Buffett's Berkshire Invests in Airlines -- 2nd Update

November 14 2016 - 9:09PM

Dow Jones News

By Doug Cameron and Nicole Friedman

Warren Buffett's Berkshire Hathaway Inc. slashed its investment

in the world's biggest retailer and placed fresh bets on three big

US airlines.

Berkshire Hathaway said in a regulatory filing that it had taken

stakes in American Airlines Group Inc., Delta Air Lines Inc. and

United Continental Holdings Inc., with the latter scheduled to hold

its investor day on Tuesday. Two of the Berkshire stakes each

totaled less than $500 million while that in American was almost

$800 million. Meanwhile, Berkshire cut its holdings in Wal-Mart

Stores Inc. by nearly 70%, leaving it with 13 million shares in the

retail giant at the end of the third quarter.

Mr. Buffett told CNBC that Berkshire had also taken a stake in

Southwest Airlines Co. A Southwest spokesman Monday declined to

confirm any investment by Berkshire.

The airlines' shares rose in after-hours trading. American

gained more than 3% while Delta and Southwest both added more than

2%. United was 1.7% higher.

It wasn't clear if the decision to invest in airlines came from

Mr. Buffett or one of his stock-picking lieutenants. Mr. Buffett

famously derided investing in airline stocks after suffering

initial losses from a foray into what was then known as USAir back

in 1989.

Shares of airlines fell in the first half of the year before

recovering from lows in the summer. For the year, the Dow Jones

U.S. Airlines index is up 0.7%

Investor sentiment toward U.S. airline stocks has improved as

carriers indicated that a prolonged slide in fares, which had hit

profits, was set to ease early next year.

Cheap jet fuel has encouraged airlines to add more flights.

That, combined with a series of fare wars, has left the closely

watched measure of revenue per available seat mile in negative

territory for more than a year. Delta and other carriers expect

this to turn positive early in 2017.

Berkshire owns other aviation-related businesses, including

NetJets Inc., which sells fractional ownership in private jets, and

training company FlightSafety International Inc. The company

acquired aerospace-parts manufacturer Precision Castparts Corp.

earlier this year for $32.7 billion, its largest acquisition

ever.

However, Mr. Buffett has long criticized airline

investments.

Berkshire bought $358 million of preferred stock in USAir Group

Inc. in 1989. The investment lost value in subsequent years. "I

plunged into the business at almost the exact moment that it ran

into severe problems," Mr. Buffett wrote in his 1990 letter to

shareholders.

Berkshire sold its stake "for a hefty gain" in 1998, Mr. Buffett

wrote in his 2007 letter, but he still regretted the purchase.

"The worst sort of business is one that grows rapidly, requires

significant capital to engender the growth, and then earns little

or no money. Think airlines," he wrote.

Given Mr. Buffett's antipathy toward airlines, the new

investments were likely made by one of his lieutenants, Todd Combs

or Ted Weschler, said Thomas Russo, managing member of Gardner

Russo & Gardner, which manages $10 billion. Berkshire is Mr.

Russo's largest holding.

Messrs. Weschler and Combs, who joined Berkshire in the past

five years, have shown willingness to invest in sectors that Mr.

Buffett has shied away from, such as technology.

Write to Doug Cameron at doug.cameron@wsj.com and Nicole

Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

November 14, 2016 20:54 ET (01:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

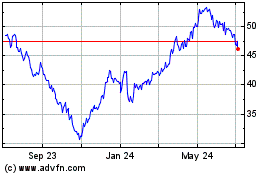

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

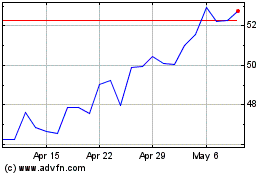

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024