.2 | % | | 7.8 | % | | 2.5 | % | | 5.7 | % |

Other income (expense) | | | | | | | |

Investment income | 6.8 |

| | 10.0 |

| | 14.7 |

| | 18.7 |

|

Interest expense | (7.6 | ) | | (7.9 | ) | | (15.6 | ) | | (14.8 | ) |

Foreign exchange (loss) gain, net | (1.2 | ) | | 0.6 |

| | (10.5 | ) | | (11.4 | ) |

Miscellaneous, net | 0.8 |

| | 1.3 |

| | (0.4 | ) | | (0.1 | ) |

Other income (expense), net | (1.2 | ) | | 4.0 |

| | (11.8 | ) | | (7.6 | ) |

Income before taxes | 29.5 |

| | 61.2 |

| | 22.5 |

| | 72.9 |

|

Income tax expense | 5.6 |

| | 18.1 |

| | 4.2 |

| | 24.9 |

|

Net income | 23.9 |

| | 43.1 |

| | 18.3 |

| | 48.0 |

|

Net income (loss) attributable to noncontrolling interests | 1.7 |

| | 1.5 |

| | (1.1 | ) | | (3.4 | ) |

Net income attributable to Diebold, Incorporated | $ | 22.2 |

| | $ | 41.6 |

| | $ | 19.4 |

| | $ | 51.4 |

|

| | | | | | | |

Basic weighted-average shares outstanding | 64.9 |

| | 64.6 |

| | 64.8 |

| | 64.4 |

|

Diluted weighted-average shares outstanding | 65.6 |

| | 65.2 |

| | 65.5 |

| | 65.0 |

|

| | | | | | | |

Basic earnings per share | 0.34 |

| | 0.64 |

| | 0.30 |

| | 0.80 |

|

Diluted earnings per share | 0.34 |

| | 0.64 |

| | 0.30 |

| | 0.79 |

|

| | | | | | | |

Common dividends declared and paid per share | $ | 0.2875 |

| | $ | 0.2875 |

| | $ | 0.575 |

| | $ | 0.575 |

|

DIEBOLD, INCORPORATED

CONDENSED CONSOLIDATED BALANCE SHEETS - UNAUDITED

(IN MILLIONS)

|

| | | | | | | |

| YTD 6/30/2015 | | YTD 12/31/2014 |

|

| | |

ASSETS | | | |

Current assets | | | |

Cash and cash equivalents | $ | 244.4 |

| | $ | 322.0 |

|

Short-term investments | 119.5 |

| | 136.7 |

|

Trade receivables, less allowances for doubtful accounts | 562.3 |

| | 477.9 |

|

Inventories | 425.5 |

| | 405.2 |

|

Other current assets | 345.3 |

| | 313.7 |

|

Total current assets | 1,697.0 |

| | 1,655.5 |

|

| | | |

|

Securities and other investments | 83.8 |

| | 83.6 |

|

Property, plant and equipment, net | 176.2 |

| | 169.5 |

|

Goodwill | 208.1 |

| | 172.0 |

|

Other assets | 230.6 |

| | 261.5 |

|

Total assets | $ | 2,395.7 |

| | $ | 2,342.1 |

|

| | | |

LIABILITIES AND EQUITY | | | |

Current liabilities | | | |

Notes payable | $ | 35.1 |

| | $ | 25.6 |

|

Accounts payable | 306.5 |

| | 261.7 |

|

Other current liabilities | 662.6 |

| | 740.4 |

|

Total current liabilities | 1,004.2 |

| | 1,027.7 |

|

|

|

| | |

Long-term debt | 634.8 |

| | 479.8 |

|

Long-term liabilities | 266.5 |

| | 279.7 |

|

| | | |

Total Diebold, Incorporated shareholders' equity | 465.6 |

| | 531.6 |

|

Noncontrolling interests | 24.6 |

| | 23.3 |

|

Total equity | 490.2 |

| | 554.9 |

|

| | | |

Total liabilities and equity | $ | 2,395.7 |

| | $ | 2,342.1 |

|

DIEBOLD, INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS - UNAUDITED

(IN MILLIONS)

|

| | | | | | | | |

| | YTD 6/30/2015 | | YTD 6/30/2014 |

Cash flow from operating activities | | | | |

Net income | | $ | 18.3 |

| | $ | 48.0 |

|

Adjustments to reconcile net income to cash flow used in operating activities: | | | | |

Depreciation and amortization | | 33.2 |

| | 36.7 |

|

Devaluation of Venezuela balance sheet | | 7.5 |

| | 12.1 |

|

Impairment of assets | | 18.9 |

| | — |

|

Other | | 7.4 |

| | (2.5 | ) |

| | | | |

Cash flow from changes in certain assets and liabilities | | | | |

Trade receivables | | (104.8 | ) | | (100.6 | ) |

Inventories | | (46.3 | ) | | (101.2 | ) |

Accounts payable | | 52.0 |

| | 87.0 |

|

Prepaid income taxes | | (14.3 | ) | | 3.7 |

|

Deferred revenue | | (4.4 | ) | | 42.8 |

|

Deferred income taxes | | 4.4 |

| | (18.5 | ) |

Certain other assets and liabilities | | (71.1 | ) | | (99.3 | ) |

Net cash used in operating activities | | (99.2 | ) | | (91.8 | ) |

| | | | |

Cash flow from investing activities | | | | |

Payments for acquisitions, net of cash acquired | | (59.4 | ) | | — |

|

Net investment activity | | (1.3 | ) | | 101.0 |

|

Capital expenditures | | (25.4 | ) | | (18.4 | ) |

Increase in certain other assets | | 2.9 |

| | 9.7 |

|

Net cash (used in) provided by investing activities | | (83.2 | ) | | 92.3 |

|

| | | | |

Cash flow from financing activities | | | | |

Dividends paid | | (37.8 | ) | | (37.4 | ) |

Net debt borrowings | | 160.2 |

| | 29.5 |

|

Repurchase of common shares | | (2.8 | ) | | (1.6 | ) |

Other | | 3.0 |

| | 12.3 |

|

Net cash provided by financing activities | | 122.6 |

| | 2.8 |

|

| | | | |

Effect of exchange rate changes on cash and cash equivalents | | (17.8 | ) | | (11.1 | ) |

| | | | |

Decrease in cash and cash equivalents | | (77.6 | ) | | (7.8 | ) |

Cash and cash equivalents at the beginning of the period | | 322.0 |

| | 230.7 |

|

Cash and cash equivalents at the end of the period | | $ | 244.4 |

| | $ | 222.9 |

|

Notes for Non-GAAP Measures

To supplement our condensed consolidated financial statements presented in accordance with GAAP, the company considers certain financial measures that are not prepared in accordance with GAAP, including non-GAAP results, adjusted earnings per share, free cash flow/(use) and net investment/(debt).

| |

1. | Profit/loss summary (Dollars in millions): |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q2 2015 | | Q2 2014 |

| | Rev | Gross Profit | % of Sales | OPEX | OP | % of Sales | | Rev | Gross Profit | % of Sales | OPEX | OP | % of Sales |

GAAP results | | $733.4 | $187.5 | 25.6 | % | $156.8 | $30.7 | 4.2 | % | | $733.5 | $186.8 | 25.5 | % | $129.6 | $57.2 | 7.8 | % |

Restructuring | | | 2.4 |

| | (4.7 | ) | 7.2 |

| | | | 0.2 |

| | (0.5 | ) | 0.7 |

| |

Non-routine income/expense: | | | | | | | | | | | | | | |

Venezuela divestiture | | | — |

| | 0.1 |

| (0.1 | ) | | | | — |

| | — |

| — |

| |

Legal, indemnification and professional fees | | | — |

| | (4.1 | ) | 4.1 |

| | | | — |

| | (1.6 | ) | 1.6 |

| |

Gain on sale of Eras | | | — |

| | — |

| — |

| | | | — |

| | 13.7 |

| (13.7 | ) | |

Brazil indirect tax | | | 0.5 |

| | — |

| 0.5 |

| | | | — |

| | — |

| — |

| |

Other | | | — |

| | (0.5 | ) | 0.5 |

| | | | — |

| | — |

| — |

| |

Total non-routine income/expense | | — |

| 0.5 |

| | (4.5 | ) | 5.0 |

| | | — |

| — |

| | 12.1 |

| (12.1 | ) | |

Non-GAAP results | | $733.4 | $190.5 | 26.0 | % | $147.7 | $42.8 | 5.8 | % | | $733.5 | $187.0 | 25.5 | % | $141.2 | $45.7 | 6.2 | % |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | YTD 6/30/2015 | | YTD 6/30/2014 |

| | Rev | Gross Profit | % of Sales | OPEX | OP | % of Sales | | Rev | Gross Profit | % of Sales | OPEX | OP | % of Sales |

GAAP results | | $1,388.9 | $362.8 | 26.1 | % | $328.5 | $34.3 | 2.5 | % | | $1,421.8 | $350.9 | 24.7 | % | $270.4 | $80.5 | 5.7 | % |

Restructuring | | | 2.4 |

| | (7.8 | ) | 10.3 |

| | | | 0.9 |

| | (4.9 | ) | 5.8 |

| |

Non-routine income/expense: | | | | | | | | | | | | | | |

Software impairment | | | — |

| | (9.1 | ) | 9.1 |

| | | | — |

| | — |

| — |

| |

Venezuela divestiture | | | — |

| | (10.1 | ) | 10.1 |

| | | | — |

| | — |

| — |

| |

Legal, indemnification and professional fees | | | — |

| | (8.7 | ) | 8.7 |

| | | | — |

| | (2.6 | ) | 2.6 |

| |

Gain on sale of Eras | | | — |

| | — |

| — |

| | | | — |

| | 13.7 |

| (13.7 | ) | |

Brazil indirect tax | | | 0.5 |

| | — |

| 0.5 |

| | | | — |

| | — |

| — |

| |

Other | | | — |

| | (0.5 | ) | 0.5 |

| | | | — |

| | — |

| — |

| |

Total non-routine income/expense | | — |

| 0.5 |

| | (28.4 | ) | 28.9 |

| | | — |

| — |

| | 11.1 |

| (11.1 | ) | |

Non-GAAP results | | $1,388.9 | $365.7 | 26.3 | % | $292.3 | $73.5 | 5.3 | % | | $1,421.8 | $351.8 | 24.7 | % | $276.6 | $75.2 | 5.3 | % |

Restructuring expenses relate to the multi-year realignment focused on globalizing the company's service organization and creating a unified center-led global organization for research and development, as well as transforming the company's general and administrative cost structure. Non-routine income/expense relate to the company's decision to exit its Venezuela joint venture, a non-cash impairment associated with legacy Diebold software following the acquisition of Phoenix Interactive Design, legal, indemnification and professional fees paid by the company in connection with ongoing obligations related to prior regulatory settlements, including the cost of the independent monitor and ongoing interest charges related to the Brazil indirect tax matter.

2. Reconciliation of diluted GAAP EPS to non-GAAP EPS from continuing operations measures:

|

| | | | | | | | | | | | | | | |

| Q2 2015 | | Q2 2014 | | YTD 6/30/2015 | | YTD 6/30/2014 |

Total diluted EPS attributable to Diebold, Incorporated (GAAP measure) | $ | 0.34 |

| | $ | 0.64 |

| | $ | 0.30 |

| | $ | 0.79 |

|

Restructuring | 0.08 |

| | 0.01 |

| | 0.13 |

| | 0.06 |

|

Non-routine (income)/expense: | | | | | | | |

Software impairment | — |

| | — |

| | 0.09 |

| | — |

|

Venezuela divestiture | — |

| | — |

| | 0.08 |

| | — |

|

Venezuela devaluation | — |

| | — |

| | 0.07 |

| | — |

|

Legal, indemnification and professional fees | 0.04 |

| | 0.02 |

| | 0.08 |

| | 0.03 |

|

Gain on sale of Eras | — |

| | (0.20 | ) | | — |

| | (0.20 | ) |

Brazil indirect tax | 0.01 |

| | — |

| | 0.01 |

| | — |

|

Other (inclusive of allocation of discrete tax items) | (0.03 | ) | | — |

| | (0.03 | ) | | — |

|

Total non-routine (income)/expense | 0.02 |

| | (0.18 | ) | | 0.30 |

| | (0.17 | ) |

Tax expense (benefit) on foreign cash repatriation | — |

| | — |

| | — |

| | 0.03 |

|

Total adjusted EPS (non-GAAP measure) | $ | 0.44 |

| | $ | 0.47 |

| | $ | 0.73 |

| | $ | 0.71 |

|

Restructuring expenses relate to the multi-year realignment focused on globalizing the company's service organization and creating a unified center-led global organization for research and development, as well as transforming the company's general and administrative cost structure. Non-routine (income)/expenses are related to the company's decision to exit its Venezuela joint venture, currency devaluation of the Venezuela bolivar, a non-cash impairment associated with legacy Diebold software following the acquisition of Phoenix Interactive Design, legal, indemnification and professional fees paid by the company in connection with ongoing obligations related to prior regulatory settlements, including the cost of the independent monitor, and ongoing interest charges recorded for the Brazil indirect tax matter. As a result of the company's decision to exit its direct presence in Venezuela and move to an indirect sales model, management is excluding the Venezuela impairment and currency devaluation from its 2015 non-GAAP results. Both the GAAP and non-GAAP results for year-to-date 2014 included $0.09 per share negative impact attributable to the devaluation of the Venezuelan bolivar.

| |

3. | Free cash flow/(use) is calculated as follows (Dollars in millions): |

|

| | | | | | | | | | | | | | | |

| Q2 2015 | | Q2 2014 | | YTD 6/30/2015 | | YTD 6/30/2014 |

Net cash provided by/(used in) operating activities

(GAAP measure) | $ | (37.0 | ) | | $ | (60.2 | ) | | $ | (99.2 | ) | | $ | (91.8 | ) |

Capital expenditures | (14.6 | ) | | (11.1 | ) | | (25.4 | ) | | (18.4 | ) |

Free cash flow/(use) (non-GAAP measure) | $ | (51.6 | ) | | $ | (71.3 | ) | | $ | (124.6 | ) | | $ | (110.2 | ) |

We define free cash flow/(use) as net cash provided by operating activities less capital expenditures. We consider free cash flow/(use) to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that, after the purchase of property and equipment, can be used for strategic opportunities, including investing in the business, making strategic acquisitions, strengthening the balance sheet, and paying dividends.

| |

4. | Net investment/(debt) is calculated as follows (Dollars in millions): |

|

| | | | | | | | | | | |

| 6/30/2015 | | 12/31/2014 | | 6/30/2014 |

Cash, cash equivalents and short-term investments

(GAAP measure) | $ | 363.9 |

| | $ | 458.7 |

| | $ | 375.8 |

|

Debt instruments | (670.0 | ) | | (505.5 | ) | | (553.6 | ) |

Net investment/(debt)

(non-GAAP measure) | $ | (306.1 | ) | | $ | (46.8 | ) | | $ | (177.8 | ) |

The company's management believes that given the significant cash, cash equivalents and other investments on its balance sheet that net cash against outstanding debt is a meaningful net debt calculation. More than 90% of the company's cash and cash equivalents and short-term investments reside in international tax jurisdictions for all periods presented.

###

PR/15-3738

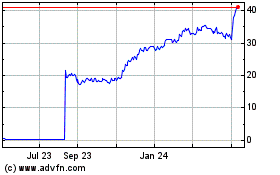

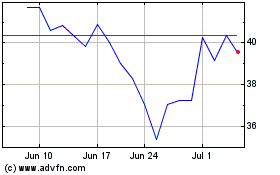

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024