IntercontinentalExchange Steps Up Surveillance Of Futures Markets

June 24 2010 - 1:55PM

Dow Jones News

Derivatives market operator IntercontinentalExchange Inc. (ICE)

has brought on board a new cop to police its derivatives markets,

amid increased regulatory scrutiny of the sector.

The partnership with Sydney-based Smarts Group gives the

exchange operator new tools to monitor potential malfeasance and

recreate specific market events on its U.S., U.K. and Canada

markets, according to ICE officials.

ICE is ramping up trading oversight as regulators sift market

data to determine the factors behind the tremendous volatility of

the May 6 trading session, when moves in stock index futures were

said to play into a rapid decline in equity prices.

The company--which hosts half of the world's trading in crude

oil futures contracts--has also come in for greater regualtory

oversight as Washington D.C. authorities scrutinize the role of

speculative traders in commodity markets.

The agreement with Smarts adds the company's market surveillance

platform to ICE's current monitoring activities. Last fall ICE

tapped Netezza Corp. (NZ) to underpin the company's regulatory

compliance and reporting.

Applying Smarts' tools across all of ICE's futures markets will

automate many oversight duties, according to ICE.

Alerts can be set up to announce odd movements in contract

prices, and the event playback feature could be used to help

regulators detect nefarious traders at work in the market,

according to the company.

Smarts also provides surveillance tools to BATS Global Markets,

operator of electronic stock markets in the U.S. and Europe.

-By Jacob Bunge, Dow Jones Newswires; (312) 750 4117;

jacob.bunge@dowjones.com

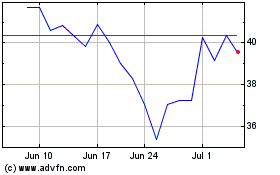

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

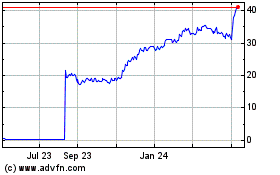

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024