United Continental Postpones Boeing 737 Jets -- Update

November 15 2016 - 11:12AM

Dow Jones News

By Doug Cameron

United Continental Holdings Inc. said Tuesday that it would

postpone receiving dozens of new Boeing Co. jets to trim

spending.

The third-largest U.S. airline will defer 61 planes from a

65-jet order for 737-700s and convert them into the new Max model

with yet-to-be-determined arrival dates. Boeing will switch the

remaining four to the larger 737-800 model for delivery next year.

United is expected to acquire the Max 9 version of the plane.

The airline, among four U.S. carriers that have recently

attracted investment from Berkshire Hathaway Inc. , also announced

a push to boost its share of budget-conscious travelers with a new

no-frills fare class.

The basic economy class entitles fliers only to an under-seat

bag, a move also intended to avoid the delays caused by passengers

stowing overhead baggage, and continues the segmentation of fares

that is being pursued by other carriers such as Delta Air Lines

Inc.

The moves are among a parade of planned changes unveiled by

United Chief Executive Oscar Munoz and his new management team that

includes cost cuts and revenue-boosting initiatives designed to

increase profits by $4.8 billion by 2020.

The fleet changes are among the industry's largest since

Southwest Airlines Co. in June reached a deal with Boeing to defer

67 of its 737 Max deliveries scheduled for the 2019-2022 period

until 2023 and beyond.

United expects the fleet changes to cut capital spending over

the next two years by $1.6 billion.

Boeing and Airbus Group SE have order books for their

best-selling jets stretching out for several years of production,

and typically overbook knowing that some planes will be canceled or

deferred. United canceled an order for 12 Airbus single-aisle

planes in late 2013.

"We constantly work with our airline customers to meet their

evolving needs, and our healthy 737 backlog of 4,321 airplanes

gives us the flexibility to meet those needs," Boeing said in a

statement.

United also plans changes to flights at its three big hubs in

Chicago, Newark and Houston that it hopes will add $900 million in

incremental revenue by 2019. Changes include using larger aircraft

on some routes and changing flight times to improve connections, as

well as revamping its demand forecasting systems.

The Chicago-based carrier is also buying 24 Embraer 175 jets

from the Brazilian manufacturer rather than leasing them from

Republic Airways Holdings Inc., which is under bankruptcy

protection.

United said it would continue reviewing its widebody aircraft

needs and consider adding more used jets in addition to the Airbus

A320 family planes it is already leasing from AerCap Holdings

NV.

The company's shares were recently up 1.2% at $63.72, trailing

gains at Southwest and American Airlines Group Inc.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

November 15, 2016 10:57 ET (15:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

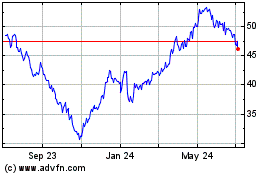

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

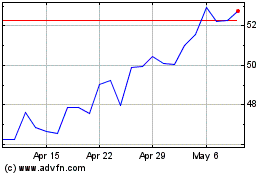

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024