Southwest Airlines Confident It Can Return to Positive Unit Revenue Growth -- 2nd Update

October 26 2016 - 5:02PM

Dow Jones News

By Susan Carey and Joshua Jamerson

Southwest Airlines Co.'s disclosure Wednesday that it expects

unit revenue to decline 4% to 5% year-over-year in the fourth

quarter and its unit cost excluding fuel to rise by a similar range

in the same period pounded the discounter's share price, slicing

off $2.2 billion in market capitalization.

Southwest shares fell 10% in premarket trading Wednesday, after

rising 9.6% in the past three months. Once the market opened,

shares fell as far as 11.2% after the company released its

third-quarter results, before rebounding to decline 8.5%, or $38.40

a share.

But executives at the Dallas-based carrier, No. 4 in the U.S. by

traffic, said they were confident they could reach revenue targets

next year despite a raft of capacity increases by rival airlines on

Southwest routes. Gary Kelly, the chief executive, said the carrier

could break into flat or positive unit revenue in the first quarter

even on planned seat growth shy of 3% in the period.

For all of 2017, Southwest expects to grow 3.5% to 4%, much more

than some of its largest competitors. But Mr. Kelly said he

believed that is the right amount, after a capacity boost of 5% to

6% this year.

"It is appropriate for us to slow our growth until unit revenue

turns positive," he said.

Unit revenue is the amount an airline takes in for each seat

flown a mile. In the third quarter, that metric declined by 4.1%

year over year.

Lower fuel prices and strong profits are prompting the airline

industry to add capacity, so more seats are fighting for the same

number of passengers, the CEO said. This is causing prices to wilt.

Southwest's average one-way fare in the third quarter fell 4.8% to

$146.96.

"Either demand needs to improve or supply come into better

alignment," he said.

Making matters worse, fuel prices are increasing. And Southwest

is facing the possibility that its pilots and flight attendants in

the coming days will ratify costly new labor contracts. Preparing

for that, it expensed $356 million pretax in the third quarter to

cover proposed signing bonuses. As a result, the company expects

its unit cost excluding fuel and profit-sharing to rise 4% to 5% in

the final quarter.

In the September quarter, Southwest earned $388 million, or 62

cents a share, down from $584 million, or 88 cents a share a year

ago. But excluding special items, profit in the latest period was

$582 million, or 93 cents a share, beating Wall Street estimates.

Revenue was $5.1 billion, down 3.4% from $5.3 billion a year

earlier.

A computer outage in July, which forced Southwest to cancel some

2,000 flights, dented revenue by $55 million in the third quarter

and added $24 million to costs. end

Write to Susan Carey at susan.carey@wsj.com and Joshua Jamerson

at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

October 26, 2016 16:47 ET (20:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

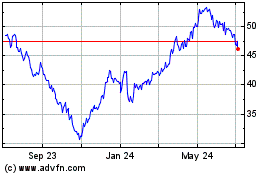

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

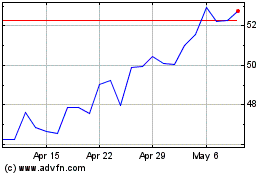

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024