Diebold Has Dismissed Russia Leadership Amid Bribery Probe -CEO

November 11 2010 - 1:43PM

Dow Jones News

Diebold Inc. (DBD) has removed five top-level employees from its

Russian operation, Chief Executive Tom Swidarski said in an

interview, as the company continues an internal investigation

related to potential breaches of the Foreign Corrupt Practices

Act.

The ATM manufacturer and security services company last month

disclosed that the Securities and Exchange Commission and U.S.

Department of Justice had both asked for information on the matter.

Diebold first announced in July that it was investigating payments

the subsidiary had made that may have been in breach of the foreign

bribery rule's provisions on books and records. The company said it

reported its findings to the Justice Department and SEC in

July.

"FCPA is a serious issue," Swidarski said. "We want to be

transparent and we want to be proactive," he said, noting that

Diebold has been investigating other country operations for signs

of irregularities.

In addition to the Russia country manager, Swidarski said the

company fired its sales and accounting managers and a manager in

charge of its relationship with the distributor. Diebold said in a

conference call last month that the payments under investigation

were made "primarily" from 2005 to 2008.

Swidarski said the red flags were first spotted as the company

began looking into acquiring its distributor in Russia. That deal

has since been scrapped, and Diebold let its contract with the

distributor lapse after it expired. The company instead will build

up its direct operation in Russia, something it has done recently

in Turkey and other countries where it sees major growth

opportunities.

"It's going to take several years" to rebuild the service and

sales organization, Swidarski said, adding that Diebold is in the

process of naming a new country manager for Russia.

While Russia contributes a small amount to Diebold's top

line--about $10 million a year, Swidarski said--he said it could be

a significant presence down the line.

"This could be one of the top 10 countries if you look out five

to 10 years," Swidarski said. Currently, it's not even on the

top-50 list, he said.

Diebold announced the SEC's subpoena of information related to

the Russian operation less than five months after reaching a final

settlement on a long-standing case alleging the company had engaged

in a fraudulent accounting scheme to inflate earnings. The company

agreed in June to pay $25 million, without admitting or denying

wrongdoing. Diebold has noted that the charges laid out by the SEC

predate the company's existing leadership.

-By Melissa Korn, Dow Jones Newswires; 212-416-2271;

melissa.korn@dowjones.com

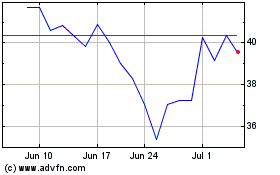

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

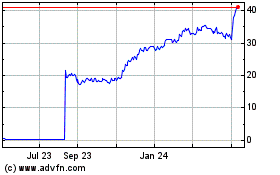

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024